On-Demand Warehousing Market Analysis and Insights:

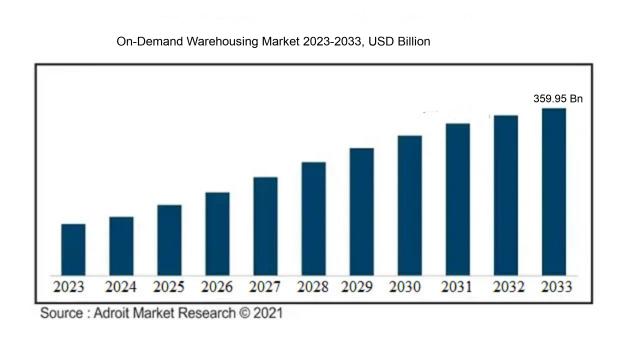

The size of the worldwide on-demand warehousing market is anticipated to be around USD 359.95 billion. rising at a compound annual growth rate (CAGR) of 13.2% from 2024 to 2033, from USD 110 billion in 2023.

The On-Demand Warehousing Market experiences significant growth driven by the escalating demand for adaptable supply chain strategies, as organizations aim to boost efficiency and quickly adjust to market dynamics. The booming e-commerce sector has further fueled the necessity for flexible warehousing solutions, enabling companies to handle varying inventory demands without the burden of heavy investments in permanent infrastructure. Innovations in technology, particularly in warehouse management systems and automation, play a crucial role in optimizing processes and enhancing inventory precision. Furthermore, the rising focus on cost savings and logistics efficiency motivates businesses to embrace on-demand approaches that minimize overhead costs. The continuing expansion of global trade and the increasing need for rapid delivery further enhance the demand for warehousing options situated close to end consumers. As companies place greater importance on agility and quick responsiveness, the on-demand warehousing sector shows robust expansion, offering customized solutions that cater to a wide range of logistical needs.

On-Demand Warehousing Market Definition

On-demand warehousing is a dynamic storage approach that provides businesses with the ability to utilize warehouse space and logistics services as required, typically supported by online platforms. This system allows organizations to modify their inventory volume and storage expenses in real-time, swiftly adapting to changes in market conditions.

The concept of on-demand warehousing is essential in the contemporary logistics environment, offering companies adaptable storage options that respond to varying demand and changing market dynamics. This strategy allows organizations to efficiently expand their operations without the constraints of extended lease agreements for physical space. Through the use of a diverse network of warehouse providers, businesses can lower operational expenses, optimize inventory management, and accelerate fulfillment processes. Additionally, on-demand warehousing promotes innovation and agility within supply chains, enabling organizations to better meet customer demands. As a result, this model equips businesses to maintain a competitive edge in the ever-evolving landscape of e-commerce.

On-Demand Warehousing Market Segmental Analysis:

Insights On Service Type

Fulfillment and Distribution

Fulfillment and Distribution is poised to dominate the Global On-Demand Warehousing Market. This area has seen exponential growth due to the rapid rise of e-commerce and consumer demand for faster delivery times. Businesses are increasingly outsourcing these services to enhance efficiency and meet customer expectations. Technological advancements have further streamlined processes, enabling real-time tracking and reduced operational costs. Companies are finding that investing in fulfillment capabilities allows them to react swiftly to market changes and customer needs, making this an essential service that oversees the optimization of warehouse operations and smooth distribution channels.

Storage and Warehousing

Storage and Warehousing plays a significant role in the supply chain, providing the necessary space for businesses to hold inventory until it is needed. Demand for efficient storage solutions increases as businesses strive to minimize overhead costs and maximize space utilization. Various storage strategies, including pallet racking and shelving systems, contribute to operational efficiency, allowing companies to easily locate and move products. Companies are also implementing flexible storage arrangements through on-demand facilities, enhancing their ability to adapt to market fluctuations and consumer demands.

