Industrial Fabric Market Analysis and Insights:

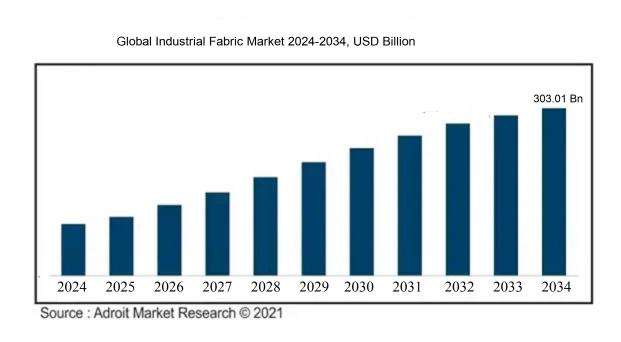

The size of the worldwide industrial fabric market was USD 164.02 billion in 2024, increased to USD 175.04 billion in 2025, and is projected to reach around USD 303.01 billion by 2034, with a compound annual growth rate (CAGR) of 7.5% from 2024 to 2034.

The Industrial Fabric Market is influenced by several pivotal factors, notably the growing need for lightweight yet robust materials in sectors such as automotive, aerospace, and construction. The advancement of these industries is driven by technological innovation, which has opened up new possibilities for the use of industrial fabrics, especially in areas like protective apparel and high-performance textiles. Furthermore, the increasing emphasis on sustainability has propelled manufacturers to create environmentally friendly fabrics, appealing to a more eco-conscious consumer base. The growth of end-user sectors in developing regions also contributes to market expansion, alongside the rise of automation and smart manufacturing that demand specialized fabrics for a range of applications. Additionally, stringent safety regulations in industries like healthcare and oil and gas significantly increase the demand for superior quality industrial fabrics, which are essential for maintaining operational safety and efficiency.

Industrial Fabric Market Definition

Industrial fabric pertains to textiles crafted for use in manufacturing and industrial sectors, distinguished by their robustness and practical utility. These materials find application in domains like construction, automotive industries, and filtration systems, offering superior strength and resilience against diverse environmental challenges.

Industrial textiles are integral to numerous industries such as automotive, aerospace, construction, and healthcare thanks to their remarkable strength, durability, and adaptability. These engineered materials are designed to endure harsh conditions and extensive wear, making them vital for producing heavy-duty equipment, protective gear, and more. Moreover, industrial fabrics can boost functionality with properties like moisture management, flame resistance, and UV shielding. Their diverse applications range from conveyor systems and tarpaulin covers to medical textiles and geosynthetics, emphasizing their role in enhancing efficiency and safety across various sectors. The continuous innovation in these fabrics is also a catalyst for technological advancements and sustainability efforts, highlighting their crucial significance.

Industrial Fabric Market Segmental Analysis:

Insights On Industrial Fabric

Polyester

Polyester is expected to dominate the Global Industrial Fabric Market primarily due to its versatility, durability, and cost-effectiveness. Its widespread use across various industries, including automotive, construction, and textiles, makes it highly favored among manufacturers. The material offers excellent resistance to stretching and shrinking, as well as quick-drying properties. The global push for sustainable and eco-friendly materials has also led to increased demand for recycled polyester, reinforcing its dominance significantly in the market. Moreover, globalization has resulted in higher production rates and innovations in polyester blends, making it a key player in meeting industrial requirements efficiently.

Aramid

Aramid fabrics are known for their exceptional strength and heat resistance, often utilized in high-performance applications such as aerospace, military, and firefighting equipment. Their ability to withstand harsh conditions without deteriorating makes them indispensable in sectors that prioritize safety and durability. Manufacturers are continuously developing new forms of aramid fibers to enhance performance, thus maintaining a substantial market presence.

Polyamide

Polyamide, often recognized for its excellent chemical resistance and resilience, finds its applications in automotive, aerospace, and industrial gear. The fibers provide high tensile strength and abrasion resistance, making them preferable for demanding industrial environments. Additionally, polyamide’s flexibility in formulation allows customization for various interactions, which is attractive for diverse end-use requirements.

