Milk Packaging Market Analysis and Insights:

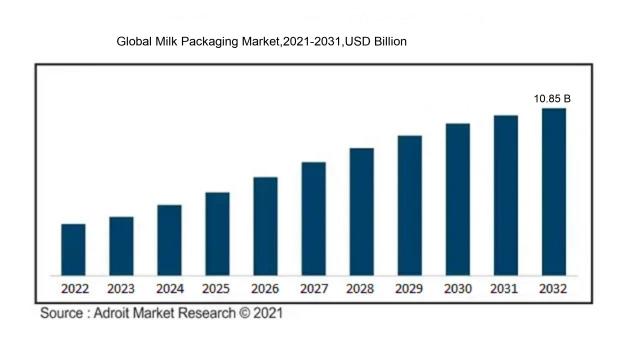

In 2023, the size of the worldwide Milk Packaging market was US$ 8.1 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 4% from 2024 to 2032, reaching US$ 10.85 billion.

The milk packaging sector is notably influenced by several critical elements. Increasing consumer understanding of food safety and quality has spurred a rise in the need for robust and innovative packaging solutions aimed at maintaining freshness and nutritional integrity. Furthermore, the trend toward convenient, portable packaging caters to the fast-paced lifestyles of today’s consumers, leading to a surge in the popularity of single-serving and user-friendly formats. The escalating focus on sustainability has also encouraged manufacturers to embrace eco-conscious materials, reflecting consumer desires for recyclable and biodegradable alternatives. In addition, advancements in technology, including the emergence of smart packaging that tracks product conditions, contribute to the growth of the market. The ongoing expansion of the dairy sector, especially in developing regions, further amplifies the demand for diverse packaging solutions, as brands seek to stand out in an increasingly competitive environment. Collectively, these dynamics play a pivotal role in shaping the progression and growth of the milk packaging market.

Milk Packaging Market Definition

Milk packaging encompasses the various materials and techniques employed to contain and safeguard milk products, guaranteeing their safety, longevity, and freshness. This often includes containers such as cartons, bottles, or pouches, which are specifically designed to avert contamination while enabling easy storage and consumption.

The packaging of milk is fundamental in maintaining its freshness, safety, and practicality. High-quality packaging safeguards the milk from contaminants and environmental elements like light and air, both of which can negatively impact its quality and flavor. Additionally, it delivers crucial information regarding nutritional values and expiration dates, allowing consumers to make educated decisions. The design of the packaging also affects consumer perceptions and brand recognition, rendering it an important tool for marketing. With a growing awareness of environmental issues, sustainable packaging solutions are becoming increasingly significant for eco-conscious shoppers, highlighting commitment to sustainability. In summary, well-considered milk packaging improves product longevity, enhances customer satisfaction, and fosters brand loyalty, making it a element in the dairy sector.

Milk Packaging Market Segmental Analysis:

Insights On Product Type

Bottle

The bottle category is expected to dominate the Global Milk Packaging Market due to its convenience and consumer preference for lightweight, portable packaging. Plastic and glass bottles provide excellent protection against contamination, ensuring freshness and quality. Additionally, their resealable nature enhances usability, appealing to families and on-the-go consumers alike. Bottles also allow for attractive branding and labeling, further contributing to their popularity in retail settings. The sustainability trend is also influencing the shift towards recyclable or reusable bottle options, pushing consumers and manufacturers alike to favor bottle formats over alternatives like pouches or cans.

Can

Cans have witnessed a steady demand in the milk packaging sector due to their durability and ability to provide extended shelf life. They are often favored for their tamper-proof nature and resistance to external factors like light and air, which helps in maintaining the nutritional quality of milk. While cans are not as popular as bottles, they cater to specific markets, such as flavored milk or niche health-focused products. Their ability to be easily transported and stacked also makes them a practical choice for both consumers and retailers, though cans currently take a backseat in terms of overall popularity compared to bottles.

Pouch

Pouches, while innovatively designed for convenience and lightweight characteristics, are currently less favored in the Global Milk Packaging Market. However, they do offer advantages such as extended shelf life and ease of storage. The flexible packaging solution caters mainly to specific demographics, including children and single-serving products. Nevertheless, their market penetration is limited compared to cans and bottles. This is partly due to concerns about recyclability and the perception of pouches as less protective against spoilage. However, advancements in materials and technology could offer future growth potential for this packaging option.

Insights On Material Type

Plastic

Plastic is expected to dominate the Global Milk Packaging Market primarily due to its lightweight nature, durability, and versatility. The increased demand for convenience and extended shelf life in the dairy sector favors plastic materials such as polyethylene and polypropylene, which are resistant to moisture and can be easily molded into various packaging forms, including bottles and pouches. Additionally, plastic packaging's cost-effectiveness makes it highly appealing to manufacturers looking to optimize production processes and reduce shipping costs. As sustainability concerns grow, the development of biodegradable plastics also bodes well for the future of plastic packaging in the milk sector, allowing it to align with both consumer preferences and environmental regulations.

