Market Analysis and Insights:

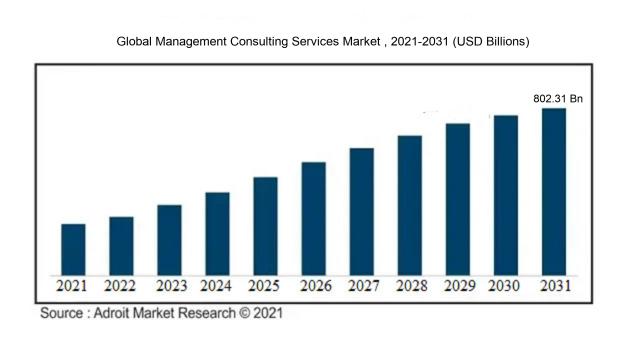

The market for Global Management Consulting Services was estimated to be worth USD 289.49 billion in 2021, and from 2022 to 2031, it is anticipated to grow at a CAGR of 10.03%, with an expected value of USD 802.31 billion in 2031.

The market for management consulting services is propelled by various factors. Firstly, businesses are increasingly aiming to boost their efficiency and productivity, fueling the demand for such services. Organizations engage consultants to assess their operations, identify areas for improvement, and devise effective strategies to attain their objectives. Secondly, the rapid progress in technology and the ongoing digital revolution in different sectors are creating a need for consulting services to guide companies through these changes and successfully implement digital solutions. Thirdly, the expansion of businesses globally due to globalization is ening the complexity of managing international operations, markets, and supply chains. This has led to a rise in the requirement for consultancy services that offer insights and recommendations to address global business challenges. Additionally, the trend of mergers and acquisitions necessitates expertise in merging different organizational cultures, optimizing processes, and achieving synergy, further driving the demand for management consulting services. Lastly, the increasingly dynamic and competitive nature of the business environment calls for continuous innovation and adaptation, prompting companies to seek consulting services to maintain a competitive edge. Collectively, these factors foster the expansion and evolution of the management consulting services market.

Management Consulting Services Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD 802.31 billion |

| Growth Rate | CAGR of 10.03% during 2022-2031 |

| Segment Covered | By Type, By End-user, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | McKinsey & Company, The Boston Consulting Group, Bain & Company, Deloitte Consulting LLP, Accenture, PricewaterhouseCoopers (PwC), Ernst & Young (EY), KPMG International, Booz Allen Hamilton, and Oliver Wyman. |

Market Definition

Management consulting services encompass the provision of strategic guidance and support to enterprises for enhancing their operational efficiency and attaining their strategic objectives. Consultants conduct in-depth analyses of current operations, pinpoint opportunities for enhancement, and facilitate the successful implementation of impactful remedies.

Organizations greatly value management consulting services due to the immense knowledge, expertise, and experience they provide to enhance business performance and facilitate well-informed strategic decisions. These services encompass a thorough evaluation of existing operations, identification of inefficiencies or areas of underperformance, and the development of tailored solutions to rectify these issues. Through the utilization of industry insights and best practices, management consultants play a pivotal role in improving operational efficiency, optimizing resource allocation, refining processes, and implementing successful change management strategies. Moreover, they offer impartial perspectives to enable organizations to tackle obstacles, adapt to market fluctuations, and capitalize on growth prospects. Ultimately, management consulting services serve as a crucial resource in organizations' decision-making processes, empowering them to achieve sustainable business growth and maintain a competitive edge.

Key Market Segmentation:

Insights On Key Type

Strategy Consulting

The Strategy Consulting is expected to dominate the Global Management Consulting Services Market. Strategy consulting focuses on providing guidance and support to businesses in developing effective strategies to achieve their organizational goals. With the increasing complexity and competitiveness in the global business landscape, companies are seeking expert advice to navigate through these challenges. Strategy consultants play a vital role in helping organizations identify growth opportunities, optimize operations, manage risk, and enhance overall performance. Their specialized knowledge and problem-solving skills make them highly sought after by businesses across industries, hence positioning Strategy Consulting as the dominant part in the Global Management Consulting Services Market.

HR Consulting

HR Consulting, although not expected to dominate the Global Management Consulting Services Market, holds significant importance in the consulting landscape. HR consultants primarily assist organizations in managing their human resources effectively. This includes talent acquisition, workforce planning, performance management, organizational development, and employee engagement. With the growing emphasis on employee well-being, diversity and inclusion, and changing labor laws, HR consulting has become crucial for organizations to optimize their HR functions and ensure compliance. While HR consulting may not have the same market dominance as Strategy Consulting, it remains a valuable and necessary part in the Global Management Consulting Services Market.

