Infection Surveillance Services Market Analysis and Insights:

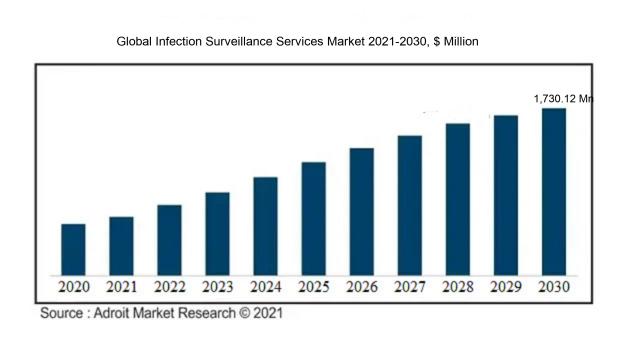

The size of the global market for infection monitoring services was estimated at $410.05 million in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 15.2% from 2021 to 2030, reaching $1,730.12 million.

The Infection Surveillance Services Market is significantly influenced by the rising incidence of infectious diseases alongside an increasing focus on infection management within healthcare environments. A key driver of this market is the ened awareness among healthcare professionals regarding the essential role of surveillance in curbing the spread of infections. Moreover, technological advancements, particularly the incorporation of artificial intelligence and data analysis tools, are improving the effectiveness and precision of monitoring infection patterns. Global health emergencies, notably the COVID-19 pandemic, have intensified investments in surveillance infrastructures, leading to a greater demand for real-time information and adaptive response strategies. Regulatory measures designed to enhance patient safety and health outcomes are motivating healthcare facilities to implement comprehensive infection surveillance systems. In addition, the growing acceptance of telehealth and remote patient monitoring is broadening the horizons of infection surveillance, presenting innovative approaches that address the evolving requirements of the healthcare landscape.

Infection Surveillance Services Market Definition

Infection surveillance services are focused on the organized observation and evaluation of infection-related data to identify, avert, and manage infectious diseases in healthcare environments. The primary goal of these services is to boost patient safety and improve public health results by implementing prompt reporting and responsive measures.

Infection Surveillance Services (ISS) are fundamental to public health, as they diligently track and assess infection trends, enabling prompt identification of outbreaks and mitigating the spread of diseases. Through organized data collection and analysis, ISS empowers healthcare organizations to adopt effective infection control strategies, better allocate resources, and enhance patient care. Additionally, these services contribute to a deeper insight into antibiotic resistance patterns and support the creation of focused interventions. Furthermore, ISS provides essential information to policymakers and health institutions, allowing them to react quickly and effectively to new infectious challenges, thus protecting community health and fostering safer healthcare settings.

Infection Surveillance Services Market Segmental Analysis:

Insights On Type

Urinary Tract Infections (UTI)

The Urinary Tract Infections (UTI) category is poised to dominate the Global Infection Surveillance Services Market due to the high prevalence of UTIs among different age groups, especially in women. This condition is one of the most common bacterial infections, often leading to significant healthcare challenges, including recurrent episodes and complications. Increased awareness of diagnostics and monitoring for UTIs has driven demand for surveillance services. Moreover, technological advancements in infection surveillance and enzyme-linked immunosorbent assay (ELISA) testing have made it more accessible to healthcare facilities, thereby fostering growth and dominance in this as healthcare providers focus on effective monitoring for better patient outcomes.

Bloodstream Infections

The Bloodstream Infections category is vital due to the serious implications associated with bacteremia and sepsis. As a leading cause of morbidity and mortality in hospitalized patients, the rising number of surgeries and invasive procedures contributes significantly to the incidence of these infections. Enhanced surveillance techniques and stringent health regulations have been established, focusing on tracking and managing these critical conditions. Consequently, healthcare providers increasingly invest in specialized services to monitor bloodstream infections, aiming to improve patient safety and treatment efficacy.

Surgical Site Infections

Surgical Site Infections represent a critical area within infection surveillance, primarily due to their associated healthcare costs and extended hospital stays. These infections are a significant concern during and after surgical procedures, necessitating rigorous monitoring and prevention strategies. The emphasis on quality of care and patient outcomes has compelled healthcare facilities to adopt comprehensive surveillance systems to track and mitigate the risks of surgical site infections, leading to increased demand for targeted surveillance services.

