Oil and Gas Security Market Analysis and Insights:

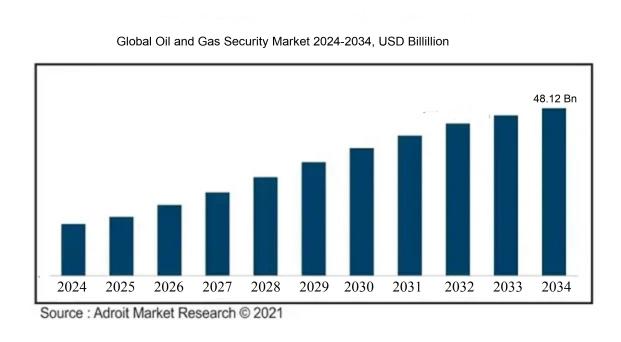

At USD 28.19 billion in 2024, the size of the worldwide oil and gas security market increased to USD 30.04 billion in 2025, and it is expected to reach around USD 48.12 billion by 2034, indicating a robust compound annual growth rate (CAGR) of 6.50% from 2024 to 2034.

The Oil and Gas Security Market is influenced by several significant factors. Primarily, escalating geopolitical tensions and conflicts in regions abundant in oil intensify the necessity for improved security protocols to safeguard essential infrastructure. Furthermore, the growing global appetite for energy, combined with the susceptibility of oil and gas installations to cyber threats and physical incursions, drives the demand for sophisticated security technologies and strategies. In addition, stringent regulatory standards and compliance obligations aimed at ensuring safety and environmental sustainability contribute to the market's expansion. The adoption of innovative technologies, including artificial intelligence and the Internet of Things, for real-time surveillance and threat identification is also pivotal in shaping the dynamics of the market. Moreover, the increasing trend of digital transformation within the oil and gas industry encourages investments in security solutions that effectively protect assets and reduce risks. Together, these elements highlight the critical need for comprehensive security frameworks to uphold operational continuity in the oil and gas sector.

Oil and Gas Security Market Definition

Oil and gas security pertains to the consistent availability and accessibility of petroleum resources, aimed at guaranteeing a stable supply to fulfill energy demands. It involves strategies implemented to safeguard these resources against interruptions, geopolitical threats, and variations in market dynamics.

The security of oil and gas resources is essential for maintaining a reliable energy supply, which is crucial for economic development and national defense. Nations that depend on fossil fuels encounter threats from geopolitical conflicts, interruptions in supply chains, and fluctuations in the market, potentially resulting in price surges and energy deficits. Achieving a secure energy landscape promotes energy autonomy, diminishes susceptibility to outside pressures, and encourages sustained investment in infrastructure. Furthermore, consistent availability of oil and gas fosters job generation and sustains employment across multiple industries, positioning energy security as a fundamental element of economic stability and national strategic initiatives.

Oil and Gas Security Market Segmental Analysis:

Insights On Component

Software

The software component is projected to dominate the Global Oil and Gas Security Market primarily due to its increasing integration with advanced technologies such as artificial intelligence, machine learning, and big data analytics to enhance security protocols. As oil and gas operations strive for improved efficiency and protection against cyber threats, robust software solutions that can analyze data in real-time and predict possible threats are becoming essential. Furthermore, regulatory compliance and the need for continuous monitoring are pushing companies to invest in sophisticated software systems that can adapt to the evolving landscape of security challenges in this sector.

Hardware

The hardware facet of the oil and gas security market plays a pivotal role by providing essential components like surveillance cameras, access control systems, and intrusion detection systems. While it may not lead the market, hardware remains crucial for establishing a physical security framework, which is necessary to support software solutions. As companies look to enhance their physical protective measures, a variety of advanced hardware options are being adopted, integrating seamlessly with software systems to create a comprehensive security strategy.

