Liquid Packaging Carton Market Analysis and Insights:

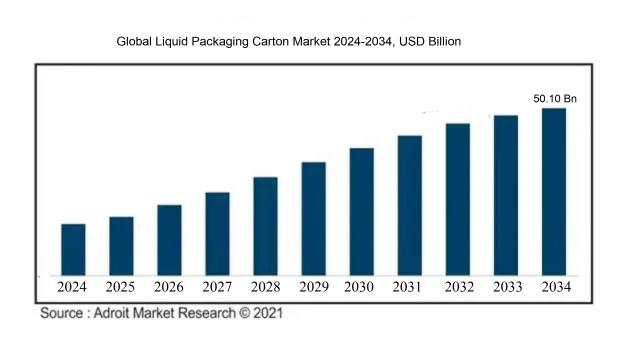

The size of the Global Market for Liquid Packaging Cartons was USD 29.13 billion in 2024, USD 30.09 billion in 2025, and almost USD 50.10 billion by 2034, with a robust compound annual growth rate (CAGR) of 6.19% from 2024 to 2034.

The Liquid Packaging Carton Market is influenced by several pivotal factors. Firstly, a growing emphasis on sustainable packaging options has emerged, spurred by ened environmental consciousness among consumers and producers alike, leading to a preference for recyclable and environmentally friendly materials. Secondly, the expansion of the beverage and dairy sectors, combined with increased consumption of liquid food items, has ened the demand for effective packaging that guarantees product safety and prolongs shelf life. Furthermore, advancements in carton design and manufacturing technologies play a critical role by improving functionality and allowing for greater customization. Additionally, the trend of urbanization and evolving lifestyle choices, particularly in emerging markets, is driving the need for convenient and portable packaging solutions. Finally, the implementation of strict regulations concerning packaging waste disposal and recycling is motivating companies to explore innovative liquid packaging carton options that align with compliance mandates while appealing to environmentally aware consumers.

Liquid Packaging Carton Market Definition

A liquid packaging carton is a specialized container intended for storing liquid goods, including drinks and food products. It is designed with protective features that prevent leaks and maintain the quality and freshness of the contents for an extended period.

Liquid packaging cartons are vital in the food and beverage sector, offering significant protection, convenience, and environmental benefits. Engineered to shield liquids from factors such as contamination, light, and oxygen, these cartons help maintain product integrity and prolong shelf life. Their lightweight construction not only lowers transportation expenses but also minimizes carbon emissions, aligning with sustainable practices. The adaptability of liquid packaging cartons enables the creation of numerous shapes and sizes to accommodate various product requirements. Moreover, their potential for using recyclable materials aligns with the increasing consumer demand for sustainable packaging options, fostering a commitment to environmental stewardship.

Liquid Packaging Carton Market Segmental Analysis:

Insights On Carton Type

Gable Top Cartons

The Gable Top Cartons are expected to dominate the Global Liquid Packaging Carton Market due to their versatility and convenience in packaging. These cartons are widely used for dairy products, juices, and other beverages, offering excellent protection against light and oxygen, which preserves the quality of the liquids. The ability to design gable top cartons in various sizes and shapes further enhances their appeal to manufacturers and consumers alike. Additionally, their ease of transport and storage contributes to lower shipping costs and greater sustainability, since they often utilize recyclable materials. The combination of functionality, consumer preference, and cost-effectiveness positions Gable Top Cartons as the leading choice in the market.

Brick Liquid Cartons

Brick Liquid Cartons hold a significant place in the liquid packaging industry, primarily due to their excellent stackability and efficient use of space. This design allows for optimal utilization of storage and transportation, making them ideal for products like soups, sauces, and beverages. While they may not have the same level of consumer recognition as Gable Top Cartons, they are still favored for their robust leak-proof characteristics and long shelf life. Their rectangular shape also allows for easy filling and sealing processes in manufacturing, making them a practical option for many producers.

Shaped Liquid Cartons

Shaped Liquid Cartons are primarily used for branding and differentiation in the market. Their unique forms and designs make them visually appealing and can attract consumers in competitive retail environments. However, they represent a smaller of the market compared to Gable Top and Brick Liquid Cartons. While they offer advantages in terms of marketing and brand identity, their production costs are often higher, which may deter manufacturers looking for cost-effective packaging solutions. As such, they are suitable for niche products that benefit from distinctive packaging but face limitations in widespread adoption.

