Market Analysis and Insights:

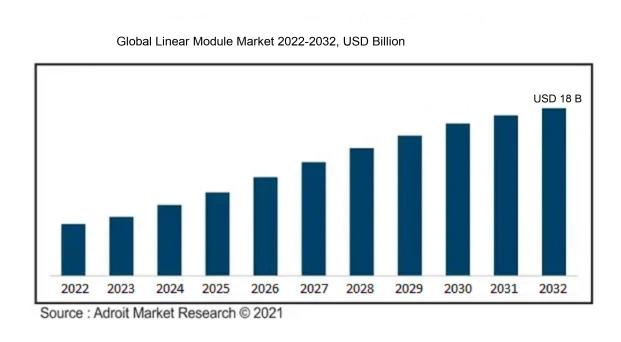

The market for Linear Module was estimated to be worth USD 10 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 6%, with an expected value of USD 18 billion in 2032.

The market for linear modules is significantly influenced by a range of important factors, notably the rising demand for automation within a variety of sectors, including manufacturing and logistics. Companies are increasingly concentrating on enhancing operational efficiency and lowering labor expenses, which has prompted a greater reliance on linear motion systems. Moreover, technological advancements, particularly the incorporation of IoT and concepts associated with Industry 4.0, are improving the efficacy and capabilities of linear modules. The growth of the e-commerce industry further contributes to this trend, as automated systems are increasingly implemented for sorting and packaging processes to fulfill consumer expectations. In addition, the movement toward smaller electronic devices necessitates precise motion control, thereby stimulating market expansion. The emphasis on sustainability is also pushing the need for energy-efficient solutions in production, making linear modules an appealing choice for organizations aiming to boost productivity while reducing their environmental footprint.

Linear Module Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2020-2023 |

| Forecast Period | 2024-2032 |

| Study Period | 2023-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 18 billion |

| Growth Rate | CAGR of 6% during 2024-2032 |

| Segment Covered | By Type, By End-User, By Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Bosch Rexroth AG, THK Co., Ltd., HIWIN Technologies Corp., NSK Ltd., Schaeffler AG, Parker Hannifin Corporation, SMC Corporation, Mitsubishi Electric Corporation, Automation Direct, and INA Bearing Company. |

Market Definition

A linear module represents an advanced mathematical framework that extends the idea of vector spaces by allowing scalars to be drawn from a ring rather than strictly a field. It comprises a set accompanied by an addition operation and a scalar multiplication, adhering to particular axioms that are similar to those applicable in vector spaces.

The Linear Module is essential in multiple domains, especially in control systems and electrical engineering, as it streamlines the evaluation and execution of linear interactions. By representing systems in a linear framework, it permits more straightforward calculations and forecasts concerning system performance, thus improving stability and effectiveness. This importance is further elevated in the realm of machine learning, where linear models form the basis for advanced algorithms. Furthermore, the Linear Module aids in comprehending multidimensional datasets through linear transformations, which is crucial for optimization challenges and data analysis, ultimately fostering improved decision-making in a wide array of applications.

Key Market Segmentation:

Insights On Key Type

Multi-Axis Linear Modules

Multi-Axis Linear Modules are expected to dominate the Global Linear Module Market due to their versatility and efficiency in complex automation tasks. As industries increasingly adopt automation solutions for enhanced productivity and precision, the demand for systems that can operate in multiple dimensions is rising. Multi-Axis systems enable manufacturers to optimize space, reduce cycle times, and accommodate intricate processes that require coordinated movements. This trend aligns with the needs of advanced manufacturing and robotics, where flexibility and multifunctionality are paramount. Consequently, the adaptability and comprehensive solutions offered by Multi-Axis Linear Modules position them as leaders in the evolving market landscape.

Single-Axis Linear Modules

Single-Axis Linear Modules cater to specific applications where linear motion is required in a singular direction. These modules are often employed in simpler automation setups, like assembly lines and pick-and-place systems, where streamlined operations are essential. Their design simplicity and ease of integration make them appealing for smaller scale projects and companies looking for cost-effective solutions. While they may not offer the versatility of Multi-Axis systems, their reliability and performance in targeted tasks solidify their niche in the linear module market.

