Laboratory Information Management System Market Analysis and Insights:

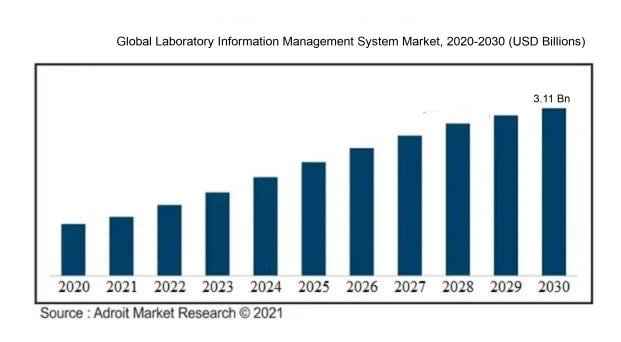

The market for Laboratory Information Management System (LIMS) was estimated to be worth USD 1.89 billion in 2023, and from 2024 to 2030, it is anticipated to grow at a CAGR of 6.26%, with an expected value of USD 3.11 billion in 2030.

The market for laboratory information management systems (LIMS) is experiencing growth driven by various key factors. Firstly, the surge in demand for effective and precise data management within laboratories is spurring the uptake of LIMS solutions. As laboratory operations become more intricate and the necessity for traceability grows, LIMS provides streamlined workflows and robust data integration functionalities. Secondly, the increasing focus on regulatory adherence across the healthcare and life sciences sectors is propelling the adoption of LIMS to ensure data integrity and audit trails. Thirdly, the escalating incidence of chronic ailments and the subsequent requirement for sophisticated diagnostics and research are generating significant demand for LIMS within clinical and research laboratory settings. Moreover, the integration of LIMS with diverse laboratory technologies like electronic lab notebooks and automation systems is amplifying its market expansion. Lastly, the rise in investments towards digitalizing healthcare infrastructure and the acceptance of cloud-based solutions are pushing the market ahead. In conclusion, these factors are propelling the growth of the laboratory information management system market and are poised to sustain its advancement in the foreseeable future.

Laboratory Information Management System Market Definition

A Laboratory Information Management System (LIMS) serves as a sophisticated software system that enhances the organization and monitoring of laboratory information, encompassing sample processing, analysis, and result generation. This advanced tool facilitates streamlined data handling, ultimately enhancing the productivity levels of laboratory operations.

The Laboratory Information Management System (LIMS) serves as a vital component in modern laboratory settings, playing a key role in the management and organization of various processes and data. Its significance lies in several aspects. Initially, LIMS aids in the optimization of laboratory workflows through the automation of tasks like sample tracking, result recording, and data management, thereby boosting efficiency and minimizing errors stemming from human intervention. Furthermore, it upholds the integrity and traceability of data by meticulously documenting all alterations made to it, establishing a clear audit trail and ensuring adherence to regulatory standards. Moreover, LIMS promotes collaboration and the exchange of information among laboratory personnel, facilitating improved communication and expedited decision-making processes. Ultimately, LIMS offers sophisticated data analysis and reporting functionalities that empower researchers and scientists to interpret data, identify patterns, and make well-informed decisions. In essence, the Laboratory Information Management System is indispensable in laboratory settings for improving operational efficiency, preserving data integrity and regulatory compliance, enhancing collaboration, and enabling advanced data analysis capabilities.

Laboratory Information Management System Market Segmental Analysis:

-market-.jpg)

Insights On Product

Cloud-based

Cloud-based laboratory information management systems (LIMS) are expected to dominate the global market. The rapid growth of cloud computing technology, along with its numerous advantages such as scalability, flexibility, and cost-effectiveness, has propelled the adoption of cloud-based LIMS. Organizations can easily access and manage their laboratory data from any location using internet-connected devices, which provides convenience and improves overall efficiency. Additionally, cloud-based LIMS allows for seamless integration with other laboratory equipment and systems, enhancing collaboration and data sharing among researchers and stakeholders. The increasing demand for real-time data analysis, automated workflows, and stringent regulatory compliance further contributes to the prominence of cloud-based LIMS in the global market.

On-premise

While cloud-based LIMS is expected to dominate the market, there is still a significant portion of the market that prefers on-premise solutions. On-premise LIMS offers greater control and security over sensitive laboratory data as it is stored and managed internally. Some organizations, especially those with strict regulatory requirements or sensitive data handling, prefer the level of control that on-premise LIMS provides. It allows for a customized infrastructure and tailored features to meet specific requirements and integrates seamlessly with existing IT systems. However, the higher initial investment, maintenance costs, and limited accessibility are some factors that may limit the growth of on-premise LIMS compared to cloud-based solutions.

