The global Network Telemetry market is projected to reach US$ 1.5 Billion by 2032, growing at a CAGR of 15.2%

.jpg

)

The market size for global network telemetry is anticipated to reach USD 860 million by 2028. The factors such as the rising need to quickly resolve downtime issues and growth in network analytics attacks and security breaches are responsible to drive the growth of the network telemetry industry. On the other hand, the need to handle enormous network performance data and evolving technologies, such as Artificial Intelligence (AI), Internet of Things (IoT), and Software-defined Networking (SDN) are projected to offer immense market prospects for network telemetry providers in the coming few years.

The demand for network telemetry is likely to surge on account of the growing demand for optimization of network infrastructure. The growing industry competition has pressurized organizations in dropping network downtimes for ensuring a competitive advantage in a dynamic market. Network telemetry solutions enable organizations to manage their routine network-based operations. Furthermore, the demand across service providers and industry verticals is anticipated to increase due to rapid modifications in IT infrastructure. Increasing mobility and data consumption are likely to create a promising landscape for the network telemetry industry over the forecast period.

Network Telemetry Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | US$ 1.5 Billion |

| Growth Rate | CAGR of 15.2% during 2022-2032 |

| Segment Covered | Component, Organization, End User, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Cisco Systems, Arista Networks, Juniper Networks, Mellanox Technologies, Barefoot Networks, Pluribus Networks, VOLANSYS Technologies, and Solarflare Communications |

Key Segment Of The Network Telemetry Market

By Component, (USD Billion)

• Appliances

• Services

By End Use, (USD Billion)

• Verticals

• Service Providers

By Organization Size, (USD Billion)

• Large Enterprises

• Sm Es

Regional Overview, (USD Billion)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

Network telemetry is an evolving and influential real-time data collection system wherein network devices such as routers, firewalls, and switches constantly push data to a centralized place for processing, analysis, and storage purpose. The network telemetry structure offers some benefits such as faster troubleshooting, enhanced network performance, easy installations, and predictions of network failure, which are ultimately impelling the growth of the industry.

One of the essential trends that have created great hopes among the industry players in the global network telemetry industry is the wide applications of network telemetry. Due to this reason, many organizations are keen on rolling out new solutions and ensure they remain prominent and relevant in the rivalry. With new applications, the adoption of network telemetry solutions will increase across different industry verticals. Companies have capitalized on roping in talent that shall enable them in creating need-specific and high-quality products. However, regulatory concerns are the main restraining factor that might hamper the market growth.

Component Segment

The global network telemetry market contains both solution and service segments. The solution segment has a maximum revenue share within the global network telemetry market in 2019. This is predominantly owing to the wide implementation of network telemetry solutions across service providers and enterprises, thereby generating demand for integration, consulting services, training support, deployment services, and maintenance services throughout the globe. The services segment is anticipated to grow at a significant growth rate from 2020 to 2028.

Organization Size Segment

Based on the deployment segment, the market is bifurcated into two sub-segments that are SMEs, and large enterprises. In 2019, the SME segment gathered the largest market revenue and it is anticipated to dominate the market throughout the forecast period. However, the large enterprise segment is anticipated to grow at a substantial growth rate over the forecast period. The large enterprise enables organizations with a unified platform with SaaS-based services providing improved security.

Application Segment

Based on the application, the market is segmented into Managed Service Providers (MSPs), Telecom Service Providers (TSPs), Cloud Service Providers (CSPs), and Others. The market for telecom service providers is anticipated to possess a significant market share in 2019 since there is a growing trend of the network telemetry adoption by telecom companies and service providers to analyze, manage, and optimize the complete network infrastructure. Advanced network telemetry equipment and solutions are capable to facilitate enhanced network management and network capacity planning features and deliver security against Distributed Denial of Service (DDoS) and malware attacks. Such dynamics are witnessed to fuel the demand for the network telemetry market in the near future.

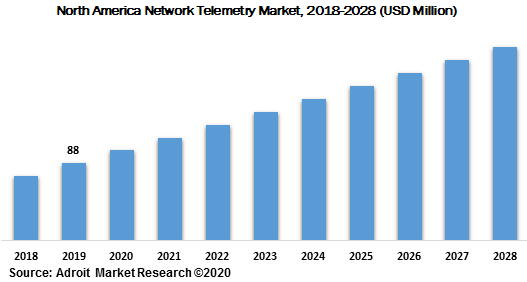

The global network telemetry market is a wide range to North America, Europe, APAC, South America, and the Middle East & Africa. North America is considered a mature market in the network telemetry applications, owing to an outsized presence of an organization with the availability of technical expertise and advanced IT infrastructure. The US and Canada are the highest contributory countries to the expansion of the network telemetry market in North America.

The major players of the global network telemetry market are Cisco Systems, Arista Networks, Juniper Networks, Mellanox Technologies, Barefoot Networks, Pluribus Networks, VOLANSYS Technologies, and Solarflare Communications, and more. The network telemetry market is fragmented with the existence of well-known global and domestic players across the globe.