Nylon

Nylon is a widely used fabric known for its impressive strength and lightweight nature. Its moisture-wicking properties and versatility in designs make it ideal for various applications, including apparel, industrial textiles, and consumer goods. The growing use in activewear and outdoor gear highlights nylon's market relevance, where performance and comfort are critical.

Fiberglass

Fiberglass is recognized for its high tensile strength and is frequently utilized in construction, automotive, and marine industries. Its lightweight nature combined with durability and insulation properties makes it suitable for reinforcing other materials. The rising focus on creating composite materials that include fiberglass will continue to extend its utilization across diverse applications.

Composite

Composite materials, which combine two or more distinct properties for enhanced performance, are gaining traction in numerous industries due to their lightweight and strength characteristics. Applications span aerospace, automotive, and sports equipment, where reducing weight while maintaining structural integrity is essential. The innovation in composite technologies continues to drive growth, making them increasingly popular in performance-driven sectors.

Kevlar

Kevlar is integral in applications requiring high tensile strength and thermal resistance, especially in protective gear like body armor, gloves, and helmets. Its use in the automotive and aerospace industries for components that require lightweight materials with high durability is notable. The increasing emphasis on safety in various sectors contributes to the sustained demand for Kevlar fabrics.

Graphite

Graphite fibers are recognized for their high-temperature resistance and electrical conductivity, making them valuable in manufacturing machinery, automotive parts, and battery components. Although this category has a smaller market share, the specific applications in advanced technologies and electronics are on the rise, potentially increasing the overall importance of graphite in industrial fabric solutions.

Other Fiber Types

The category of Other Fiber Types encompasses materials like cotton, wool, and hemp, which cater to niche markets in industrial applications. These natural fabrics often appeal to eco-conscious consumers and industries looking for sustainable options. Advancements in organic farming and processing techniques are enhancing the viability of these fibers, thereby gaining traction in specific sectors emphasizing natural and biodegradable materials.

Insights On Application

Protective Apparel

Protective apparel is expected to dominate the Global Industrial Fabric Market due to the increasing focus on worker safety and regulatory standards in various industries. As businesses place more emphasis on employee welfare, the demand for high-performance fabrics that offer durability, resistance to hazardous materials, and comfort is rising. Key sectors such as construction, manufacturing, and healthcare are driving the demand for specialized protective clothing, which further solidifies protective apparel as a leading. Innovation in fabric technology, including the development of lightweight yet resilient materials, is also bolstering this sector's growth potential, thus making it a critical focus in the industrial fabric market.

Conveyor Belt

The conveyor belt application is significant within the industrial fabric market, primarily due to its crucial role in streamlining manufacturing and logistics. As industries continue to automate processes, the demand for high-strength and versatile conveyor belts is soaring. These belts are essential in sectors such as mining, food processing, and automotive, where efficient material handling is imperative. The increasing emphasis on mechanization drives innovation in fabric technologies, ensuring that conveyor belts meet stringent performance requirements while enhancing operational efficiency.

Automotive Carpet

The automotive carpet holds relevance in the industrial fabric market due to the automotive industry's focus on aesthetics, comfort, and sound insulation. Manufacturers are focused on using advanced fabrics that not only enhance the vehicle's interior but also provide durability and ease of maintenance. As trends lean toward electric vehicles and sustainable materials, the automotive carpet is likely to innovate further, thereby maintaining its importance among the various applications in industrial fabrics.

Flame Resistance Apparel

Flame resistance apparel serves a critical role in sectors such as oil and gas, firefighting, and electrical utilities, where exposure to extreme heat and fire hazards is frequent. The growing awareness of safety regulations and workplace hazards has driven the demand for high-performance flame-resistant garments. Innovations in fabric technology enable the development of lightweight, comfortable, and effective flame-resistant apparel, which is increasingly being adopted across industries as a protective standard.

