Market Analysis and Insights:

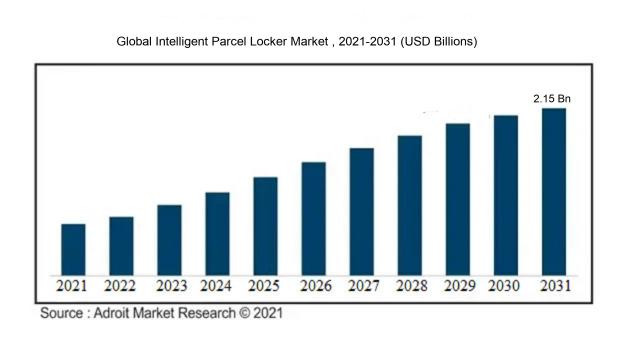

The market for Global Intelligent Parcel Locker was estimated to be worth USD 639.2 million in 2021, and from 2022 to 2031, it is anticipated to grow at a CAGR of 12.39%, with an expected value of USD 2.15 billion in 2031.

The intelligent parcel locker market is experiencing robust growth driven by various factors. The expansion of the e-commerce sector is a key contributor to this trend. The surge in online shopping activities has created a demand for secure and convenient delivery solutions. Intelligent parcel lockers offer a safe and efficient way for package drop-off and pickup, ensuring the security of goods. Another significant driver is the escalating requirement for contactless delivery options in response to the COVID-19 pandemic. Consumers are increasingly seeking delivery methods that minimize physical interactions, making intelligent parcel lockers an appealing choice. Moreover, the increase in urbanization and population density in cities has amplified the necessity for efficient and accessible delivery services. Intelligent parcel lockers address this need by providing round-the-clock accessibility, reducing the need for multiple delivery attempts. Additionally, advancements in technology, such as the integration of Internet of Things (IoT) and cloud-based platforms, have enhanced the functionality and reliability of intelligent parcel lockers, making them more attractive to consumers and businesses alike. In summary, the main drivers behind the growth of the intelligent parcel locker market include the expansion of e-commerce, the demand for contactless delivery, urbanization, and technological innovations.

Intelligent Parcel Locker Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD 2.15 billion |

| Growth Rate | CAGR of 12.39% during 2022-2031 |

| Segment Covered | By Component, By Application, By End-user, By Region . |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | TZ Limited, KEBA AG, Luxer One, Cleveron AS, Parcel Port Solutions, Santa Monica Networks, American Locker Group Inc., Snaile Inc., Quadient SA, and Hangzhou Dongcheng Electronics Co. |

Market Definition

A sophisticated parcel locker serves as a safe and automated storage solution enabling users to conveniently manage the sending, receiving, and collection of packages. By leveraging advanced technologies, it ensures efficient delivery processes, reduces the likelihood of theft, and delivers a seamless customer experience.

The use of Intelligent Parcel Lockers has become indispensable in the contemporary era, characterized by the prevalence of online shopping and parcel deliveries. These lockers serve as a reliable, secure, and efficient means for the distribution and reception of parcels. As the e-commerce industry continues to grow, there is a ened demand for a dependable system that can handle the surge in packages, ensuring their safe and prompt delivery to the designated recipients. Equipped with features such as real-time tracking, secure storage, and user-friendly accessibility, Intelligent Parcel Lockers greatly mitigate the risks associated with lost or pilfered packages. They also eliminate the inconvenience of having to make repeated trips to post offices or waiting at home for deliveries. In essence, Intelligent Parcel Lockers play a vital role in optimizing the logistics of package transportation, thereby enhancing the convenience and satisfaction levels for both enterprises and customers.