Operations Consulting

Operations Consulting provides crucial support to organizations in improving their operational efficiency and effectiveness. This involves streamlining processes, optimizing supply chains, reducing costs, and enhancing overall productivity. Operations consultants analyze existing workflows, identify bottlenecks, and recommend strategies to improve operational performance. While Operations Consulting may not dominate the Global Management Consulting Services Market, its importance in helping businesses achieve efficiency gains cannot be underestimated. As organizations strive to enhance their competitiveness and profitability, the demand for operations consulting will continue to grow.

Other Types

The Other Types in the Global Management Consulting Services Market encompasses a range of consulting services that do not fall under the categories of HR consulting, strategy consulting, or operations consulting. This can include niche consulting areas such as financial consulting, IT consulting, marketing consulting, and legal consulting, among others. The dominance of these other types of consulting services may vary depending on the specific industry or market trends. While they may not overshadow Strategy Consulting, HR Consulting, or Operations Consulting in terms of market share, they still play a significant role in providing specialized expertise and support to organizations in their respective fields.

Insights On Key End-user

IT and Telecommunication

IT and Telecommunication is expected to dominate the Global Management Consulting Services market. With the rapid advancement of technology and digital transformation, businesses in this sector are continually seeking guidance and expertise to enhance their operational efficiency, optimize their IT infrastructure, and develop innovative solutions. Management consulting services play a crucial role in assisting IT and Telecommunication companies in addressing their specific needs, such as cybersecurity, data management, cloud computing, and digital strategy. The increasing complexity of the industry and the constant need for adaptation to emerging technologies make IT and Telecommunication the dominant part in the Global Management Consulting Services market.

Healthcare

Healthcare is another significant end-user in the Global Management Consulting Services market. The healthcare industry is undergoing numerous changes due to factors such as regulatory reforms, technological advancements, and increasing patient expectations. Management consulting services offer valuable insights and strategic guidance to healthcare organizations, helping them navigate these challenges. Consulting firms assist healthcare providers in areas like mergers and acquisitions, process optimization, healthcare analytics, and patient experience improvement. As the healthcare sector continues to evolve and strive for quality improvement and cost control, the demand for management consulting services within this part is expected to remain high.

Hotel and Hospitality

In the Hotel and Hospitality industry, management consulting services play a pivotal role in providing expertise and guidance for improving operational efficiency, increasing revenue, and enhancing customer satisfaction. Consulting firms assist hotels and hospitality companies in various areas such as revenue management, marketing strategies, cost control, and customer relationship management. As the competition in this industry intensifies and customer demands become more diverse, the need for specialized consulting services will continue to rise. While it may not dominate the overall Global Management Consulting Services market, the Hotel and Hospitality part holds a significant position due to its unique requirements.

Media and Entertainment

The Media and Entertainment within the Global Management Consulting Services market is expected to cater to the evolving needs of this industry. Consulting firms offer strategic advice and support to media companies in adapting to digital disruptions, maximizing their content distribution, and developing new revenue models. Furthermore, as the media landscape becomes more complex, consulting services in areas such as brand strategy, content creation, and audience engagement gain prominence. While not the dominant part, Media and Entertainment holds a crucial position in the Global Management Consulting Services market given its specific challenges and requirements.

Real Estate

The Real Estate industry relies on management consulting services to address various challenges such as market volatility, investment analysis, project management, and sustainability. Consulting firms assist real estate companies by providing strategic guidance in areas like property development, portfolio optimization, risk assessment, and market intelligence. Although real estate consulting services may not dominate the overall Global Management Consulting Services market, they play a vital role in supporting this sector's growth, facilitating informed decision-making, and mitigating risks.

Other End-user

The Other End-user category encompasses a variety of industries outside of IT and Telecommunication, Healthcare, Hotel and Hospitality, Media and Entertainment, and Real Estate. This category includes sectors such as manufacturing, finance, retail, and government, among others. While specific parts within 'Other End-user' industries may have their own consulting needs, the domination of the Global Management Consulting Services market lies in the aforementioned sectors. The 'Other End-user' category represents a diverse range of industries with unique requirements, and consulting firms can provide specialized services tailored to meet their specific demands. Although not dominating the market, this category remains an essential component of the overall Global Management Consulting Services market.