Insights On Key Application

Electronics and Semiconductor

The Electronics and Semiconductor sector is anticipated to dominate the Global Linear Module Market primarily due to the increasing demand for automation and precision within this industry. The rapid advancements in technology, including miniaturization and the need for high-quality manufacturing processes, are driving the need for linear modules. These components play a critical role in enhancing the automation of electronic assembly lines, enabling more efficient production and reduced operational costs. Additionally, the growing emphasis on the Internet of Things (IoT) and smart devices adds further pressure on semiconductor manufacturers to adopt advanced machinery, further supporting the demand for linear modules in this particular sector.

Automotive

The Automotive industry shows significant potential for growth within the Linear Module Market, driven by the push towards automation in manufacturing processes and the increasing development of electric and autonomous vehicles. As car manufacturers seek to incorporate advanced technologies into vehicle design, the need for precise manufacturing systems, including linear modules, becomes apparent. Consequently, this results in higher demand for efficient and reliable automation solutions to streamline production and assembly operations within the automotive sector.

Food and Beverage

The Food and Beverage sector, while not the leading area for linear modules, remains a noteworthy contributor to the market. The need for automation in food processing, packaging, and distribution is continually on the rise, aimed at improving efficiency, ensuring food safety, and meeting increasing consumer demands. As companies in this sector adopt automation technologies to enhance their operations, the requirement for reliable, precise linear modules to support these initiatives will also grow, providing consistent opportunities in this application area.

Medical and Pharmaceutical

The Medical and Pharmaceutical industry is expected to grow steadily in the Linear Module Market, driven by the increasing emphasis on precision in manufacturing processes such as drug development and medical device production. Automation within laboratories and production lines is becoming more prevalent, as companies strive for enhanced accuracy and efficiency in their operations. The need for adherence to stringent regulatory requirements further drives the demand for reliable and precise linear modules to support quality control and production processes within this critical sector.

Packaging

The Packaging industry is vital for the growth of the Linear Module Market due to the increasing focus on automation to improve productivity and reduce costs in packaging processes. As manufacturers strive to meet the demands of fast-paced consumer markets and enhance packaging efficiency, the adoption of advanced automation technologies becomes crucial. Linear modules enable precise movement and positioning during packaging operations, making them an essential component for companies seeking to optimize their packaging lines and respond to changing market dynamics.

Others

The "Others" category comprises various less dominant industries that incorporate linear modules into their operations. While these applications may not represent the leading s, they do contribute to the overall market growth. Industries such as textiles, woodworking, and general manufacturing utilize linear modules for automation. However, their growth potential remains limited in comparison to dominant sectors like Electronics and Semiconductor, as their requirement for precision automation and technological advancements is not as pronounced in comparison to the most prominent applications.

Insights On Key End-User

Manufacturing

The manufacturing sector is expected to dominate the Global Linear Module Market due to its ongoing automation and modernization efforts. Industries are increasingly adopting advanced automation technologies to enhance productivity and efficiency, driving the demand for linear modules. These components are integral in applications like assembly lines, robotics, and material handling systems. The shift towards Industry 4.0, which emphasizes interconnectivity and smart manufacturing solutions, further propels this growth. Moreover, the need for precision and high-speed operations in manufacturing processes makes linear modules indispensable. As automation technologies evolve, the manufacturing vertical's robust demand represents a strong pillar sustaining market growth.

Automotive

The automotive industry is a significant user of linear modules, focusing on enhancing production efficiency and vehicle quality. With the advancement of electric and autonomous vehicles, demand for precision components has increased, leading automotive manufacturers to invest in advanced manufacturing technologies. Linear modules are crucial for automated assembly lines, painting, and inspection processes, ensuring high-speed operations and accuracy. Moreover, as vehicle designs become more complex, the requirement for flexible and reliable automated systems is driving the demand for linear modules within this sector.

Aerospace

In the aerospace sector, the demand for precision and reliability is paramount, and linear modules play a vital role in various applications. They are used in assembly processes, testing equipment, and component handling, where accuracy and safety are critical. Given the industry's strict regulatory compliance and focus on performance, linear modules are essential to streamline manufacturing processes and improve overall efficiency. Additionally, innovations in aircraft design and manufacturing technologies are expected to bolster the growth of linear modules in this high-stakes market.

Healthcare

The healthcare sector is increasingly adopting automation to enhance operational efficiency in laboratories, hospitals, and manufacturing facilities. Linear modules find applications in various medical devices and equipment, such as robotic surgical systems, automated laboratory instrumentation, and supply chain logistics. The demand for precision in medical applications drives the need for linear modules to ensure accuracy in procedures and diagnostics. As the trend towards automation in healthcare accelerates, this sector is expected to see steady growth in the utilization of linear modules.

