Market Analysis and Insights:

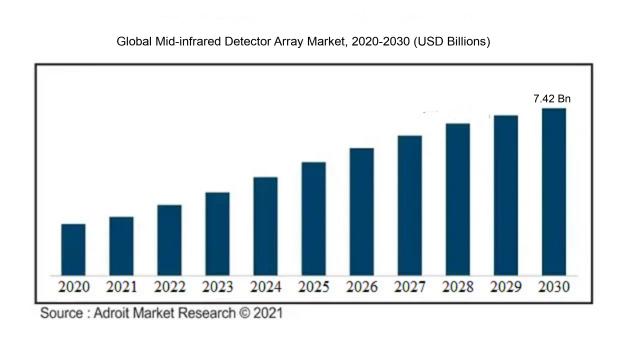

The market for mid-infrared detector arrays was estimated to be worth USD 4.53 billion in 2023, and from 2024 to 2030, it is anticipated to grow at a CAGR of 8.27%, with an expected value of USD 7.42 billion in 2030.

The Mid-infrared Detector Array Market is witnessing significant growth due to multiple pivotal factors. Primarily, the market is experiencing a surge in demand for mid-infrared detector arrays across various sectors like thermal imaging, spectroscopy, chemical sensing, and industrial operations, driven by their high sensitivity, low noise levels, and rapid response times, rendering them highly suitable for these functions. Furthermore, technological progressions, including the evolution of microbolometer and quantum cascade laser (QCL) technologies, have enhanced the efficiency and effectiveness of mid-infrared detector arrays, bolstering market expansion. The increasing utilization of mid-infrared spectroscopy techniques in sectors such as healthcare, environmental surveillance, and energy is also playing a significant role in driving market growth. Additionally, ened investments in research and development endeavors, along with a focus on achieving miniaturization and cost-efficiency, are further catalyzing the demand for mid-infrared detector arrays. In essence, the confluence of escalating application demands, technological innovations, and industry-specific requirements are the primary catalysts propelling the Mid-infrared Detector Array Market forward.

Mid-infrared Detector Array Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 7.42 billion |

| Growth Rate | CAGR of 8.27% during 2024-2030 |

| Segment Covered | By Type, By Application, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Teledyne Technologies Incorporated, Hamamatsu Photonics K.K., Excelitas Technologies Corp., FLIR Systems, Inc., InfraTec GmbH Infrarotsensorik und Messtechnik, Murata Manufacturing Co., Ltd., Nippon Ceramic Co., Ltd., Texas Instruments Incorporated, Sofradir Group, and Raytheon Company. |

Market Definition

A mid-infrared sensor array is a specialized group of detectors engineered to detect and quantify mid-infrared electromagnetic radiation, allowing for the identification of thermal patterns and molecular vibrations. This array provides enhanced performance and a broader observation range in comparison to single detectors, playing a critical role in diverse applications like remote sensing, thermal imaging, and spectroscopy within the mid-infrared spectrum.

The utilization of Mid-infrared (MIR) detector arrays is critical across a variety of applications thanks to their unique capacity to sense thermal radiation emitted by objects at ambient temperature. This technology serves diverse sectors such as medical imaging, environmental monitoring, defense and security, and industrial processes. Due to its exceptional sensitivity and quick response, the MIR detector array facilitates precise and instantaneous identification of objects, gases, and substances that may be indiscernible through other detection techniques. By offering a broad spectral range, it allows for the identification of distinct molecular markers, proving essential in disciplines like spectroscopy and chemical analysis. Overall, the MIR detector array stands as a significant instrument that enriches our observational capabilities and enhances comprehension of our environment, thereby driving progress in various scientific and technological fields.

Key Market Segmentation:

Insights On Key Type

Pbse

Pbse (lead selenide) is expected to dominate the Global Mid-infrared Detector Array Market. Pbse detectors offer several advantages, including high quantum efficiency, excellent response in the mid-infrared range, and low-cost fabrication. These detectors are widely used in applications such as gas sensing, spectroscopy, thermal imaging, and military surveillance. Pbse detectors have gained popularity due to their high sensitivity, fast response time, and compatibility with various types of readout electronics. As a result, Pbse detectors are expected to dominate the global mid-infrared detector array market.

InSb

InSb (indium antimonide) detectors have been widely used in high-performance mid-infrared applications. However, they are not expected to dominate the Global Mid-infrared Detector Array Market. InSb detectors offer high quantum efficiency and excellent performance in the mid-infrared range, particularly at low temperatures. These detectors are commonly used in scientific research, astronomy, and defense applications, where sensitivity and high resolution are critical. Despite their impressive characteristics, the high cost of InSb detectors limits their widespread adoption, making them less dominant compared to other parts in the market.

