Military Satellite Market Analysis and Insights:

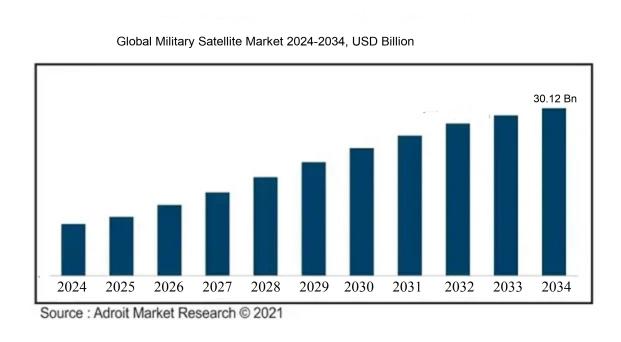

The size of the worldwide military satellite market was USD 16.09 billion in 2024, increased to USD 17.03 billion in 2025, and is expected to reach around USD 30.12 billion by 2034, indicating a robust compound annual growth rate (CAGR) of 7.83% from 2024 to 2034.

The Military Satellite Market is significantly influenced by rising geopolitical conflicts and concerns regarding national security, driving countries to upgrade their defense mechanisms through state-of-the-art satellite technology. The ened necessity for real-time communication and surveillance in military operations further boosts demand within this sector. Moreover, the advent of hybrid warfare strategies calls for advanced intelligence and reconnaissance systems, which military satellites adeptly fulfill. Innovations such as the miniaturization of satellite components and the introduction of cutting-edge launch systems are crucial in promoting market growth by lowering expenses and enabling faster deployment. Additionally, there is a notable increase in investments aimed at developing satellite constellations that provide comprehensive global coverage and improve interoperability among allied military forces. Finally, the rise of private companies in the fields of satellite production and launch services is fostering a competitive environment, driving further innovation and contributing to the overall expansion of the market.

Military Satellite Market Definition

A military satellite is a type of artificial satellite designed specifically for defense-related applications such as surveillance, reconnaissance, and communication. These satellites play a vital role in military activities by delivering essential information and enhancing situational awareness.

Military satellites are integral to contemporary defense and security initiatives, offering essential functions that include reconnaissance, surveillance, and communication. They facilitate the gathering of real-time intelligence, which is critical for informed strategic decisions and effective operational planning. These satellites guarantee secure and dependable communication links among military forces, improving mission coordination and execution. Furthermore, they are instrumental in supporting navigation and targeting systems necessary for accurate strikes and troop deployments. In summary, military satellites bolster situational awareness, enhance reaction times, and play a vital role in national security by delivering a thorough understanding of potential threats and operational landscapes.

Military Satellite Market Segmental Analysis:

Insights On Orbit Type

Low Earth Orbit

Low Earth Orbit (LEO) is anticipated to dominate the Global Military Satellite Market due to its ability to facilitate faster communications, rigorous surveillance, and real-time data acquisition. LEO satellites operate at altitudes ranging from approximately 160 to 2,000 kilometers above Earth, significantly enhancing their responsiveness and latency. As military operations increasingly rely on advanced technologies such as artificial intelligence and machine learning for logistical and operational efficiency, the demand for low orbit capabilities, which provide high-resolution imagery and constant connectivity, is expected to surge. Furthermore, the growing necessity for small satellite constellations, which can provide redundancy and expand defense infrastructure, reinforces LEO's dominance in this sector.

Medium Earth Orbit

Medium Earth Orbit (MEO) serves a specific purpose in the military satellite landscape, primarily for navigation and communication. Operating at altitudes between 2,000 to 20,000 kilometers, MEO satellites offer a balance between coverage and latency when compared to their low and high-altitude counterparts. The Global Positioning System (GPS) is a prime example of how MEO technology significantly enhances precision in military operations. While not as popular as LEO for real-time imagery and data, MEO's unique capabilities in positioning and timing still hold substantial value within defense applications, particularly in complex operational environments.