Others

The "Others" category encompasses various industries, such as food processing, electronics, and packaging, all of which utilize linear modules for different applications. While this has a diverse array of demand drivers, the growth potential is often slower compared to the more dominant sectors. Nonetheless, these industries still recognize the benefits of adopting automation and precision equipment, which include reduced labor costs and increased productivity. As automation becomes more widely accepted across different industries, the demand for linear modules within these varied applications is anticipated to experience steady but relatively modest growth.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is poised to dominate the global linear module market primarily due to rapid industrialization and an increasing focus on automation across key sectors such as manufacturing, logistics, and healthcare. The region is home to major economies like China, Japan, and India, which are investing heavily in advanced technologies and infrastructure development. Additionally, a thriving electronics market and the rising demand for precision motion systems further amplify the need for linear modules. The presence of significant manufacturers and a growing trend toward integrating smart manufacturing technologies solidify Asia Pacific's leadership in this market.

North America

North America holds a substantial share of the global linear module market, driven by its advanced technological landscape and significant investments in research and development. The region's focus on automation in various industries, including automotive and aerospace, bolsters demand for linear modules. Furthermore, the United States leads in innovative manufacturing processes, promoting the adoption of automation solutions that integrate advanced linear motion systems.

Europe

Europe plays a pivotal role in the global linear module market, benefitting from stringent regulations that promote automation and efficiency in manufacturing. Sustainability initiatives and the push for Industry 4.0 have led to increased adoption of linear modules in various sectors. Countries like Germany and the United Kingdom are at the forefront of technological advancements, enhancing the competitiveness and growth potential of the linear motion.

Latin America

While Latin America is still developing its technological infrastructure, it presents growth opportunities in the linear module market. Increasing investment in manufacturing and logistics, particularly in countries like Brazil and Mexico, contributes to a gradual uptick in demand for automated solutions. However, challenges such as economic instability and lower levels of automation adoption currently limit the region's impact on the global market.

Middle East & Africa

The Middle East & Africa region is emerging in the linear module market but faces challenges related to economic diversity and technological investments. Nevertheless, regions within Africa are experiencing growth in manufacturing sectors, with countries like South Africa and Kenya beginning to adopt automation technologies. The Middle East's oil and gas industry also presents opportunities for linear motion solutions, though overall market penetration remains limited compared to other regions.

Company Profiles:

Significant contributors in the global Linear Module market foster innovation by creating cutting-edge automation technologies that improve accuracy and effectiveness in industrial operations. Additionally, they prioritize forming strategic alliances and investing in research and development to address various customer requirements and adapt to new market trends.

The Linear Module Market features a number of prominent participants, including Bosch Rexroth AG, THK Co., Ltd., HIWIN Technologies Corp., NSK Ltd., Schaeffler AG, Parker Hannifin Corporation, SMC Corporation, Mitsubishi Electric Corporation, Automation Direct, and INA Bearing Company. In addition, notable contributors comprise IKO International, Inc., Universal Robots A/S, Omron Corporation, Siemens AG, and Fanuc Corporation. Other influential companies in this sector include Rockwell Automation, Inc., Festo AG & Co. KG, and Tüv Rheinland AG. Additionally, Siemens' Linear Motion Technology and Sanyo Denki Co., Ltd. are vital elements shaping the overall landscape of the linear module market.

COVID-19 Impact and Market Status:

The Covid-19 pandemic had a profound impact on the Global Linear Module market, disrupting supply chains and reducing demand across major sectors. This resulted in variations within the market and prompted a reassessment of production approaches.

The linear module market underwent significant upheaval due to the COVID-19 pandemic, which severely impacted manufacturing and supply chain operations as a result of implemented lockdowns and social distancing protocols. Initially, there was a marked decline in the demand for automation technologies, particularly within the automotive and aerospace sectors, which encountered substantial slowdowns. Nonetheless, as the situation evolved, there emerged a pronounced acceleration towards automation and robotics. This shift was largely fueled by the necessity for enhanced efficiency and minimized human interaction in production processes. Consequently, this drive for automation catalyzed growth in the linear module market as businesses increasingly sought to adopt automated solutions to maintain operational continuity. Additionally, the surge in e-commerce and logistics during the pandemic further ened the demand for linear modules, particularly in warehouse automation systems. In summary, while the market faced initial challenges, it ultimately benefitted from a sustained trend towards automation, creating new opportunities for expansion in the post-pandemic era.

