Market Analysis and Insights:

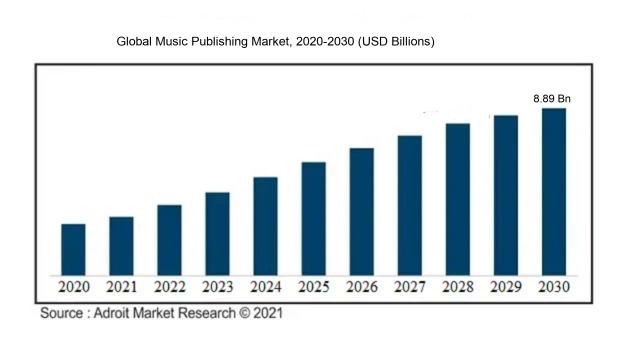

The market for Global Music Publishing was estimated to be worth USD 5.03 billion in 2023, and from 2024 to 2030, it is anticipated to grow at a CAGR of 9.11%, with an expected value of USD 8.89 billion in 2030.

The music publishing industry is influenced by a variety of significant factors. One crucial element is the growing trend of music consumption shifting towards digital platforms, particularly the rise of streaming services, which has resulted in a ened demand for licensed music content. Consequently, music publishers have seen a notable boost in revenue as they manage the licensing and royalty collection for their musical works. Alongside this, the proliferation of social media channels has empowered artists to connect with broader audiences, thereby increasing the necessity for music publishing services to safeguard and capitalize on their intellectual property. Moreover, the expanding global reach of the music sector, driven by the popularity of international collaborations and cross-border music distribution, presents new avenues for music publishers to diversify their repertoire and revenue streams.

Lastly, the emergence of independent musicians and record labels has played a role in the growth of the music publishing market, with these entities seeking publishing agreements to enhance their visibility, facilitate royalty management, and protect their copyrights. In summary, the evolution towards digital music consumption, the surge in streaming services, the impact of social media, global industry expansion, and the presence of independent music creators collectively propel the growth and significance of the music publishing landscape.

Music Publishing Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 8.89 billion |

| Growth Rate | CAGR of 9.11% during 2024-2030 |

| Segment Covered | By Revenue, By End-users, By Type of Right, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Universal Music Publishing Group, Sony/ATV Music Publishing LLC, Warner Chappell Music, Kobalt Music Group, BMG Rights Management GmbH, Concord Music Group, Peermusic, Downtown Music Publishing, Reservoir Media Management, and Round Hill Music. |

Market Definition

The realm of music publishing involves the acquisition, management, and authorization of the rights associated with musical pieces. This encompasses the oversight of publishing royalties, as well as the dissemination of these works across diverse platforms and mediums. Music publishing serves a pivotal function in safeguarding and capitalizing on the creative works of songwriters and composers.

Music publishing plays a pivotal role within the music sector by ensuring that creators such as songwriters, composers, and producers are duly compensated for their artistic endeavors. This facet of the industry encompasses activities such as overseeing and authorizing musical compositions, including the collection and distribution of royalties to all relevant stakeholders. Music publishers play a key role in safeguarding the copyrights and intellectual property of music makers, acquiring synchronization licenses for various media outlets like films, television, and advertisements, and orchestrating agreements with artists and record companies. In the absence of music publishing, artists would encounter challenges in upholding their rights and obtaining the appropriate financial recognition for their creative inputs, potentially hindering innovation and jeopardizing the longevity of the music field.

Key Market Segmentation:

Insights On Key Revenue

Sync Licensing

Sync licensing is expected to dominate the Global Music Publishing market. Sync licensing refers to the process of granting individuals or organizations the right to synchronize music with visual media, such as films, TV shows, commercials, and video games. This part is projected to be the most dominant in terms of revenue generation within the music publishing industry. The widespread use of visual media across various platforms and the increasing demand for high-quality soundtracks in entertainment have contributed to the growth of sync licensing. With the popularity of streaming platforms and the expanding global entertainment industry, sync licensing presents lucrative opportunities for music publishers to monetize their catalog and reach a wide audience.

Royalties

Royalties, although not projected to dominate the Global Music Publishing market compared to sync licensing, play a crucial role in revenue generation. Royalties are payments made to songwriters, composers, and music publishers for the usage of their music. This part represents the traditional revenue model in the music publishing industry, where income is generated through mechanical royalties, performance royalties, and other licensing fees. While royalties may not capture the largest market share, they continue to be a significant source of income for music creators and publishers, especially in relation to physical sales, radio airplay, and live performances.

