Mobile Gaming Market Analysis and Insights:

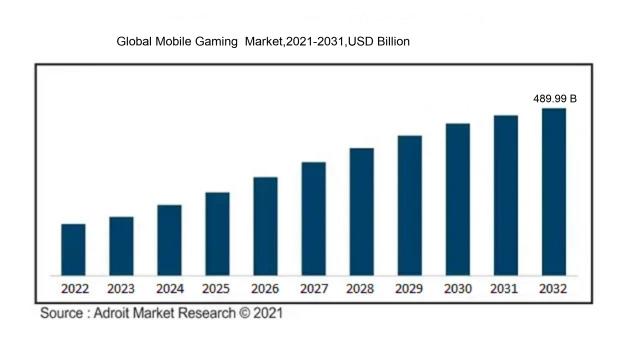

In 2023, the size of the worldwide Mobile Gaming market was US$ 118.25 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 17.2% from 2024 to 2032, reaching US$ 489.99 billion.

The mobile gaming industry is expanding rapidly due to several pivotal elements. Firstly, the omnipresence of smartphones and tablets has democratized access to gaming, significantly broadening the user base and enhancing player interaction. Moreover, technological improvements—such as superior graphics and enhanced processing capabilities—greatly enrich the gaming experience. The incorporation of social components and multiplayer functionalities nurtures a sense of community, motivating players to invest more time in games. The emergence of free-to-play models, paired with in-app purchases, has transformed revenue generation strategies, appealing to a wider audience. Effective marketing efforts and collaborations with well-known franchises elevate brand visibility, while continuous innovation in game development captivates players' attention. Lastly, the growing availability of high-speed internet and 5G connectivity facilitates smooth, uninterrupted gameplay, establishing mobile gaming as a leading form of entertainment today.

Mobile Gaming Market Definition

Mobile gaming involves engaging with video games on handheld devices like smartphones and tablets. This genre covers a diverse array of games and leverages mobile technology to provide convenient entertainment that can be enjoyed anywhere.

Mobile gaming has become a vital part of the entertainment sector, primarily owing to its convenience and the widespread availability of smartphones. This medium appeals to a broad range of users, allowing individuals to participate in gaming activities at their leisure, regardless of location. The growth of mobile games has spurred technological innovations, such as enhanced visual fidelity and augmented reality elements, which further captivate players. Moreover, the mobile gaming sector plays a significant role in the global economy, yielding considerable income from in-app purchases and advertising. As mobile technology becomes further engrained in everyday life, the role of mobile gaming in influencing entertainment trends is set to expand even more.

Mobile Gaming Market Segmental Analysis:

Insights On Type

In-app Purchases

In-app purchases are expected to dominate the Global Mobile Gaming Market due to their lucrative nature and the emerging trend of free-to-play gaming models. This mechanism allows developers to offer games for free while monetizing through additional content and features, creating a significant revenue stream. Gamers often engage in acquiring virtual goods, characters, or exclusive levels, which boosts overall user engagement and satisfaction. The continuing rise in smartphone penetration and a broad user base also contribute to this 's dominance, making it vital for both developers and marketers to optimize their strategies around in-app purchases to maximize profits.

Paid Apps

Paid apps represent a traditional monetization model within the mobile gaming industry. Although their popularity has declined due to the prevalence of free-to-play games, a of gamers still prefers to purchase games upfront, believing in the value proposition they offer. This model attracts specific audiences looking for quality gameplay without the frustration of ads or the pressures of in-game monetization. However, the market for paid apps is tightening, as many consumers opt for free options, prompting developers to innovate in delivering content and experiences that justify the upfront costs.

Advertising

The advertising model is a significant component of the mobile gaming ecosystem, particularly for free-to-play games. Developers utilize this approach to generate revenue by placing ads within the games, which can either be displayed during gameplay or as interstitials. Although this model provides steady income, it risks user experience, as intrusive ads can lead to player frustration and disengagement. The success of advertising relies heavily on effective targeting and the ability to integrate ads seamlessly into gameplay. With the right balance, advertising can still present a viable avenue for revenue generation despite the growing preference for ad-free experiences.

