Market Analysis and Insights:

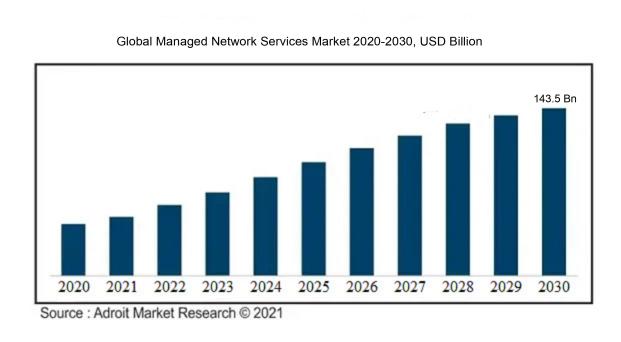

In 2022, the global market for Managed Network Services was valued at approximately USD 61 billion. It is forecasted to expand at a compound annual growth rate (CAGR) of 11.51% over the period from 2023 to 2030, reaching a projected market size of USD 143.5 billion by the end of 2030.

The sector of Managed Network Services is on track for significant growth in the coming years, spurred by several key factors. Initially, the increasing demand for cost-effective solutions in IT infrastructure management is driving growth in this sector. Companies are increasingly outsourcing their network management tasks to reduce operational costs and boost efficiency. Moreover, the growing complexity of network infrastructures and the need for specialized knowledge are increasing the demand for these services. Companies are seeking reliable service providers with the technical expertise necessary to manage their networks effectively. Additionally, the rise in digital transformation efforts and the adoption of cloud services are boosting demand for these services as companies require constant network connectivity and real-time management. Finally, the increased focus on cybersecurity and the need to address potential risks and vulnerabilities are further driving the adoption of managed network services. Companies are searching for service providers who can ensure the security and reliability of their network infrastructures.

Managed Network Services Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 143.5 billion |

| Growth Rate | CAGR of 11.51% during 2023-2030 |

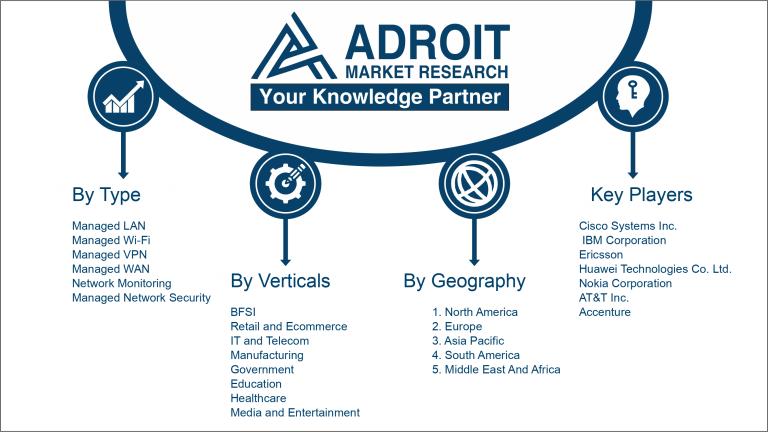

| Segment Covered | By Type, By Deployment Mode ,By Organisation Size ,By Verticals ,By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Cisco Systems Inc., IBM Corporation, Ericsson, Huawei Technologies Co. Ltd., Nokia Corporation, AT&T Inc., Verizon Communications Inc., Accenture plc, HCL Technologies Ltd., and BT Group plc. |

Market Definition

Managed Network Services involve outsourcing the management and oversight of a company’s network infrastructure to an external service provider. This arrangement allows companies to focus on their core business functions while benefiting from expert support and maintenance for their network systems.

Companies utilize Managed Network Services for several critical reasons. These services provide expert support and specialized knowledge for efficient network management, ensuring optimal performance and reliability. They include proactive monitoring, troubleshooting, and maintenance, which help reduce downtime and disruptions. Using Managed Network Services is a cost-effective strategy, as it allows companies to outsource network management rather than maintaining an in-house IT team. This enables companies to better allocate their resources and focus on core business activities. Additionally, Managed Network Services are crucial for enhancing network security through continuous monitoring for vulnerabilities, strong security measures, and compliance with regulations, protecting sensitive data and strengthening defenses against cyber threats.

Key Market Segmentation:

Insights On Key Type

Managed LAN

Managed LAN is expected to lead in the Global Managed Network Services market, driven by the growing implementation of local area networks in businesses for effective and centralized network management. The increasing demand for better connectivity, enhanced security, and faster data transfer rates in companies is fueling the demand for managed LAN services.