Services

The services component encompasses crucial offerings such as installation, maintenance, and consulting for security systems within the oil and gas industry. While not the leading, services are integral for ensuring the optimal functioning and longevity of both hardware and software components. With the increasing complexity of security challenges, organizations are likely to invest in expert consulting services that can tailor solutions to their specific needs and provide ongoing support, thereby ensuring that security systems remain effective and up-to-date in a rapidly changing environment.

Insights On End User

Oil and Gas Companies

Oil and Gas Companies are anticipated to dominate the Global Oil and Gas Security Market due to their central role in extraction and production, which exposes them to numerous security threats, including sabotage, theft, and cyberattacks. The increasing need for enhanced security measures to safeguard assets, personnel, and operational information makes investments in security solutions a priority for these companies. As geopolitical tensions and environmental concerns grow, the requirement for comprehensive security strategies becomes critical, further driving the demand for advanced security technologies within this sector.

Pipeline Operators

Pipeline Operators play a crucial role in the oil and gas industry, ensuring the safe and efficient transportation of resources. However, their infrastructure is susceptible to threats ranging from vandalism to cyber intrusions. As incidents targeting the pipeline sector grow, the operators are increasingly investing in robust security systems and surveillance technologies to protect their assets. The emphasis on regulatory compliance and safety protocols is expected to enhance the focus on security measures within this area, leading to a significant market presence.

Drilling Contractors

Drilling Contractors face unique security challenges as they operate in remote locations with valuable equipment. The risk of theft and equipment damage necessitates robust security solutions to protect personnel and assets. Although they represent a smaller part of the overall market, the increasing need for tight security protocols during drilling operations is observed. Moreover, partnerships with security providers are becoming more common, creating layers of security that further support their operational integrity.

Energy Infrastructure Providers

Energy Infrastructure Providers are responsible for the management of facilities that support oil and gas activities, and they encounter various threats that could disrupt their operations. These threats include not only physical security breaches but also cyber threats affecting interconnected systems. Though they are a vital link in the energy supply chain, their focus on security measures is often less emphasized than that of larger oil and gas firms. Nevertheless, with the rising importance of cybersecurity and infrastructure protection, their contributions to the security market are gradually increasing.

Third-party Security Providers

Third-party Security Providers are essential in the Global Oil and Gas Security Market, delivering specialized services and expertise to enhance security for various clients. Their role often includes risk assessments, technology implementations, and ongoing monitoring. However, their reliance on partnerships with larger entities for substantial contracts positions them as a supporting force rather than the main player. Even though they provide critical services, their dominance is throttled by the primary users of security services, which lie predominantly within the main oil and gas firms.

Global Oil and Gas Security Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Oil and Gas Security market. The increasing energy demand from rapidly growing economies such as China and India, alongside the ongoing urbanization and industrialization, are the primary drivers stimulating this market. Additionally, the geopolitical tensions, especially concerning energy security, make this region a focal point for investments in oil and gas security measures. Furthermore, with the increased adoption of advanced technologies and digital transformation in the energy sector, Asia Pacific is poised to strengthen its position. Countries in this region are actively looking to enhance their energy infrastructure, ensure supply chain security, and adopt robust risk management frameworks, thereby outpacing other global regions.

North America

North America is a significant player in the Global Oil and Gas Security market, driven primarily by the strong presence of established oil and gas companies and advanced regulatory frameworks. The region benefits from technological advancements in extraction and production processes, particularly in the United States with its shale gas revolution. Additionally, improving energy self-sufficiency and the shift towards cleaner energy solutions create an innovative landscape where security measures are critical. The region's proactive stance in cybersecurity and infrastructure investments further positions it as a formidable contender in the oil and gas security arena.

Europe

Europe has been focusing on diversifying its energy sources and enhancing energy security due to fluctuating geopolitical influences. The region is seeing a shift towards renewable energy, which requires robust security measures for both traditional and alternative sources. European nations are heavily investing in infrastructure upgrades and cybersecurity initiatives to protect against potential threats. Collaborative measures among EU member states also foster a united approach towards energy security, including strategic partnerships internationally. However, the reliance on imported oil and gas adds a level of vulnerability that could affect its competitive standing in the market.