Web-hosted

Web-hosted LIMS, also known as Software as a Service (SaaS), is another sector within the market. It offers the advantages of cloud-based LIMS but with limited customization. While web-hosted LIMS provides the convenience of accessing laboratory data remotely, it may lack certain features and flexibility compared to cloud-based or on-premise solutions. Some organizations might opt for web-hosted LIMS due to its lower upfront costs and ease of implementation, as it eliminates the need for complex infrastructure setup. However, the dominance of cloud-based LIMS and the demand for more customizable solutions may limit the growth of web-hosted LIMS in the global market.

Insights On Component

Services

Services are expected to dominate the Global Laboratory Information Management System (LIMS) market. LIMS services include installation, maintenance, and support, as well as training and consulting services. These services are crucial for the successful implementation and operation of a LIMS, as they ensure smooth functionality, customization, and user training. With the increasing adoption of LIMS across various industries such as healthcare, pharmaceuticals, biotechnology, and research, the demand for services is expected to witness significant growth. Service providers play a vital role in offering specialized expertise and ongoing technical support, which is essential for the effective utilization of LIMS. Consequently, services are projected to dominate the Global LIMS market.

Software

Although services are expected to dominate the Global LIMS market, software remains an integral component of this market. LIMS software enables laboratories to efficiently manage their data, workflows, and processes. It facilitates sample tracking, data analysis, inventory management, and regulatory compliance, among other functions. The demand for LIMS software is driven by the increasing need for process automation, data integration, and enhanced operational efficiency in laboratories. As organizations seek to improve their data management and compliance capabilities, the adoption of LIMS software is expected to grow. While services may dominate the market, the significance of LIMS software should not be overlooked.

Insights On End-use

Life Sciences

The Life Sciences end-use is expected to dominate the Global Laboratory Information Management System (LIMS) Market. This is primarily due to the extensive use of LIMS in various life sciences applications such as pharmaceutical research, drug discovery, biobanking, genomics, and clinical diagnostics. LIMS provides essential functionalities for data management, sample tracking, workflow automation, and regulatory compliance, which are critical for the efficient and effective operation of life sciences laboratories. Additionally, the increasing adoption of LIMS by pharmaceutical companies, research institutes, and academic institutions further contributes to the dominance of the Life Sciences part in the global market.

CROs

CROs (Contract Research Organizations) form another important player within the Global Laboratory Information Management System Market. As research and testing services providers, CROs rely on LIMS to manage their laboratory operations, quality assurance, data tracking, and regulatory compliance needs. While CROs have a significant presence in the market, this part is not expected to dominate the overall LIMS market. However, its continued growth and reliance on LIMS solutions contribute to the overall market expansion.

Petrochemical Refineries & Oil and Gas Industry

The Petrochemical Refineries & Oil and Gas Industry is another sector within the Global Laboratory Information Management System Market. LIMS plays a crucial role in these industries by managing testing and analysis processes, ensuring compliance with regulatory standards, and optimizing laboratory efficiency. While the Petrochemical Refineries & Oil and Gas Industry part has specific demands for LIMS, such as sample tracking, data management, and instrument interfacing, it is not expected to dominate the overall market. However, the industry's continuous growth and need for advanced laboratory management solutions contribute to the broader LIMS market.

Chemical Industry

The Chemical Industry is a significant player within the Global Laboratory Information Management System Market. Chemical laboratories require LIMS for managing diverse testing procedures, regulatory compliance, sample tracking, and data management. While the Chemical Industry part has a substantial presence in the LIMS market, it is not expected to dominate the overall market. Nevertheless, the ongoing expansion of the chemical industry and its increasing emphasis on efficient laboratory operations contribute to the overall growth and demand for LIMS solutions.

Food and Beverage & Agriculture Industries

The Food and Beverage & Agriculture Industries are essential sectors within the Global Laboratory Information Management System Market. LIMS plays a crucial role in ensuring food safety, quality control, and compliance with regulatory standards. It helps manage various aspects of laboratory operations, such as sample tracking, inventory management, and data analysis. While the Food and Beverage & Agriculture Industries have a significant demand for LIMS solutions, they are not expected to dominate the overall market. Nonetheless, their continuous growth and increasing focus on laboratory efficiency fuel the demand for LIMS within these industries.