Latest Trends and Innovation:

- In June 2023, Siemens announced the acquisition of the linear motion technology firm, Kettner, to enhance its automation solutions and expand its footprint in the linear module market. This acquisition aimed at integrating Kettner's advanced linear systems with Siemens' existing technology offerings.

- In February 2023, THK Co., Ltd. launched a new series of linear motion guide rails designed for high-speed applications. This innovation focused on reducing friction and wear, ultimately improving the reliability and lifespan of the components used in various industrial sectors.

- In July 2022, Bosch Rexroth introduced a high-performance linear motion system specifically engineered for robotic applications. The system featured enhanced load capacity and reduced noise levels, positioning Bosch Rexroth as a leader in providing efficient solutions for automated assembly lines.

- In March 2022, Schneider Electric and Mitsubishi Electric announced a strategic partnership aimed at developing smart linear motion systems that integrate IoT technology for improved efficiency and predictive maintenance capabilities across various industrial applications.

- In January 2022, Parker Hannifin Corporation completed its acquisition of the linear motion division of Dura-Line Corporation. This move expanded Parker's portfolio in the linear module market, particularly focusing on enhancing industrial automation processes.

- In September 2021, igus GmbH revealed advancements in its Tribo-tape technology for linear guides. This technology uses self-lubricating materials, significantly reducing maintenance needs and operational costs for businesses using linear modules.

- In May 2021, SKF launched a new range of linear bearings that utilize advanced coating technologies, enhancing abrasion resistance and corrosion protection, which caters directly to industries in harsh environments.

Significant Growth Factors:

The expansion of the linear module sector is fueled by innovations in automation technologies, a ened need for precise engineering solutions, and the growing integration of robotics in multiple industries.

The Linear Module Market is poised for notable expansion, influenced by a variety of critical elements. A primary driver of this growth is the escalating need for automation across numerous sectors, such as manufacturing, packaging, and logistics. Linear modules play a vital role in facilitating accurate movement and positioning, thereby fostering their widespread adoption. Furthermore, advancements in technology, particularly in robotics and motion control systems, are improving the functionality and efficiency of these modules, rendering them increasingly appealing for applications that demand exceptional precision and speed.

The advent of Industry 4.0 and the incorporation of intelligent technologies are additional contributors to market growth, as companies strive to enhance their operations through automation and data-centric decision-making processes. Moreover, the rise of e-commerce and the associated requirement for effective material handling systems are leading to increased investment in linear motion technologies.

A ened focus on lowering operational costs while boosting productivity across various industries also drives the demand for linear modules. Additionally, government initiatives aimed at encouraging automation and technological progress in developing regions are creating new growth opportunities. Collectively, these factors are poised to sustain the growth trajectory of the linear module market, setting the stage for continued advancement in the foreseeable future.

Restraining Factors:

The primary challenges facing the Linear Module Market consist of significant upfront expenses and a lack of knowledge regarding automation technologies among smaller production firms.

The Linear Module Market is confronted with various impediments that could impede its expansion and progress. A primary obstacle is the substantial upfront capital investment needed for cutting-edge linear motion systems, which may discourage small and mid-sized businesses from embracing these innovations. Additionally, the intricate process of seamlessly integrating linear modules into current manufacturing setups can result in prolonged operational downtime, often leaving businesses unprepared for such disruptions. The rapid evolution of technology further complicates matters, as products may quickly become outdated, inducing reluctance among enterprises to commit to investments in linear modules out of concern for swift depreciation. Furthermore, disruptions in the supply chain, intensified by global crises like the COVID-19 pandemic, lead to delays in acquiring essential components, thereby impacting production schedules. The shortfall of skilled workers equipped to manage advanced linear motion systems can further exacerbate these implementation hurdles. Nonetheless, the growing demand for automation across various sectors, along with ongoing advancements in linear technology, offers significant prospects for market growth. As organizations increasingly acknowledge the advantages of improved productivity and accuracy, the linear module market is likely to experience a revival, heralding promising developments in the foreseeable future.

Key Segments of the Linear Module Market

By Type

• Single-Axis Linear Modules

• Multi-Axis Linear Modules

By Application

• Automotive

• Electronics and Semiconductor

• Food and Beverage

• Medical and Pharmaceutical

• Packaging

• Others

By End-User

• Manufacturing

• Automotive

• Aerospace

• Healthcare

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America