Glass

Glass packaging offers premium aesthetics and excellent barrier properties, making it preferable for high-end products in the milk sector. Its inert nature prevents chemical interaction with milk, preserving quality and taste. However, the weight and fragility of glass limit its convenience compared to lighter materials, restricting its wider use in the mass market. Despite these challenges, glass continues to hold a significant share due to its recyclability and consumer perception of safety. The trend of eco-conscious consumers is driving a niche market for glass milk containers, especially in artisanal and organic s.

Paper

Paper is gaining traction in the packaging of milk due to its biodegradable nature and ability to convey a sustainable brand image. Innovations in water-resistant coatings have enhanced the functionality of paper packaging, allowing it to be a viable alternative for milk products. However, its limited barrier properties compared to plastic and glass mean it is often used for milk cartons in smaller volumes rather than for larger containers. As brands strive to improve their sustainability profiles, paper packaging is likely to see increased adoption, particularly in markets that prioritize eco-friendliness.

Paper Board

Paper board is primarily used for packaging milk in the form of cartons, providing excellent printability for branding and marketing purposes. Its strong, lightweight structure makes it suitable for bulk packaging, although it faces competition from plastic due to concerns over moisture and barrier properties. While paper board offers a sustainable option for manufacturers, its susceptibility to loss of structural integrity when wet limits its appeal for certain dairy products. Still, the growing emphasis on sustainable packaging solutions may push companies to invest in advancements that enhance the functionality and appeal of paper board in the milk sector.

Global Milk Packaging Market Regional Insights:

Asia Pacific

Asia Pacific is poised to dominate the global milk packaging market due to its rapidly expanding dairy industry and increasing consumption of milk products. Countries like India and China are leading the demand, driven by a growing population and rising urbanization, which has shifted consumer preferences towards packaged dairy products for convenience and hygiene. Additionally, advancements in packaging technology and sustainability initiatives in these nations enhance the appeal of milk packaging solutions. The region's economic growth and the ascending middle-class population are pivotal in catalyzing robust investment in infrastructure and supply chain improvements, reinforcing Asia Pacific's dominance in the market.

North America

North America holds a significant position in the global milk packaging market, characterized by a mature dairy industry and high per capita consumption of dairy products. The region benefits from a well-established distribution network and innovative packaging solutions designed to cater to consumer preferences for convenience and shelf-life extension. Strong demand for organic and premium dairy products also fuels packaging innovation, reflecting changing consumer attitudes towards health and sustainability. However, growth is tempered by market saturation and competition from other beverages demanding similar packaging solutions.

Europe

Europe demonstrates a robust milk packaging market, driven by a focus on sustainability and stringent environmental regulations. The demand for eco-friendly packaging materials is growing, fueled by consumer awareness and governmental policies aimed at reducing plastic use. Prominent dairy producers are increasingly investing in innovative and biodegradable packaging solutions, which align with lifestyle trends towards sustainability. Furthermore, the region’s penchant for diverse dairy products, such as cheese and yogurt, necessitates effective packaging solutions that maintain quality and extend shelf life, contributing to a steady growth trajectory.

Latin America

Latin America’s milk packaging market presents a promising scenario with rising dairy consumption, particularly in countries like Brazil and Mexico. Factors such as increased urbanization, a younger demographic, and a growing middle class are propelling demand for packaged milk and dairy products. However, logistical challenges and varying economic conditions across the region can present obstacles to robust growth. As infrastructure continues to improve, there is potential for enhanced distribution capabilities and a surge in innovative packaging solutions tailored to local preferences, which could reshape the market landscape.

Middle East & Africa

In the Middle East & Africa, the milk packaging market is emerging but is dominated by challenges such as regional conflicts and less developed infrastructure. The demand for milk and dairy products is growing due to population increase and urbanization, yet the region is characterized by a lack of consistency in supply chain management. Investment in packaging innovations that cater to local tastes and preferences is essential for capturing market share. As economic stability improves and awareness of health trends rises, there exists potential for growth, albeit at a slower pace compared to more developed regions.

Milk Packaging Market Competitive Landscape:

The principal contributors to the worldwide milk packaging industry encompass manufacturers, suppliers, and technological pioneers who propel the sector forward through innovations in sustainability, design, and operational efficiency. Their efforts are essential in fulfilling consumer expectations for quality and safety while complying with regulatory requirements.

Prominent participants in the milk packaging sector comprise Tetra Pak, Elopak, SIG Combibloc, Stora Enso, Arla Foods, FrieslandCampina, Parmalat, International Paper, Amcor, Sealed Air Corporation, Scholle IPN, DS Smith, A2 Milk Company, and Visy Industries.

