Market Analysis and Insights:

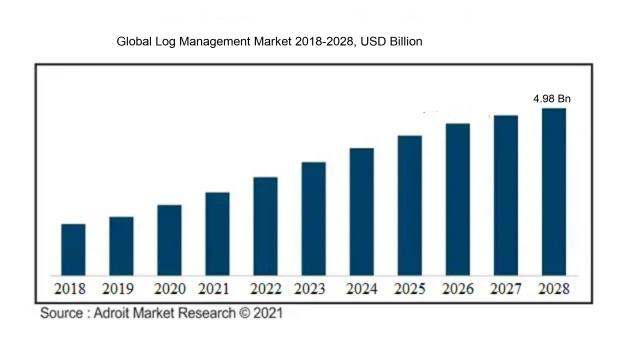

The market for Global Log Management was estimated to be worth USD 2.23 billion in 2023, and from 2021 to 2031, it is anticipated to grow at a CAGR of 17.01%, with an expected value of USD 4.98 billion in 2028.

The Log Management Market is being driven by various significant factors. Primarily, the rapid surge in data volumes being generated by organizations spanning multiple sectors has necessitated the development of efficient log management solutions. With companies producing substantial amounts of log data from diverse sources like applications, servers, and networks, there is a ened demand for robust log management systems that can securely gather, analyze, and retain this data. Moreover, the rising apprehensions surrounding data security and regulatory compliance have also bolstered the market. Businesses are increasingly recognizing the critical role of log management in upholding data integrity and fortifying defenses against cyber threats. Furthermore, the upsurge in cloud computing and the uptake of hybrid IT environments have spurred the need for log management solutions adept at monitoring and overseeing log data from both traditional on-premises setups and cloud-based infrastructure. Finally, the escalating frequency of cyber-attacks and the imperative for proactive threat detection and incident response have further propelled market growth, with log management proving to be crucial in pinpointing and mitigating security breaches.

Log Management Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD 4.98 billion |

| Growth Rate | CAGR of 17.01% during 2021-2031 |

| Segment Covered | By Component, By Deployment Mode, By Organization Size, By Vertical, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | IBM Corporation, SolarWinds Worldwide LLC, Splunk Inc., AT&T Inc., Loggly Inc., Sumo Logic Inc., Rapid7 LLC, Micro Focus International plc, Trustwave Holdings Inc., and Paessler AG. |

Market Definition

Log management is the process of gathering, preserving, and evaluating log data to efficiently oversee and address issues in technological systems, software, and networks in order to enhance performance and safety. By aiding organizations in upholding transparency, trackability, and adherence to regulations, log management plays a crucial role in ensuring smooth operations.

Effective log management plays a critical role in organizational operations for several important reasons. Foremost, it serves as a tool for organizations to detect and address security breaches or system malfunctions by collecting and analyzing log data. This data analysis offers valuable insights into potential security threats, suspicious activities, and abnormalities within the system. Furthermore, log management aids in ensuring compliance with regulatory requirements and industry standards by systematically recording and retaining logs for a designated period. This practice enables organizations to exhibit transparency and accountability during audit processes. Additionally, log management contributes to the monitoring and enhancement of system performance by tracking application usage, identifying performance bottlenecks, and resolving issues promptly. Furthermore, it supports incident response and forensic investigations by maintaining a historical log of events that can be scrutinized to determine the underlying causes of disruptions or incidents. In summary, effective log management is indispensable for safeguarding the security, compliance, and operational efficiency of an organization's systems.

Key Market Segmentation:

Insights On Key Component

Solution

Solution is expected to dominate the Global Log Management Market. Log management solutions play a crucial role in aggregating, analyzing, and archiving logs from various sources within an organization. These solutions help organizations enhance their security posture, identify potential threats and vulnerabilities, and comply with regulatory requirements. With the increasing need for efficient log management and analysis, organizations are investing in log management solutions to streamline their operations and improve their overall security. As a result, the solution part is expected to dominate the Global Log Management Market.