Managed Wi-Fi:

With the proliferation of wireless devices and the increasing demand for high-speed connectivity, managed Wi-Fi services are expected to witness significant growth. Managed Wi-Fi enables organizations to provide reliable and secure wireless internet access to their employees and customers, leading to improved productivity and customer satisfaction.

Managed VPN:

Managed VPN services allow organizations to establish secure and private connections over a public network infrastructure. The growing need for secure remote access to corporate networks and the rise in virtualization technologies are driving the demand for managed VPN services.

Managed WAN:

The increasing complexity of wide area networks and the need for efficient management of network infrastructure across multiple locations are fueling the demand for managed WAN services. Managed WAN offers centralized control, improved network performance, and cost optimization for organizations with geographically dispersed operations.

Network Monitoring:

Effective network monitoring is vital for the smooth functioning of organizations, as it allows real-time detection and resolution of network issues. The demand for network monitoring services is driven by the need to ensure network uptime, proactive troubleshooting, and efficient utilization of network resources.

Managed Network Security:

With the growing number of cyber threats and security breaches, organizations are increasingly prioritizing network security. Managed network security services provide comprehensive protection against malware, unauthorized access, and data breaches. The increasing emphasis on data privacy and regulatory compliance is expected to drive the demand for managed network security services.

Insights On Key Deployment Mode

Cloud Deployment Mode:

Cloud Deployment Mode is predicted to take a leading position in the Global Managed Network Services market. The cloud model offers benefits such as scalability, flexibility, and cost efficiency. Businesses are progressively adopting cloud-based managed network services to enhance their network infrastructure, boost productivity, and decrease operational costs. The capability for remote access to network resources and advanced security features also contribute to the growing demand for cloud-managed network services.

On-Premises Deployment Mode:

While cloud deployment is expected to be the dominating part in the Global Managed Network Services market, the on-premises deployment mode remains a relevant option for certain organizations. On-premises deployment provides complete control over network infrastructure and data, making it particularly suitable for industries with strict compliance and security requirements, such as healthcare and finance. Some organizations also prefer on-premises deployment to maintain physical ownership of their network assets. However, the limitations in scalability, higher upfront costs, and potential for additional maintenance and support can limit the adoption of on-premises deployment in comparison to cloud deployment.

Insights On Key Organisation Size

Large Enterprises

Large Enterprises are poised to dominate the Global Managed Network Services market. This dominance is largely due to their extensive network infrastructures and the greater volume of data they handle. Large enterprises typically have more users and locations, which creates complex network management needs. They also generally have more substantial IT budgets and are more inclined to outsource network management to specialized service providers.

Small and Medium Enterprises (SMEs)

Small and Medium Enterprises (SMEs) hold significant potential for the Global Managed Network Services market. Although they may not dominate the market, SMEs represent a substantial share of organizations globally. SMEs often lack the resources and expertise to establish and manage their own extensive network infrastructure. With the increasing reliance on cloud-based services and the need for secure and reliable connectivity, SMEs are recognizing the benefits of outsourcing network management to expert providers. As a result, SMEs are expected to contribute significantly to the growth of the managed network services market.

Insights On Key Verticals

IT and Telecom

The IT and Telecom part is expected to dominate the global managed network services market. This can be attributed to the increasing reliance on digital technologies and the growing complexity of IT networks in the industry. The demand for managed network services in this part is driven by the need for efficient network management, cybersecurity, and enhanced connectivity to support various technological advancements.

BFSI (Banking, Financial Services, and Insurance)

The BFSI part is characterized by strict regulations and the need for secure and reliable network infrastructure. Managed network services are crucial in this part to ensure data privacy, protection against cyber threats, and uninterrupted network connectivity for critical financial transactions.

Retail and Ecommerce

In the retail and ecommerce part, managed network services play a vital role in enabling smooth online operations, improving customer experience, and managing digital supply chains. With the rise of omni-channel retail and the growing importance of e-commerce platforms, businesses in this part require efficient network management to meet consumer demands.

Manufacturing

The manufacturing part relies on managed network services to optimize operational efficiency, facilitate real-time communication across production units, and manage complex supply chain networks. The increasing adoption of IoT devices and industrial automation further drives the demand for managed network services in this part.

Government

The government part requires managed network services to ensure secure communication and data exchange across various departments and agencies. Effective network management helps enhance public services, manage critical infrastructures, and support government initiatives such as smart cities and digital governance.