Insights On Platforms

Android

Android is expected to dominate the Global Mobile Gaming Market due to its vast and diverse user base, accounting for over 70% of the global smartphone market share. The platform’s open-source nature fosters a larger variety of game developers and products, including indie developers who contribute to a rich ecosystem of unique games. Additionally, Android's significant penetration in emerging markets where users gravitate towards affordable devices heralds further growth opportunities. The flexibility of the Google Play Store and its extensive reach enables faster game distribution and updates, making it an attractive platform for both developers and gamers alike, solidifying its position as the leading platform in the mobile gaming landscape.

iOS

iOS holds a notable position in the mobile gaming market, primarily due to its affluent user demographic. Users of iOS devices typically spend more on apps and in-game purchases compared to their Android counterparts, making it an appealing platform for premium game developers. Moreover, Apple's stringent quality control ensures a highly polished and user-friendly experience for gamers, which contributes to player retention and loyalty. The App Store also provides a curated environment where high-quality games can thrive, leading to substantial profits for developers willing to invest in creating premium content.

Other Third-party Stores

Other third-party stores have a limited but growing footprint in the Global Mobile Gaming Market. While they do not have the extensive reach of Android or iOS, these platforms are gaining traction in niche markets and regions with users seeking alternative distribution channels. They often cater to specific game genres or target audiences, offering unique titles that are not available on major platforms. Additionally, some of these stores provide lower barriers to entry for developers, fostering innovation and diversification in the types of games available, which can attract players looking for unique gaming experiences.

Insights On Age Group

24-44 Years

The age group of 24-44 years is anticipated to dominate the Global Mobile Gaming Market primarily due to its significant percentage of active users and spending power. This demographic not only encompasses young professionals who typically have disposable income but also includes millennials who grew up with mobile gaming and continue to engage with it. The versatility of mobile games, which cater to both casual gamers and more dedicated players, appeals to this age group. Furthermore, the rise of competitive gaming and esports has particularly attracted players within this age range, contributing to higher engagement levels and expenditure on mobile gaming titles.

Below 24 Years

The below 24 years age group plays a pivotal role in the mobile gaming landscape. This demographic is heavily influenced by social trends, including the popularity of multiplayer games and free-to-play models. Younger players often gravitate towards mobile games that offer quick play sessions and social interactions, leading to high levels of engagement. The integration of mobile gaming into social media platforms also enhances this appeal, making it a staple form of entertainment for this age bracket. The continuous influx of new players from this demographic fosters innovation within the gaming industry, as developers tailor experiences that resonate well with youthful preferences.

Above 44 Years

The above 44 years age group is gradually becoming an increasingly important of the mobile gaming market, although not as dominant as the 24-44 years cohort. As technology becomes more accessible, older adults are discovering mobile gaming as a source of entertainment and mental engagement. This demographic often engages with casual gaming formats, such as puzzle games and word games, which provide enjoyable distractions without the intensity often preferred by younger users. Additionally, the growing focus on health-related or brain-training games appeals to the desire for cognitive engagement, improving the gaming experience for this audience while promoting mental well-being.

Global Mobile Gaming Market Regional Insights:

Asia Pacific

The Asia Pacific region is poised to dominate the Global Mobile Gaming market due to several factors. This area boasts the highest number of smartphone users globally, with countries like China and India leading in adoption rates. The younger demographic heavily engages in mobile gaming, complemented by a high prevalence of internet access. Additionally, the region has seen substantial investment from major gaming companies, enhancing game development and distribution channels. Mobile esports, social gaming, and innovative monetization strategies, including in-app purchases and advertising, further amplify growth. Therefore, Asia Pacific's unique blend of technological advancement and robust gaming culture solidifies its position as the leading region in mobile gaming.

North America

North America remains a significant player in the Global Mobile Gaming market, primarily driven by high disposable incomes and consumer spending on entertainment. The presence of gaming companies and advanced technological infrastructure facilitates continuous innovation in game development. Moreover, with strong competition and a diverse gaming community, North America fosters an environment ripe for new game ideas and trends. However, its market growth is more stable than explosive due to saturation and a shift towards other forms of digital entertainment.