Services

While the solution is expected to dominate the Global Log Management Market, the services also holds significant importance. Log management services provide organizations with the necessary expertise and support to effectively implement and manage log management solutions. These services include consulting, training, maintenance, and support. Organizations often require assistance in selecting the right log management solution, configuring it to their specific needs, and optimizing its functionality. Additionally, ongoing support and maintenance are essential for ensuring the smooth operation of log management systems. Therefore, the services part plays a crucial role in supporting and complementing the adoption of log management solutions.

Insights On Key Deployment Mode

Cloud Based

Cloud Based is expected to dominate the Global Log Management Market. With the increasing adoption of cloud computing and the growing demand for scalable and flexible log management solutions, the cloud-based deployment mode offers numerous advantages. It allows organizations to easily access log data from anywhere, at any time, and from any device. Additionally, cloud-based log management solutions offer cost savings by eliminating the need for in-house servers and infrastructure. The ability to seamlessly scale resources based on demand and the availability of advanced analytics and real-time monitoring further contribute to the dominance of the cloud-based part in the Global Log Management Market.

On Premises

While the cloud-based deployment mode is expected to dominate the Global Log Management Market, the on-premises part still holds significance for certain industries and organizations. Some enterprises prefer to have full control over their log management infrastructure and want to keep data within their own premises due to security and compliance concerns. In industries like finance, healthcare, and government, where data privacy and regulatory compliance are crucial, on-premises log management solutions may be preferred. However, the growth of the on-premises part may be limited compared to the cloud-based part due to the increased adoption of cloud technologies and the benefits they offer in terms of scalability, accessibility, and cost-effectiveness.

Insights On Key Organization Size

Small and Medium-Sized Enterprises

Small and medium-sized enterprises (SMEs) are expected to dominate the Global Log Management Market. SMEs make up a significant portion of businesses globally, and their need for effective log management solutions is growing. As SMEs continue to adopt digital technologies and rely on data-driven operations, the importance of managing logs becomes paramount. Log management enables SMEs to monitor security events, troubleshoot system issues, and comply with regulatory requirements. Moreover, log management solutions tailored to the needs and budgets of SMEs are becoming more available in the market, further driving their adoption. Therefore, SMEs are expected to hold a prominent position in the Global Log Management Market.

Large Enterprises

Large enterprises also form a crucial part of the Global Log Management Market. These organizations typically have complex and extensive IT infrastructures, generating a vast amount of log data. Effective log management is essential for large enterprises to monitor and analyze logs, identify anomalies or security breaches, and ensure compliance. With their greater resources and budgets, large enterprises have the capability to invest in robust log management solutions that cater to their specific needs. Although SMEs may dominate in terms of the sheer number of businesses, large enterprises are expected to have a strong foothold as they have substantial log management requirements, making them a significant within the Global Log Management Market.

Insights On Key Vertical

IT and ITeS

IT and ITeS is expected to dominate the Global Log Management Market. With the increasing dependence on technology and the rise in cyber threats, the IT and ITeS industry has become more focused on ensuring the security and integrity of their logs. Log management plays a crucial role in this industry as it helps in monitoring, analyzing, and securing the vast amount of logs generated by various IT systems and applications. Moreover, compliance requirements, such as GDPR and PCI DSS, further drive the demand for efficient log management solutions in the IT and ITeS sector. Therefore, it is expected that the IT and ITeS part will dominate the Global Log Management Market.

BFSI

Being a highly regulated industry, the BFSI has a significant need for robust log management solutions. Regulatory standards, such as SOX and KYC, require financial institutions to store and monitor logs to ensure transparency, security, and compliance. Additionally, banks and financial institutions deal with sensitive customer information and financial transactions, making log management essential to identify any security breaches or fraudulent activities. Hence, the BFSI part is expected to have a strong demand for log management solutions in the Global Log Management Market.

