The global industrial sewing machines market size was valued at USD 2.29 Billion in 2018 and is anticipated to expand at a reasonable growth rate from 2019 to 2025. The market is driven by robust demand for apparel due to rise in population. In the last five-six decades, the worldwide population has undergone a massive growth on year-on-year basis. Such an increase in population has led to a significant demand for clothing. The clothing products have transformed from a necessity to fashion statements and luxurious items leading to witnessing a high growth momentum over the past two decades by the global apparel market. The strong need for ready-made clothing is expected to drive the global sewing machines market during the projection period as sewing machines play a crucial role in making ready-made apparels.

The value of the Industrial Sewing Machines market is projected to grow to US$ 5 Bn with an estimated CAGR of 45% by 2031.

.jpg)

Industrial sewing machines are different from domestic traditional industrial sewing machines in number of ways. An industrial sewing machine is purposely built for a longer term, doing professional sewing tasks and hence is manufactured with enhanced parts, durability and motors. Whereas domestic traditional industrial sewing machines might include plastic or nylon gears. The gears that are appended in the industrial sewing machines, the connecting rods, housing and body are in general manufactured from high-quality metals, like cast iron or aluminium.

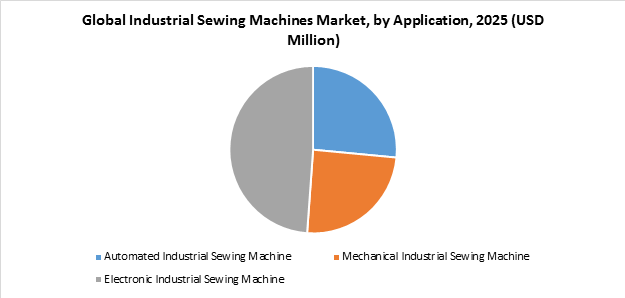

Of the industrial sewing machines, the automated industrial sewing machines are advanced technology industrial sewing machines which can be connected to the internet, computer or design loaded cards. These machines are best suitable for industrial purpose, hence termed as automated industrial sewing machines. These industrial sewing machines have inbuilt stitches capacity of a minimum of 50 and maximum of 200. The Mechanical Industrial Sewing Machine also known as manual machines/tailoring machines/treadle industrial sewing machines where the basic settings are done by the operator manually like by rotating the knobs, etc. to set various measurements. These machines are most suitable for the beginners who want to learn sewing from basics. Electronic industrial sewing machines are combination of mechanical industrial sewing machines and automated industrial sewing machines. It provides varieties of features and it comes in light weight, compact size and consists of a LCD screen. These sewing machines are a better choice for the expert operators.

Apart from this, the latest improvements and innovations are anticipated to fuel the global industrial sewing machines market in the given timeline. For instance, In May 2019, Juki Corporation announced to launch Semi-dry head with digital zigzag stitch sewing system, namely, LZ-2290C Series. The digitalized function in the series is aimed to improve seam quality besides reducing time setup. In February 2018, Pegasus Sewing Machine announced the launch of GXT series which includes dry-head type, variable top feed, safety stitch machines / overedgers. It features “ease of operation” and produces “beautiful seams.”

This report on the global industrial sewing machines offers insights into the evolution of industrial sewing machines and their various use cases in varied applications such as apparels, shoes, bags, automobile, and others. At present, apparels are the leading demand market for industrial sewing machines.

The report also analyzes the types of industrial sewing machines offering a contrast between automated, mechanical, and electronic. Electronic Industrial Sewing Machine are leading the growth driven by availability of numerous features that helps in meeting the consumer’s demand.

The competitive landscape of the global industrial sewing machines market is fragmented. It includes large multinational players leading with cutting-edge technology offering various sewing machines to meet the different demands of the customers.

Industrial Sewing Machines Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | US $ 5 Bn |

| Growth Rate | CAGR of 45% during 2021-2031 |

| Segment Covered | Product, Mode of Operation, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Bernina International, Brother Industries, JACK Sewing Machine Co. Ltd., Janome Sewing Machine Co. Ltd., JUKI Corporation, MSISM Co. Ltd., Pegasus Sewing Machine Mfg Co. Ltd., PFAFF Industriesystme und Maschinen GmbH, Seiko Sewing Machine Co. Ltd., Duerkopp Adler, USHA International, Singer Corporation |

Key Segments of the Global Industrial Sewing Machines Market

Type Overview (USD Billion)

- Automated

- Mechanical

- Electronic

Application Overview, (USD Billion)

- Apparels

- Shoes

- Bags

- Automobile

- Others

Regional Overview, (USD Billion)

- North America

- Asia Pacific

- Europe

- Central & South America

- Middle East and Africa

Reasons for the study

- The purpose of the study is to give an exhaustive outlook of the global industrial sewing machines market.

- We intend to present how industrial sewing machines have evolved and how it may impact execution of Industry 4.0

- The study aims to identify the disruptive technologies, their adoption trend, impact on traditional approaches and monitor the transition of the industry

What does the report include?