Geosynchronous Orbit

Geosynchronous Orbit (GEO) is characterized by satellites maintaining a consistent position relative to the Earth's surface, orbiting at approximately 35,786 kilometers. This attribute allows for continuous monitoring of specific areas and facilitates uninterrupted communications. GEO satellites are often deployed for large-scale data transmission and critical communication relay, making them indispensable in military operations requiring extensive coverage, such as strategic communications and missile warning systems. However, their higher latency compared to LEO satellites may limit their effectiveness for real-time data needs, which is critical in many modern military engagements, thus diminishing their competitive edge in this market.

Insights On Payload Type

Communication Payload

The dominating in the Global Military Satellite Market is the Communication Payload. This is primarily due to the growing necessity for secure and reliable communication networks in military operations. Communication Payloads facilitate instant connectivity between ground forces, naval units, and aerial assets, which is crucial during combat scenarios. Enhanced communication capabilities, including satellite-based data transfer and voice communication, have become vital as militaries increasingly depend on real-time information for decision-making. Furthermore, advancements in technology have led to improved bandwidth and networking capabilities, resulting in greater efficiencies and effectiveness of military operations globally. The increasing focus on joint and coalition operations among allies also emphasizes the critical need for robust communication systems.

Navigation Payload

Navigation Payload is another essential component, albeit not the leading one. This system plays a critical role in military applications, providing accurate positioning and timing data to forces on the ground, aerial units, and naval ships. The ability to navigate effectively is paramount, especially during complex operations where precision is required. Moreover, the increasing reliance on GPS technology and advancements in satellite navigation systems further enhance the effectiveness of military strategies. The robustness of navigation Payloads in adverse conditions also supports their importance, maintaining functionality through jamming and other countermeasures.

Imaging Payload

Imaging Payloads hold significant importance in military operations, focusing on surveillance, reconnaissance, and intelligence-gathering. This technology enables armed forces to obtain detailed visual imagery of enemy positions, terrains, and movements from space. The ability to gather real-time intelligence offers a strategic advantage, allowing military planners to make informed decisions instantly. The evolving capabilities of high-resolution imaging, along with multi-spectral sensors, continue to support enhanced situational awareness. Integration with other systems further underscores the role of Imaging Payloads in comprehensive military operations, leading to tactical advantages in various combat scenarios.

Others

The 'Others' category includes various specialized payload technologies that support unique mission requirements. These may consist of electronic warfare systems, scientific payloads, or tactical sensors designed for particular operational contexts. Though this is not as dominant as the others, it plays a crucial role in enhancing the overall effectiveness and versatility of military satellite capabilities. As military technology advances, innovative payloads in this category could emerge to address specific challenges faced by armed forces, potentially shaping future operational paradigms, albeit their current market presence remains limited compared to Communication, Navigation, and Imaging Payloads.

Insights On Satellite Type

Medium-to-Heavy Satellite

The Medium-to-Heavy Satellite category is expected to dominate the Global Military Satellite Market due to its superior capabilities in communication, reconnaissance, and surveillance. Equipped with advanced technology, these satellites provide extensive coverage and the ability to handle large volumes of data, essential for military operations. Moreover, they are often deployed for long-term missions, facilitating critical strategic advantages. The demand for high-resolution imagery and secure communication channels drives investment in this category, as military forces require robust systems that can operate in challenging environments. Thus, as military requirements grow and evolve, the Medium-to-Heavy Satellites are set to become indispensable assets for national defense.

Small Satellite

Small Satellites are gaining traction due to their lower cost and quicker deployment compared to larger counterparts. They offer flexible solutions for tactical missions, which appeal to military forces looking for agile assets to support operations. While they may not match the capabilities of Medium-to-Heavy Satellites, their ability to work in constellations allows for enhanced coverage and resilience. Additionally, Small Satellites provide data acquisition for specific applications like Earth observation and communications, making them an attractive option for many military agencies seeking cost-effective alternatives for certain operational needs.

Medium Satellite

Medium Satellites serve as a bridge between Small and Heavy categories, offering a balanced approach in terms of capacity and cost. They often fulfill specific roles such as communications or data relay, making them suitable for a variety of military applications. Their moderate size allows for a decent payload while keeping launch costs reasonable. As military agencies prioritize flexibility and responsiveness, Medium Satellites play a vital part in executing diverse operational missions without significant financial strain. They contribute to hybrid satellite architectures, ensuring military forces maintain a comprehensive capability range within budget constraints.