Healthcare

In the healthcare industry, log management plays a vital role in ensuring patient data privacy and security. Healthcare organizations generate vast amounts of logs from various systems, such as electronic health records and medical devices, which need to be securely stored, monitored, and analyzed. Compliance with regulations like HIPAA and GDPR also requires robust log management practices. Thus, the healthcare part is expected to have a significant demand for log management solutions in the Global Log Management Market.

Retail and Ecommerce

The retail and ecommerce also holds considerable importance in the Global Log Management Market. With the increasing digitalization of retail and the rise of online shopping, retail and ecommerce businesses generate a large volume of logs that need to be effectively managed to ensure smooth operations, detect any security threats or fraud, and analyze customer behavior patterns. Log management solutions can help with inventory management, supply chain optimization, and enhancing the overall customer experience. Therefore, log management solutions are expected to be in high demand in the retail and ecommerce part.

Telecom

The telecom in the Global Log Management Market is expected to have a significant demand for log management solutions. Telecom companies generate large volumes of logs from network devices, call records, and customer interactions, which need to be effectively managed for security, network optimization, and regulatory compliance. Log management helps in identifying network issues, detecting anomalies or unauthorized access, and improving overall network performance. Hence, the telecom part is an important market for log management solutions.

Education

Although the education may not dominate the Global Log Management Market, it still represents a potential market for log management solutions. Educational institutions handle a significant amount of data related to student records, admissions, and financial transactions. Log management can help in securing this data, identifying any security breaches, and tracking user activities within the institution's systems. While the demand may not be as high as in other parts, log management solutions can provide valuable support to educational institutions in safeguarding sensitive data.

Others

The Others covers industries and verticals that are not specifically mentioned in the given options. Depending on the specific industries included in this part, the demand for log management solutions may vary. It is difficult to determine which particular industries or verticals will dominate this part, as it depends on specific market trends and requirements. However, industries such as manufacturing, transportation, and energy can have a potential need for log management solutions to ensure operational efficiency, security, and compliance.

Insights on Regional Analysis:

North America

North America is expected to dominate the Global Log Management market. This dominance can be attributed to the early adoption of advanced technologies and the presence of well-established players in the region. The growing need for improved network security and compliance with stringent regulations has led to the increased demand for log management solutions in North America. Additionally, the region has a highly developed IT infrastructure, which further supports the growth of the log management market. The strong emphasis on data protection and privacy in North America is also driving the demand for effective log management solutions. Overall, North America is set to maintain its dominant position in the Global Log Management market.

Asia Pacific

Asia Pacific is witnessing significant growth in the log management market. The rapid digitization and increasing adoption of cloud technologies in countries like China, India, and Japan are driving the demand for log management solutions in the region. Moreover, the region is experiencing a surge in cyber attacks, leading to the growing concern for data security among organizations. The need to comply with data protection regulations is also encouraging companies to invest in efficient log management solutions. As a result, Asia Pacific is expected to be a prominent market for log management in the coming years.

Europe

Europe is another key market for log management solutions. The region has a well-established IT infrastructure and a high level of cyber awareness, which has resulted in the increased adoption of log management practices. The stringent data protection regulations, such as the General Data Protection Regulation (GDPR), have also played a significant role in driving the demand for log management solutions in Europe. Furthermore, the presence of major players and the growing focus on cybersecurity are contributing to the growth of the log management market in the region.

Latin America

Latin America is witnessing steady growth in the log management market. The increasing adoption of digitization and cloud technologies across various industries in the region has led to a greater need for effective log management solutions. Moreover, the rising instances of cyber threats and data breaches have fueled the demand for log management practices to enhance security and compliance. While Latin America may not dominate the Global Log Management market, it is expected to contribute significantly to its growth in the coming years.