Latin America

Latin America possesses vast oil and gas reserves, making it a key area of interest for energy security. However, political instability in some of its leading oil-producing countries has hampered consistent investment in security measures. Regionally, there is a push to enhance exploration and production while focusing on improving security frameworks. Initiatives to stabilize governance and promote foreign investment are promising signs for the market. The growing interest from international companies seeking to establish new partnerships in the energy sector could help solidify Latin America's position in the global oil and gas security landscape.

Middle East & Africa

The Middle East & Africa region is rich in oil reserves and plays a crucial role in the global energy market. Security concerns, however, are paramount due to geopolitical instability and potential disruptions in supply chains. The region is focusing on bolstering security measures through collaborations with international partners and investing in technology. However, ongoing conflicts and regulatory challenges limit its full potential in dominating the oil and gas security market. The emphasis on public-private partnerships and refined economic strategies may enhance its competitive edge, although significant hurdles remain in achieving a decisive leading position.

Oil and Gas Security Competitive Landscape:

Prominent participants in the Global Oil and Gas Security sector consist of leading energy corporations and cybersecurity specialists who utilize cutting-edge technologies and approaches to shield vital infrastructure from potential threats, thereby guaranteeing a secure supply of energy resources. Their cooperative initiatives enhance resilience to cyber threats and geopolitical challenges, preserving the operational integrity of the industry.

Major contributors to the Oil and Gas Security Market comprise Halliburton, Schlumberger, Baker Hughes, McKinsey & Company, Deloitte, IBM, Honeywell International Inc., Accenture plc, Aker Solutions, KBR, Inc., Wood Group, Siemens AG, General Electric Company, and PwC. Other prominent entities in this sector include GFT Technologies SE, SAIC, Cyberhawk Innovations, Radnor Consulting, Taranis, and Convergint Technologies. Furthermore, important players such as the Cybersecurity and Infrastructure Security Agency (CISA), Siemens Energy, and Chevron also play a crucial role in the market landscape.

Global Oil and Gas Security COVID-19 Impact and Market Status:

The Covid-19 crisis profoundly impacted the Global Oil and Gas Security sector, triggering an extraordinary drop in demand. This situation resulted in volatile pricing and ened emphasis on building resilience and sustainability within energy supply networks.

The COVID-19 crisis has had a profound impact on the security landscape of the oil and gas sector, primarily driven by a steep decline in demand and interruptions in supply chains. With lockdowns and restrictions on movement, oil consumption plummeted, compelling companies to reevaluate their security protocols amid volatile prices and operational transitions. The ened focus on health and safety has necessitated enhancements in cybersecurity frameworks to safeguard sensitive information from potential threats, particularly in light of increased remote work. Additionally, geopolitical uncertainties and a pressing need for strategic adaptability have spurred investments in cutting-edge surveillance and monitoring systems. As the industry begins to stabilize, there is a significant movement towards embracing innovative tools, such as AI-based risk assessment and integrated security solutions, to bolster preparedness for future challenges. Overall, the pandemic has highlighted the critical importance of strong security frameworks in the oil and gas industry, aimed at fostering improved resilience and long-term sustainability.

Latest Trends and Innovation in The Global Oil and Gas Security Market:

- In September 2023, Halliburton acquired the technology startup Addax Energy, focusing on enhancing security measures in digital oilfield operations through advanced analytics and machine learning capabilities.

- In August 2023, Shell announced a joint venture with C3 AI to develop AI-driven security solutions that protect critical infrastructure within the oil and gas sector, aiming to improve cyber resilience.

- In July 2023, BP integrated innovative blockchain technology into its supply chain management, collaborating with IBM to enhance security and transparency in transactions, thereby reducing the risk of fraud and data breaches.