Key Market Segmentation:

Insights On Key Component

Hardware

The hardware component is expected to dominate the Global Intelligent Parcel Locker Market. Hardware components play a vital role in the functioning of intelligent parcel lockers, as they include the physical structures, sensors, locks, and interfaces utilized for accessing and securing the lockers. With the increasing demand for efficient and secure parcel management solutions, the hardware part is expected to see significant growth. The adoption of advanced hardware technologies such as biometric authentication systems, integrated cameras, and touchscreens enhances the overall user experience and security of the parcel lockers, further driving the dominance of hardware in this market. Additionally, the substantial investments in developing intelligent and innovative hardware solutions by key industry players contribute to its dominance in the global market.

Software

While the hardware component dominates the Global Intelligent Parcel Locker Market, the software component remains a crucial component of intelligent parcel locker systems. The software enables key functionalities such as user authentication, data storage and analysis, locker management, and user interface. It enables seamless integration with back-end systems, tracking and monitoring of parcels, and facilitates efficient operations. Although not the dominant part, the growth of the intelligent parcel locker market depends on the proper implementation and utilization of software solutions. As the market expands, the demand for intelligent software with advanced features and enhanced functionality will increase, strengthening the significance of the software part in the overall market landscape.

Insights On Key Application

Outdoor

The outdoor application is expected to dominate the Global Intelligent Parcel Locker Market. As e-commerce continues to thrive and the demand for convenient and secure package delivery solutions increases, outdoor intelligent parcel lockers provide a practical and efficient solution. Outdoor lockers are strategically placed in residential areas, commercial spaces, and public locations, allowing customers to easily retrieve their parcels at any time, without the need for physical presence or interaction with delivery personnel. These lockers are designed to withstand various weather conditions and offer enhanced security features, ensuring the safe storage of packages. With their ability to accommodate a large volume of packages and their convenience for both customers and delivery providers, the outdoor part is anticipated to dominate the intelligent parcel locker market.

Indoor

While the outdoor application is expected to dominate the Global Intelligent Parcel Locker Market, the indoor application still holds significant importance. Indoor intelligent parcel lockers are typically located within buildings, such as residential complexes, offices, and universities. They provide a secure and convenient delivery option for recipients who prefer to have their packages delivered inside a controlled environment. These lockers can be easily integrated into the existing infrastructure of buildings and offer various features like tracking systems and notifications to ensure seamless package retrieval. While the demand for outdoor lockers is projected to be higher due to the rapid growth of e-commerce and the need for contactless delivery options, indoor lockers cater to specific environments where indoor access control and limited space availability are important factors.

Insights On Key End-user

Non-residential

The non-residential sector is expected to dominate the Global Intelligent Parcel Locker Market. The non-residential part consists of commercial establishments such as retail stores, office buildings, and industrial facilities. These locations often face the challenge of managing a high volume of parcel deliveries and pickups. Intelligent parcel lockers provide a convenient and secure solution for these businesses to streamline their parcel management processes. With the increasing growth of e-commerce and online shopping, the demand for intelligent parcel lockers is expected to rise significantly in the non-residential sector. Additionally, the integration of advanced technologies such as IoT and cloud-based software solutions further enhances the efficiency and security of parcel management for non-residential establishments.

Residential

While the non-residential sector dominates the Global Intelligent Parcel Locker Market, the residential application also plays a significant role. As online shopping continues to gain popularity, more consumers are opting for home delivery of their packages. Intelligent parcel lockers provide a secure and convenient way for residents to receive their parcels even when they are not at home. These lockers offer features such as password access, notification alerts, and multiple storage compartments, ensuring the safe and automated delivery of packages to residential addresses. The residential part is expected to witness steady growth as more residential complexes and housing communities adopt intelligent parcel locker systems to cater to the increasing delivery demands of online shoppers.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the global intelligent parcel locker market. The region's dominance can be attributed to several factors. Firstly, the rapid growth of e-commerce and online shopping activities in countries like China, India, and Japan has led to an increased demand for efficient last-mile delivery solutions, including intelligent parcel lockers. These lockers provide convenience and security for customers, making them a preferred choice for e-commerce retailers. Additionally, the presence of major global players in the intelligent parcel locker market, such as TZ Limited and Cleveron, further strengthens Asia Pacific's position. Furthermore, increasing urbanization and improving infrastructure in the region contribute to the widespread adoption of intelligent parcel lockers.

