Medical Devices Market Analysis and Insights:

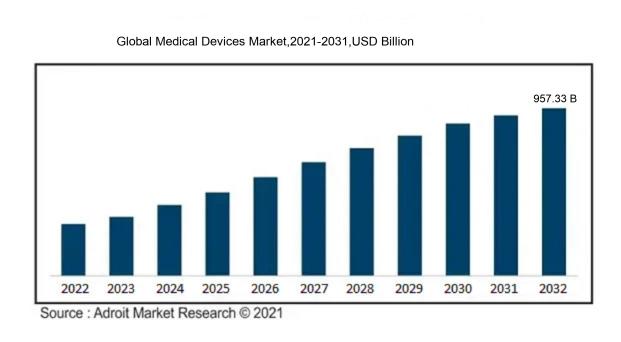

In 2023, the size of the worldwide Medical Devices market was US$ 543.14 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 6.51% from 2024 to 2032, reaching US$ 957.33 billion.

The medical devices industry is primarily propelled by the growing proportion of elderly individuals seeking sophisticated healthcare solutions, coupled with the rising incidence of chronic conditions like diabetes and heart diseases. Innovations in technology, particularly in miniaturization and the application of artificial intelligence, are enhancing the efficacy of devices and improving patient outcomes. Increasing healthcare budgets and governmental support for medical advancements are further stimulating market expansion. Moreover, the trend towards home-based healthcare and telemedicine is driving the development of portable and remote monitoring solutions. Regulatory frameworks are adapting to enable quicker approvals of new technologies, thus facilitating the entry of cutting-edge products into the market. Additionally, a focus on preventive care and personalized treatment approaches is enhancing the demand for diagnostic tools. Together, these elements are fostering a vibrant atmosphere that promotes growth and diversification within the medical devices sector, attracting investments and encouraging competitive innovation.

Medical Devices Market Definition

Medical devices encompass a variety of instruments, equipment, or machines specifically created for healthcare applications, which include the diagnosis, prevention, surveillance, or treatment of illnesses. These devices vary widely in complexity, from basic items like bandages to sophisticated systems such as magnetic resonance imaging (MRI) machines.

Medical devices are integral to contemporary healthcare, significantly improving patient outcomes and enabling precise diagnosis and treatment. They encompass a wide range, from basic instruments like thermometers to sophisticated equipment such as MRI scanners. These devices not only assist healthcare practitioners in providing effective care but also enable patients to manage their health independently, thereby enhancing their overall quality of life. Furthermore, advancements in medical technology propel improvements in surgical techniques, monitoring systems, and the management of chronic conditions. Ultimately, the significance of medical devices resides in their capacity to preserve lives, boost efficiency within healthcare systems, and support continuous medical research and innovation.

Medical Devices Market Segmental Analysis:

Insights On Type

Contract Manufacturing

The contract manufacturing sector is anticipated to dominate the Global Medical Devices Market due to its cost-effectiveness, flexibility, and access to specialized expertise. Companies opt for this approach to reduce operational costs and focus on core competencies. Outsourcing manufacturing allows firms to scale production rapidly without substantial capital investments in facilities or equipment. Furthermore, the rising demand for innovative medical devices requires a swift response to market changes, which contract manufacturers can provide through established supply chains and advanced technologies. Contract manufacturing facilities also have the advantage of being compliant with regulations and certifications, making them an attractive option for many medical device companies.

In-house

The in-house manufacturing approach allows companies to maintain greater control over their production processes, quality assurance, and intellectual property. This method is particularly beneficial for organizations that are developing proprietary medical devices where the safeguarding of technology is paramount. Companies can ensure product quality and compliance with regulations effectively by keeping production within their facilities. Additionally, in-house operations can facilitate better communication between development teams and production staff, enabling more efficient iterations and innovations. While this method may involve higher upfront costs and resource allocations, it is favored by companies that prioritize quality and control over scalability or cost savings.

Insights On Device Type

Cardiovascular

The cardiovascular device market is anticipated to dominate the global medical devices space due to an increasing prevalence of heart diseases, advancements in technology, and a growing aging population. The substantial rise in cardiovascular surgeries and interventions, coupled with innovations such as minimally invasive techniques and wearable devices that monitor heart health, is propelling the market. Additionally, rising healthcare expenditures and government initiatives to improve cardiovascular health have created a robust demand for cardiovascular devices, effectively positioning this category as a front-runner in the market.

Orthopedic

The orthopedic device market showcases significant growth potential, largely driven by an increasing number of orthopedic procedures, innovations in joint reconstruction, and advancements in fixation devices. The rise in road accidents and sports injuries, along with the aging population that often requires hip and knee replacements, contributes to a steady demand for orthopedic solutions. Furthermore, technological advancements, such as robotic-assisted surgeries and 3D printing, enhance treatment efficacy and patient outcomes, ensuring the orthopedic market remains vital and continues to evolve.

