The production of vehicles is changing as smart and connected cars are developed in the automotive sector. For the market of automobile original equipment manufacturers, this is anticipated to open up new potential for intra-factory logistics. Furthermore, the demand for electric vehicles is anticipated to rise as a result of the growing emphasis on decreasing carbon emissions and minimizing environmental impact, which will in turn promote market expansion.

In order to optimise the manufacturing process by reducing waste and increasing production efficiency, the automotive original equipment manufacturers industry needs intra-factory logistics. The material management system within the factory walls can be streamlined, and the overall cost of manufacturing can be decreased, with the aid of intra-factory logistics solutions. These alternatives also assist in raising the calibre of the goods produced.

For automotive original equipment manufacturers (OEMs), intra-factory logistics refers to the movement and handling of raw materials, assembled parts, and finished goods inside an automobile production plant. Intra-factory logistics' primary goal is to support the manufacturing process by making sure that the necessary materials are supplied to the assembly line promptly and effectively. A variety of material handling tools and systems, including automated guided vehicle (AGV), material handling, robots, retrieval management system (S/R systems), and software solutions, are employed to do this. These options assist in lowering labour expenses, making the most of production space mining, and raising total productivity and effectiveness.

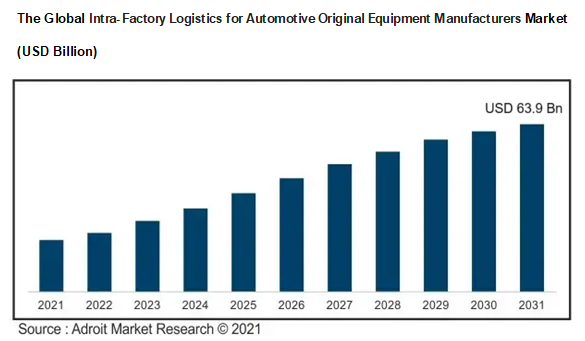

From 2021 to 2031, the market for intra-factory logistics for automotive original equipment suppliers is anticipated to expand at a CAGR of 8.7%. By 2031, the industry is anticipated to grow to USD 63.9 billion.

This expansion can be ascribed to the expanding global demand for effective and streamlined intra-factory freight forwarding as well as the rising worldwide demand for autos.

One of the biggest issues facing the intra-factory logistics sector for automotive original equipment manufacturers is the high cost of automation and the scarcity of competent labour. Furthermore, it is anticipated that the market growth will be constrained by the government's strict laws addressing emissions. Nonetheless, the market for intra-factory logistics for automotive original equipment manufacturers is anticipated to see new growth prospects as Industry 4.0 and the creation of smart factories become more prominent. Additionally, it is projected that the growing demand for electric vehicles would open up new opportunities for market expansion.

COVID-19 Impact and Market Status

Due to the closure of manufacturing plants and dealer networks around the world, the COVID-19 outbreak has had a negative effect on the automotive industry. The demand for intra-factory logistics solutions for automotive OEMs has been impacted by the decline in automobile sales as a result of this. But in the upcoming years, the market is anticipated to rebound thanks to the gradually restored operations of factories and dealerships.

Segment Analysis

The Vehicle Logistics Type emerged as the Most Booming Segment

The intra-factory logistics for the market of automotive OEMs are divided into two categories based on Types: Parts logistics and Vehicle Logistics. The category for vehicle logistics is anticipated to expand at a greater CAGR than the other two over the forecast period. This is due to the rising demand for automobiles on a global scale as well as the requirement for effective and efficient vehicle mobility inside an automobile production plant.

The Most Prominent Application Segment is the Custody & Circulation

Stock Removal, Custody & Circulation, and Stock In are the three submarkets that make up the intra-factory logistics industry for car OEMs. In terms of these three applications, the custody and circulation application category is anticipated to experience the fastest growth during the forecast period. The requirement for effective material management and tracking inside an automotive production plant might be credited with this increase.

The Most Lucrative Industry Verticals Segment is the Automotive Industry

The intra-factory logistics market for automotive original equipment manufacturers is divided into the following industrial verticals: automotive, food and beverage, e-commerce, retail, and aerospace. The industrial vertical for the automotive sector is anticipated to expand at the highest CAGR throughout the projection period. The necessity for effective production methods in the automotive sector and the rising demand for automobiles are both factors contributing to this expansion.

The APAC Region to render Ample Financing Opportunities

The automotive original equipment manufacturers market for intra-factory logistics is further divided based on geographies into North America, South America, Africa, Asia Pacific, Europe, and the Middle East. When compared to the other regions, Asia Pacific is anticipated to develop at the greatest CAGR. This expansion might be related to the existence of numerous car OEMs in this area and the rising global consumption of autos.

The major companies in the intra-factory logistics industry for automakers' original equipment suppliers are CEVA Logistics, Changan Minsheng APLL Logistics Co., Ltd., China Capital Logistics Co., Ltd., GEFCO, and BLG Logistics, DB Schenker, Lödige Industries, FENGSHEN LOGISTICS, Rhenus Logistics, etc. By offering numerous intra-factory logistics options and services to their clients who are automotive OEMs, these suppliers significantly contribute to the market's expansion.

Recent Developments in the Intra-Factory Logistics for Automotive Original Equipment Manufacturers Market

• The German company Jungheinrich AG opened a new electric counterbalanced forklift manufacturing facility in Wurzen in October 2020. With cutting-edge machinery and equipment, the new facility has a production area of roughly 30,000 square meters. To meet the growing demand for its products from the automotive and other industries, the company will be able to expand and increase its production capacity.

• Dematic Corporation (US), a top supplier of material handling and logistics solutions, purchased PAS Integrated (US), a manufacturer of stockroom execution tools, in September 2020. (WES). Through this acquisition, Dematic will be able to diversify its product line and reinforce its position as a leader in the intra-factory logistics industry for automobile OEMs.

Intra-Factory Logistics for Automotive Original Equipment Manufacturers Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD 63.9 billion |

| Growth Rate | CAGR of 8.7 %during 2021-2031 |

| Segment Covered | by Type, By Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | CEVA Logistics, Changan Minsheng APLL Logistics Co., Ltd., China Capital Logistics Co., Ltd., GEFCO, and BLG Logistics, DB Schenker, Lödige Industries, FENGSHEN LOGISTICS, Rhenus Logistics, etc. |

Key Segments of the Global Intra-Factory Logistics for Automotive Original Equipment Manufacturers Market

By Type Overview (USD Billion)

- Parts Logistics

- Vehicle Logistics

By Application Overview (USD Billion)

- Stock Removal

- Custody & Circulation

- Stock In

By Regional Overview (USD Billion)

North America

- U.S

- Canada

Europe

- Germany

- France

- UK

- Rest of Europe

Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

South America

- Mexico

- Brazil

- Rest of South America

Middle East and Africa