Subscriptions

Subscriptions, which include revenue generated from streaming platforms and subscription-based services, are also an important part in the Global Music Publishing market. As music consumption shifts towards digital platforms, streaming has become the primary mode of accessing and experiencing music for many consumers worldwide. Subscription-based services offer unlimited access to vast catalogs of music, providing a convenient and cost-effective alternative to physical purchases. While subscriptions show promise and have experienced substantial growth, they are not expected to dominate the market compared to sync licensing. Nonetheless, they contribute significantly to the overall revenue in the music publishing industry and are increasingly shaping the way music is consumed and monetized globally.

Insights On Key End-users

Media and Entertainment Companies

Media and entertainment companies are expected to dominate the global music publishing market. These companies have a significant influence on the industry as they possess the platforms and resources required for music distribution and promotion. With the rise of online streaming platforms and digital music consumption, media and entertainment companies have embraced digital technologies to reach a broader audience. They have established strong partnerships with record labels, artists, and songwriters, allowing them to have a significant stake in the music publishing market. Moreover, these companies have the financial capabilities to invest in marketing and advertising, ensuring the visibility and popularity of the published music. Overall, media and entertainment companies are poised to dominate the global music publishing market due to their extensive reach, technological advancements, and strong industry partnerships.

Record Labels

Record labels continue to hold a prominent position within the global music publishing market. These entities play a crucial role in discovering, developing, and promoting artists and their music. Record labels possess the expertise and infrastructure required to produce high-quality recordings and distribute them to a wide range of platforms and consumers. While the digital era has disrupted some aspects of the traditional record label business model, they have adapted by incorporating digital distribution channels, collaborating with streaming platforms, and utilizing social media for artist promotion. Record labels remain essential for providing funding, marketing resources, and industry connections that artists and songwriters need to succeed. With their longstanding presence and established networks, record labels will continue to be a significant part of the music publishing landscape.

Artists and Songwriters

Artists and songwriters, as the creative force behind the music industry, hold a vital role within the global music publishing market. These individuals are responsible for composing, producing, and performing the music that drives the industry. Artists and songwriters often collaborate with record labels and rely on publishing deals to ensure their works are monetized and reach a broader audience. With the advent of digital platforms, artists and songwriters have gained greater control over their music, opting for independent distribution and utilizing social media platforms for direct fan engagement. However, while their influence and autonomy have increased, artists and songwriters often still require the support and promotional resources that record labels and media companies can provide.

Insights On Key Type of Right

Performance Rights

The Performance Rights is expected to dominate the Global Music Publishing Market. Performance Rights refer to the rights granted to the music creators or performers when their music is performed publically, such as on television, radio, or live performances. With the increasing popularity of streaming services and digital platforms, the demand for music performances, both live and recorded, is growing rapidly. This trend is expected to continue, making Performance Rights the dominating part in the Global Music Publishing Market.

Mechanical Rights

Mechanical Rights, which pertain to the rights granted for the reproduction and distribution of music through physical or digital means, are expected to be one of the significant parts in the Global Music Publishing Market. While Performance Rights are likely to dominate due to the increasing demand for music performances, Mechanical Rights still hold significance. The proliferation of digital music platforms and the rise of streaming services have led to a surge in music consumption, resulting in increased mechanical royalties. Therefore, although Mechanical Rights may not dominate the market, they remain a crucial part.

Synchronization Rights

Synchronization Rights, which cover the use of music in various media, such as movies, TV shows, commercials, and video games, are also anticipated to be a significant part in the Global Music Publishing Market. The need for music synchronization in visual media has been consistently expanding, driven by the growth of the entertainment industry and advertising. However, compared to Performance Rights and Mechanical Rights, Synchronization Rights may not dominate the market. Nonetheless, the demand for music in visual media will continue to support its relevance and importance in the music publishing industry.

Insights on Regional Analysis:

Europe

Europe is expected to dominate the global music publishing market. This region has a rich musical heritage and has been the birthplace of various genres and styles. With strong music traditions and highly developed infrastructure, Europe holds a significant share in the global music industry. Countries like the United Kingdom, Germany, and France have established themselves as key players in the music publishing market. Additionally, Europe is home to major record labels, publishing companies, and renowned music events. The region also benefits from a large consumer base and a high level of digital music adoption. These factors contribute to Europe's dominance in the global music publishing market.

