Oil and Gas Analytics Market Analysis and Insights:

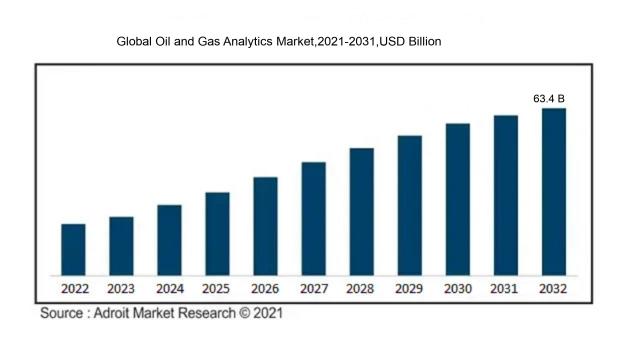

In 2023, the size of the worldwide Oil and Gas Analytics market was US$ 8.45 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 22.2% from 2024 to 2032, reaching US$ 63.4 billion.

The Oil and Gas Analytics Market is experiencing significant growth fueled by the increasing necessity for data-informed decision-making and enhanced operational effectiveness within the industry. As exploration and production activities become more intricate, there is a pressing requirement for sophisticated analytics that can optimize performance while minimizing costs. Furthermore, the ened focus on sustainability and adherence to regulatory standards urges organizations to utilize analytics for improved resource management and assessment of environmental effects. The incorporation of technologies like the Internet of Things (IoT), big data, and artificial intelligence significantly bolsters predictive analytics capabilities, aiding in asset management, supply chain efficiency, and risk assessment. In addition, the fluctuations in oil prices prompt companies to implement advanced analytical solutions for superior forecasting and strategic development. Altogether, these elements drive the growing integration of analytics tools, empowering oil and gas firms to maintain their competitive edge in a dynamic market environment.

Oil and Gas Analytics Market Definition

Oil and gas analytics encompasses the utilization of data analytical methods aimed at refining exploration, extraction, and distribution activities within the petroleum sector. This field leverages cutting-edge technologies and strategies to bolster decision-making processes, enhance operational effectiveness, and lower expenditures.

The utilization of analytics in the oil and gas industry is vital for improving operational productivity, minimizing expenses, and optimizing resource utilization. Through the application of sophisticated data analysis techniques, organizations can forecast market trends, assess equipment efficiency, and pinpoint potential hazards, facilitating sound decision-making processes. Furthermore, analytics provides insights into consumer behavior and enhances supply chain management, ultimately boosting profitability. As operations become more intricate and the emphasis on sustainability grows, harnessing data-derived insights becomes crucial for achieving a competitive advantage and responding to regulatory shifts in the fluctuating oil and gas landscape. In essence, analytics is fundamental in influencing strategic business development.

Oil and Gas Analytics Market Segmental Analysis:

Insights On Offering

Software

The Software offering is anticipated to lead the Global Oil and Gas Analytics Market due to the increasing need for advanced data analysis and decision-making capabilities in the industry. As companies strive to improve operational efficiency and enhance production levels, the adoption of intelligent analytics solutions is becoming essential. Software solutions provide valuable insights into drilling efficiencies, predictive maintenance, and market demand forecasting, allowing companies to optimize their resources and reduce costs significantly. The ongoing digital transformation and the introduction of machine learning techniques further enhance the attractiveness of software offerings, positioning them at the forefront of market growth in this sector.

Hardware

The Hardware category is also a vital component within the Global Oil and Gas Analytics Market, serving to enable high-efficiency data collection and processing. Devices such as sensors, advanced drilling equipment, and IoT devices play a crucial role in gathering real-time data from oil fields and refineries. As the demand for automation and enhanced operational visibility rises, hardware solutions are becoming indispensable. More investments in smart devices and technological innovations will continue to propel growth in this domain, as companies look to integrate seamless hardware and software systems for improved analytics.

Services

The Services aspect of the market is significant as well, encompassing consulting, implementation, and maintenance support for analytics solutions. As organizations seek to maximize their return on investment and minimize operational risks, demand for expert guidance becomes increasingly important. Service providers help oil and gas firms to customize and integrate analytics solutions tailored to their specific needs, facilitating more robust decision-making processes. This ongoing need for expertise in system deployment and management is expected to drive steady growth in the services sector, contributing to overall market advancement, despite not leading in dominance.