Europe

Europe's mobile gaming market is characterized by its cultural diversity and regulatory frameworks that impact gaming experiences. The region enjoys a strong gaming community, although the growth rate is slower compared to Asia Pacific. Local developers frequently release successful indie titles, enriching the gaming landscape. Additionally, robust regulations around in-game purchases can influence spending habits, although the increasing acceptance of gaming as leisure sustains interest. Despite this, Europe is likely to remain a solid contributor rather than a leading force.

Latin America

Latin America shows promising potential in the mobile gaming sector, driven by increasing smartphone penetration and improving internet connectivity. Young consumers exhibit a growing interest in gaming, and local developers are beginning to tap into this rising market with tailored content. The region also benefits from a vibrant gaming community that fosters social and competitive gaming environments. However, economic challenges and limited access to high-end devices may restrict rapid growth, making it an emerging, rather than dominant, market.

Middle East & Africa

The Middle East and Africa represent a nascent but rapidly growing of the Global Mobile Gaming market. The rising accessibility of mobile technology, combined with an expanding youth population, creates significant opportunities. However, cultural variations and economic disparities can hinder uniform market growth across the region. While there is keen interest in mobile gaming, infrastructure and payment method challenges must be addressed. As the market evolves, investments from international gaming companies may boost the sector’s potential in the coming years.

Mobile Gaming Market Competitive Landscape:

Prominent figures in the worldwide mobile gaming industry, comprising leading developers and publishers, are at the forefront of innovation and content generation. They refine user experiences by leveraging cutting-edge technology and captivating gameplay. Through their strategic alliances and marketing initiatives, they improve the visibility and accessibility of games, playing a crucial role in the expansion of the market.

The primary contributors to the mobile gaming industry encompass Tencent Games, Activision Blizzard, Electronic Arts (EA), Supercell, Zynga, Niantic, Nintendo, Roblox Corporation, Take-Two Interactive, Square Enix, Sony Interactive Entertainment, Gameloft, GungHo Online Entertainment, King, NetEase, Bandai Namco Entertainment, Glu Mobile, Jam City, Playtika, and Ubisoft.

Global Mobile Gaming Market COVID-19 Impact and Market Status:

The Covid-19 pandemic served as a catalyst for the rapid expansion of the worldwide mobile gaming sector, fueled by lockdown restrictions and social distancing protocols that led to an increase in user participation and download rates.

The COVID-19 pandemic acted as a catalyst for the mobile gaming market's remarkable expansion. As lockdowns and social distancing protocols were implemented, people turned to home-based entertainment options. With traditional entertainment venues closing and a transition to remote lifestyles, mobile gaming emerged as a major recreational outlet, resulting in a significant uptick in downloads and user engagement across various platforms. Industry analyses indicate that revenue from mobile games experienced a substantial spike, with a dramatic rise in consumer spending as players sought fresh content and experiences. Additionally, there was an increased appetite for casual and socially interactive games, which fostered community connections through multiplayer options and social features. This transformation not only broadened the demographic of players but also motivated developers to innovate and refine their products, maintaining a sustained momentum in the mobile gaming industry even as pandemic restrictions began to lift. Consequently, the role of mobile gaming evolved into a facet of global entertainment consumption.

Latest Trends and Innovation in The Global Mobile Gaming Market:

- In September 2023, Tencent acquired a 100% stake in the game developer Homa Games for an estimated $50 million, enhancing its presence in the hyper-casual gaming.

- In August 2023, Electronic Arts announced the launch of “The Simpsons: Tapped Out” update, which introduced new gameplay features and characters based on the latest season, showcasing EA's commitment to continuous innovation in mobile gaming franchises.

- In July 2023, Netflix expanded its mobile gaming portfolio by acquiring Next Games, a mobile game studio known for location-based games. This acquisition aims to bolster Netflix’s strategy in the interactive gaming space.

- In June 2023, Activision Blizzard announced a partnership with NetEase to develop new mobile games based on popular franchises like Call of Duty and Overwatch, signaling a strategy to tap into the Chinese mobile gaming market.