Education

The education part benefits from managed network services to support online learning systems, enable seamless communication among students and faculty, and ensure a secure network environment within educational institutions. The increasing digitization of education drives the demand for efficient network management in this part.

Healthcare

In the healthcare industry, managed network services are crucial for secure data transmission, reliable connectivity between different healthcare facilities, and efficient management of medical devices. The increasing adoption of telemedicine and digital health solutions further fuels the demand for managed network services in this part.

Media and Entertainment

The media and entertainment part requires managed network services to support high-speed data transfer, content delivery, and smooth streaming services. With the growing demand for digital media consumption and the rise of immersive technologies, reliable network infrastructure is essential in this part.

Other

The Other part includes various industries that may not fit directly into the defined verticals. The demand for managed network services in this part depends on the unique requirements of each industry, such as transportation, energy, and professional services. Efficient network management helps optimize operations and enables digital transformation in these diverse industries.

Insights on Regional Analysis:

North America:

North America is expected to maintain its lead in the Global Managed Network Services market due to its advanced technological infrastructure, robust investments in digital transformation, and widespread adoption of managed services among businesses. The region also benefits from the presence of major market players and a growing need for secure and reliable network solutions.

Latin America:

In Latin America, the Managed Network Services market is witnessing steady growth. The region is experiencing rapid digitalization, leading to increased demand for managed network services. Small and medium-sized enterprises (SMEs) are increasingly adopting these services to enhance their operational efficiency and focus on core business activities. Furthermore, the rising need for secure connectivity and data protection is driving the market growth in Latin America.

Asia Pacific:

With the growing emphasis on digitalization initiatives, Asia Pacific is expected to witness significant growth in the Managed Network Services market. Rapid economic growth, increasing internet penetration, and the rising adoption of cloud-based solutions are driving the demand for managed network services in this region. Moreover, the presence of numerous emerging economies, such as China and India, paves the way for business expansion and market potential in Asia Pacific.

Europe:

Europe holds substantial growth potential in the Managed Network Services market. The region's strong IT infrastructure and the need for secure and efficient networking solutions fuel the market's growth. Additionally, stringent regulations regarding data protection and compliance increase the adoption of managed network services among enterprises. Moreover, the increasing number of interconnected devices and the growing trend of remote working further drive the demand for these services in Europe.

Middle East & Africa:

The Managed Network Services market in the Middle East & Africa (MEA) region is also witnessing growth. Factors such as increasing investments in digital infrastructure, rapid adoption of cloud-based services, and rising awareness about cybersecurity drive the market in this region. Moreover, the need for cost-effective network management solutions, particularly in small and medium-sized enterprises (SMEs), further contributes to the market growth in the Middle East & Africa.

Company Profiles:

Key players in the global managed network services sector are responsible for providing comprehensive network management solutions. These solutions include network monitoring, security services, maintenance, and support for businesses and various organizations. Their primary role is to enhance network efficiency, ensure data integrity, and provide seamless connectivity to their clients globally.

Leading entities in the Managed Network Services sector include prominent companies like Cisco Systems Inc., IBM Corporation, Ericsson, Huawei Technologies Co. Ltd., Nokia Corporation, AT&T Inc., Verizon Communications Inc., Accenture plc, HCL Technologies Ltd., and BT Group plc. These companies play crucial roles in providing managed network services to businesses and institutions worldwide. They offer a range of services and support to help clients streamline their network infrastructure, enhance security measures, improve operational efficiency, and ensure reliable connectivity. With extensive industry experience and technological expertise, these key stakeholders are driving advancements and shaping the development of the Managed Network Services field.

COVID-19 Impact and Market Status:

The global Managed Network Services market has experienced a notable transformation due to the effects of the Covid-19 pandemic. This has resulted in a considerable increase in demand, driven by businesses swiftly integrating remote work solutions and bolstering their network security protocols.

The global Managed Network Services (MNS) market has seen significant shifts due to the COVID-19 pandemic's impact. The rapid move to remote work has introduced unprecedented challenges for companies in managing their network infrastructures effectively. This has led to a surge in demand for specialized MNS providers capable of monitoring and managing network assets to guarantee the continuous availability of essential business applications and data. The pandemic has accelerated the adoption of digital technologies, emphasizing the need for reliable and resilient network connectivity solutions. Economic fluctuations caused by the crisis have forced businesses to reconsider their IT budgets, affecting the short-term growth prospects of the MNS market. Supply chain disruptions and reduced IT spending in certain sectors have posed challenges for MNS providers.