Inventory Management

Inventory Management is crucial for ensuring that companies have the right amount of stock on hand to meet customer demand without overstocking. Effective management minimizes waste and enhances profitability, as accurate tracking reduces the risk of stockouts or excess inventory. The growth of technology, including cloud-based solutions and automated systems, has transformed how businesses handle their inventory. This ensures real-time data visibility and enables better forecasting and planning, which are vital for sustaining competitiveness in the on-demand warehousing landscape.

Transportation and Logistics

Transportation and Logistics are vital for the seamless movement of goods from warehouses to consumers. This service type is integral to ensuring timely deliveries, particularly with the increasing demand for quick fulfillment in today's market. Efficient transportation can significantly reduce costs and improve customer satisfaction through reliable services. As companies look for ways to enhance their logistics strategies, investments in fleet management, route optimization, and partnerships with third-party carriers have become essential in maintaining a competitive edge.

Packaging and Labeling

Packaging and Labeling are important services that contribute to the overall efficiency and branding of products. Well-designed packaging safeguards goods during transit and storage, while effective labeling provides crucial information for inventory management and compliance with regulations. As e-commerce grows, so does the need for sustainable and innovative packaging solutions that enhance the product's appeal. Businesses are increasingly focusing on eco-friendly materials and designs that minimize waste and enhance consumer experience, thus playing a pivotal role in the supply chain management process.

Insights On Warehouse Type

Cold Storage

The Cold Storage is expected to dominate the Global On-Demand Warehousing Market. The rising demand for perishable goods, coupled with the expansion of e-commerce, has significantly increased the need for refrigerated and frozen storage solutions. Consumers' changing preferences for fresh food, as well as the growth of the pharmaceutical and biotechnology sectors requiring temperature-sensitive products, further augments this demand. Cold Storage inherently supports the efficacy of the food supply chain and the safe transportation of temperature-sensitive items, creating a robust foundation for its dominance in the evolving warehousing landscape.

Dry Storage

Dry Storage plays a crucial role in the Global On-Demand Warehousing Market, serving as a fundamental solution for a wide array of non-perishable goods. Typically less expensive to maintain compared to Cold Storage, this option appeals to a broad range of industries, including retail, automotive, and consumer goods. Efficiency and flexibility are key benefits of Dry Storage, enabling businesses to adapt quickly to market demands. While it does not hold the dominating position, its significant contribution to overall warehousing capacity makes it a critical component.

Climate-Controlled Storage

Climate-Controlled Storage is designed to manage ambient conditions beyond temperature, catering to products that require strict humidity and air-quality control. This warehousing solution appeals to sectors like electronics, textiles, and certain types of machinery, where environmental fluctuations could lead to deterioration. While not the leading choice in the market, it occupies a niche space essential for businesses needing to ensure product integrity in specific conditions, thus maintaining its relevance amidst the dominant Cold Storage sector.

Insights On Duration

Medium-Term Warehousing

Medium-Term Warehousing (1-6 Months) is expected to dominate the Global On-Demand Warehousing Market due to increasing demand from businesses looking for flexible storage solutions that cater to fluctuating inventory needs. This bridges the gap between short-term and long-term warehousing, providing a fair balance of cost-effectiveness and accessibility. Companies often experience seasonal inventory spikes, necessitating storage solutions that accommodate varying durations without committing to long-term leases. Moreover, with the growth of e-commerce, businesses are adopting more variable warehousing strategies that complement their dynamic supply chain requirements, further solidifying the prominence of this.

Short-Term Warehousing (Less than 1 Month)

Short-Term Warehousing (Less than 1 Month) caters to businesses with immediate, urgent needs for storage, often linked to seasonal demand or short-lived projects. This aspect of warehousing is attractive to startup companies and small businesses that require temporary solutions without long-term commitments. However, while demand exists, the limitations associated with the rapid turnover of inventory and the need for quick operations can lead to higher costs. Growth is generally more variable in this category as it is heavily dependent on specific logistical requirements and market conditions.