Transmission Belt

Transmission belts are essential for transferring power in various engineering applications, including automotive and industrial machinery. The demand for high-quality transmission belts is influenced by technological advancements and the need for reliable performance under various operational conditions. Industries such as manufacturing and automotive rely heavily on robust power transmission solutions, making this application a significant player in the industrial fabric market. Enhanced durability and increased efficiency are pivotal factors driving the development and adoption of advanced transmission belt materials.

Other Applications

The 'Other Applications' category encompasses a diverse range of uses for industrial fabrics, including niche markets like aerospace, medical textiles, and home furnishings. As these sectors evolve, unique fabric requirements are emerging, demanding specialized solutions for their applications. This flexibility and adaptability of industrial fabrics allow them to cater to various needs that transcend traditional applications, ensuring that this remains relevant within the broader market landscape. The ongoing diversification of fabric properties and applications keeps this significant and adaptive to market trends.

Insights On End User

Clothing

Clothing is projected to dominate the Global Industrial Fabric Market due to the persistent demand for high-performance textiles in fashion and apparel industries. The growth can be attributed to the increasing trend of functional clothing, which includes moisture-wicking, UV protection, and insulation properties. Furthermore, with the rise of athleisure and sportswear, manufacturers are continuously seeking advanced industrial fabrics that enhance comfort and durability. The fashion industry's ongoing evolution towards sustainability also drives demand for eco-friendly fabrics, compelling more manufacturers to innovate. This combination of trends solidifies Clothing as the leading category in the market.

Homeware

The Homeware category plays an essential role in the Global Industrial Fabric Market, primarily driven by the increasing demand for durable and aesthetically pleasing textiles for home furnishings. Products such as upholstery fabrics, curtains, and table linens require materials that not only look good but can also withstand wear and tear. Additionally, the ongoing home improvement trend, fueled by increasing disposable incomes and consumer interest in interior design, suggests a steady growth trajectory for the home textile industry. However, while important, Homeware does not rival the dynamic growth observed in the Clothing sector.

Accessories

Accessories account for a notable share in the Global Industrial Fabric Market, as they encompass a wide range of products including bags, belts, and other fashion accessories. The increasing consumer inclination toward customization and personalization tends to fuel demand for specialized fabrics, particularly those that are lightweight and durable. Nonetheless, while this appeals to niche markets and showcases potential for growth, it remains overshadowed by the more dominant Clothing sector. The continued shift towards functionality and versatility in accessories propels innovation but does not significantly impact the overall market as compared to Clothing.

Other End-Users

The Other End-Users category in the Global Industrial Fabric Market includes various miscellaneous applications such as automotive, industrial textiles, and agriculture. While these areas contribute to the market, they cater to specialized needs that are less mainstream than those served by Clothing. Although industrial textiles for heavy-duty applications have gained traction, the overall demand remains fragmented due to diverse requirements across different industries. Thus, while Other End-Users presents opportunities for growth, it does not achieve the same prominence or influence seen in the Clothing market.

Global Industrial Fabric Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the Global Industrial Fabric market due to the region's robust manufacturing base, rapid industrialization, and a surge in demand from sectors like automotive, textiles, and construction. The growth of countries such as China and India, which are leading in both production and consumption of industrial fabrics, significantly contributes to the dominance. Moreover, the rise in infrastructure development, combined with increased investments in technology and production processes, strengthens the region's position. The high demand for technical textiles, driven by advancements in industries such as aerospace and healthcare, further enhances Asia Pacific's market potential, solidifying its role as the frontrunner.

North America

North America, particularly the United States, exhibits a stable industrial fabric market bolstered by technologically advanced industries and infrastructure development. The region benefits from significant investments in research and development, propelling innovation in fabric technologies. The presence of major industrial fabric manufacturers, combined with a growing trend towards sustainable fabrics, is enhancing market dynamics in this region. However, despite robust demand, the market is somewhat overshadowed by the rapid growth of Asia Pacific.