North America

North America is one of the leading regions in the global music publishing market. The United States, in particular, has a thriving music industry and is home to some of the biggest music publishers and record labels. The presence of famous music companies and a strong infrastructure for copyright protection supports the growth of the music publishing market in this region. Additionally, North America has a large population of music consumers and a high level of digital music consumption. These factors contribute to North America's prominent position in the global music publishing market.

Asia Pacific

Asia Pacific is a rapidly growing region in the global music publishing market. With the rise of digital platforms and a booming music industry, countries like China, Japan, and South Korea are witnessing significant growth in music consumption. The increasing popularity of K-pop, J-pop, and other Asian music genres has contributed to the region's prominence. Moreover, the region is home to a large young population that is highly engaged in music streaming and digital platforms. Asia Pacific is also witnessing the entry of global music publishers and collaborations with local artists, further driving the growth of the music publishing market in this region.

Latin America

Latin America is an emerging region in the global music publishing market. This region has a rich and diverse musical heritage, with genres like salsa, reggaeton, and samba gaining global popularity. Countries like Brazil and Mexico have vibrant music scenes and a large audience base. The growth of music streaming platforms and digital music consumption has opened up opportunities for artists and publishers in Latin America. However, challenges such as piracy and copyright issues still exist in the region. Despite these challenges, Latin America has significant potential for growth in the music publishing market.

Middle East & Africa

Middle East & Africa is a region with untapped potential in the global music publishing market. Although the region has a rich musical heritage and diverse genres, it faces challenges such as limited infrastructure, piracy, and cultural restrictions. However, with the growing popularity of digital music platforms and the increasing demand for local music, the Middle East & Africa region is gradually gaining recognition in the global music industry. Countries like South Africa, Nigeria, Egypt, and the United Arab Emirates have seen a rise in music consumption and the emergence of local talent. With the right investments and developments, this region has the opportunity to grow and contribute to the global music publishing market.

Company Profiles:

Major contributors in the global music publishing industry include prominent record labels, autonomous music publishers, and online music streaming services, all of which are essential in the investment, distribution, and global promotion of music content.

Prominent companies in the music publishing sector consist of Universal Music Publishing Group, Sony/ATV Music Publishing LLC, Warner Chappell Music, Kobalt Music Group, BMG Rights Management GmbH, Concord Music Group, Peermusic, Downtown Music Publishing, Reservoir Media Management, and Round Hill Music. These firms are integral to the music publishing landscape, managing copyrights, licensing, and distribution of musical creations. Universally recognized, Universal Music Publishing Group is a leader in the global industry, while Sony/ATV Music Publishing LLC boasts an extensive repertoire of popular songs. Warner Chappell Music, BMG Rights Management, and Kobalt Music Group are esteemed players within the sector, with Concord Music Group, Peermusic, Downtown Music Publishing, Reservoir Media Management, and Round Hill Music also making substantial contributions to the music publishing domain.

COVID-19 Impact and Market Status:

The global music publishing market has witnessed a notable downturn in revenues as a result of the Covid-19 pandemic, which has been characterized by diminished music consumption and a decrease in live events.

The music publishing industry has been significantly affected by the global COVID-19 pandemic. The enforcement of social distancing measures and restrictions on public gatherings has led to the cancellation or indefinite postponement of live concerts and events, resulting in a notable financial downturn for artists, music publishers, and related sectors. This decline in live performances has also caused a reduction in music licensing and synchronization for various media platforms such as films, television shows, and commercials. Moreover, the closure or limited operation of physical music stores has further exacerbated the decrease in physical album sales.

Nonetheless, the pandemic has expedited the transition to digital consumption, with a surge in usage observed on streaming platforms. This shift has opened up new avenues for the music publishing industry to explore diverse revenue streams through online music distribution. Despite these challenges, music publishers have adapted by focusing on virtual concerts, live-streamed performances, and online collaborations as a means to connect with audiences and generate income. The long-term implications of the pandemic on the music publishing market remain uncertain, contingent upon factors like the duration and efficacy of containment measures, the resumption of live events, and the broader economic recovery.