Diagnostic Imaging

The diagnostic imaging market plays a crucial role in patient diagnosis and treatment, driven by advancements in imaging modalities like MRI, CT, and ultrasound. Increased incidences of chronic diseases, along with a growing demand for early disease detection, have amplified the requirement for advanced imaging technologies. Additionally, the investment in healthcare infrastructure and the integration of artificial intelligence in imaging systems is enabling precise and efficient diagnostic processes, thus bolstering the diagnostic imaging market significantly.

IVD

The in-vitro diagnostics sector is growing rapidly, largely due to increased awareness of preventive healthcare and the rising prevalence of infectious diseases. Demand for accurate and fast diagnostic tests is climbing, accentuated by the COVID-19 pandemic, which revealed the crucial need for efficient diagnostics in controlling outbreaks. The sector benefits from innovations such as point-of-care testing and home diagnostic kits, enhancing accessibility and convenience for patients, which continues to drive growth within this category.

Minimally Invasive Surgery (MIS)

Minimally invasive surgery has become increasingly favored due to its numerous benefits, including reduced patient recovery time and less postoperative pain. This approach is particularly appealing in areas like gynecology and urology, where less trauma to the body is paramount. The rising awareness of surgical risks paired with technological advancements in tools such as laparoscopic devices ensures the continual growth and application of MIS techniques in various surgical fields, thereby forming a substantial market.

Wound Management

The wound management is gaining traction due to the rise in the prevalence of chronic wounds and the growing need for advanced wound care products. The aging population and increased incidences of diabetes-related complications are driving the demand for effective wound care solutions. Innovations in wound dressing, alongside the emphasis on cost-effective healthcare solutions, play a vital role in the expansion of this category, ensuring patients receive optimal care for complex wounds.

Diabetes Care

The diabetes care market is burgeoning, primarily because of the global rise in diabetes cases fueled by lifestyle changes and an aging population. There is a growing necessity for innovative diabetes management products, ranging from insulin delivery systems to continuous glucose monitoring devices. With technology rapidly advancing, the introduction of smart devices and personalized treatment plans enhances patient compliance and management, solidifying diabetes care as a critical area within the medical device industry.

Ophthalmic

The ophthalmic devices market continues to expand due to the increasing prevalence of eye disorders and an aging population. Innovations in surgical procedures and breakthroughs in corrective technologies drive market growth. Furthermore, the rising awareness regarding eye health alongside advancements in diagnostic tools such as OCT (Optical Coherence Tomography) ensures ongoing investment and focus on ophthalmic devices, thus making this category a growing participant in the medical devices landscape.

Dental

The dental devices is experiencing growth driven by rising dental disorders and greater awareness of oral care. A surge in cosmetic dentistry and technological advancements in procedures such as implantology and orthodontics play a significant role. Additionally, the increasing adoption of digital dentistry solutions, including 3D imaging and CAD/CAM technologies, is enhancing patient experiences and outcomes, making the dental market a vital area of the broader medical device sector.

Nephrology

The nephrology market is evolving due to an increase in chronic kidney diseases, necessitating enhanced renal care devices such as dialysis machines. The rising prevalence of diabetes and hypertension, risk factors for kidney disease, further supports the growth of nephrology-related medical devices. Advanced technologies in home dialysis and kidney transplantation improve patient outcomes, positioning nephrology as a significant contributor to the medical devices market landscape.

General Surgery

The general surgery is fundamental within the medical device industry, driven by a wide array of surgical procedures performed globally. Advancements in surgical tools, sutures, and staplers are enhancing precision and efficiency in various surgical applications. The increasing focus on patient safety and improved surgical outcomes underscores the importance of innovative devices in this field, making general surgery a consistent and vital area in medical device development.

Insights On End User

Hospitals & ASCs

The of Hospitals and Ambulatory Surgical Centers (ASCs) is expected to dominate the Global Medical Devices Market primarily due to the increasing demand for advanced diagnostic and therapeutic devices resulting from the rising prevalence of chronic diseases. As healthcare shifts towards more sophisticated treatments and interventions, Hospitals and ASCs are investing significantly in modern medical devices to enhance patient care and treatment outcomes. This focus on technological advancements, coupled with the increasing patient influx and surgical volumes, positions this as a leading force in the market. Furthermore, Hospitals and ASCs have the financial capabilities and infrastructure necessary to adopt innovative technologies rapidly, ensuring their dominance in the medical devices sector.