- In May 2023, Chevron completed the acquisition of 50% stake in a cybersecurity firm specializing in oil and gas infrastructure protection, which aims to bolster cybersecurity measures across its global operations.

- In April 2023, TotalEnergies launched its new comprehensive security management system called "SecureProd", designed to mitigate risks associated with physical threats to its facilities and personnel in multiple regions.

- In March 2023, Equinor partnered with Palantir Technologies to leverage big data analytics for enhanced security monitoring and threat detection in oil and gas operations, streamlining response times to potential security incidents.

- In January 2023, Enbridge invested heavily in the development of a new smart surveillance system leveraging drone technology, aimed at protecting pipelines and facilities from intrusions and environmental threats.

- In December 2022, ExxonMobil rolled out a new cybersecurity framework to safeguard its operational technology systems, following a comprehensive vulnerability assessment that identified potential risks in its digital infrastructure.

- In November 2022, ConocoPhillips entered into a strategic alliance with the international firm Control Risks to enhance risk management and security strategies across its global exploration and production sites.

Oil and Gas Security Market Growth Factors:

The primary drivers for the growth of the Oil and Gas Security Market encompass ened investments in energy infrastructure, escalating geopolitical conflicts, and the growing implementation of cutting-edge security technologies.

The expansion of the Oil and Gas Security Market is primarily influenced by a variety of significant factors. Heightened geopolitical tensions and conflicts in regions abundant in oil resources are prompting nations and corporations to bolster their security protocols. Furthermore, the surge in cyber threats directed at vital infrastructure in this sector has highlighted the critical importance of strong cybersecurity measures, resulting in substantial investments in advanced protective technologies by industry players.

In addition, compliance with regulations designed to mitigate environmental and operational risks has driven organizations to implement comprehensive security systems. The growing focus on digital transformation within the industry not only boosts operational efficiencies but also ens the risk of security vulnerabilities, necessitating the adoption of more robust security frameworks.

Moreover, the transition toward renewable energy sources is challenging the traditional oil and gas landscape, leading firms to re-assess and modernize their security strategies to keep pace with shifting market trends. Lastly, as the industry rebounds in the wake of the COVID-19 pandemic, there is a notable uptick in production and exploration efforts, which amplifies the need for improved security measures to safeguard both assets and personnel. Together, these dynamics underscore the urgent demand for innovation and capital investment in oil and gas security solutions, driving growth in a fiercely competitive market.

Oil and Gas Security Market Restaining Factors:

The primary challenges facing the Oil and Gas Security Market are geopolitical uncertainties, variable petroleum prices, and a growing focus on alternative energy solutions.

The Oil and Gas Security Market is undergoing a variety of challenges that could impede its expansion. A primary concern is the increasing emphasis on renewable energy and the global transition toward sustainability, which shifts investments away from conventional fossil fuels. Additionally, regulatory hurdles, such as more stringent environmental regulations and geopolitical instability, may affect both operations and investment decisions, creating an atmosphere of uncertainty. The oscillation of oil prices and economic recessions can also negatively influence financial support for security technologies and services. Moreover, the rising threat of cyberattacks poses a significant risk, as the sector becomes more dependent on digital frameworks, rendering it vulnerable to disruptions. The substantial expenses involved in implementing state-of-the-art security systems may also discourage some enterprises from making full investments. Nevertheless, the market is experiencing advancements in security technologies and an increased recognition of energy security’s significance, motivating organizations to strengthen their security processes. The dedication to enhancing energy resilience, along with the continuous evolution of integrated security solutions, suggests a hopeful trajectory for the market, demonstrating its potential to adapt and thrive amid existing challenges and upcoming prospects.

Key Segments of the Oil and Gas Security Market

By Component

• Hardware

• Software

• Services

By End User

• Oil and Gas Companies

• Pipeline Operators

• Drilling Contractors

• Energy Infrastructure Providers

• Third-party Security Providers

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America