Insights on Regional Analysis:

Europe

Europe is expected to dominate the Global Management Consulting Services market. With its strong economies including Germany, France, and the United Kingdom, Europe has a well-established consulting services sector. These countries host major consulting firms and have a high demand for management consulting services across industries such as banking, manufacturing, and healthcare. Additionally, Europe's proactive approach towards digital transformation and innovation creates further opportunities for management consulting services. The region's stable political environment, advanced infrastructure, and presence of multinational companies also contribute to its dominance in the market.

Asia Pacific

Asia Pacific is a rapidly growing market for management consulting services. The region's emerging economies such as China, India, and Southeast Asian countries are witnessing significant expansion in their industries, resulting in increased demand for consulting services. With the rise of digital transformation, companies in Asia Pacific are seeking expertise in areas like technology implementation, strategy development, and operational efficiency. Furthermore, the region's growing middle class and their changing consumer behavior require consulting support in market research, branding, and customer experience. While Europe currently dominates the global market, Asia Pacific has the potential to become a major player in the future.

North America

North America is another prominent region in the Global Management Consulting Services market. The United States is home to several world-renowned consulting firms and serves as a hub for business activities across various sectors. The region's highly developed financial services, technology, and healthcare industries generate a substantial demand for management consulting services. Moreover, North America's culture of entrepreneurship and innovation drives the need for consulting assistance in areas like strategy formulation, mergers and acquisitions, and digital disruption management. Although Europe currently dominates the market, North America remains a key player and is expected to maintain its substantial market share.

Latin America

Latin America presents a growing market for management consulting services. The region's economies, such as Brazil, Mexico, and Colombia, are experiencing economic growth and attracting foreign investments. As companies expand operations or enter these markets, the need for consulting support in market entry strategies, process optimization, and talent management is increasing. Latin America's focus on diversifying industries, improving infrastructure, and enhancing business competitiveness also contributes to the demand for management consulting services. While Latin America's market share is smaller compared to Europe or North America, its potential for growth and development should not be overlooked.

Middle East & Africa

The Middle East & Africa region is gradually emerging as a significant market for management consulting services. Countries like the United Arab Emirates, Saudi Arabia, and South Africa are witnessing rapid economic development, infrastructure projects, and government initiatives to diversify their economies. These factors create opportunities for consulting services in areas such as strategy development, organizational design, and investment advisory. Moreover, the region's pursuit of digital transformation and innovation further drives the demand for management consulting expertise. While the Middle East & Africa currently holds a smaller market share, its potential for growth and the increasing demand for professional consulting services make it an important region to watch in the future.

Company Profiles:

Prominent figures in the international management consulting services sector play a vital role in offering organizations strategic insights and specialized knowledge aimed at enhancing their efficiency and reaching their corporate goals. Their services encompass strategy formulation, operational enhancement, and fostering organizational growth.

Prominent companies in the Management Consulting Services Market are McKinsey & Company, The Boston Consulting Group, Bain & Company, Deloitte Consulting LLP, Accenture, PricewaterhouseCoopers (PwC), Ernst & Young (EY), KPMG International, Booz Allen Hamilton, and Oliver Wyman.

These firms are esteemed for their proficiency in strategic planning, operational management, and organizational enhancement. Leveraging extensive experience and global presence, these entities play a critical role in assisting enterprises in navigating intricate obstacles and fostering expansion. Their significant contributions in this sector have positioned them as frontrunners and trusted advisors sought after by various industries.

COVID-19 Impact and Market Status:

The global management consulting services market has been greatly impacted by the Covid-19 pandemic, resulting in decreased demand and a growing requirement for remote consulting solutions.

The global management consulting services market has been significantly influenced by the COVID-19 pandemic. The widespread economic upheaval resulting from lockdowns and travel restrictions has compelled companies in various industries to review their strategies and adapt to the evolving business landscape. As a result, there has been a decrease in the demand for management consulting services as organizations prioritize cost-saving initiatives and adopt a cautious approach to investments. Many consulting projects have been delayed or called off due to the uncertainties brought about by the pandemic. Nevertheless, in the midst of adjusting to the "new normal," there are opportunities for consulting firms to support companies in reorganizing, streamlining operations, and integrating digital solutions. These firms can play a crucial role in helping businesses overcome challenges associated with remote working, disruptions in supply chains, and shifts in consumer behavior. As the economy slowly rebounds, management consulting services are anticipated to pick up pace once again, with a particular focus on crisis management, improving operational efficiency, and implementing digital transformation strategies. The lasting effects of COVID-19 on the management consulting services sector will be contingent upon the duration and severity of the pandemic, as well as the pace of economic revival.