Insights On Deployment

Cloud

The cloud deployment method is expected to dominate the Global Oil and Gas Analytics Market due to its numerous advantages over traditional on-premise solutions. Organizations in the oil and gas sector are increasingly embracing digital transformation, seeking flexible, scalable, and cost-effective solutions that cloud offers. The ability to access data and analytics from anywhere, paired with lower initial infrastructure investments, is making cloud-based analytics a preferred choice. Furthermore, cloud solutions often provide enhanced collaboration capabilities and real-time data processing, vital for timely decision-making in the oil and gas industry. As companies prioritize efficiency and operational agility, the cloud deployment method is set to lead the market.

On-Premise

On-premise deployment is characterized by organizations hosting their analytics systems internally, which provides certain advantages, especially in terms of data security and compliance. Some oil and gas companies feel more comfortable maintaining direct control over their sensitive data and proprietary algorithms, as regulatory requirements often dictate strict data privacy protocols. Despite the initial higher capital expenditure and maintenance costs associated with on-premise solutions, these organizations might prefer the stability and security that comes with having their analytics infrastructure on-site. However, the trend is shifting towards cloud solutions that offer greater flexibility and lower costs.

Insights On Application

Midstream

The Midstream sector is poised to dominate the Global Oil and Gas Analytics Market due to its critical role in the transportation, storage, and distribution of oil and gas. As the transition towards smarter energy solutions accelerates, analytics tools in the Midstream sector enhance operational efficiency, optimize logistics, and improve regulatory compliance. The increasing focus on pipeline monitoring and integrity management, coupled with the analytics derived from transportation data, significantly reduces costs while maintaining safety standards. Moreover, the integration of IoT and real-time data analytics in handling midstream operations ensures a seamless flow of information, contributing to modernization efforts and fostering decision-making based on predictive insights.

Upstream

In the Upstream application, analytics play a significant role in exploration and production efficiency. This area focuses on drilling optimization, reservoir management, and data-driven decision-making. Companies leverage advanced analytics for seismic data interpretation and to enhance recovery rates, yet challenges such as high costs and unpredictable market volatility can limit growth. Despite being crucial for discovering new reserves, the turbulent environment makes it less attractive compared to the operational efficiencies offered in others.

Downstream

The Downstream category, which involves refining and marketing petroleum products, utilizes analytics mainly to optimize refinery operations and supply chain management. While this sector relies on analytics for predictive maintenance and market demand forecasting, it often experiences tighter margins due to price fluctuations in crude oil. Although important for improving customer engagement and production efficiency, it tends to lag behind the Midstream sector in terms of significant technological investments and growth opportunities, thereby limiting its overall dominance in the analytics market.

Insights On End Use

Large Enterprises

The Global Oil and Gas Analytics Market is expected to be dominated by large enterprises due to their significant financial resources and capacity to leverage advanced analytics technologies. These large entities inherently possess greater volumes of data generated from their extensive operations, making them prime candidates for adopting comprehensive analytics solutions. As they face complex challenges such as optimizing production, managing risks, and complying with regulations, large enterprises are inclined to invest in robust analytics platforms that provide actionable insights. Furthermore, their established market presence allows for accelerated technology adoption, resulting in a competitive edge. Thus, their demand for sophisticated analytics tools is projected to continue driving market growth.

Medium Enterprises

Medium enterprises are gradually increasing their adoption of oil and gas analytics solutions, driven primarily by the need to enhance operational efficiency and reduce costs. As these entities aim to compete with larger firms, they are beginning to recognize the value of data analytics in optimizing their supply chain and maintenance processes. The ongoing digital transformation initiatives also encourage medium enterprises to invest in analytics tools that can improve decision-making. However, they often face budget constraints compared to larger organizations, which may limit the extent to which they can utilize advanced analytics platforms.

Small Enterprises

Small enterprises in the oil and gas sector are the least likely to dominate the analytics market due to limited financial resources and data volume. While they may rely on basic analytics to monitor performance and support decision-making, many small companies find it challenging to invest in sophisticated analytics solutions. Their operations are often less complex, leading to a lower perceived need for advanced analytics technologies. Nevertheless, some small enterprises are starting to adopt cloud-based analytics tools, which provide more affordable access to insights and could help them remain competitive in a rapidly evolving market landscape.