Long-Term Warehousing (6+ Months)

Long-Term Warehousing (6+ Months) offers stability and security for businesses that prefer to secure inventory over extended periods. This predominantly attracts large enterprises or manufacturers who require consistent storage for goods in production or for planned distribution over time. However, while it provides reliability, the financial commitment needed for long-term leases can deter smaller companies from accessing this option. Additionally, the growing inclination of businesses towards flexibility in their operations poses a challenge for this category, making it relatively less favorable compared to the more adaptable medium-term warehousing solutions.

Insights On Industry

E-commerce and Retail

E-commerce and Retail is expected to dominate the Global On-Demand Warehousing Market due to the rapid growth of online shopping and the increasing demand for fast, flexible logistics solutions. The rise of digital platforms has transformed consumer purchasing habits, leading to a ened need for efficient warehousing to facilitate quicker delivery times. Companies are increasingly adopting on-demand warehousing to respond to fluctuating inventory needs without the burden of fixed costs associated with traditional warehousing solutions. This flexibility enables retailers and e-commerce businesses to manage their supply chains more effectively, ultimately supporting a seamless customer experience and driving market growth in this sector.

Consumer Goods

Consumer Goods is a significant area within the On-Demand Warehousing Market, as companies seek to respond to varying consumer preferences and seasonal demand spikes. The need to store and distribute a wide range of consumer products in an efficient manner is paramount, particularly amid changing shopping patterns. On-demand warehousing allows these businesses to quickly adjust their storage capabilities without long-term commitment, ensuring they can maintain sufficient stock levels without incurring unnecessary costs.

Food and Beverage

The Food and Beverage sector requires specialized warehousing solutions due to its unique challenges, such as temperature control and freshness requirements. On-demand warehousing plays a crucial role in helping businesses navigate seasonal fluctuations, promotions, and supply chain disruptions. By leveraging flexible storage solutions, companies can better manage their perishable inventory and ensure timely distribution, ultimately enhancing their overall operational efficiency and customer satisfaction.

Pharmaceuticals and Healthcare

Pharmaceuticals and Healthcare also necessitate specialized warehousing operations due to stringent regulatory requirements and the critical nature of the products involved. On-demand warehousing provides the flexibility needed to accommodate fluctuating storage requirements, ensuring that healthcare providers and pharmaceutical companies can distribute their products efficiently. Additionally, the capacity to respond quickly to unexpected spikes in demand for essential health products is invaluable in this industry.

Electronics and Technology

Electronics and Technology often face rapid product lifecycle changes, requiring adaptive warehousing solutions to keep pace with innovation. On-demand warehousing enhances storage capacity and allows for quick distribution, addressing the fast-moving nature of tech products. Companies within this sector benefit from agile warehousing strategies that accommodate varying inventory levels, improving timelines for product launches and responsiveness to market trends

Automotive

The Automotive industry relies heavily on efficient logistics and warehousing strategies to manage complex supply chains. On-demand warehousing offers the flexibility to adjust to production schedules and changing consumer demand for various vehicle models and components. By utilizing on-demand warehousing, automotive companies can minimize storage costs while ensuring they have the necessary parts on hand when needed, thus streamlining operations and maintaining high service levels.

Global On-Demand Warehousing Market Regional Insights:

North America

North America is expected to dominate the Global On-Demand Warehousing market due to the region's advanced logistics infrastructure, high e-commerce penetration, and growing demand for flexible warehousing solutions. Major industry players, including Amazon and Walmart, are investing heavily in on-demand warehousing to meet consumer expectations for faster delivery. The proliferation of technology and automation within warehousing operations in the U.S. further streamlines processes, providing competitive advantages. Additionally, a robust supply chain ecosystem and a growing trend towards urbanization intensify the need for adaptive space solutions, solidifying North America's position as the leading region in this market.

Latin America

Latin America shows significant growth potential in the on-demand warehousing market, driven by increasing e-commerce activities and foreign investments in logistics infrastructure. Countries like Brazil and Mexico are seeing improvements in their warehousing capabilities, attracting businesses seeking localized storage solutions. However, challenges such as political instability and economic fluctuations may hamper stronger growth compared to other regions, making it a developing market in this sector.