Insights On System

SATCOM

In the Global Military Satellite Market, SATCOM is expected to dominate due to its critical role in providing reliable communication capabilities for military operations. The increasing demand for real-time data transmission and secure communications across different platforms drives the adoption of SATCOM solutions. The advancements in satellite technology further enhance bandwidth, enabling more robust connectivity for command and control, intelligence, surveillance, and reconnaissance (ISR) capabilities. Furthermore, the growing necessity for global surveillance and reconnaissance, particularly in conflict zones, positions SATCOM as a vital component, making it a preferred choice among defense organizations worldwide.

Electro-Optic/Infrared Sensor (EO/IS)

The Electro-Optic/Infrared Sensor is crucial for military operations, primarily focusing on target acquisition, tracking, and engagement. Its ability to provide high-resolution imagery and infrared data allows armed forces to gain superior situational awareness, especially during nighttime operations or adverse weather conditions. The growing emphasis on precision strikes and improved battlefield intelligence contributes to the increasing investments in EO/IS technologies. Moreover, the integration of advanced sensors with UAVs and other platforms reinforces the importance of this technology in modern warfare.

Radar

Radar systems play a significant role in military capabilities by providing vital information on air and ground movements. They are essential for surveillance, reconnaissance, and missile defense applications. Continuous advancements in radar technology, including phased array and synthetic aperture radar, enhance detection capabilities, making them indispensable for modern military operations. The increasing need for national security and defense against aerial threats bolsters radar system adoption among military organizations, solidifying its importance in maintaining superior battlefield awareness and enhancing operational effectiveness.

Insights On Application

ISR

Intelligence, Surveillance, and Reconnaissance (ISR) is expected to dominate the Global Military Satellite Market due to the increasing emphasis on advanced reconnaissance capabilities among military forces worldwide. ISR satellites play a crucial role in gathering critical intelligence, which enhances situational awareness, supports decision-making, and facilitates timely and informed responses to threats. As geopolitical tensions continue to rise and asymmetric warfare becomes prevalent, militaries are investing heavily in ISR capabilities to maintain an edge over adversaries. The growing demand for real-time intelligence and surveillance data in defense operations, along with advancements in satellite technology, positions ISR as the key driving force in the military satellite space.

Communication

Communication is another vital application within the military satellite market, albeit not the leading one. Military forces rely heavily on satellite communication systems to ensure secure and reliable transmission of voice, video, and data across vast distances. As operations become increasingly joint and international, the demand for effective communication systems is paramount. The advancement of technologies such as Software-Defined Radios (SDRs) and the integration of satellite networks with terrestrial systems have significantly enhanced military communication capabilities. This need for robust, interoperable, and high-capacity satellite communication systems showcases the importance of this application within the broader military satellite environment.

Navigation

While Navigation may not lead the military satellite market, it remains an essential component of military operations. Navigation satellites provide critical positioning, navigation, and timing (PNT) information to various military platforms, including aircraft, ships, and ground forces. The demand for precise and reliable navigation data is crucial for mission success, especially in complex and dynamic operational environments. The increased interest in unmanned systems and autonomous vehicles further boosts the significance of navigation satellites. As a result, advancements in satellite technology are focused on improving accuracy, resilience, and coverage, demonstrating the continued relevance of this application in portraying tactical advantages in military operations.

Global Military Satellite Market Regional Insights:

North America

North America is expected to dominate the Global Military Satellite market due to its advanced technological capabilities and significant investment in defense technologies. The United States, as the leading military power, allocates substantial financial resources to the development of satellite communications, surveillance, reconnaissance, and navigation systems. Furthermore, the presence of prominent defense contractors and manufacturers in the region, including Lockheed Martin, Boeing, and Northrop Grumman, propels innovation and competition within the military satellite sector. Additionally, ongoing military collaborations and partnerships with allied nations further strengthen the region's position in this market, ensuring its long-term growth and leadership.

Latin America

In Latin America, the military satellite market is gradually evolving, driven by increasing defense budgets and interest in enhancing national security capabilities. Countries like Brazil and Chile are making strides in developing satellite technologies, often with a focus on regional collaboration and transnational partnerships. However, constraints such as limited investment and slower technological advancements compared to other regions indicate that while growth is present, it may not allow for a significant market share compared to North America.