Insights On Application

Juices & Drinks

The "Juices & Drinks" category is expected to dominate the Global Liquid Packaging Carton Market significantly. This is primarily due to an increasing consumer preference for healthy and convenient beverage options, as well as the rising trend towards on-the-go consumption. Juice products, often perceived as healthier alternatives to sugary drinks, have seen a surge in demand, particularly among health-conscious consumers. Additionally, the versatility of liquid cartons, which preserve freshness and flavor while being lightweight and recyclable, aligns well with the sustainability goals of the beverage industry. Consequently, key players are investing in innovative packaging solutions that cater to the growth of this category, further establishing its dominance.

Dairy Products

The Dairy Products remains a strong player in the liquid packaging carton market. This category includes milk, yogurt drinks, and flavored dairy alternatives, which are staples in many households. Growing health awareness has propelled the demand for fresh dairy products, additionally leading to innovations in packaging that extend shelf life and maintain quality. The emphasis on sustainable packaging options, driven by eco-conscious consumers and regulatory pressure, is also encouraging brands in the dairy sector to adopt liquid cartons, enhancing the growth and significance of this category.

Liquid Food

The Liquid Food category, encompassing soups, sauces, and ready-to-eat meals, demonstrates steady growth within the liquid packaging carton market. The increasing demand for convenience products, especially in urban areas with busier lifestyles, supports this 's expansion. Liquid cartons provide several advantages, such as extended shelf life and ease of use, which cater to consumers seeking quick meal options. Furthermore, as more people embrace healthy eating habits, the trend toward packaged liquid foods that support nutritional balance is likely to contribute positively to this growth.

Alcoholic Beverages

The Alcoholic Beverages showcases potential for growth in the liquid packaging carton market, driven by changing consumer preferences and innovation. As brands explore eco-friendly packaging options, many are transitioning from traditional glass and plastic to cartons for their beverages. This shift not only reflects sustainability efforts but also adds convenience for consumers looking for portable drink options. Formats such as ready-to-drink cocktails and wine in cartons are gaining popularity due to their lightweight and recyclable attributes, appealing to younger demographics who prioritize easy-to-carry beverages for social occasions.

Others

The "Others" category captures a diverse range of liquid products that do not fit neatly into the aforementioned classifications. This includes sauces, dressings, and plant-based drinks, which have gained traction in recent years. The increasing interest in global cuisines and health-oriented diets pushes the demand for various sauces and condiments, which benefit from liquid cartons due to their practical design and storage efficiency. As consumers seek more variety and gourmet options, the adoption of liquid packaging solutions in this category will likely continue to rise, offering both convenience and sustainability.

Insights On Material

Coated Paperboard

Coated paperboard is expected to dominate the Global Liquid Packaging Carton Market. This material's superior printability and sleek finish make it highly desirable for branded liquid products, including beverages. Additionally, coated paperboard offers enhanced barrier properties against moisture and oxygen, which is crucial for maintaining product quality and shelf life. Manufacturers are increasingly favoring this material in response to consumer demands for attractive packaging that effectively preserves liquids. Furthermore, as sustainability becomes a significant factor in consumer purchasing decisions, coated paperboard's recyclable nature aligns well with emerging eco-friendly trends, boosting its market position.

Uncoated Paperboard

Uncoated paperboard finds its place in the Global Liquid Packaging Carton Market due to its cost-effectiveness and functional properties. Many manufacturers prefer this option for budget-conscious liquid products that do not require high-end branding. While it may not offer the same level of aesthetic appeal as coated paperboard, uncoated paperboard provides adequate barrier protection for many liquids. Its easy availability and simple manufacturing process make it a reliable choice for companies looking to balance quality and cost.

Aluminum

The aluminum category in the Global Liquid Packaging Carton Market is appreciated for its excellent barrier properties, particularly for products that require protection from light, oxygen, and moisture. Aluminum packaging is lightweight and easily recyclable, making it an attractive option for environmentally conscious consumers. However, it often comes with a higher production cost and is less versatile compared to paper-based materials when it comes to printing and branding. Despite this, its robust performance in preserving beverage quality has resulted in a steady demand, particularly for carbonated drinks and dairy products.