Global Milk Packaging Market COVID-19 Impact and Market Status:

The Covid-19 pandemic had a profound impact on the Global Milk Packaging sector, driving a surge in the need for sanitary and secure packaging options while simultaneously shifting consumer buying habits towards digital platforms and products with extended shelf life.

The milk packaging industry experienced considerable transformation due to the COVID-19 pandemic, influencing both consumer habits and supply chain operations. The crisis ened consumer consciousness around hygiene, leading to a surge in demand for safe and single-use packaging options. Additionally, as lockdown measures promoted increased home consumption, retail sales surged, compelling brands to modify their packaging approaches to meet new consumer expectations. The expansion of e-commerce further drove the need for innovative packaging solutions, prioritizing aspects of sustainability and user convenience. Initially, global supply chain disruptions hindered production capabilities; however, manufacturers swiftly adapted their processes to align with the changing demand landscape. As the market begins to stabilize, there is a pronounced focus on eco-friendly materials, mirroring a wider consumer shift towards sustainable practices. In summary, while the pandemic presented significant challenges, it simultaneously created avenues for innovation and advancement in the milk packaging market.

Latest Trends and Innovation in The Global Milk Packaging Market:

- In September 2022, Tetra Pak announced a partnership with the environmental organization World Wildlife Fund (WWF) to develop sustainable packaging solutions aimed at reducing the environmental impact of milk packaging.

- In February 2023, FrieslandCampina acquired Engro Foods Limited’s dairy division in Pakistan, expanding its market presence in Southeast Asia and strengthening its milk supply chain.

- In March 2023, Emmi Group unveiled a new line of fully recyclable milk cartons using plant-based materials, reflecting its commitment to sustainability and innovation in packaging.

- In April 2023, Lactalis acquired the milk processing business of Italian dairy producer, Parmalat S.p.A., enhancing its product offerings in the European market.

- In June 2023, SIG Combibloc launched its first fully renewable packaging made from plant-based materials, which has been adopted for milk packaging, aiming to meet the rising consumer demand for sustainable solutions.

- In August 2023, Danone announced a strategic collaboration with a tech startup to integrate smart technology in milk packaging to enhance freshness and supply chain transparency.

- In October 2023, PepsiCo's Quaker Oats Company introduced a new line of dairy-based beverages packaged in eco-friendly cartons, aiming to promote sustainability in its product offerings.

Milk Packaging Market Growth Factors:

The expansion of the milk packaging sector is fueled by a rising consumer preference for convenience, eco-friendliness, and cutting-edge packaging options.

The Milk Packaging Market is witnessing remarkable growth, driven by a myriad of factors. A surge in consumer interest in dairy products, coupled with a growing recognition of the health and nutritional advantages linked to milk, is fueling this upward trend. As urban populations expand, there is an increasing demand for convenient, ready-to-use packaging solutions, further catalyzing market development.

Moreover, advancements in packaging technology, particularly the emergence of eco-friendly and sustainable materials, are appealing to environmentally aware consumers and aligning with global trends towards sustainability. Innovations in sealing and sterilization techniques also bolster the shelf life and safety of milk products, enhancing their distribution capabilities.

The acceleration of e-commerce and online grocery shopping has further amplified demand, as consumers prioritize efficient delivery for their dairy purchases. Additionally, the rising popularity of lactose-free and organic milk options is driving the need for specialized packaging to cater to these specific markets.

Industry participants are concentrating on improving brand visibility through eye-catching packaging designs, which is essential in an increasingly competitive environment. In summary, these elements together contribute to the strong growth trajectory of the Milk Packaging Market, reflecting shifting consumer preferences and changing industry dynamics.

Milk Packaging Market Restaining Factors:

The Milk Packaging Industry is encountering difficulties due to escalating costs of raw materials and growing environmental concerns regarding plastic waste.

The milk packaging industry is confronted with various challenges that can impede its expansion and progress. To begin, environmental issues related to plastic waste and the increasing demand for sustainable packaging options create notable obstacles. Conventional plastics are increasingly regarded as harmful to the environment, resulting in more stringent regulations and a shift in consumer behavior towards eco-conscious packaging choices. Furthermore, fluctuations in the prices of raw materials, especially plastics and aluminum, can influence production expenses, impacting manufacturers' profit margins.

Compounding these issues are the complexities and costs associated with creating innovative packaging solutions that enhance shelf life and ensure product safety. Additionally, the surge in competition from fortified and plant-based dairy alternatives poses a risk, as consumers seek out new products that often require unique packaging specifications. Labor shortages, alongside supply chain disruptions exacerbated by global events, add further complications, making it challenging for businesses to respond to market demands effectively.

Nevertheless, these hurdles also create avenues for innovation and the development of sustainable methodologies, setting the stage for growth in the milk packaging sector as firms adapt to changing consumer preferences and regulatory standards.

Segments of the Milk Packaging Market

By Product Type:

- Can

- Bottle

- Pouch

By Material Type:

- Glass

- Paper

- Paper Board

- Plastic

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America