Gastrointestinal Infections

The Gastrointestinal Infections sector is experiencing notable attention as these infections can rapidly spread in community and healthcare settings, particularly due to pathogens like Clostridium difficile. There is a marked increase in focus on infection prevention and control practices to minimize the occurrence of gastrointestinal infections, especially in acute care settings. This awareness, coupled with an emphasis on antibiotic stewardship, drives healthcare providers to seek surveillance services that will help provide accurate data and prompt interventions for improved disease management.

Others

The "Others" category encompasses various infections not categorized elsewhere, such as respiratory and skin infections. Although not dominant, this area remains important due to the increasing incidence of multi-drug resistant organisms and the evolving nature of infection threats. Surveillance services targeting these infections are becoming more critical as healthcare organizations recognize the need for comprehensive monitoring and data collection to ensure public health and safety, thereby promoting the implementation of innovative strategies for infection control across diverse infection types.

Insights On Application

Hospitals & Clinics

Hospitals and clinics are expected to dominate the Global Infection Surveillance Services Market due to their primary focus on patient care and the ened need for infection control. These healthcare facilities experience the highest volume of patient interactions, making them critical environments for monitoring and controlling infections. Moreover, the increasing prevalence of healthcare-associated infections (HAIs) has urged hospitals to implement robust infection surveillance systems to ensure patient safety and comply with regulatory requirements. As hospitals invest in advanced technologies aimed at improving patient outcomes and reducing transmission rates, this sector will continue to lead the market, particularly as healthcare providers become more vigilant in their infection management strategies.

Ambulatory Surgical Centers

Ambulatory surgical centers (ASCs) represent a growing market for infection surveillance services, as these facilities specialize in outpatient surgeries. The expansion of outpatient care and surgical procedures has necessitated a more focused approach to infection control. ASCs often face unique challenges related to infection surveillance due to their high turnover rate of patients. Consequently, organizations are increasingly implementing specialized infection monitoring systems aimed at improving surgical outcomes and reducing the incidence of postoperative infections. With regulatory pressures and the need for increased patient safety, the demand for infection surveillance in ambulatory surgical centers is expected to rise steadily.

Academic Institutes

Academic institutes play a vital role in infection surveillance, particularly in research and training. These institutions are crucial for developing new methodologies and technologies for infection control. Their focus on education and the cultivation of future healthcare professionals fosters innovation and critical discussions around best practices. Research conducted in academic settings can lead to advancements in infection tracking technologies and strategies. Although their direct impact on the overall market may be limited compared to hospitals, they are essential for long-term improvements in the field of infection surveillance, ultimately influencing policy and practice in broader healthcare settings.

Others

The "Others" category encompasses various healthcare settings and facilities, including long-term care facilities, rehabilitation centers, and private practices. While this may not dominate the market, it is still significant, as these facilities also face challenges related to infection control and surveillance. The rising awareness about the importance of monitoring infections in less traditional settings drives the demand for tailored infection surveillance services. However, these facilities typically have lower budgets and fewer resources compared to hospitals, which may limit their capacity to adopt comprehensive infection surveillance systems. Hence, while important, this remains relatively niche in the overall market landscape.

Global Infection Surveillance Services Market Regional Insights:

North America

North America is anticipated to dominate the Global Infection Surveillance Services market due to its robust healthcare infrastructure, advanced technological capabilities, and a high prevalence of healthcare-associated infections. The U.S. is at the forefront of infection control practices and holds a significant share of research funding, leading to innovation in surveillance methods. The region's stringent regulatory frameworks and the increasing demand for effective infection control to combat antibiotic resistance further amplify the need for comprehensive infection surveillance services. With a higher adoption rate of sophisticated digital health technologies and strong investments in healthcare IT solutions, North America is poised to maintain its leadership in this market.

Latin America

Latin America presents a growing opportunity within the infection surveillance services market due to increasing awareness about infection control and epidemiological research. Governments and health organizations are gradually investing more in healthcare infrastructure to respond to infectious disease outbreaks. However, challenges like economic variability and limited access to advanced technologies in certain regions may hinder rapid growth. Still, the increasing incidence of infectious diseases and the need for better healthcare systems are likely to elevate the demand for infection surveillance services in the near future.