However, the MNS market is expected to recover as companies prioritize strengthening their network infrastructures, enhancing cybersecurity measures, and adopting advanced technologies like cloud networking. MNS providers are well-positioned to capitalize on this opportunity by offering flexible and scalable services to meet the evolving needs of businesses in the post-pandemic landscape.

Latest Trends and Innovation:

- On March 4, 2021, Verizon Business announced its acquisition of BlueJeans Network, a leading provider of enterprise video conferencing solutions.

- On May 10, 2020, Microsoft completed the acquisition of Metaswitch Networks, a provider of cloud-based communication solutions for telecom operators.

- On February 1, 2021, GlobalLogic, a leading digital product engineering company, announced its acquisition by Hitachi for $9.6 billion.

- On November 10, 2020, Fujitsu Limited and Ericsson announced their strategic alliance to deliver innovative end-to-end 5G network solutions and services.

- On September 7, 2021, NTT Ltd announced the acquisition of Secure-24 Intermediate Holdings, Inc., a leading provider of managed services and cybersecurity solutions.

- On January 13, 2020, Cisco completed the acquisition of Acacia Communications, a provider of high-speed optical interconnect technologies, after a lengthy regulatory process.

- On July 21, 2021, DXC Technology announced the acquisition of Luxoft Holding, Inc., a global digital strategy consulting and software engineering firm, to boost its digital capabilities.

- On November 30, 2020, Accenture announced the acquisition of End-to-End Analytics, an analytics services and solutions provider, to strengthen its applied intelligence capabilities.

- On March 8, 2021, Telstra announced the acquisition of 100% of the shares in Datacom Data Centres from Datacom Group Limited, enhancing its data center capabilities in Australia and New Zealand.

- On January 25, 2021, AT&T completed the sale of its managed application and hosting services unit, including its data centers, to Brookfield Infrastructure.

Significant Growth Factors:

The rising need for a robust, flexible, and trustworthy network infrastructure is propelling the expansion of the Managed Network Services Market.

The market for managed network services is experiencing remarkable growth for various reasons. Initially, the increasing adoption of cloud-based services is propelling the demand for managed network services as businesses strive to enhance their network infrastructure capabilities and ensure efficient data management and communication. Additionally, the rising number of digital transformation initiatives across industries is amplifying the need for effective and secure network management. Businesses are aiming to optimize their operations and improve customer experiences, highlighting the importance of efficient network management services.

The growing complexity of network infrastructure and the escalating need for specialized expertise are prompting companies to outsource their network management functions, thereby driving the growth of managed network services providers. The advent of IoT devices and the resulting increase in data volumes necessitate robust network management solutions to ensure seamless connectivity and data security. Additionally, the increased prevalence of cyber threats is pushing businesses toward managed network services that offer advanced threat detection and mitigation capabilities.

Restraining Factors:

The Managed Network Services Market faces considerable growth limitations due to the intricate and continuously changing technology environment.

The Managed Network Services Market is set for substantial growth in the near future, although several factors may hinder this progress. Primarily, the significant costs associated with the deployment and maintenance of managed network services could pose challenges for companies, especially smaller businesses with limited budgets. Concerns about data security and privacy also present significant obstacles to the widespread adoption of managed network services, as companies are cautious of potential data breaches and compliance issues with strict regulations.

Moreover, the scarcity of skilled professionals in the sector could impede the expansion of managed network services, given the rising demand for experts proficient in network management and security coupled with limited availability, leading to increased costs and extended deployment times. Additionally, the increasing complexity of networks and the rapid evolution of technology pose challenges for service providers in meeting the continuously changing requirements of their clients. Despite these challenges, the Managed Network Services Market shows promising growth prospects. With companies increasingly prioritizing digital transformation and seeking secure and efficient networking solutions, the demand for managed network services is projected to rise. Furthermore, advancements in technologies like artificial intelligence and automation offer the potential to mitigate some existing constraints, making managed network services more cost-effective and reliable. By investing strategically in infrastructure and developing a pool of skilled professionals, the market for managed network services is well-positioned for growth in the coming years.

Key Segments of the Managed Network Services Market

Type Overview

• Managed LAN

• Managed Wi-Fi

• Managed VPN

• Managed WAN

• Network Monitoring

• Managed Network Security

Deployment Mode Overview

• On-Premises

• Cloud

Organization Size Overview

• Small and Medium Enterprises

• Large Enterprises

Verticals Overview

• BFSI (Banking, Financial Services, and Insurance)

• Retail and Ecommerce

• IT and Telecom

• Manufacturing

• Government

• Education

• Healthcare

• Media and Entertainment

• Other

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America