The global magnetic resonance angiography market was valued at USD 5.34 billion in 2019 and is expected to grow at a CAGR of 5.1% over the forecast period. Improving insurance benefits, favorable regulatory legislation, and an improvement in the use of magnetic resonance angiography (MRA) procedures can be credited to demand expansion.

The global Magnetic Resonance Angiography market size is expected to reach close to USD 11,567.6 million by 2029 with an annualized growth rate of 6.1% through the projected period.

.jpg

)

In the coming years, it is expected that the rising geriatric population and artificial intelligence-based imaging technologies will drive market development. It is likely that an increase in FDA approvals would propel the market for MRI systems.

MRA is a diagnostic technique that is helpful for detecting diseases/disorders that primarily involve blood vessels and soft tissues allografts ,such as tumours and lesions. Demand for diagnostic imaging techniques, especially in soft tissue imaging, is expected to experience steady growth over the coming years. Furthermore, with the rise in the geriatric population and the prevalence of chronic diseases, substantial growth is anticipated in the market for MRA procedures.

Key players serving the global market include Ecolab, Inc., Angiodynamics, Inc., Serres, Hologic, Inc., Traubco LLC, Smith & Nephew plc, Stryker Corporation, CONMED Corporation, Medtronic plc, among other prominent players.

Magnetic Resonance Angiography Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2029 |

| Study Period | 2018-2029 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2029 | USD 11,567.6 million |

| Growth Rate | CAGR of 6.1% during 2019-2029 |

| Segment Covered | Product, End User, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Siemens Healthineers, GE Healthcare, Canon Medical Systems, and Philips Healthcare |

Key Segment Of The Magnetic Resonance Angiography Market

By Product,(USD Million)

• Systems

• Disposables

• Accessories

By End-Users,(USD Million)

• Hospitals

• Dialysis Centers

• Ambulatory Surgical Centers

• Others

Regional Overview, (USD Million)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

MRA uses heavy magnetic field along with radio waves. The results are then displayed on desktop for evaluation. This test does not use radiation and will require a comparison substance injection. The contrast material used during MRA is less probable than the contrast media used mostly for computed tomography (CT) to trigger an allergic reaction.

To detect and cure blood vessel-related disorders, physicians use angiography. Angiography tests produce photographs in the body of major blood vessels. The comparison content may or may not be used for an MRA exam.

Physicians use MRA technique to identify irregularities such as aneurysms in abdomen, aorta chest and other arteries. The technique is used to detect atherosclerotic carotid artery of the neck, and observe blockages limiting blood flow to the brain resulting in stroke. Detection of aneurysm/ arteriovenous malformation.

However, there are some limitations to the technique. MRA images cannot be as simple as catheter angiography images of certain arteries. In specific, MRA assessment of tiny vessels can be challenging. Separate pictures of veins and arteries with MRA can often be hard to make. Furthermore, MRA does not provide high definition images as catheter angiography pictures.

The global magnetic resonance angiography market has been bifurcated based on technique, application and region. In terms of technique, the market is divided into Contrast Enhanced MRA and Non-contrast Enhanced MRA. On the basis of application, the segment is divided into abdomen, lower extremities, and others.

Non-contrast enhanced magnetic resonance angiography dominated the global market in 2019 and is expected to maintain its market dominance over the study period owing to the use of contrast dyes, leading to an increase in demand for diagnostic procedures. For patients who are either pregnant or who suffer from kidney diseases, non-contrast improved MRAs are prescribed. In comparison, it is recommended to undergo non-contrast enhanced MRA in some elderly patients, which is the preferable option where no contrast agent is inserted into the bloodstream.

The other category led the industry in 2019 and retained a share of over 75 percent of total sales. Over the projected era, the abdominal magnetic resonance angiography section is likely to develop at the quickest CAGR. Around 9 percent of Emergency Room (ED) visits are due to intense abdominal pain, according to the NCBI.

.png)

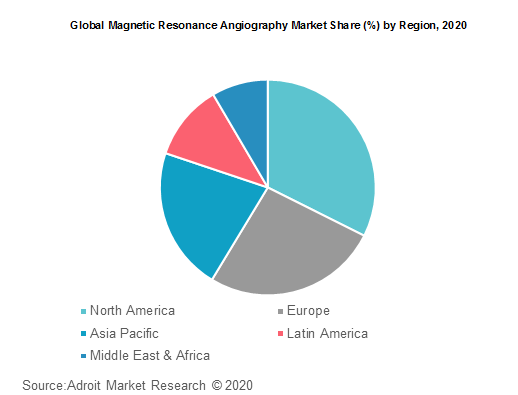

Based on regions, the global magnetic resonance angiography market is segmented into North America, Europe, Asia Pacific, Central and South America and Middle East & Africa. Emerging markets such as APAC are giving companies major growth prospects in the demand for the Industry’s in coming years.

In 2019, North America dominated the global market and is expected to grow at a CAGR of more than 4%over the forecast period. High penetration rate coupled with early adoption of technology in the U.S. is the major reason for the market dominance. Furthermore, Asia Pacific is expected to emerge as the most lucrative segment over the forecast period. Continuous healthcare infrastructure development in South East Asian countries owing to increasing medical tourism is likely to favor the market growth over the forecast period.