North America

North America is expected to be a significant market for intelligent parcel lockers, but it may not dominate the global market. The region's strong e-commerce industry, technological advancements, and high consumer expectations for fast and secure deliveries drive the demand for intelligent parcel lockers. However, factors such as the presence of alternative delivery options like doorstep deliveries and the established network of courier services may limit the wide-scale adoption of parcel lockers in the region.

Europe

Europe is another region with potential in the intelligent parcel locker market. The region's well-developed e-commerce industry and growth in online retail sales contribute to the demand for last-mile delivery solutions. In addition, the emphasis on sustainability and reducing carbon emissions drive the adoption of intelligent parcel lockers as they enable efficient and environmentally-friendly deliveries. However, the presence of established logistics networks and the availability of alternative delivery options like local post offices may impact the dominance of parcel lockers in Europe.

Latin America

Latin America has seen significant growth in e-commerce activities, and the demand for intelligent parcel lockers is increasing in the region. The market is driven by factors such as the expanding middle class, improving digital infrastructure, and increasing smartphone penetration. However, challenges such as logistics and postal system limitations, security concerns, and the need for robust consumer education may hinder the dominance of intelligent parcel lockers in Latin America.

Middle East & Africa

The Middle East & Africa region has shown a steady growth in e-commerce and online retail, which creates opportunities for intelligent parcel lockers. Factors such as an expanding young population, increasing internet connectivity, and the rise in consumer demand for convenience contribute to the market growth. However, challenges including underdeveloped logistics infrastructure, security concerns, and the prevalence of cash on delivery payment method in certain markets may limit the dominating potential of intelligent parcel lockers in the Middle East & Africa region.

Company Profiles:

The significant contributors in the worldwide Smart Parcel Locker industry are instrumental in spearheading innovation and technological progress in the parcel delivery sector. Their efforts involve the creation of cutting-edge locker solutions, refining operational effectiveness, and elevating the overall customer satisfaction.

Major key players in the Intelligent Parcel Locker Market are TZ Limited, KEBA AG, Luxer One, Cleveron AS, Parcel Port Solutions, Santa Monica Networks, American Locker Group Inc., Snaile Inc., Quadient SA, and Hangzhou Dongcheng Electronics Co. They are pivotal in advancing the intelligent parcel locker industry through their commitment to cutting-edge solutions, technological advancements, and customer-centric approaches. These firms significantly impact market dynamics by offering a wide range of products, forming strategic alliances, and perpetually investing in research and innovation.

COVID-19 Impact and Market Status:

The global market for intelligent parcel lockers has been greatly affected by the Covid-19 pandemic, with the growth rate slowing due to strict lockdown measures and reduced consumer demand.

The intelligent parcel locker sector has been significantly impacted by the COVID-19 pandemic. The increased reliance on e-commerce and online shopping during periods of lockdown has generated a surge in demand for intelligent parcel lockers as a safe and convenient method for delivering goods, thereby promoting growth in the market. This rise in online retail activity has highlighted the necessity for efficient and secure last-mile delivery solutions, which has further fueled the expansion of the intelligent parcel locker market. However, the global supply chain has faced disruptions due to trade limitations and movement restrictions, resulting in delays in the production and deployment of intelligent parcel lockers. Furthermore, the economic instability stemming from the pandemic has impeded investments in infrastructure initiatives, thereby impacting market development. Despite these obstacles, the market is anticipated to recover post-pandemic as the emphasis on contactless and effective parcel delivery solutions continues to grow. Market participants must adapt to evolving consumer preferences and safety protocols to ensure competitiveness in the post-pandemic environment. In conclusion, the COVID-19 pandemic has presented a mix of opportunities and challenges for the intelligent parcel locker industry, leading to a reconfiguration of industry dynamics both in the short and long term.