Global Oil and Gas Analytics Market Regional Insights:

North America

North America is expected to dominate the Global Oil and Gas Analytics market due to its advanced technological landscape, substantial investments in digital transformation, and the presence of industry players. The region benefits from a well-established oil and gas infrastructure, facilitating the adoption of data analytics solutions to optimize operations, improve decision-making, and enhance safety. Additionally, the growing emphasis on sustainability and efficiency drives companies to utilize analytics for predictive maintenance and resource management. The ongoing innovations in cloud computing and Internet of Things (IoT) technologies further bolster North America's leadership position in this sector, creating a competitive edge for businesses operating within this market.

Latin America

Latin America is witnessing a gradual uptake of oil and gas analytics, driven primarily by the need for operational efficiency and improved asset management as energy companies seek to maximize production while minimizing costs. However, the region faces challenges such as regulatory uncertainties and infrastructure limitations that hinder the rapid growth of analytics adoption. Nevertheless, countries like Brazil and Mexico are making strides toward integrating more advanced analytics solutions, encouraging growth in the sector.

Asia Pacific

Asia Pacific presents significant growth potential in the oil and gas analytics market, largely propelled by increasing energy demand and investments in digital technologies. Countries such as China and India are focusing on enhancing their oil and gas sectors through analytics to drive efficiency and innovation. However, the region's growth is somewhat tempered by varying technological readiness and infrastructure challenges across different countries, leading to a fragmented market landscape currently.

Europe

Europe is adopting oil and gas analytics, fueled by a strong focus on sustainability and regulatory compliance. The European Union's initiatives toward energy transition drive companies to turn to analytics to improve production efficiency and reduce environmental impact. However, competition among various nations with differing regulatory frameworks and technologies creates a complex market. While some regions like Scandinavia are leading in innovation, others are progressing at a slower pace.

Middle East & Africa

The Middle East and Africa region is gradually embracing oil and gas analytics, primarily driven by the need for operational excellence in an industry known for volatility. Countries with established oil reserves, such as Saudi Arabia and the UAE, are focusing on implementing analytics to optimize their production capabilities. Challenges such as economic instability and varying levels of technological adoption across the continent may hinder faster growth in the analytics market compared to other regions.

Oil and Gas Analytics Market Competitive Landscape:

Prominent participants in the worldwide Oil and Gas Analytics industry play a crucial role in fostering innovation and operational efficiency. By utilizing cutting-edge data analytics, they enhance operational optimization and refine decision-making strategies. Their specialized knowledge contributes to better exploration, production, and supply chain management in the industry.

Prominent participants in the Oil and Gas Analytics sector comprise IBM Corporation, SAS Institute Inc., Palantir Technologies, Halliburton Company, Schlumberger Limited, Baker Hughes Company, Oracle Corporation, Accenture PLC, Wood Mackenzie, IHS Markit, Enverus, Kognitio, Sapient Consulting, Rystad Energy, and GlobalData PLC.

Global Oil and Gas Analytics Market COVID-19 Impact and Market Status:

The Covid-19 pandemic had a profound impact on the Global Oil and Gas Analytics sector, leading to a sharp decrease in demand and hastening the necessity for data-oriented approaches aimed at improving operational efficiency and responding to market fluctuations.

The COVID-19 pandemic had a significant effect on the oil and gas analytics sector, mainly because of the sharp drop in global demand for oil and the corresponding fall in prices during the initial phase of the crisis. The implementation of lockdowns and movement restrictions curtailed industrial operations and travel, leading to a notable reduction in energy consumption. As a result, numerous companies delayed or reduced their investments in analytics technologies that are essential for enhancing efficiency and optimization. Conversely, the crisis accelerated the shift towards digital solutions as businesses sought to streamline their operations and manage intricate supply chains more effectively. The growing importance of data-driven decision-making led to increased investments in advanced analytics and machine learning, aimed at improving predictive capabilities and operational resilience. As the market slowly recovers, a noticeable trend towards digital transformation initiatives has emerged, suggesting a long-term change in the oil and gas industry that could strengthen the analytics sector in the coming years. In summary, the pandemic served as a catalyst for both difficulties and opportunities within this dynamic landscape.