Asia Pacific

The Asia Pacific region, particularly countries such as China and India, is experiencing rapid growth in on-demand warehousing driven by urbanization, evolving retail landscapes, and rising consumer demand for quick deliveries. The increasing proliferation of advanced technologies, such as IoT and AI, further enhances operational efficiencies within warehouses. Despite these advancements, challenges like regulatory hurdles and infrastructure limitations in some areas may slow down the pace of market dominance.

Europe

Europe is witnessing a steady increase in on-demand warehousing, primarily fueled by growing e-commerce and logistics sector innovations. The push for sustainability and green logistics is also playing a crucial role in shaping the European warehousing market. However, variations in market maturity across different countries and economic considerations may limit its ability to compete with North America’s more robust and established infrastructure.

Middle East & Africa

The Middle East & Africa region is emerging in the on-demand warehousing market as investment in logistics and infrastructure is on the rise. Countries like the UAE are enhancing their warehousing capabilities to support a diverse economy and increasing trade activity. However, many areas are still facing infrastructural constraints and regulatory challenges, which may hinder the region from achieving significant market share compared to more developed areas.

On-Demand Warehousing Competitive Landscape:

Prominent entities within the Global On-Demand Warehousing sector provide adaptable storage options by utilizing advanced technology and robust logistics frameworks, thereby improving operational efficiency and scalability for companies. These players foster innovation and refine supply chain processes via strategic collaborations and effective resource allocation.

The principal entities in the on-demand warehousing sector encompass Flexe, Stowga, Flowspace, Warehousing.com, ShipBob, Whiplash, DigitalOcean, XPO Logistics, IDS Logistics, and Cargomatic. Other prominent firms include 3PL Central, Red Stag Fulfillment, Rivigo, Zappos, and Goodstore. Furthermore, organizations such as Rappi, ShipMonk, and Prologis also hold substantial influence within this industry.

Global On-Demand Warehousing COVID-19 Impact and Market Status:

The Covid-19 pandemic significantly expedited the expansion of the worldwide on-demand warehousing sector, as it ened the need for adaptable storage options and swift delivery services in response to interruptions in the supply chain.

The COVID-19 pandemic brought about profound changes in the on-demand warehousing sector, propelling the growth of e-commerce and reshaping supply chain frameworks. As companies navigated through lockdowns and varying consumer behaviors, many pivoted to flexible warehousing solutions, enabling them to swiftly respond to evolving market conditions. The increase in online shopping created a demand for more storage capacity and improved order fulfillment processes, leading businesses to adopt on-demand warehousing to optimize inventory management. Furthermore, the limitations of conventional logistics underscored the necessity for adaptability and scalability, driving the incorporation of cutting-edge technologies like artificial intelligence and automation into warehousing functions. This transition sparked intensified competition among warehousing providers, inspiring new innovations in services and pricing structures. As a result, the on-demand warehousing market experienced notable expansion, fueled by the imperative for resilience and agility in logistics strategies in the post-pandemic landscape, thereby establishing new operational standards for the future of the supply chain industry.

Latest Trends and Innovation in The Global On-Demand Warehousing Market:

- In July 2023, Flexe, a leading on-demand warehousing platform, announced a partnership with Walmart to expand the latter's fulfillment capacity, leveraging Flexe's network to meet increased consumer demand for fast shipping options.

- In March 2023, Stowga, a UK-based on-demand warehousing company, secured £10 million in Series A funding led by BGF, intended to enhance its technological capabilities and expand its marketplace for warehouse space across Europe.

- In June 2023, Flowspace introduced a new AI-driven inventory management tool designed to optimize warehouse space utilization, which enables businesses to gain better visibility and control over their inventory in real-time.

- In August 2023, Warehouse Anywhere acquired the technology assets of a smaller competitor, focusing on integrating cutting-edge software solutions to improve operational efficiency in their on-demand warehousing services.