Latest Trends and Innovation:

- In January 2021, McKinsey & Company, one of the world's largest management consulting firms, announced the acquisition of Candid Partners, a technology consulting company specializing in cloud-based solutions.

- In April 2020, Deloitte announced the acquisition of Acne, a creative agency based in Sweden, to strengthen its brand and creative offerings.

- In March 2021, Boston Consulting Group (BCG) entered into a strategic partnership with Palantir Technologies, a leading data analytics company, to provide advanced analytics capabilities to BCG's clients.

- In May 2020, KPMG acquired Wirefire Creative, a digital services agency, to enhance its digital transformation and customer experience consulting services.

- In December 2020, PwC announced the acquisition of Teambase, a provider of cloud-based workforce management software, to expand its Human Resources consulting capabilities.

- In November 2020, Accenture acquired Myrtle Consulting Group, a Houston-based firm specializing in operational and supply chain consulting, to strengthen its industry expertise in the energy, manufacturing, and chemicals sectors.

Significant Growth Factors:

Factors driving the growth of the Management Consulting Services Market encompass a rising need for strategic direction, technological progress, and the trend of globalization.

The market for management consulting services is currently witnessing a notable uptick driven by several significant factors. The intricate and competitive nature of today's global business landscapes has amplified the demand for specialized guidance and strategic assistance. Organizations spanning diverse sectors are increasingly turning to management consulting services to streamline their operations, optimize processes, and secure a competitive edge. Furthermore, the widespread integration of sophisticated technologies like artificial intelligence, big data analytics, and digital transformation has spurred a need for consulting support to navigate these digital disruptions and leverage emerging opportunities effectively. Moreover, the expansion of multinational corporations into emerging markets has led to a surge in demand for consulting services that offer insights into local regulations, cultural nuances, and market dynamics. Additionally, the escalating interest in sustainability and environmental consulting services, propelled by stringent environmental mandates, corporate ethics, and consumer consciousness, is contributing to market expansion. The repercussions of the COVID-19 pandemic have further ened the reliance on management consulting services as organizations seek aid in adjusting their operations, implementing remote work strategies, and managing crisis-related risks. Collectively, these factors have underpinned the rapid expansion of the management consulting services market, with this trajectory poised to persist in the foreseeable future.

Restraining Factors:

One of the primary obstacles in the Management Consulting Services Market is the intense competition between consulting firms, which results in cost reduction efforts that can pose difficulties in sustaining profitability.

The sector of management consulting services is currently in a state of evolution and expansion; however, certain factors may act as impediments to its development. To begin with, economic unpredictability and instability have the potential to significantly influence the decision-making processes of companies, resulting in a decline in the demand for consulting services.

Additionally, the intense competitiveness within the market exerts pricing pressures as clients strive to negotiate for reduced fees and attain cost efficiencies. Furthermore, the advent of technological advancements like artificial intelligence and automation presents a challenge to the conventional consulting model by possibly substituting human expertise with machine intelligence. The global disruption caused by the ongoing COVID-19 pandemic has led to budget constraints and decreased investments, impacting the requirement for management consulting services. Another notable difficulty stems from clients' perceptions of a lack of concrete outcomes, given that the results of consulting projects are often intangible and challenging to assess, fostering doubt and hesitancy in engaging consulting services. Despite these hurdles, the management consulting services industry shows promise for growth and adaptability. The rising demand for proficiency in digital transformation, sustainability, and change management provides consulting firms with the opportunity to deliver specialized services in these domains. Through the adoption of innovation, investment in data analytics capabilities, and the showcasing of their value proposition to clients, consulting firms can surmount these challenges and prosper in a constantly evolving business environment.

Key Segments of the Management Consulting Services Market

Type Overview

• HR Consulting

• Strategy Consulting

• Operations Consulting

• Other Types

End-User Overview

• IT and Telecommunication

• Healthcare

• Hotel and Hospitality

• Media and Entertainment

• Real Estate

• Other End-user

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America