Latest Trends and Innovation in The Global Oil and Gas Analytics Market:

- In August 2023, Halliburton announced the acquisition of Gaffney, Cline & Associates, a strategic move aimed at enhancing its consulting and analytic capabilities in oil and gas to support clients in navigating the energy transition.

- In July 2023, Schlumberger launched its new cloud-based platform called DELFI, which integrates AI-based analytics to enhance upstream oil and gas operations and promote real-time decision-making processes.

- In March 2023, Baker Hughes formed a partnership with Microsoft to leverage Azure's capabilities, focusing on integrating advanced analytics and AI technologies into oil and gas workflows for improved operational efficacy.

- In January 2023, ENI and Google Cloud collaborated to develop advanced digital tools that utilize big data analytics to optimize energy production and reduce operational costs across ENI’s global operations.

- In December 2022, TotalEnergies announced a merger with the renewable energy company, EREN Renewable Energy, to enhance its analytics capabilities in assessing and managing energy transition risks and opportunities.

- In November 2022, Wood Mackenzie released a new analytics suite that enhances resource tracking and market insights, allowing operators to optimize their portfolios amid fluctuating energy prices.

- In September 2022, IBM and BP entered into a partnership to improve data analytics in energy trading, using machine learning to enhance predictive analytics for better market insights.

- In June 2022, IHS Markit (now part of S&P Global) launched a comprehensive analytics platform that utilizes machine learning algorithms to forecast oil and gas trends, providing clients with enhanced market visibility and strategic insights.

Oil and Gas Analytics Market Growth Factors:

The expansion of the Oil and Gas Analytics sector is fueled by a rising appetite for data-centric decision processes, a pressing requirement for enhanced operational efficiency, and significant progress in predictive analytics technologies.

The Oil and Gas Analytics Market is undergoing notable expansion, driven by several critical factors. One primary catalyst is the ened demand for improved operational efficiency and cost-effectiveness in exploration and production processes. Companies are increasingly turning to sophisticated analytics solutions that optimize workflows, minimize downtime, and enhance decision-making through valuable insights gained from data throughout the supply chain. Furthermore, the intricate nature of data generated from diverse sources, including IoT devices, necessitates the use of advanced analytics tools for effective management and analysis.

In addition, the growing focus on safety and regulatory compliance accelerates the need for analytics to monitor environmental impacts and ensure industry standards are being met. The incorporation of artificial intelligence and machine learning into analytics systems is also facilitating predictive maintenance and advancing reservoir management, thus bolstering production efficiency. Moreover, the global movement toward sustainable energy initiatives encourages oil and gas firms to leverage analytics for improved resource management and reduced carbon emissions. Lastly, the swift digital transformation within the sector, spurred by innovations in cloud computing and big data technologies, is creating a robust framework for the continued growth of the oil and gas analytics market.

Oil and Gas Analytics Market Restaining Factors:

Significant limiting factors in the Oil and Gas Analytics Market encompass issues related to data privacy and the substantial expenses tied to the adoption of sophisticated analytics technologies.

The Oil and Gas Analytics Market encounters a variety of challenges that may impede its advancement. A primary obstacle is the substantial initial expenditure necessary for sophisticated analytics technologies and associated infrastructure, which can discourage smaller enterprises from embracing these innovations. Moreover, there is a notable lack of skilled professionals adept in data analytics and interpretation specifically within the oil and gas field, creating a significant hindrance to the effective application of these technologies. Additionally, the complexities of regulatory compliance and concerns regarding data security present further challenges, as companies must navigate stringent regulations and safeguard sensitive data, potentially delaying decision-making processes. The volatility of oil prices can also result in unpredictable financial plans, complicating long-term commitments to analytics initiatives. Resistance to altering established operational paradigms may obstruct the seamless integration of new analytical solutions. Nevertheless, as the industry increasingly prioritizes efficiency, safety, and sustainability, organizations are progressively acknowledging the advantages that analytics can offer in boosting productivity and improving resource management. With the rising recognition of the importance of data-driven decision-making, the market is set for innovations and growth, enabling companies to adapt and succeed in an evolving environment.

Segments of the Oil and Gas Analytics Market

By Offering

• Hardware

• Software

• Services

By Deployment

• On-Premise

• Cloud

By Application

• Upstream

• Midstream

• Downstream

By End Use

• Small Enterprises

• Medium Enterprises

• Large Enterprises

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America