Latest Trends and Innovation:

- In March 2021, Quadient SA, an intelligent parcel locker provider, announced the merger of its subsidiary, Quadient Parcel Locker Solutions (QPLS), with Parcel Pending, a leader in the U.S. intelligent locker market.

- In January 2021, TZ Limited, a provider of intelligent parcel lockers, announced the acquisition of Digital Scanning & Imaging (DSI), a technology solutions company specializing in secure mail and parcel processing.

- In November 2020, ParcelGuard, a leading provider of intelligent mailbox solutions, and Locker Alliance, a smart locker provider, announced a strategic partnership to offer a comprehensive intelligent parcel locker solution.

- In June 2020, Package Nexus, a technology company specializing in smart lockers, announced the launch of its new intelligent parcel locker solution.

- In April 2020, Apex Supply Chain Technologies, a global leader in automated dispensing systems, announced the acquisition of ParcelPort, an intelligent locker provider, to expand its portfolio of intelligent parcel locker solutions.

Significant Growth Factors:

The intelligent parcel locker market is fueled by a combination of factors such as the growth of e-commerce, higher levels of urbanization, and the increasing demand for secure, efficient, and contactless delivery options.

The intelligent parcel locker sector is poised for substantial growth in the upcoming years driven by various factors. The exponential expansion of the e-commerce sphere has resulted in a surge in parcel deliveries, thereby necessitating efficient and secure management systems for packages.

Intelligent parcel lockers present a user-friendly solution for consumers and delivery services alike by ensuring round-the-clock availability and mitigating risks associated with theft or delivery failures. Additionally, the increasing urbanization trends and the widespread adoption of online shopping practices have led to a notable increase in deliveries to residential complexes, businesses, and office spaces. This ened demand for intelligent parcel lockers is primarily attributed to their capability to effectively manage high volumes of packages and streamline the last-mile delivery process.

Furthermore, the escalating emphasis on sustainability and the imperative to curb carbon footprints have encouraged logistics enterprises to explore alternative delivery mechanisms like parcel lockers to minimize individual vehicle trips. This not only aids in alleviating traffic congestion but also supports environmental preservation efforts. These pivotal factors are forecasted to propel the global growth of the intelligent parcel locker market in the near future.

Restraining Factors:

Restrictions related to space for installation and apprehensions concerning theft and security serve as impediments to the expansion of the smart parcel locker industry.

The growth and adoption of the Intelligent Parcel Locker Market are hindered by multiple factors. Foremost among these is the substantial initial investment required for establishing and maintaining intelligent parcel lockers, which can deter new market participants. The installation and integration of software, hardware, and security systems necessitate significant financial inputs, potentially dissuading smaller businesses from embracing this technology.

Additionally, consumer concerns surrounding data security and privacy pose a significant challenge, with incidents of theft or unauthorized access undermining trust and adoption rates. The lack of interoperability among different locker systems presents operational challenges, complicating efforts to enhance efficiency across heterogeneous solutions. Moreover, varying regulatory frameworks across regions create inconsistencies and obstacles to market expansion. Furthermore, consumer behavior favoring traditional delivery methods like doorstep delivery or in-store pick-up contributes to the slower adoption rate of intelligent parcel lockers. Nevertheless, the Intelligent Parcel Locker Market holds substantial growth prospects driven by the rise in e-commerce activities and the increasing demand for secure and convenient delivery solutions. Ongoing technological advancements and the ongoing focus on enhancing data security practices are propelling the market towards a positive growth trajectory.

Key Segments of the Intelligent Parcel Locker Market

Component Overview

• Hardware

• Software

Application Overview

• Indoor

• Outdoor

End-User Overview

• Residential

• Non-Residential

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America