Asia Pacific

The Asia Pacific region is emerging as a significant player in the infection surveillance services market, driven by the rapid growth of healthcare infrastructure, rising awareness regarding infectious diseases, and increasing investments in health IT solutions. Countries like China and India are experiencing high disease burdens, necessitating improved surveillance systems. Moreover, the projected growth in healthcare spending and initiatives to strengthen public health systems bolster the market potential. While urbanization and population density present challenges, innovation and faster adoption of technology can pave the way for a more robust infection surveillance landscape in the region.

Europe

Europe is expected to show steady growth in the infection surveillance services market as healthcare systems emphasize minimizing infection rates and improving patient safety. The region comprises advanced economies that prioritize health technology assessments and have a strong regulatory environment fostering quality standards in infection control. Collaborative efforts between various healthcare stakeholders and governmental initiatives aimed at disease prevention enhance the market landscape. Nonetheless, differing healthcare practices among European nations might result in varied pacing of market growth across the region.

Middle East & Africa

The Middle East & Africa region exhibits potential for growth in the infection surveillance services market, driven by a rising burden of infectious diseases and efforts to strengthen health systems. Emerging economies in this region are focusing on upgrading healthcare infrastructure and improving infection prevention and control measures. However, challenges such as underfunding and limited access to advanced technologies can limit the speed of development. Nevertheless, initiatives to enhance public health and international collaborations can illuminate pathways to better infection surveillance practices and improved health outcomes.

Infection Surveillance Services Competitive Landscape:

Major stakeholders in the global infection surveillance services sector, comprising healthcare organizations and technology companies, prioritize the creation of cutting-edge solutions aimed at the monitoring, identification, and prevention of infections within healthcare environments. Their joint initiatives bolster the processes of data gathering and analysis, thereby significantly advancing patient safety and overall public health results.

The Infection Surveillance Services Market features several prominent organizations, such as BioMedica Management, Inc., Cerner Corporation, Meditech, and Baxter International Inc. Key players also include AdvancedMD, Inc., Conemaugh Health System, Rhapsody Healthcare, and Siemens Healthineers. Other influential companies in this sector are Truven Health Analytics, RelayHealth, MedAptus, HealthStream, Optum, IBM Watson Health, and Epic Systems Corporation. Additionally, significant market contributors encompass Premier Inc., EClinicalWorks, Allscripts Healthcare Solutions, NextGen Healthcare, and Fresenius Medical Care. These entities play a vital role in offering infection surveillance services and aiding healthcare providers in the effective management of infectious diseases.

Global Infection Surveillance Services COVID-19 Impact and Market Status:

The Covid-19 pandemic notably intensified the need for sophisticated global infection monitoring systems, underscoring the necessity for immediate data and analytical tools to efficiently address public health challenges.

The COVID-19 pandemic has profoundly influenced the market for infection surveillance services, accelerating the shift towards digital health technologies and strengthening the emphasis on infection control measures within healthcare frameworks. As the need for instantaneous monitoring and data interpretation to handle COVID-19 cases grew, healthcare entities channeled resources into sophisticated surveillance systems and cohesive reporting tools. This ened demand has spurred the creation of cutting-edge solutions, such as mobile applications and cloud-based systems, which enable prompt communication of infection data. Additionally, an increased consciousness of infectious diseases has led regulatory bodies to emphasize the importance of infection prevention tactics, thus creating a more dynamic marketplace. Consequently, the infection surveillance services sector is expected to witness ongoing expansion as healthcare systems work to tackle both the urgent and enduring challenges associated with infectious diseases in the aftermath of the pandemic.

Latest Trends and Innovation in The Global Infection Surveillance Services Market:

- In April 2023, Baxter International announced its acquisition of Hillrom for approximately $10.5 billion, enhancing its infection prevention solutions through Hillrom's advanced connected care technologies and infection surveillance services.

- In February 2023, Cerner Corporation launched its updated infection prevention software, designed to integrate with electronic health records and improve response times for infection outbreaks in healthcare settings.