Others

The "Others" category in the Global Liquid Packaging Carton Market includes various materials such as plastic and biodegradable options. While these alternatives provide versatility and unique benefits, their overall market share is limited compared to the more established materials like coated paperboard and aluminum. However, the rising interest in sustainable packaging solutions may result in a gradual increase in popularity for certain innovative materials. Nevertheless, this remains niche, primarily serving specific market needs and usually not competing with the major players in the liquid packaging industry.

Insights On Opening Type

Straw Hole

The Straw Hole opening type is expected to dominate the Global Liquid Packaging Carton Market. This popularity stems from consumer preference for convenience and ease of use, particularly for on-the-go consumption. Straw Hole cartons offer an added benefit of maintaining product freshness and minimizing spillage, which is essential for juice, dairy, and other liquid products. Additionally, companies are increasingly adopting this design to enhance user experience, especially among children and youths who prefer using straws. The practicality combined with consumer habits makes Straw Hole the favored choice among various opening types.

Cut Opening

Cut Opening is a practical design favored for its straightforward usability; it involves tearing the carton open easily without additional tools. This type is prevalent in products like soups and ready-to-drink items, where pouring the contents directly is essential. However, its propensity for spillage and leaks has limited its market share compared to newer designs that offer better control and convenience. The demand remains stable but is often overshadowed by more innovative alternatives in the liquid packaging space.

Clip Opening

The Clip Opening design is recognized for its ability to reseal and maintain freshness after initial use, making it ideal for products that require consumption over multiple sittings, such as sauces or soups. While it caters to a niche market focused on preserving product quality, its overall usage remains less prevalent compared to competitors like the Straw Hole. Moreover, the manufacturing complexity and additional cost involved in producing Clip Opening cartons limit its widespread adoption, though it retains a loyal customer base that values reusability.

Twist Opening

Twist Opening is characterized by its ease of operation, allowing consumers to effortlessly access the product without the potential mess associated with tearing or cutting. This option is mainly used in products like flavored beverages and ready-to-drink options. However, while it offers convenience, the market often leans towards the more popular Straw Hole, which is perceived to align better with modern consumption habits. Therefore, although Twist Opening has its merits, it has not achieved significant dominance in the liquid packaging category.

Others

The "Others" category encompasses various specialized opening designs that cater to unique products or niche markets. These designs might include screw caps or specialized pour spouts. Although innovative and potentially beneficial for specific applications, the fragmentation of this category makes it less prominent in terms of market share. Manufacturers might explore these options to differentiate their products, but they do not attract as much mainstream attention as the main competitors, such as Straw Hole, which are tailored to broader consumer preferences and habits.

Insights On Shelf Life

Long-term Shelf Life

The long-term shelf life category is poised to dominate the Global Liquid Packaging Carton Market due to increasing consumer demand for convenience and sustainability. The rise in packaged food and beverage consumption, coupled with the need for long-lasting products, drives this 's growth. Consumers are increasingly seeking packaging that preserves product freshness over extended periods, particularly for dairy products, juices, and meal kits. Moreover, manufacturers are adapting to regulatory standards for food safety which necessitates efficient packaging solutions. With advancements in materials and technology improving shelf life, this area is experiencing robust growth, positioning it as the leading in the market.

Short-term Shelf Life

Short-term shelf life packaging is primarily utilized for products that are consumed quickly, such as fresh juices, dairy products, and ready-to-eat meals. This category caters to the increasing demand for fresh and minimally processed foods among health-conscious consumers. While it faces competition from long-term options, the appeal lies in the freshness and flavor retention that short-lived products offer. Manufacturers also benefit from reduced costs in material and production, as short-term solutions often require less sophisticated technology. Nonetheless, rising sustainability concerns encourage brands to explore eco-friendlier options even within this realm.

Global Liquid Packaging Carton Market Regional Insights:

Asia Pacific

Asia Pacific is poised to dominate the Global Liquid Packaging Carton market due to several key factors. The region experiences rapid urbanization and an increasing population, both contributing to higher demand for packaged liquid products. Additionally, the burgeoning food and beverage industry, especially in countries such as China and India, continues to fuel the need for efficient packaging solutions. The shift towards sustainable practices has led manufacturers to adopt eco-friendly packaging materials, which are also prevalent in liquid packaging cartons. Furthermore, advancements in production techniques and growing consumer awareness about environmental issues are propelling growth in this sector.