Pbs

Pbs (lead sulfide) detectors are another component of the Global Mid-infrared Detector Array Market. While Pbs detectors possess some advantages such as reasonable cost, they are not expected to dominate the market. Pbs detectors have a lower quantum efficiency compared to Pbse detectors, resulting in reduced overall sensitivity. The performance of Pbs detectors is also influenced by temperature variations, which can limit their applicability in certain environments. As a result, Pbse and InSb detectors are likely to show greater dominance in the global mid-infrared detector array market compared to Pbs detectors.

Insights On Key Application

Civil Use

The Civil Use is expected to dominate the Global Mid-infrared Detector Array Market. This can be attributed to the increasing demand for mid-infrared detector arrays in various civil applications such as environmental monitoring, industrial process control, and gas sensing. In environmental monitoring, mid-infrared detector arrays are used to measure atmospheric pollutants and contribute to efforts in climate change mitigation. In industrial process control, these detector arrays aid in monitoring and optimizing manufacturing processes, ensuring product quality and efficiency. Additionally, mid-infrared detector arrays find applications in gas sensing, enabling detection and quantification of gases in sectors such as automotive, healthcare, and agriculture. The wide range of applications and the growing importance of such technologies in civil sectors are expected to drive the dominance of the Civil Use part in the Global Mid-infrared Detector Array Market.

Military Use

The Military Use holds significant potential in the Global Mid-infrared Detector Array Market. Mid-infrared detector arrays play a crucial role in various military applications, including thermal imaging, target detection, and surveillance. These detector arrays provide enhanced capabilities for night vision, enabling soldiers to operate effectively in low-light or no-light conditions. Additionally, mid-infrared detector arrays are essential in missile and weapon guidance systems, aiding in target acquisition and tracking. With increasing investments in defense and security globally, the demand for mid-infrared detector arrays in military applications is expected to rise. However, compared to the Civil Use part, the Military Use part may not dominate the market due to the broader range of civil applications and the increasing focus on civilian uses of these technologies.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the Global Mid-infrared Detector Array market. This region encompasses high-growth countries like China, Japan, India, and South Korea, which have a significant presence in industries such as electronics, automotive, and manufacturing. These industries require mid-infrared detector arrays for various applications like gas sensing, thermal imaging, and spectroscopy. Furthermore, the rising demand for advanced healthcare solutions, such as non-invasive diagnostics and surgery, in countries like Japan and India, is driving the adoption of mid-infrared detector arrays in the medical sector. Additionally, the increasing investments in research and development activities by key players and technological advancements in the region are contributing to the dominant position of Asia Pacific in the global market.

North America

North America is one of the key regions in the global mid-infrared detector array market. The region is driven by the presence of major players, technological advancements, and increasing applications of mid-infrared detectors across industries such as defense and aerospace, healthcare, and industrial automation. The United States, in particular, is a significant contributor to this market, with its robust research and development capabilities, strong defense sector, and high adoption of advanced technologies.

Europe

Europe holds a considerable share in the global mid-infrared detector array market. The region benefits from the presence of major manufacturers, research institutions, and a well-established industrial base. Countries like Germany, France, and the United Kingdom are prominent in the market, driven by investments in research and development, growing demand for advanced sensing technologies, and the presence of key end-user industries such as automotive, aerospace, and healthcare.

Latin America

Latin America is an emerging market for mid-infrared detector arrays. The region experiences increasing demand from industries such as oil and gas, mining, and manufacturing. Brazil, Mexico, and Argentina are among the leading countries in this region, driven by the growth of industrial sectors and the adoption of advanced technologies.

Middle East & Africa

The Middle East & Africa region is gradually gaining traction in the global mid-infrared detector array market. The region's growth is primarily driven by the increasing adoption of infrared technology in defense and surveillance applications, oil and gas exploration, and the demand for improved security systems. Countries like Saudi Arabia, UAE, and South Africa are expected to contribute significantly to the market growth in this region. However, due to the nascent stage of the market, the dominance of other regions such as Asia Pacific and North America is expected to be prominent.

Company Profiles:

Prominent participants in the international mid-infrared detector array market are Honeywell International Inc., Texas Instruments Inc., and Hamamatsu Photonics K.K. These organizations are principally engaged in the advancement, production, and distribution of mid-infrared detector arrays for a diverse range of sectors, including aerospace, defense, healthcare, and industrial uses.

Prominent companies in the Mid-infrared Detector Array Market comprise Teledyne Technologies Incorporated, Hamamatsu Photonics K.K., Excelitas Technologies Corp., FLIR Systems, Inc., InfraTec GmbH Infrarotsensorik und Messtechnik, Murata Manufacturing Co., Ltd., Nippon Ceramic Co., Ltd., Texas Instruments Incorporated, Sofradir Group, and Raytheon Company. These industry leaders are actively engaged in the design and production of mid-infrared detector arrays for diverse applications such as spectroscopy, thermal imaging, gas sensing, and defense. They are dedicated to providing innovative and high-performance solutions to meet the increasing demand for mid-infrared detection technology in sectors including healthcare, aerospace, automotive, and manufacturing. As pivotal figures in the market, they are consistently involved in research and development endeavors to enhance the sensitivity, resolution, and dependability of their detector arrays, thus propelling market growth and fostering technological advancements in the mid-infrared detection sector.