- In March 2023, BD (Becton, Dickinson and Company) unveiled its new BD Synapsys infection surveillance software, which utilizes AI analytics to provide real-time insights for healthcare providers and enable them to better manage infection control efforts.

- In January 2023, Medtronic enhanced its portfolio with the acquisition of Mazor Robotics, focusing on robotic-assisted surgical technologies that improve infection surveillance and management in surgical environments.

- In June 2022, Wolters Kluwer integrated advanced analytics into its UpToDate platform, allowing healthcare professionals to track and analyze infection trends and improve outcomes in clinical settings.

- In August 2022, Thermo Fisher Scientific launched a new molecular diagnostics platform aimed at enhancing pathogen detection and infection surveillance, boosting laboratory capabilities and response strategies for infectious diseases.

- In May 2022, Epic Systems collaborated with various health systems to improve its infection control software, enabling integrated data sharing and enhancing real-time surveillance capabilities across networks.

- In December 2021, a significant partnership was established between Philips and the American Hospital Association, focusing on infection prevention technologies and data analytics to enhance hospital infection surveillance practices.

Infection Surveillance Services Market Growth Factors:

The market for Infection Surveillance Services is propelled by the growing incidence of infectious diseases, innovations in healthcare technology, and a ened focus on ensuring patient safety and implementing effective infection control strategies.

The market for Infection Surveillance Services is undergoing remarkable expansion, influenced by a variety of pivotal elements. Foremost among these is the rising incidence of healthcare-associated infections (HAIs) and increased awareness surrounding infection control protocols within hospitals and healthcare settings, driving the demand for efficient surveillance solutions. The ened focus on patient safety and quality care has led healthcare organizations to implement comprehensive infection surveillance systems aimed at monitoring and reducing infection risks effectively.

Moreover, technological advancements—particularly the incorporation of artificial intelligence and machine learning into surveillance mechanisms—have significantly improved data gathering and analysis capabilities, enhancing strategic responses to infection outbreaks. The COVID-19 pandemic has underscored the urgent necessity for effective infection monitoring, prompting an upsurge in investments in surveillance services across various s of the healthcare industry.

In addition, regulatory requirements and guidelines set forth by health authorities are instrumental, encouraging healthcare providers to adopt standardized infection control measures. The growth of telehealth services and remote patient monitoring technologies has further broadened access to infection surveillance solutions, making them increasingly attractive to a diverse array of healthcare institutions. Collectively, these factors are transforming the Infection Surveillance Services Market, paving the way for substantial advancements in technology and its applications in the healthcare landscape.

Infection Surveillance Services Market Restaining Factors:

The Infection Surveillance Services Market faces significant challenges such as regulatory hurdles, elevated implementation expenses, and issues related to data privacy and system interoperability.

The Infection Surveillance Services Market is encountering various challenges that may impede its development. One of the primary obstacles is the absence of uniform protocols among healthcare facilities, which results in varied infection control methods and inconsistent data collection, potentially diminishing the effectiveness of surveillance initiatives. Furthermore, restricted funding and inadequate resource distribution within healthcare systems, especially in less developed areas, limit the establishment of thorough surveillance programs. The insufficient number of trained personnel adept in infection surveillance exacerbates the situation, as inaccurate data analysis can lead to ineffective intervention strategies. Privacy issues concerning patient information may also discourage healthcare providers from fully embracing these services, thus restricting the availability of essential data. Additionally, regulatory complexities and the intricate process of integrating surveillance systems into current healthcare IT frameworks could hinder the pace of market adoption. The ever-changing nature of pathogens presents further challenges to existing surveillance mechanisms, complicating the task of tracking emerging infectious diseases. Nevertheless, an increasing recognition of the significance of infection control, particularly following global health emergencies, is fostering developments in surveillance technologies. This trend indicates a movement towards improved infection prevention and control methodologies, ultimately propelling the market forward.

Key Segments of the Infection Surveillance Services Market

By Type

• Bloodstream Infections

• Surgical Site Infections

• Gastrointestinal Infections

• Urinary Tract Infections (UTI)

• Others

By Application

• Hospitals & Clinics

• Ambulatory Surgical Centers

• Academic Institutes

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America