- In April 2023, ShipBob announced that it had raised $200 million in a Series E funding round, with plans to use this capital to expand its on-demand warehousing capabilities, particularly in the areas of automation and fulfillment technology.

- In September 2023, Prologis, a global logistics real estate investment trust, announced a joint venture with e-commerce company Shopify to develop a network of on-demand warehouses that will support Shopify's merchant fulfillment goals.

- In February 2023, Locus Robotics revealed the launch of their new robotics system designed for warehouses, aimed at streamlining operations and providing on-demand warehousing solutions by enhancing picking efficiency.

On-Demand Warehousing Market Growth Factors:

The On-Demand Warehousing sector is experiencing growth driven by the increasing need for adaptable storage options, a surge in e-commerce operations, and the necessity for streamlined supply chain management.

The On-Demand Warehousing Market is witnessing remarkable expansion, propelled by multiple key elements. A primary driver is the surge in e-commerce, which has amplified the need for adaptable storage solutions, as companies strive to refine their supply chains and fulfill consumer demands for expedited delivery. This movement towards flexible warehousing is further supported by the increasing prevalence of third-party logistics (3PL) providers that deliver customizable warehousing services, catering to businesses with varying seasonal or unpredictable inventory requirements. Additionally, innovations in technology, such as warehouse management systems and automation tools, significantly boost operational effectiveness and inventory tracking, enticing more enterprises to adopt on-demand warehousing practices. The globalization of trade is another contributing factor, as organizations increasingly rely on versatile warehousing to manage international shipping needs. Moreover, the COVID-19 pandemic has hastened the digital transformation across numerous sectors, urging businesses to reassess their logistics strategies and embrace more progressive warehousing options. Lastly, the focus on cost efficiency and optimization is encouraging companies to turn to on-demand warehousing as a practical substitute for conventional leasing arrangements, allowing them to reduce overhead costs while sustaining service quality. Collectively, these dynamics foster a strong landscape for the ongoing growth of the on-demand warehousing industry.

On-Demand Warehousing Market Restaining Factors:

The On-Demand Warehousing Market faces significant obstacles such as varying demand trends, elevated operational expenses, and apprehensions regarding the dependability of supply chains.

The On-Demand Warehousing Market encounters various challenges that may hinder its expansion, such as regulatory obstacles, variable demand trends, and intricate operational issues. For instance, differing zoning requirements and safety regulations in different jurisdictions can limit the ability to set up new warehousing facilities. Furthermore, the erratic demand associated with e-commerce poses difficulties for inventory control and supply chain optimization, potentially resulting in either stock shortages or excess inventory. The complexities of operations, which include the seamless integration of technology and the effective management of a network of dispersed warehouses, can stretch resources thin and raise operational costs for companies aiming for logistical flexibility. The scarcity of appropriate real estate in metropolitan locales also adds to the difficulties of growth, while traditional logistics firms may present competitive obstacles to entering the market. Nonetheless, the market is undergoing transformation, fueled by technological advancements and innovative practices in supply chain management that create avenues for growth and enhanced operational efficiency. As businesses increasingly prioritize agility and flexibility in their processes, the On-Demand Warehousing Market is poised to adapt and prosper in the face of these hurdles, leveraging challenges as opportunities for innovation and superior service delivery.

Key Segments of the On-Demand Warehousing Market

By Service Type

- Storage and Warehousing

- Fulfillment and Distribution

- Inventory Management

- Transportation and Logistics

- Packaging and Labeling

By Warehouse Type

- Dry Storage

- Cold Storage

- Refrigerated

- Frozen

- Climate-Controlled Storage

By Duration

- Short-Term Warehousing (Less than 1 Month)

- Medium-Term Warehousing (1-6 Months)

- Long-Term Warehousing (6+ Months)

By Industry

- E-commerce and Retail

- Consumer Goods

- Food and Beverage

- Pharmaceuticals and Healthcare

- Electronics and Technology

- Automotive

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America