- The study on the global industrial sewing machines market includes qualitative factors such as drivers, restraints, and opportunities

- Additionally, the market has been evaluated using the Porter’s 5 Forces and Value Chain Analysis.

- The study covers a qualitative and quantitative analysis of the market segmented on the basis of type and end-user. Moreover, the study provides similar information for the key geographies.

- Actual market sizes and forecasts have been provided for all the above-mentioned segments.

- The study includes the profiles of key players in the market with a significant global and/or regional presence.

Who should buy this report?

This study is suitable for industry participants and stakeholders in the global industrial sewing machines market. The report will benefit:

- Every stakeholder involved in developing and distributing industrial sewing machines solutions.

- Product managers looking to publish recent and forecasted statistics pertaining to the global industrial sewing machines market.

- Government organizations, regulatory authorities, policymakers and financial organizations looking for innovative global industrial sewing machines solutions.

- Analysts, researchers, educators, strategy managers, and academic institutions looking for insights into the market to determine future strategies.

Frequently Asked Questions (FAQ) :

Due to the growing competition, businesses are seeking alternatives to enhance profit and reduce costs. The significance of industrial sewing machines in large scale enterprises to finish the tasks in lesser time. The companies can improve their effectiveness and efficiency of its activities. Industrial sewing machines reduces the workload and eliminates human errors, in turn, boosts effectiveness and consistency. The sophisticated industrial sewing machines are becoming a favored choice for garment manufacturers as it saves energy and time, and reduce intricacy of the manufacturing process due to their upgraded features.

Sewing is widely used and recognized as a medium for allowing people to make their own clothes more personalized. Sewing has now become easier and is less time consuming than it was regarded to be long time ago. Electronic sewing machines expedite this process by enabling the tailors to adopt the modern features and complex embroidering styles. Additionally, electronic sewing machines are now comparatively affordable, even for those households with moderate incomes.

Market leaders are investing in enhancing their sewing capabilities to offer better products for industrial sewing machines solutions. For e.g. In May 2019, Brother Industries released Electronic Pattern Sewer with Bridge Type Programmable: NEXIO BAS-370H and NEXIO BAS-375H. The bridge type mechanism offers extreme sewing quality at higher sewing speeds with maximum 2,500sti/min. These machines comes with a sewing area of 700mm x 700mm and 1,200mm x 700mm respectively. Also, the machines are equipped with a needle cooler that prevents thread breakage and user-friendly color LCD with touch panel display.

Based on the application, the market includes categories: apparels, shoes, bags, automobile, and others. In terms of revenue, the apparels segment led the application market demand in 2018. This segment is projected to attain a 46.9% market share by 2025, with a CAGR of 4.9%. This is mainly due to rise in population.

.png)

By type, the market includes categories: automated industrial sewing machine, mechanical industrial sewing machine, and electronic industrial sewing machine. In terms of revenue, the electronic industrial sewing machine segment led the application market demand in 2018. Electronic industrial sewing machine is projected to attain a 48.9% market share by 2025, with a CAGR of 4.5%. As these sewing machines comes in light weight, compact size, and LCD screen, the operators mostly prefer these. It also has features like good quality of stitching, minimum 7 in-built stitch capability, embroidering, blind stitch, hemming, hemming zip fixing, buttonhole stitch, reverse stitch lever, smocking, quilting, stretch stitching, built in needle threaded, adjustable stitch length and width, top loading drop in bobbin, automatic thread cutter, auto tripping bobbin, adjustable presser foot, adjustable needle positioning, twin needle compatibility, attachment option for other features.

In terms of revenue, the global industrial sewing machines market is dominated by Asia Pacific, followed by Europe and North America, respectively. Asia Pacific was the largest market for industrial sewing machines in 2018 and is expected to dominate the market till 2025, attributable to development of the industrial sector. The presence of most of the sewing machine manufacturers are headquartered in the region is one of the important factor accelerating market growth. Also, the growth witnessed is driven by rising digitalization in India and China.

.png)

In terms of revenue, Asia Pacific is anticipated to dominate the industrial sewing machines market with an estimated market share of 57.63% in the year 2025. As a result of low manufacturing cost alternatives, the production of different products using industrial sewing machines has noticed a massive transformation from the developed countries in Europe and North America to the developing countries of Asia Pacific region. Hence, there has been a stable and relentless rise in demand from the Asia Pacific region for industrial sewing machines over the past.

The major players of Global Industrial Sewing Machines Market include Brother Industries Ltd., Feiyue Group Co., Ltd., Juki Corporation, JACK Sewing Machine Co., Ltd., ZOJE Sewing Machine Co., Ltd, Shang Gong Group, Singer, Gemsy Five Continents Technology Group Co., LTD., Jaguar International Corporation, Xi'an Typical Industries Co.,Ltd., Husqvarna AB, and SunStar SWF, Inc,