Europe

Europe represents a significant share of the Global Industrial Fabric market driven by the demand for technical textiles within various sectors, including automotive and aerospace. The increasing focus on sustainability and eco-friendly fabrics aligns with European regulatory standards and consumer preferences. Furthermore, the presence of established textile manufacturing hubs, such as Germany and Italy, enables Europe to maintain its steady market growth. Collaborative initiatives in R&D among countries further drive innovation, though competition from Asia Pacific presents challenges.

Latin America

Latin America has been relatively slower in terms of industrial fabric development compared to its counterparts. However, countries like Brazil and Mexico are gradually enhancing their industrial capabilities, with growing domestic markets in automotive and construction sectors. Economic fluctuations and political instability can impact growth, yet increasing international partnerships and investments in local manufacturing present opportunities for market expansion. The region's potential remains untapped, but there is cautious optimism around its future development.

Middle East & Africa

The Middle East & Africa region shows emerging potential in the Global Industrial Fabric market, especially due to infrastructural developments and the oil and gas sector’s growth. As countries engage in diversifying their economies, increased investments in construction and manufacturing are expected to fuel demand for industrial fabrics. However, challenges such as limited local manufacturing capacity and reliance on imports hinder swift market advancement. Nevertheless, ongoing urbanization projects and governmental initiatives may result in gradual market improvements and opportunities for growth in the near future.

Industrial Fabric Competitive Landscape:

The leading figures in the global industrial fabric sector, encompassing both producers and suppliers, propel advancements and elevate quality standards by creating sophisticated textiles tailored for a variety of uses. Distributors are essential in facilitating effective supply chain operations and expanding market access. Moreover, the demands and preferences of end-users, shaped by their unique industry requirements, significantly impact trends and overall market dynamics.

The prominent participants in the Industrial Fabric Market are: DuPont, 3M Company, Ahlstrom-Munksjö, Milliken & Company, Schweitzer-Mauduit International, Inc., Trelleborg AB, SAAF, TenCate Protective Fabrics, BASF SE, Archer Daniels Midland Company, Teijin Limited, Freudenberg Group, Kyndryl Holdings, Inc., Hohenstein Group, and Sioen Industries.

Global Industrial Fabric COVID-19 Impact and Market Status:

The Covid-19 pandemic had a profound impact on the Global Industrial Fabric market, leading to production stoppages, disruptions in supply chains, and a noticeable change in demand towards protective textiles.

The COVID-19 pandemic caused significant upheaval in the industrial fabric sector, resulting in disruptions to supply chains and reduced production capabilities. Restrictions imposed due to health concerns led to a downturn in demand from major industries such as automotive, aerospace, and construction—key users of industrial fabrics. Nevertheless, a recovery commenced in 2021 as manufacturers adjusted to enhanced health protocols, adopted automation technologies, and investigated innovative materials tailored to the shifting requirements of the industry. Additionally, the pandemic hastened the transition to e-commerce and digital sales platforms, transforming the marketing and distribution methods for industrial fabrics. The ened emphasis on hygiene and safety has driven increased demand for specialized fabrics, particularly in the medical field. As the global economy begins to stabilize, the industrial fabric market is poised for a rebound, fueled by pent-up demand and a strengthened focus on sustainable and high-performance materials.

Latest Trends and Innovation in The Global Industrial Fabric Market:

- In September 2023, BASF announced a strategic partnership with Sioen Industries to develop advanced industrial fabrics that enhance durability and performance for various applications, ranging from automotive to outdoor gear.

- In March 2023, Globe Machine Manufacturing Company acquired the assets of C.G. Reynolds, known for their innovation in automated fabric handling systems, aiming to enhance their offerings in automated textile manufacturing solutions.

- In August 2023, Ahlstrom-Munksjö completed the acquisition of Mitsubishi’s Industrial Nonwoven Fabrics Division, expanding its product portfolio in the nonwoven and strengthening its position in the global market.

- In May 2023, DuPont launched a new line of high-performance fabrics under the brand Tyvek, specifically designed for protective apparel in the industrial and construction sectors, highlighting its commitment to innovation in safety materials.