Asia Pacific

The Asia Pacific region is witnessing a rise in military satellite capabilities, primarily fueled by the growing defense expenditures of countries such as China, India, and Japan. These nations recognize the importance of advanced satellite systems for strategic surveillance, reconnaissance, and communication. China's ambitious space agenda and India's successful satellite launches are notable highlights within this. Despite this growth, the region still focuses on local development and regional interoperability, which may limit the pace at which it can outpace North America’s established military satellite capabilities.

Europe

Europe is actively expanding its military satellite market, with several nations investing in joint projects and enhanced capabilities. The European Space Agency plays a crucial role in coordinating efforts to develop and deploy military satellite systems, especially for intelligence and reconnaissance purposes. Countries like France, Germany, and the UK are leading players; however, political complexities and varying defense budgets across member states can impede cohesive growth, demonstrating that the region, while significant, is currently not positioned to challenge North America's dominance effectively.

Middle East & Africa

The Middle East and Africa region is emerging as a niche market for military satellites, driven by escalating security threats and conflicts. Countries such as the UAE and Israel are making strides in developing indigenous satellite capabilities, recognizing the strategic advantage of military satellite systems for defense and surveillance. However, the overall market remains limited due to smaller defense budgets and varying levels of technological development. While there is potential for growth, the region still lacks the comprehensive infrastructure and investment necessary to compete with North America.

Military Satellite Competitive Landscape:

Major contributors within the worldwide military satellite sector, including leading contractors and defense organizations, play a crucial role in the design, deployment, and upkeep of satellite systems that improve surveillance, communication, and reconnaissance functions. Their teamwork fosters technological progress and strengthens national security by establishing a resilient satellite framework.

Prominent entities within the military satellite sector encompass Lockheed Martin Corporation, Northrop Grumman Corporation, Boeing Defense, Space & Security, Airbus Defence and Space, Raytheon Technologies Corporation, Thales Group, L3Harris Technologies, Elbit Systems Ltd., General Dynamics Mission Systems, Israel Aerospace Industries, Kratos Defense & Security Solutions, Maxar Technologies, and RUAG International. Additionally, significant players such as the Italian Space Agency, RSC Energia, ASTRA, Inmarsat Government, and SES S.A. contribute to the advancement, production, and management of military satellites and their associated technologies.

Global Military Satellite COVID-19 Impact and Market Status:

The Covid-19 pandemic caused significant disruptions in supply chains and postponed satellite launches, markedly impacting the expansion and progression of the worldwide military satellite sector.

The COVID-19 pandemic has profoundly impacted the military satellite sector, presenting both obstacles and avenues for growth. At the onset, the industry faced significant disruptions, including supply chain interruptions, delays in manufacturing, and restrictions on workforce availability, which collectively pushed back project timelines and satellite launches, leading to deferred contracts and ened expenses. Nevertheless, as governments placed a stronger emphasis on national security and defense in response to the crisis, there was a marked increase in funding directed towards cutting-edge satellite technologies, encompassing communication, reconnaissance, and ISR (Intelligence, Surveillance, and Reconnaissance) systems. The increased focus on remote operations and secure communication channels further intensified the need for improved satellite infrastructure, thereby fostering market expansion. Additionally, the move towards more resilient and flexible military frameworks has encouraged greater partnerships between commercial satellite providers and military entities, resulting in a more fortified ecosystem that could yield long-term benefits for the industry. In summary, while the pandemic introduced immediate challenges, it also served as a catalyst for innovation and investment in military satellite capabilities.

Latest Trends and Innovation in The Global Military Satellite Market:

- In March 2023, Northrop Grumman announced its acquisition of a majority stake in the satellite communications company, SES Government Solutions, to enhance its capabilities in the military satellite market and expand its service offerings to government clients.

- In February 2023, Lockheed Martin successfully launched its Advanced Extremely High Frequency (AEHF-6) satellite, further strengthening its position in secure military communications, significantly improving resilience and survivability for U.S. and allied forces.

- In January 2023, Maxar Technologies revealed advancements in its Earth observation satellite technology, announcing the successful deployment of its WorldView Legion constellation designed to enlarge and enhance military and intelligence imaging capabilities.