Latest Trends and Innovation:

- In August 2020, Concord Music Publishing announced the acquisition of Boosey & Hawkes, adding classical and contemporary classical catalogs to its global music publishing business.

- In November 2019, Warner Music Group acquired the music publishing rights for Fleetwood Mac's Stevie Nicks' song catalog, including hits like "Dreams" and "Rhiannon."

- In September 2018, Sony/ATV Music Publishing signed a worldwide publishing agreement with songwriter and producer Timbaland, further expanding its catalog of popular music.

- In July 2017, Universal Music Publishing Group entered into a global administration agreement with the estate of legendary songwriter Leonard Cohen, managing his music publishing rights worldwide. - In January 2016,

BMG acquired the music publishing catalogs of Richard Gottehrer and Seymour Stein's labels, including hits like Blondie's "Heart of Glass" and Madonna's "Like a Virgin."

- In December 2015, Sony/ATV Music Publishing acquired the music publishing catalog of Country Music Hall of Fame member Roy Orbison, adding iconic songs like "Pretty Woman" and "Crying" to their portfolio.

- In November 2014, Kobalt Music Group acquired the music publishing catalogs of both American alternative rock band Spoon and Icelandic post-rock band Sigur Rós, expanding their independent publishing platform.

Significant Growth Factors:

The expansion of the Music Publishing Market is fueled by the widespread adoption of digital platforms, the growing international interest in music streaming, and the emergence of independent artists within the sector.

The music publishing industry is undergoing a period of notable expansion driven by various factors. One significant factor is the increasing prevalence of digital streaming platforms, which have enhanced the accessibility and convenience of music consumption, resulting in a ened demand for licensed music content. Additionally, the worldwide proliferation of smartphones and internet connectivity has opened up new markets and extended the reach of music publishers, enabling them to access previously unexplored opportunities. Moreover, the growing popularity of live events and concerts has generated a greater need for music licensing, as event organizers strive to secure the requisite permissions for playing copyrighted music at their gatherings. The advent of cutting-edge technologies like artificial intelligence (AI) and machine learning has transformed the landscape of music discovery and recommendation systems, facilitating publishers in effectively connecting artists with their target audience. Furthermore, the escalating trend of collaborations and partnerships between brands and the music sector has fueled a surge in demand for original music compositions tailored specifically for advertising campaigns and brand promotions. Collectively, these factors are propelling the ongoing expansion of the music publishing market, presenting avenues for both established entities and up-and-coming artists to excel.

Restraining Factors:

The music publishing industry is facing challenges due to the rapid changes in digital platforms and the widespread unauthorized sharing of content, which is significantly affecting the ability of artists and publishers to generate revenue.

The music publishing industry remains vibrant and dynamic, yet faces various challenges that impede its growth. Copyright infringement and piracy are significant hurdles as digital platforms and file-sharing networks facilitate unauthorized music distribution, diminishing revenue streams for music publishers and deterring investment in emerging talents. Moreover, the dominance of streaming services has altered revenue structures, resulting in artists and songwriters earning less from streaming than traditional sales, impacting the financial health of music publishing firms and limiting their capacity for nurturing new talents and groundbreaking projects. Furthermore, escalating licensing and royalty fees burden smaller publishing companies, constraining their resources for expansion and diversification. The absence of global synchronization and standardization in copyright laws complicates the international music distribution landscape, contributing to legal obstacles and administrative challenges. The COVID-19 pandemic has further disrupted the music publishing sector by disrupting live events and performances, causing a substantial decrease in revenue from licensing and royalties. Despite these obstacles, the industry is resilient and continuously adapts to seize new prospects. The escalating demand for digital content and the emergence of new markets offer a promising outlook. Additionally, technological advancements and the increasing popularity of streaming platforms create fresh avenues for revenue generation and audience interaction. Embracing novel business models, investing in innovative strategies, and safeguarding artists' rights are pivotal in enabling the music publishing industry to surmount these challenges and persevere.

Key Segments of the Music Publishing Market

Revenue Overview

• Royalties

• Sync Licensing

• Subscriptions

End-Users Overview

• Record Labels

• Artists and Songwriters

• Media and Entertainment Companies

Type of Right Overview

• Mechanical Rights

• Performance Rights

• Synchronization Rights

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America