The global Medical Device Contract Manufacturing market is projected to reach USD 512.7 billion by 2030, growing at a CAGR of 9.6 %

.jpg)

The global medical device contract manufacturing market was valued at USD 55.14 billion in 2019 and is expected to grow at a CAGR of 10.5% over the forecast period. Among the major market drivers are the rising prevalence of chronic diseases and the growing geriatric population in the world. The primary factors propelling the global of the contract manufacturing market for medical devices also include aggregate growth of the overall market for medical devices, primarily due to a growing prevalence of diseases, lifespan and geriatric population.

Technological innovation has forced end-users to upgrade or redesign their production processes. They look to contract manufacturing because this is a costly operation. Recent demand for minimally invasive surgeries has increased, and this is expected to drive suppliers of medical devices in the market. Minimally invasive procedures include minimal incisions, quick wound healing in the hospital, fewer discomfort and surgical wounds and a reduced risk of complications compared to open surgery.

The market for CMOs with medical device experience is increasingly growing in lightfield of the need for medical devices. In fact, the USFDA approved more than 100 medical devices in 2018 alone. It is worth emphasizing that more than 65 CMOs have been developed since 2000. Such transitions across the idnsutry is likely to increase the number of players over the study period.

Key players serving the global market include Flex Ltd., Jabil Inc., TE Connectivity Ltd., Sanmina Corporation, Nipro Corporation, Plexus Corp., SMC Ltd., Consort Medical PLC., Tessy Plastics Corp, Phillips-Medisize Corporation, among other prominent players.

Medical Device Contract Manufacturing Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 512.7 billion |

| Growth Rate | CAGR of 9.6 % during 2020-2030 |

| Segment Covered | Type, By Service, By Therapeutic Area, End use, Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Nordson Corporation, Integer Holdings Corporation, Jabil Inc., Viant Technology LLC, FLEX LTD., Celestica Inc., Sanmina Corporation, Plexus Corp., Phillips-Medisize, West Pharmaceutical Services, Inc., Synecco |

Key Segment Of The Medical Device Contract Manufacturing Market

Type, (USD Billion)

o Medical Device

o By Service

• Accessories Manufacturing

• Assembly Manufacturing

• Component Manufacturing

• Device Manufacturing

o By Therapeutic Area

• Cardiology

• Diagnostic imaging

• Orthopedic

• IVD

• Ophthalmic

• General & plastic surgery

• Drug delivery

• Dental

• Endoscopy

• Diabetes care

• Others

End use, (USD Billion)

• Medical Device Companies

• Pharmaceutical Companies

• Biopharmaceutical Companies

Regional Overview (USD Billion)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

Because of a decrease in operating costs and a decrease in production costs, the market is likely to show good growth to put a commodity onto the market in time. These dynamics make the concentrating of its resources on the inside and with trusted Contract Manufacturing Partner Organizations (CMOs) supplying their goods or critical components. The medical device manufacturing landscape has changed rapidly as major medical device OEMs combined in the last few years Additional skills to gain greater market share. OEM's choose Outsourcing the engineering and manufacturing facilities to trust suppliers reduce their presence at production. Work outsourced the different components in a medical device enable the manufacturers to be offer products at a comparatively lower price than in-house manufacturing.

Since OEMs were purchasing other OEMs, CMOs pursued the wider pattern in the sector and unified capability creation and practice for OEMs as business allies. Moreover, as OEMs are rising the number of suppliers and the consolidation of their supply chain should be withdrawn from the authorized supplier by the fewer, less competitive contract manufacturers lists. Contract due to increased visibility within the supply chain of OEMs producers shift to mergers and acquisitions to diversify their resources and positioning itself as trusted partners.

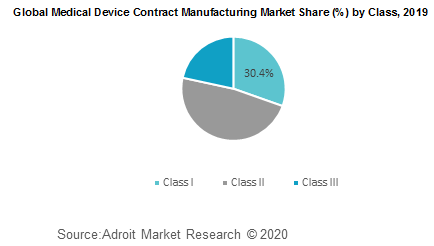

The global Medical Device Contract Manufacturing market has been bifurcated based on product and class. On the basis of product the market is divided into IVD devices, diagnostic imaging devices, cardiovascular devices, drug delivery devices, orthopedic devices, ophthalmology devices, diabetes care devices, others. On the basis of Class the market is divided into Class I, Class II, Class III.

In the year 2019, cardiovascular devices accounted for noticeable market share and is likely to grow at a CAGR over 8% by 2028.increasing prevalence of cardiac disorders coupled with increased hospital admissions for medical conditions such as cardiac arrest, COPD, etc. is anticipated to fuel the demand for the segment over the forecast period.

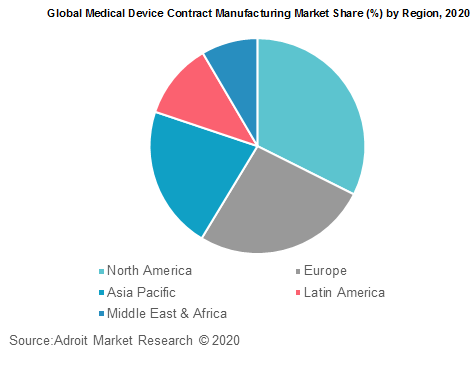

Based on regions, the global medical device contract manufacturing market is segmented into North America, Europe, Asia Pacific, Central and South America and Middle East & Africa. Emerging markets such as China, India, Brazil are giving companies major growth prospects in the contract manufacturing industry for medical devices.

A tremendous customer population, increasing healthcare knowledge, and healthcare technology upgrades have created a favorable regulatory landscape, cheap labour, for healthcare business growth overall. These nations also have regulations, which are comparatively mild compared to their developed counterparts. Increasing healthcare spending in these countries and increasing healthcare prices have, however, expanded the use of medical devices.