North America

North America holds a significant share in the liquid packaging carton market, driven largely by the advanced food and beverage industry and the preference for convenience among consumers. The region is witnessing a growing trend towards health-conscious packaging, which favors liquid cartons over traditional containers. Moreover, established players in the market are focusing on innovation, making North America a competitive landscape for liquid packaging solutions. Sustainability initiatives also drive growth, as consumers and brands increasingly prioritize eco-friendly alternatives.

Europe

Europe is characterized by a mature liquid packaging carton market marked by regulatory pressures aimed at reducing plastic waste. The region is increasingly leaning towards sustainable packaging, incentivized by government policies that encourage recycling and the use of renewable materials. Consumer demands for organic and healthier beverage options further propel the growth of liquid packaging cartons. Key players in the European market are significantly investing in R&D to develop innovative solutions catering to eco-conscious and quality-driven consumers.

Latin America

Latin America is gradually emerging in the global liquid packaging carton market, mainly driven by increased consumption in sectors such as dairy and juices. The region is witnessing improvements in manufacturing capabilities, which enables local businesses to tap into the growing trend of packaged goods. Additionally, urbanization and changing lifestyles are promoting the adoption of packaged liquids. However, challenges such as economic fluctuations and competition from other packaging forms may hinder rapid growth in the.

Middle East & Africa

The Middle East & Africa region is in the nascent stages of the liquid packaging carton market. While there is growing demand for liquid packaged products driven by urbanization and a burgeoning retail sector, the market faces challenges such as economic volatility and infrastructural issues. However, the increasing focus on sustainability in packaging solutions is encouraging investment and innovation. Local manufacturers have begun to recognize the opportunities and niche markets available, leading to gradual growth in this.

Liquid Packaging Carton Competitive Landscape:

Prominent actors in the worldwide liquid packaging carton sector, including Tetra Pak, SIG Combibloc, and Elopak, are at the forefront of innovation and sustainability efforts. They emphasize improving product safety and user convenience. Through strategic collaborations and technological advancements, these companies are effectively addressing consumer needs while adhering to environmental regulations.

The prominent entities in the Liquid Packaging Carton sector comprise Tetra Pak International S.A., SIG Combibloc Group AG, Elopak AS, Stora Enso Oyj, Reynolds Group Holdings Ltd., CombiPack, Evergreen Packaging LLC, Nippon Paper Industries Co., Ltd., International Paper Company, and DS Smith Plc. Furthermore, significant firms such as Mondi Group, Nampak Limited, WestRock Company, Printpack Inc., and ProAmpac LLC play a vital role. Additional influential players in the industry include Origin Packaging, Huhtamaki Oyj, Smurfit Kappa Group, and GS Packaging.

Global Liquid Packaging Carton COVID-19 Impact and Market Status:

The Covid-19 pandemic greatly boosted the need for liquid packaging cartons, as individuals increasingly opted for safer, packaged food and drink choices, transforming market dynamics and growth opportunities.

The COVID-19 pandemic had a profound effect on the liquid packaging carton industry, introducing both obstacles and prospects. At the onset, manufacturers faced significant challenges due to disruptions in supply chains, labor shortages, and reduced production capabilities, which hindered their ability to satisfy consumer demand. Additionally, the slowdown in consumption of food and beverages during lockdowns adversely affected sales figures. However, the pandemic also catalyzed an increased need for liquid packaging solutions, especially for food and beverages, as consumers turned to online shopping and delivery options. Furthermore, the ened focus on hygiene and safety resulted in a growing preference for packaged goods rather than bulk purchases. As the industry began to bounce back, there was a noticeable shift towards sustainable and eco-friendly packaging solutions, driving innovation and design throughout the sector. In summary, while the pandemic presented immediate challenges, it also stimulated a shift towards more sustainable practices, which will likely influence the future direction of the liquid packaging carton market.

Latest Trends and Innovation in The Global Liquid Packaging Carton Market:

- In April 2022, Tetra Pak announced its acquisition of a minority stake in the Singapore-based startup, Dairy Distillery, to support innovation in sustainable packaging solutions for liquid dairy products.