- In April 2023, CommScope, a leader in communication infrastructure, announced a merger with Cisco, focusing on enhanced connectivity solutions that leverage advanced industrial fabric technologies for improved connectivity in smart buildings.

- In January 2023, TenCate Protective Fabrics, part of Royal Ten Cate, unveiled a new range of flame-resistant fabrics aimed at the oil and gas industries, showcasing technology advances in safety and protection.

- In February 2023, NSN Fabric launched an eco-friendly industrial fabric solution made from recycled materials, taking a significant step towards sustainability in the textile industry.

- In December 2022, W. L. Gore & Associates, known for its GORE-TEX technology, announced advancements in its industrial fabric offerings, enhancing breathability and waterproof capabilities for harsh environments.

- In November 2022, Miller Weldmaster collaborated with Serimax to develop innovative welding technologies for industrial fabrics, significantly improving the efficiency of fabric joining techniques.

- In October 2022, Honeywell introduced its latest smart textile technology integrating IoT capabilities into industrial fabrics, aiming to improve functionality and monitoring in manufacturing processes.

Industrial Fabric Market Growth Factors:

The Industrial Fabric Market is set to expand, fueled by rising?? in industries like automotive, construction, and healthcare, as well as innovations in textile technology.

The Industrial Fabric Market is witnessing notable growth, propelled by several pivotal elements. Primarily, the rising demand across diverse end-user sectors—including automotive, textiles, and construction—underpins this expansion, as these industries increasingly depend on industrial fabrics for their robustness and performance capabilities. Furthermore, technological advancements and the emergence of innovative materials, particularly sustainable and high-performance textiles, are broadening the product spectrum and drawing in a wider customer demographic.

Additionally, an increased focus on product safety and environmental responsibility is prompting manufacturers to concentrate on the creation of eco-friendly fabrics, ensuring compliance with regulations and aligning with consumer expectations. The globalization of trade and the surge in infrastructure investments in developing nations also play significant roles in driving market growth, as these dynamics elevate the need for specialized fabric solutions.

Moreover, the growing trend of automation and the incorporation of smart textiles within manufacturing processes are fostering innovation and unveiling new market prospects. Lastly, the ened interest in lightweight and multifunctional materials aimed at enhancing efficiency in industrial applications further supports the market’s trajectory, suggesting a promising growth outlook for the industrial fabric industry in the years to come.

Industrial Fabric Market Restaining Factors:

The Industrial Fabric Market faces significant challenges due to volatility in raw material costs and the rising presence of competing materials.

The Industrial Fabric Market is confronted with various constraining elements that may hinder its growth trajectory. A primary concern is the volatility in the prices of essential raw materials, including nylon and polyester, which can affect production expenses and profit margins. Moreover, strict regulations concerning environmental sustainability and labor standards can place additional compliance demands on manufacturers, likely escalating operational costs. The sector also faces stiff competition from low-priced imports, especially from emerging economies, which can pressure local producers and limit their capacity for innovation. Additionally, the market's progress may be slowed by the gradual adoption of advanced technologies, such as automation and digitalization, which are crucial for enhancing efficiency and productivity. Economic downturns can further complicate demand dynamics, introducing more challenges. Nevertheless, the Industrial Fabric Market holds promise for growth, fueled by advancements in textile technologies and rising demand in emerging industries such as automotive, aerospace, and construction. This responsiveness demonstrates the sector's capability to maneuver through challenges and flourish in an evolving global environment.

Key Segments of the Industrial Fabric Market

By Industrial Fabric:

- Aramid

- Polyester

- Polyamide

- Nylon

- Fiberglass

- Composite

- Kevlar

- Graphite

- Other Fiber Types

By Application:

- Conveyor Belt

- Automotive Carpet

- Flame Resistance Apparel

- Transmission Belt

- Protective Apparel

- Other Applications

By End User:

- Clothing

- Homeware

- Accessories

- Other End-Users

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America