Clinics

The clinics is characterized by a growing demand for outpatient services and preventive care, which is supported by an increasing emphasis on primary healthcare accessibility. While clinics are expanding their use of medical devices for diagnostics and monitoring, they often have more limited budgets compared to Hospitals and ASCs. Despite this financial constraint, the rising trend of telemedicine and point-of-care devices has enabled clinics to invest in essential medical devices that enhance patient care, thereby improving their operational efficiency. However, their overall market presence remains smaller compared to the larger hospital and ASC facilities, which can leverage higher therapeutic and diagnostic demands.

Global Medical Devices Market Regional Insights:

North America

North America is expected to dominate the Global Medical Devices Market due to several factors. The region boasts advanced healthcare infrastructure, groundbreaking technology development, and significant investments in research and development. The presence of major medical device manufacturers in the United States and a robust regulatory framework with the FDA ensures product safety and efficacy. Additionally, a higher prevalence of chronic diseases demands innovative medical solutions, leading to increased consumption of medical devices. The region's focus on elderly care and home healthcare further adds to the market growth, reinforcing its position as the leader in the medical devices sector.

Latin America

Latin America has been witnessing moderate growth in the medical devices market, primarily driven by rising investments in healthcare infrastructure and increasing awareness about advanced treatments. Countries like Brazil and Mexico are emerging as players, with a growing middle class leading to higher demand for healthcare solutions. Economic challenges and varying regulatory environments, however, limit rapid expansion. The focus on improving healthcare quality and accessibility presents opportunities within this region, although it has not yet achieved the dominance evidenced in North America.

Asia Pacific

Asia Pacific shows immense potential in the medical devices market, attributed to a burgeoning population and increasing healthcare expenditures. Countries such as China and India are rapidly evolving healthcare markets, driven by urbanization and technological advancements. However, challenges related to regulatory standards and varying healthcare infrastructure across nations may hinder faster growth. Nonetheless, the push for affordable healthcare solutions and the rising prevalence of lifestyle-related diseases create a conducive environment for the medical device industry in this region.

Europe

Europe is a significant player in the global medical devices market, characterized by a well-regulated environment and high-quality healthcare systems. The European Union's strong focus on innovation and strict regulations ensures the safety and efficacy of medical devices. Additionally, the aging population and increasing demand for personalized healthcare solutions foster market growth. However, fierce competition among established players and economic disparities among member states may affect the overall dynamics of the market, preventing Europe from taking a dominant position compared to North America.

Middle East & Africa

The Middle East & Africa region is gradually growing in the medical devices market due to increasing investments in healthcare. Countries like the UAE and South Africa are at the forefront, working towards enhancing their healthcare systems and attracting global investments. However, challenges such as political instability, economic disparities, and inadequate infrastructure can significantly impact the market potential. Long-term growth depends on government initiatives aimed at improving healthcare accessibility and advancing technology adoption in the region.

Medical Devices Market Competitive Landscape:

The primary contributors in the worldwide medical devices sector foster innovation and enhance competition through the creation of cutting-edge technologies and the broadening of their product lines. They skillfully maneuver through regulatory frameworks and tackle varied healthcare demands on a global scale. Their strategic alliances and extensive global presence play a crucial role in shaping market dynamics and facilitating access to vital healthcare solutions.

Prominent entities within the medical devices sector encompass Medtronic plc, Johnson & Johnson, Siemens Healthineers, GE Healthcare, Philips Healthcare, Abbott Laboratories, Boston Scientific Corporation, Stryker Corporation, Becton, Dickinson and Company, Thermo Fisher Scientific Inc., Zimmer Biomet Holdings, Inc., Cardinal Health, Inc., Baxter International Inc., Edwards Lifesciences Corporation, and Olympus Corporation. Additionally, noteworthy firms include 3M Company, Halyard Health, Inc., Canon Medical Systems Corporation, Varian Medical Systems, Cochlear Limited, Smith & Nephew plc, and F. Hoffmann-La Roche Ltd. These organizations play an essential role across various facets of the medical devices industry, providing an array of innovative products aimed at enhancing healthcare results.

Global Medical Devices Market COVID-19 Impact and Market Status:

The Covid-19 pandemic immensely boosted both innovation and the demand within the worldwide medical devices sector, especially for diagnostic instruments, remote monitoring solutions, and personal protective gear.