- In May 2023, Ubisoft launched “Rainbow Six Mobile,” a tactical shooter designed specifically for mobile platforms, aiming to capture the growing audience in mobile esports.

- In March 2023, Niantic concluded the acquisition of the gaming studio TPC, focusing on enhancing the AR capabilities of its mobile games, particularly in games like Pokémon GO and Harry Potter: Wizards Unite.

- In February 2023, Take-Two Interactive's Zynga launched “FarmVille 3,” an updated version of its classic franchise that integrates social features and cross-platform play, reinforcing its strategy on mobile cultivation games.

- In January 2023, Roblox Corporation celebrated its 20 million daily active users milestone, reflecting significant growth in its platform, particularly the mobile gaming sector, where it has seen increased engagement from younger audiences.

- In December 2022, Microsoft announced plans to acquire Activision Blizzard for $68.7 billion, a deal aimed at strengthening Microsoft’s gaming portfolio including mobile platforms, although regulatory approvals and discussions were ongoing into 2023.

- In November 2022, Epic Games introduced new features to Fortnite on mobile, including cross-platform play and enhanced graphics, showcasing its commitment to pushing technological boundaries in mobile gaming.

Mobile Gaming Market Growth Factors:

The expansion of the mobile gaming sector is driven by improvements in smartphone technology, enhanced internet availability, and a growing appetite for portable entertainment options.

The mobile gaming industry is witnessing remarkable expansion driven by several pivotal elements. Primarily, the extensive adoption of smartphones and tablets has rendered gaming more accessible than ever, enabling players to engage in games at their convenience, irrespective of location. The enhanced capabilities of modern mobile devices—boasting high-resolution displays and powerful processors—significantly elevate the gaming experience, attracting a wider demographic. Additionally, the rise of affordable mobile internet has streamlined online play and game downloads, further propelling market growth.

Social connectivity and the emergence of multiplayer experiences foster community interaction, which is crucial for maintaining player interest. This sector is also thriving due to the increasing popularity of casual gaming, catering to varied audiences, including women and older individuals. Moreover, novel monetization strategies, such as freemium models and in-app purchases, have established sustainable financial avenues for developers.

The COVID-19 pandemic notably highlighted the value of home-based entertainment, leading to a remarkable increase in mobile game downloads and user participation. Furthermore, the incorporation of augmented reality (AR) elements and advancements in artificial intelligence (AI) are refining gameplay, offering immersive experiences that captivate users. Together, these elements are fueling the dynamic growth of the mobile gaming sector, solidifying its status as a powerful player within the global entertainment landscape.

Mobile Gaming Market Restaining Factors:

The mobile gaming industry faces challenges that include restricted internet connectivity, expensive devices, and apprehensions regarding data privacy and security.

The mobile gaming sector is experiencing swift growth, yet it encounters various obstacles that could impede its advancement. A primary issue is market saturation, characterized by an abundance of game titles that complicates the process for new releases to stand out and for players to identify quality games. Furthermore, limitations in hardware, due to the differing performance standards of various devices, can result in inconsistent gaming experiences, particularly for users with lower-spec smartphones.

Another pressing issue is the rising trend of in-app purchases, alongside the potential for consumer burnout stemming from aggressive monetization tactics, which might deter players who favor traditional gaming experiences. Data privacy is also a significant concern, as regulatory pressures regarding user information intensify, particularly in light of growing awareness of cybersecurity threats.

Moreover, the necessity for constant internet access for numerous mobile games can restrict playability for individuals in regions with unreliable connectivity. Nevertheless, despite these challenges, the mobile gaming industry is persistently innovating through technological advancements, a wide array of game options, and a broadening international audience, showcasing its resilience and the potential for a vibrant future filled with opportunities for expansion and creativity.

Segments of the Mobile Gaming Market

By Type

• In-app Purchases

• Paid Apps

• Advertising

By Platforms

• Android

• iOS

• Other Third-party Stores

By Age Group

• Below 24 Years

• 24-44 Years

• Above 44 Years

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America