Environmental Testing Laboratories

The Environmental Testing Laboratories sector is an important end-use of the Global Laboratory Information Management System Market. LIMS is vital for managing environmental testing processes, tracking samples, ensuring regulatory compliance, and analyzing vast amounts of analytical data. However, this part is not expected to dominate the overall market. Nevertheless, the growing concerns regarding environmental protection, pollution control, and regulatory requirements drive the demand for LIMS within the Environmental Testing Laboratories part.

Other Industries

The Other Industries category includes companies and organizations from various industries that utilize Laboratory Information Management System (LIMS) solutions for their specific laboratory management needs. While this part is diverse and has a presence in the LIMS market, it is not expected to dominate the overall market. The demand for LIMS within Other Industries is driven by the need for efficient laboratory processes, data management, regulatory compliance, and improved operational performance.

Global Laboratory Information Management System Market Regional Insights:

Europe

Europe is expected to dominate the Global Laboratory Information Management System (LIMS) market. In recent years, Europe has witnessed significant growth in the healthcare and pharmaceutical sectors, which has increased the demand for LIMS. The region has a well-established healthcare infrastructure and stringent regulatory requirements, driving the adoption of LIMS solutions. Additionally, the presence of major players in the region further supports the growth of the market. The increasing focus on research and development activities, precision medicine, and personalized healthcare is also contributing to the dominance of Europe in the global LIMS market.

North America

North America is a key player in the global LIMS market. The region has a well-established healthcare system, advanced technological infrastructure, and a high adoption rate of healthcare IT solutions. The presence of renowned research institutions, academic and government laboratories, and pharmaceutical companies further drives the demand for LIMS. However, while North America is a significant market, it may not dominate the global market due to the growing adoption of LIMS in other regions.

Asia Pacific

Asia Pacific is witnessing rapid growth in the LIMS market. The region is home to emerging economies such as China and India, which are investing heavily in healthcare infrastructure and research and development activities. Factors such as the increasing focus on precision medicine, rising demand for advanced healthcare solutions, and growing pharmaceutical and biotechnology industries contribute to the growth of the LIMS market in Asia Pacific. Although the region has immense potential, it may not dominate the global market due to the presence of highly established markets in Europe and North America.

Latin America

Latin America is witnessing steady growth in the LIMS market. The region has a growing healthcare sector, with countries like Brazil and Mexico investing in healthcare infrastructure. The adoption of LIMS is increasing due to the rising demand for quality healthcare services, increasing number of clinical trials, and growing awareness of the benefits of laboratory automation. However, Latin America is not expected to dominate the global market due to the presence of more developed markets in other regions.

Middle East & Africa

The Middle East & Africa region has a developing healthcare sector and is investing in healthcare infrastructure. The region is witnessing growth in the pharmaceutical and biotechnology industries, which is driving the adoption of LIMS. Factors such as the increasing prevalence of chronic diseases, growing population, and rising investments in healthcare contribute to the growth of the LIMS market in the Middle East & Africa. However, the region is unlikely to dominate the global market due to the presence of more established markets in Europe, North America, and Asia Pacific.

Global Laboratory Information Management System Market Competitive Landscape:

Prominent figures in the worldwide Laboratory Information Management System industry play a vital role in the advancement and delivery of software solutions facilitating effective administration of laboratory data and operations. Their dedication lies in perpetual innovation and tailored solutions tailored to cater to the distinct requirements of various industries and research institutions.

Prominent companies in the Laboratory Information Management System (LIMS) industry consist of LabWare Inc., Thermo Fisher Scientific Inc., Abbott Laboratories, Siemens Healthineers AG, PerkinElmer Inc., Cerner Corporation, Waters Corporation, McKesson Corporation, Agilent Technologies Inc., and Apollonian Healthcare Solutions. These entities are important participants in the international LIMS sector, delivering software solutions and services that aid labs in efficiently overseeing data, optimizing procedures, and adhering to regulatory standards. Through their established knowledge and inventive products, these influential entities are pivotal in propelling progress in laboratory information management systems on a global scale.

Global Laboratory Information Management System Market COVID-19 Impact and Market Status:

The Global Laboratory Information Management System (LIMS) market has experienced a surge in growth due to the Covid-19 pandemic, as there is a growing need for sophisticated data management and traceability solutions. This demand has arisen from the necessity to effectively monitor and analyze test results and research data associated with the virus.