- In November 2022, Boeing completed the acquisition of Aerojet Rocketdyne, aiming to integrate advanced propulsion systems into their military satellite platforms for improved performance and operational capabilities.

- In September 2022, Raytheon Technologies unveiled its new satellite communication system that leverages artificial intelligence for dynamic bandwidth allocation and improved relay capabilities, contributing to enhanced operational efficiency for military applications.

- In June 2022, the U.S. Space Force finalized a contract with L3Harris Technologies for the development of the next-generation Tactical tied to the Protected Tactical Satcom program, enhancing secure and jam-resistant communications for military personnel.

- In April 2022, Thales Alenia Space, part of Thales Group, announced the signing of a contract with the European Space Agency to develop a new military satellite system aimed at strengthening Europe's independent satellite navigation capabilities.

- In January 2022, the U.S. Government awarded a contract to Intelsat General for support of operational satellite communications in multiple military environments, reflecting a growing emphasis on public-private partnerships within the military satellite sector.

Military Satellite Market Growth Factors:

The expansion of the Military Satellite Market is fueled by escalating defense expenditures, technological advancements in satellite systems, and a growing need for secure communication and surveillance solutions.

The Military Satellite Market is on the verge of substantial expansion driven by multiple pivotal factors. Primarily, escalating geopolitical conflicts and increasing defense expenditures across nations motivate countries to bolster their satellite capabilities for essential functions such as communication, reconnaissance, and surveillance. Innovations in satellite technology, especially in terms of miniaturization and enhanced payload efficiencies, are facilitating more streamlined and cost-effective deployment and operation of satellites. Furthermore, the rising demand for real-time data analysis and intelligence has encouraged armed forces to invest in sophisticated satellite systems that improve situational awareness and operational effectiveness. The incorporation of artificial intelligence and machine learning within these systems is also fostering innovation by enabling autonomous operations and sophisticated data processing capabilities. Collaborations between governmental entities and private sector organizations are further accelerating the development and rollout of next-generation military satellites, ensuring that armed services can effectively combat emerging threats. Additionally, as cybersecurity becomes increasingly essential in satellite operations, nations are prioritizing the protection of their assets against potential attacks. Lastly, the growing recognition of space as a critical operational arena underscores the necessity for dependable satellite support in military strategies, highlighting the imperative for continuous investment and technological progress in military satellite systems. Collectively, these elements are driving a vigorous growth trajectory for the military satellite market.

Military Satellite Market Restaining Factors:

The military satellite sector encounters several limiting factors, including substantial expenses associated with development and operations, as well as complex regulatory frameworks and geopolitical obstacles.

The Military Satellite Market encounters various challenges that could hinder its expansion and evolution. A key issue is the substantial financial commitment needed for the research, development, and implementation of sophisticated satellite technologies, which can put pressure on government finances, particularly in economically challenging times. Furthermore, the intricate regulatory environment governing military satellite launches varies by nation, complicating international partnerships and licensing processes. Concerns regarding cybersecurity vulnerabilities and the potential threats posed by anti-satellite weaponry complicate the landscape, necessitating enhanced security protocols that can drive up costs and extend project timelines. Additionally, the swift advancement of technology requires ongoing upgrades and maintenance, further straining available resources. Geopolitical tensions may also shift focus and resource allocation away from satellite programs. Nonetheless, the surging need for dependable communication, surveillance, and reconnaissance capabilities is propelling innovation and funding within the military satellite domain. As countries acknowledge the strategic benefits of cutting-edge satellite systems, initiatives are being implemented to mitigate these obstacles, setting the stage for a more resilient and technologically sophisticated military satellite market moving forward.

Key Segments of the Military Satellite Market

By Orbit Type

- Low Earth Orbit

- Medium Earth Orbit

- Geosynchronous Orbit

By Payload Type

- Communication Payload

- Navigation Payload

- Imaging Payload

- Others

By Satellite Type

- Small Satellite

- Medium-to-Heavy Satellite

By System

- Electro-Optic/Infrared Sensor (EO/IS)

- Radar

- SATCOM

By Application

- ISR (Intelligence, Surveillance, and Reconnaissance)

- Communication

- Navigation

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America