Middle East & Africa

The Middle East & Africa region is also experiencing growth in the log management market. The increasing adoption of digital transformation initiatives and the rising number of cyber attacks have driven the demand for log management solutions in the region. Moreover, the strict data protection regulations and the need for compliance have propelled organizations to invest in robust log management practices. Although the Middle East & Africa may not dominate the Global Log Management market, it is expected to emerge as a significant market for log management solutions in the foreseeable future.

Company Profiles:

Prominent entities in the worldwide Log Management sector are vital for offering innovative log management solutions and services to enterprises, aiding them in the efficient monitoring, analysis, and safeguarding of their log data to enhance operational productivity and security.

Prominent companies driving the log management market forward include IBM Corporation, SolarWinds Worldwide LLC, Splunk Inc., AT&T Inc., Loggly Inc., Sumo Logic Inc., Rapid7 LLC, Micro Focus International plc, Trustwave Holdings Inc., and Paessler AG. These industry leaders play a vital role in providing a wide range of log management solutions and services aimed at assisting businesses in gathering, analyzing, and overseeing log data to enhance security, compliance, and operational effectiveness. Whether it be renowned tech giants such as IBM and AT&T or specialized firms like Loggly and Rapid7, each entity contributes distinct capabilities and offerings to the log management sector, addressing the unique needs and demands of organizations spanning various industries.

COVID-19 Impact and Market Status:

The global need for advanced security and compliance management in remote work settings has surged due to the Covid-19 outbreak, leading to a substantial rise in the adoption of log management solutions.

The log management market has been significantly impacted by the COVID-19 pandemic. The sudden transition to remote work and increased reliance on digital infrastructure have resulted in organizations managing and analyzing a larger volume of logs. Consequently, there is a ened demand for log management solutions as businesses prioritize robust monitoring and security measures. However, the economic uncertainties stemming from the pandemic have imposed financial constraints on many enterprises, potentially hindering the uptake of log management tools. Moreover, the market is experiencing ened competition with the entry of new players offering innovative and cost-efficient solutions. This competitive environment, combined with the need for customization and easy deployment, is anticipated to shape the market dynamics in the foreseeable future. Ultimately, the COVID-19 pandemic has both expedited the adoption of log management solutions and presented new obstacles that will impact the market's growth trajectory.

Latest Trends and Innovation:

- In February 2021, IBM announced the acquisition of Turbonomic, a leading provider of application resource management (ARM) and network performance management (NPM) software. This acquisition will enhance IBM's AI-powered automation capabilities for managing workloads across hybrid cloud environments.

- In March 2021, Elastic, the company behind Elasticsearch and the Elastic Stack, announced the acquisition of security analytics company Endgame. This acquisition will enable Elastic to offer advanced endpoint security capabilities to its users.

- In April 2021, Splunk, a leading provider of log management and analytics solutions, announced the acquisition of TruSTAR, a platform that helps organizations manage and operationalize threat intelligence data. This acquisition will strengthen Splunk's security operations capabilities.

- In May 2021, Rapid7, a provider of security analytics and automation solutions, announced the acquisition of IntSights, a leader in external threat intelligence and protection. This acquisition will enhance Rapid7's capabilities to detect and respond to threats.

- In June 2021, SolarWinds, a provider of IT management software, announced the acquisition of SentryOne, a leading provider of database performance monitoring and DataOps solutions. This acquisition will expand SolarWinds' portfolio of IT operations management solutions.

- In July 2021, Sumo Logic, a cloud-based log management and analytics platform, announced its initial public offering (IPO) on the Nasdaq stock exchange. The IPO raised approximately $326 million for the company.

- In August 2021, Graylog, an open-source log management platform, announced the release of Graylog 4.0, which introduces new features and improvements for log management and analysis.

- In September 2021, Logz.io, a cloud-native observability platform, announced a partnership with Microsoft Azure to offer its log management and analytics solutions on the Azure Marketplace.