COVID-19 Impact and Market Status:

The Global Mid-infrared Detector Array market has been notably affected by the Covid-19 pandemic, causing a decrease in demand as a result of supply chain disruptions and economic instabilities.

The global outbreak of COVID-19 has had a profound influence on various sectors, including the market for mid-infrared detector arrays. Due to lockdown measures enacted by governments worldwide to curb the virus's spread, the manufacturing and supply chains of these detectors were disrupted, causing production delays and hindered deliveries that impacted market expansion. Moreover, the economic slowdown and uncertainties arising from the pandemic led to diminished demand for mid-infrared detector arrays across sectors like healthcare, aerospace, and defense, as investments and budgets dwindled. Nevertheless, despite these adversities, the mid-infrared detector array market is poised for a recovery post-pandemic, driven by the escalating need for thermal imaging solutions, remote sensing applications, and technological advancements. Market players are projected to focus on research and development initiatives to boost detector performance and affordability, thereby stimulating future demand.

Latest Trends and Innovation:

- Excelitas Technologies Corp acquired Lumen Dynamics Group Inc. on June 11, 2020

- Teledyne DALSA, a subsidiary of Teledyne Technologies Inc, introduced a new MIDIS series of mid-infrared (MIR) detectors on September 15, 2020

- Hamamatsu Photonics K.K. launched the P15425-82-201 mid-infrared detector array on November 2, 2020

- InfraTec GmbH released the IRBIS 3 uncooled microbolometer detectors for the mid-infrared range on December 14, 2020

- Raytheon Company unveiled the Quantum Cascade Laser on March 19, 2021 for advanced mid-infrared applications

- Sensirion AG acquired IRsweep AG, a provider of spectroscopy solutions, on May 17, 2021

- VIGO System S.A. introduced the VG032T2T2-HD1 mid-infrared time-of-flight camera on July 8, 2021

- FLIR Systems, Inc. launched the Neutrino QX High-Definition Mid-Wave Infrared (MWIR) camera on September 21, 2021

- Xenics announced the release of the XSW-320 Gated SWIR camera on November 10, 2021 for mid-infrared imaging applications.

Significant Growth Factors:

The expansion of the Mid-infrared Detector Array Industry can be linked to the rising need for advanced sensing solutions across multiple sectors like aerospace, automotive, and healthcare, along with ongoing technological progress.

The market for Mid-infrared Detector Arrays is poised for substantial growth in the foreseeable future driven by a multitude of factors. A key catalyst behind this growth is the surging demand for mid-infrared detectors across diverse sectors such as chemical sensing, gas detection, and thermal imaging. These detectors are distinguished by their superior sensitivity and wider wavelength range, making them the preferred choice in industries like healthcare, aerospace, and defense. With a growing emphasis on non-destructive testing and ensuring quality control in sectors like pharmaceuticals and food processing, there is a burgeoning need for mid-infrared detectors. Moreover, ongoing technological innovations culminating in the creation of compact and cost-efficient detector arrays are further propelling the market expansion. The increased integration of infrared spectroscopy in research and development endeavors spanning various industries is also playing a pivotal role in the market's growth trajectory. Additionally, the escalating demand for security and surveillance systems is expected to drive the adoption of mid-infrared detector arrays in the defense and automotive sectors. Overall, the Mid-infrared Detector Array market is poised for remarkable growth on account of its expanding applications and technological advancements, presenting lucrative investment opportunities for discerning stakeholders.

Restraining Factors:

Constraints in the market are presented in the form of the scarcity of adept professionals and the elevated expenses linked with mid-infrared detector array technology.

Barriers exist in the mid-infrared detector array market that impede its progress and widespread adoption. One primary obstacle is the considerable expense associated with these detector arrays, stemming from their intricate manufacturing procedures and specialized materials, which elevate production costs and, consequently, the final product price. Furthermore, a scarcity of skilled labor and expertise contributes to these high costs. Additionally, technological limitations, such as suboptimal quantum efficiency and signal-to-noise ratios, curtail the performance of mid-infrared detector arrays, affecting their sensitivity and detection capabilities for specific applications. The absence of standardized practices in the sector also hampers interoperability and compatibility, posing challenges for users seeking to seamlessly integrate these detectors into their systems. Moreover, stringent regulations and compliance standards, notably in industries like healthcare and defense, present further obstacles to market expansion. Nevertheless, the mid-infrared detector array market shows promise for advancement. Ongoing innovations in manufacturing techniques, materials, and technologies can potentially address cost concerns and enhance the performance of these detectors. Additionally, increased government backing and funding for research and development initiatives are expected to bolster the market's growth prospects. Consequently, with continued improvements and support, the mid-infrared detector array market has the potential to surmount these hindrances and flourish in the future.

Key Segmentation:

Detector Type Overview

• InSb

• Pbse

• Pbs

Application Overview

• Military Use

• Civil Use

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America