- In October 2022, Elopak launched a new plant-based carton, the Pure-Pak® Sense, made from 100% renewable materials, aimed at enhancing the sustainability of liquid packaging.

- In January 2023, SIG Combibloc launched its “SIG Refill” initiative, which focuses on developing refillable carton solutions for beverages, showcasing a significant step towards circular packaging.

- In March 2023, Huhtamaki completed its acquisition of the Chilean packaging company, Papeteries de Geny, enhancing its presence in the Latin American liquid packaging market.

- In July 2023, The Coca-Cola Company announced a partnership with Tetra Pak to create a new range of environmentally friendly packaging for its beverage lines as part of its sustainability strategy.

- In September 2023, Crown Holdings acquired a patent portfolio related to the production of innovative liquid carton packaging technology, which aims to improve the barriers and shelf life of packaged goods.

- In October 2023, Stora Enso introduced a new fiber-based, fully recyclable carton packaging solution aimed at the beverage sector, aligning with its commitment to sustainability and responsible sourcing practices.

Liquid Packaging Carton Market Growth Factors:

The expansion of the liquid packaging carton industry is fueled by the rising consumer preference for eco-friendly packaging options, advancements in design innovation, and the growth of the food and beverage sector.

The Liquid Packaging Carton Market is witnessing substantial growth fueled by a multitude of factors. A primary catalyst is the rising consumer preference for packaging that is both convenient and environmentally friendly, as sustainable materials increasingly influence buying choices. The ened demand for beverages, particularly non-alcoholic options like juices, dairy products, and plant-based drinks, further propels the market’s growth. Moreover, advancements in packaging technology and design enhance the efficiency and dependability of liquid cartons, making them more attractive to producers.

The global movement towards minimizing plastic waste aligns with this trend, encouraging manufacturers to embrace liquid cartons that provide recyclability and a reduced ecological footprint. The surge in e-commerce also drives the need for durable packaging capable of withstanding shipping and storage challenges, creating new opportunities for liquid carton applications. Furthermore, innovations in barrier coatings improve product shelf life, thereby increasing the adoption of cartons across various food and beverage sectors. In summary, the interplay of consumer demand for sustainable solutions, technological advancements, and rising beverage consumption is significantly contributing to the vigorous growth of the Liquid Packaging Carton Market.

Liquid Packaging Carton Market Restaining Factors:

The Liquid Packaging Carton Market faces several significant challenges, such as ened competition, variable costs of raw materials, and the necessity of adhering to strict regulatory standards.

The Liquid Packaging Carton Market encounters a variety of challenges that may hinder its progress. One significant issue is the implementation of rigorous regulations concerning packaging materials driven by environmental considerations, which compels manufacturers to explore more sustainable alternatives, often resulting in higher production expenses. Additionally, the burgeoning availability of alternative packaging types, such as plastics and glass, provides consumers with diverse options, which could detract from the appeal of liquid cartons. The market also faces stiff competition from rigid packaging solutions, regarded by many as more robust and upscale.

Moreover, disruptions within supply chains, ened by global occurrences, may impede the prompt procurement of essential raw materials, further complicating production efforts. The volatility in the costs of raw materials necessary for carton production can also impact profit margins and pricing strategies. Nevertheless, the liquid packaging carton sector stands to gain from the escalating demand for eco-friendly packaging options and the rising use of recyclable materials. Innovations in carton design and functionality that enhance barrier properties and user convenience open avenues for market differentiation and expansion. As consumer awareness increasingly gravitates towards sustainability, the liquid packaging carton industry is well-positioned to evolve and flourish in dynamic packaging environments.

Key Segments of the Liquid Packaging Carton Market

By Carton Type

• Brick Liquid Cartons

• Gable Top Cartons

• Shaped Liquid Cartons

By Application

• Dairy Products

• Juices & Drinks

• Liquid Food

• Alcoholic Beverages

• Others

By Material

• Uncoated Paperboard

• Coated Paperboard

• Aluminum

• Others

By Opening Type

• Cut Opening

• Straw Hole

• Clip Opening

• Twist Opening

• Others

By Shelf Life

• Short-term Shelf Life

• Long-term Shelf Life

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America