The COVID-19 pandemic has profoundly impacted the medical devices industry, presenting both hurdles and new possibilities. At the onset, an overwhelming demand for diagnostic equipment, personal protective gear, and ventilators put immense pressure on supply chains and manufacturing operations. Lockdowns and workforce shortages disrupted production and logistics, creating significant challenges for companies. Conversely, the urgent need for cutting-edge medical technology accelerated innovation and spurred a shift toward digital solutions, increasing investments in telehealth and remote monitoring systems. Regulatory agencies responded by streamlining the approval processes for essential medical devices, improving market entry. Additionally, a rise in financial support from both public and private sectors aimed at healthcare infrastructure has positioned the medical devices field for sustained growth. As healthcare systems evolve in the wake of the pandemic, there is an intensified emphasis on comprehensive health solutions that enhance preparedness for future health crises, thereby transforming industry structures and consumer needs. In summary, while the pandemic introduced immediate difficulties, it has also served as a catalyst for enduring transformations within the medical devices landscape.

Latest Trends and Innovation in The Global Medical Devices Market:

- In December 2022, Medtronic announced the acquisition of Mazor Robotics, a leader in robotic-assisted spine surgery, for approximately $1.7 billion, enhancing Medtronic’s capabilities in surgical robotics.

- In January 2023, Abbott launched the FreeStyle Libre 3, a continuous glucose monitoring system noted for its smaller size and improved accuracy, signaling advancements in diabetes management technologies.

- In March 2023, Siemens Healthineers completed the acquisition of EverNorth Health Services for $1 billion, aiming to strengthen its position in the healthcare ecosystem and expand its portfolio in value-based care solutions.

- In April 2023, Philips announced a partnership with BioTelemetry to integrate remote cardiac monitoring solutions into its health technology platform, enhancing its offerings in patient monitoring systems.

- In August 2023, Stryker Corporation acquired Wright Medical Group for $4 billion, significantly bolstering its position in the orthopedic market by enhancing its extremities business.

- In September 2023, GE HealthCare unveiled its AI-powered imaging solutions, designed to improve diagnostic accuracy and operational efficiency in radiology departments, reflecting the growing trend of artificial intelligence in medical devices.

- In October 2023, Boston Scientific announced the acquisition of Farapulse, a company focused on innovative catheter-based technology, for $1 billion, aiming to advance its electrophysiology portfolio.

Medical Devices Market Growth Factors:

The expansion of the medical devices sector is fueled by technological innovations, ened healthcare spending, and a growing preference for minimally invasive treatments.

The Medical Devices Market is witnessing remarkable expansion, influenced by several pivotal factors. A significant increase in chronic diseases and an aging demographic are driving the need for sophisticated medical technologies. Enhanced investments in healthcare and a preference for minimally invasive techniques are further boosting the market, as patients lean towards options that promise shorter recovery periods and minimized discomfort. Innovations in technology, particularly in robotics, telehealth, and wearable health gadgets, are transforming patient monitoring and treatment approaches, making healthcare delivery more efficient and accessible. Moreover, the COVID-19 pandemic has expedited the integration of digital health solutions and remote monitoring devices, a trend likely to persist beyond the pandemic's peak. Supportive regulatory frameworks and governmental initiatives aimed at advancing medical innovations also substantially contribute to market growth, complemented by ened research and development funding. Additionally, growing awareness around preventive healthcare and the demand for high-quality diagnostic tools are fostering market expansion. Together, these factors establish a solid foundation for the continuous progression and enhancement of the medical devices industry, securing its essential position in contemporary global healthcare systems.

Medical Devices Market Restaining Factors:

The advancement of the medical devices sector is considerably hindered by regulatory obstacles and substantial development expenses.

The landscape of the medical devices sector is confronted with numerous factors that can hinder its growth path. Among these challenges are rigorous regulatory standards that differ across regions, resulting in prolonged approval timelines and ened expenses for manufacturers. Moreover, the swift pace of technological innovation demands ongoing investments in research and development, which can place a substantial financial strain on smaller enterprises. The escalating prices of raw materials and production, combined with fierce competition within the industry, further squeeze profit margins. Additionally, the rising incidence of counterfeit medical devices poses considerable safety threats, leading regulatory authorities to enhance their monitoring efforts. Fluctuations in the economy and alterations in healthcare reimbursement frameworks also influence market conditions, as healthcare providers might curtail spending during economic downturns. Resistance to embracing new technologies in various areas, often due to insufficient healthcare infrastructure, adds yet another layer of complexity. Nevertheless, the medical devices industry is on track for growth, fueled by advancements in telemedicine, minimally invasive interventions, and personalized treatment approaches that are revolutionizing patient care and fostering new opportunities for stakeholders.

Segments of the Medical Devices Market

By Type

- In-house

- Contract Manufacturing

By Device Type

- Orthopedic

- Cardiovascular

- Diagnostic Imaging

- IVD (In Vitro Diagnostics)

- MIS (Minimally Invasive Surgery)

- Wound Management

- Diabetes Care

- Ophthalmic

- Dental

- Nephrology

- General Surgery

By End User

- Hospitals & ASCs (Ambulatory Surgical Centers)

- Clinics

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America