The Laboratory Information Management System (LIMS) market has been significantly affected by the COVID-19 pandemic. Labs worldwide have been at the forefront of testing and research efforts during this time, leading to a ened demand for LIMS solutions. The increased need for efficient management of data, sample tracking, and quality control in the face of rising testing demands has prompted the adoption of LIMS software to streamline lab processes. The shift towards cloud-based LIMS solutions has been driven by the necessity for remote data access and collaborative functionalities. However, the pandemic has disrupted supply chains, delayed new system implementations, and caused financial challenges for some organizations, impacting their investment decisions in LIMS. The market has also seen a cautious approach to spending due to uncertainties surrounding the pandemic's duration and impact. While experiencing growth, the LIMS market has faced various challenges and fluctuations as a consequence of COVID-19.

Laboratory Information Management System Market Latest Trends & Innovations:

- In January 2021, LabVantage Solutions, a leading provider of laboratory informatics solutions, acquired AgileBio, a provider of Electronic Lab Notebook (ELN) and laboratory management software.

- In September 2020, Thermo Fisher Scientific announced the acquisition of Roper Technologies for $810 million. Roper Technologies is a provider of scientific software solutions, including laboratory information management systems (LIMS).

- In June 2020, Abbott Laboratories launched Alinity, a next-generation laboratory information management system that combines laboratory automation, cloud computing, and artificial intelligence to improve efficiency and accuracy in diagnostics.

- In March 2020, LabWare introduced LabWare 8, a new version of its laboratory information management system. LabWare 8 offers enhanced capabilities for managing complex laboratory workflows and supports cloud deployment.

- In February 2020, Siemens Healthineers completed the acquisition of Corindus Vascular Robotics, a company specializing in robotic-assisted vascular interventions. This acquisition enhances Siemens Healthineers' position in the laboratory information management system market.

Laboratory Information Management System Market Growth Factors:

The Laboratory Information Management System Market is being propelled by the rising need for effective data management solutions and the growing popularity of cloud-based systems.

The Laboratory Information Management System (LIMS) market is experiencing notable expansion due to various growth drivers. Industries including pharmaceuticals, biotechnology, clinical research, and healthcare are increasingly embracing LIMS for its benefits in efficiently managing and organizing extensive data volumes, reducing errors, ensuring data integrity, enhancing traceability, and meeting regulatory compliance standards. The market is further boosted by the growing demand for advanced data analytics tools, cloud-based solutions, and the integration of LIMS with diverse laboratory instruments and systems. The ongoing trend towards digitalization and automation in laboratory processes is another significant factor driving market growth. The focus on personalized medicine, genomics, and proteomics research, along with the necessity for accurate and reliable data management solutions, is also fueling the demand for LIMS. Additionally, the rise in research and development efforts and the emergence of cutting-edge technologies like artificial intelligence and machine learning are expected to contribute to further market expansion. Despite these positive factors, challenges such as high implementation costs, system integration complexities, and a shortage of skilled professionals capable of effectively operating and maintaining LIMS could impede market growth to some degree. Ultimately, the Laboratory Information Management System market is poised for substantial growth as organizations increasingly recognize the importance of efficient laboratory data management for enhancing operational efficiency and data security.

Laboratory Information Management System Market Restraining Factors:

Barriers inhibiting the Laboratory Information Management System Market include the challenges associated with expensive implementation expenses and intricate integration procedures.

The market for Laboratory Information Management Systems (LIMS) has experienced substantial growth recently; however, certain factors can impede its ongoing expansion. One primary concern is the significant costs associated with implementing and maintaining LIMS. The substantial financial investment and continuous expenses required may dissuade smaller laboratories or those with limited budgets from adopting LIMS. Additionally, integrating LIMS into existing lab workflows and systems can pose challenges, particularly for labs using outdated systems or with restricted IT capabilities. Another obstacle is the lack of awareness and comprehension regarding the benefits of LIMS among some lab professionals, leading to reluctance in embracing this technology. Furthermore, apprehensions around data security and privacy may also inhibit LIMS adoption, considering that lab data often contains sensitive information that necessitates safeguarding. Despite these hurdles, it is essential to note that LIMS offers multiple advantages, including enhanced efficiency, traceability, and compliance with regulations. Efforts are underway to address these challenges by reducing costs, streamlining integration processes, and raising awareness about the benefits of LIMS, thereby fostering an optimistic outlook for the future of the Laboratory Information Management System market.

Key Segments of the Laboratory Information Management System Market

Product Overview

• On-premise

• Web-hosted

• Cloud-based

Component Overview

• Software

• Services

End-use Overview

• Life Sciences

• CROs (Contract Research Organizations)

• Petrochemical Refineries & Oil and Gas Industry

• Chemical Industry

• Food and Beverage & Agriculture Industries

• Environmental Testing Laboratories

• Other Industries

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America