- In October 2021, LogDNA, a provider of log management solutions, announced a partnership with Amazon Web Services (AWS) to offer its log aggregation and analysis platform on the AWS Marketplace.

- In November 2021, Datadog, a monitoring and analytics platform, announced the acquisition of Sqreen, a provider of application security solutions. This acquisition will enhance Datadog's capabilities to secure cloud-native applications.

- In December 2021, Graylog announced the acquisition of Packetbeat, an open-source log analyzer, to further strengthen its log management and analysis capabilities.

Significant Growth Factors:

The Log Management Market is propelled by growth factors such as the rising demand for sophisticated security solutions and regulatory compliance oversight within businesses.

The Log Management Market is witnessing substantial expansion propelled by several critical factors. Initially, the escalating requirement for efficient log management solutions in various industry sectors is propelling the market's advancement. The growing complexity and abundance of logs emanating from systems, applications, and networks necessitate sophisticated log management tools for centralizing and scrutinizing these logs. This, in turn, elevates security levels, ensures compliance, and enhances operational effectiveness. Furthermore, the surge in the adoption of cloud-based log management solutions stands out as a prominent growth stimulant. The cloud furnishes scalable and adaptable log management services capable of managing large log volumes and delivering real-time analysis, making it an appealing choice for enterprises. Additionally, the mounting need for log management solutions to combat cybersecurity threats and meet regulatory demands is fueling market expansion. As businesses recognize the vital role of log analysis in identifying security vulnerabilities and guaranteeing adherence to regulations, the demand for log management tools is anticipated to surge. Moreover, the incorporation of machine learning and artificial intelligence technologies into log management solutions is steering market progression. These advanced technologies conduct real-time log data analysis, aiding organizations in preemptively identifying and addressing security breaches. Ultimately, the remarkable growth of the Log Management Market stems from the escalating necessity for log management solutions to enhance security measures, meet compliance standards, and optimize operational efficiency within organizations.

Restraining Factors:

The Log Management Market may face challenges due to the limited uptake of log management solutions by small and medium-sized enterprises, as well as budget constraints.

The log management sector encounters various factors that can impede its progress. One key issue is the intricate nature of log management solutions, which can pose difficulties for organizations lacking in resources or technical skills. The implementation and upkeep of such solutions often necessitate specialized expertise and dedicated personnel, creating barriers for smaller businesses looking to integrate them. Data security and privacy concerns also stand as obstacles to the growth of the log management market. With the rise in cyber threats and regulatory frameworks like GDPR, organizations must ensure that their log management systems are secure and compliant, a process that can be resource-intensive and time-consuming. Furthermore, the scalability of log management solutions presents a potential limitation. Given the sheer volume of log data generated by organizations, the ability to scale solutions for efficient data storage, analysis, and retrieval becomes crucial.

Without scalable options, organizations may struggle to manage escalating log data effectively and could face performance bottlenecks. Nonetheless, amidst these challenges, the log management market offers notable opportunities. Factors such as the increasing adoption of cloud-based solutions, advancements in machine learning and AI technologies, and a rising recognition of the advantages of log management in detecting and addressing security threats paint a promising picture for the market. Through ongoing innovations and the evolution of log management solutions, organizations can address these hindrances and tap into the vast potential of log management to enhance operational efficiency and fortify their cybersecurity protocols.

Key Segments of the Greenhouse Horticulture Market

By Type

• Plastic Film Greenhouse

• Glass House

• Rigid Panel Greenhouse

By Shape

• Raised Dome

• Sawtooth

• Venlo

• Flat Arch

• Tunnel

• Modified Quonset

By Crop Type

• Nursery Crops

• Flowers and Ornamentals

• Fruits

• Vegetables and Herbs

• Others

By End User

• Research and Educational Institutes

• Commercial Growers

• Retail Gardens

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America

Frequently Asked Questions (FAQ) :