Industrial Cooling Systems Market Analysis and Insights:

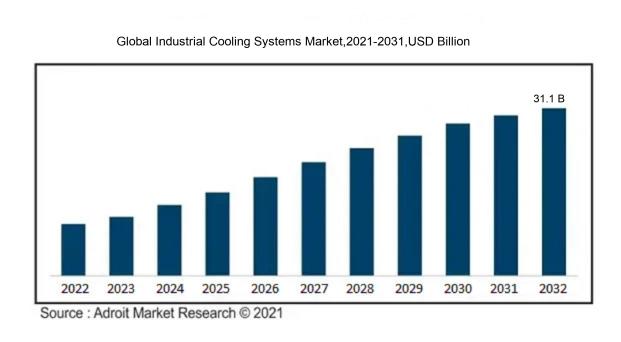

In 2023, the size of the worldwide Industrial Cooling Systems market was US$ 17.8 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 5.1 % from 2024 to 2032, reaching US$ 31.1 billion.

The market for Industrial Cooling Systems is largely influenced by the ened necessity for effective cooling mechanisms across various sectors, including manufacturing, pharmaceuticals, and data centers. This demand for energy-efficient solutions is further intensified by rigorous regulations aimed at minimizing environmental effects and optimizing operational efficiency. The rapid pace of industrialization and urban growth has resulted in increased heat production, which necessitates sophisticated cooling methods to sustain ideal operational environments. Additionally, advancements in technology, encompassing the emergence of novel cooling solutions and intelligent systems, are driving the market forward. Growing apprehensions regarding climate change, alongside the shift towards sustainable practices, are prompting industries to allocate resources toward eco-friendly cooling technologies, thereby fueling market development. The expansion of data center activities and the ened productivity of industrial machinery also play crucial roles in the escalating demand for dependable cooling systems, which are vital for maintaining efficiency and prolonging equipment lifespan.

Industrial Cooling Systems Market Definition

Industrial cooling systems are advanced configurations specifically engineered to manage and disperse surplus heat produced during manufacturing activities or the functioning of machinery. These systems play a crucial role in regulating temperatures, thereby improving operational efficiency, extending the lifespan of equipment, and ensuring safe conditions within industrial settings.

Industrial cooling systems are vital for regulating temperatures during manufacturing processes, thereby averting overheating that can result in equipment malfunctions, reduced operational efficiency, and potential safety risks. These systems are integral to maintaining product integrity and prolonging the life of machinery by effectively removing surplus heat. Furthermore, efficient cooling solutions enhance energy savings, lower operational expenses, and lessen ecological footprints. In sectors like petrochemicals, energy production, and food processing, dependable cooling mechanisms are essential for compliance with regulatory requirements and for sustaining steady production rates. In the end, their functionality significantly boosts both productivity and sustainability within industrial settings.

Industrial Cooling Systems Market Segmental Analysis:

Insights On Product Type

Air Cooling

Air cooling systems are expected to dominate the Global Industrial Cooling Systems Market as they are favored in environments where water availability is limited or where the installation of water infrastructure is not practical. These systems utilize air as the primary medium for cooling, making them easier to set up and maintain. Furthermore, air coolers are often more economical with lower initial investment costs for smaller applications. However, they may not be as efficient under high-load industrial conditions compared to their water counterparts. Their simplicity and ease of operation make air cooling solutions popular in sectors like telecommunications and data centers.

Water Cooling

The water cooling is expected to grow in the Global Industrial Cooling Systems Market due to its efficiency in large-scale applications. Industries such as power generation, oil & gas, and manufacturing require robust cooling solutions to maintain equipment performance and prolong operational life. Water cooling systems offer superior heat exchange capabilities, making them ideal for environments characterized by high thermal loads. Furthermore, advancements in technology and water recycling techniques contribute to the sustainability and cost-effectiveness of water cooling solutions, attracting more industrial users. This is anticipated to grow significantly as industries continue to prioritize efficiency and environmental responsibility.

Evaporative Cooling

This method uses the natural process of evaporation to cool air, making it an energy-efficient choice for many industries. Evaporative cooling systems can significantly reduce heat while utilizing minimal amounts of water, thus making them a preferable solution in arid regions. Their lower operational costs and eco-friendly design appeal to companies looking to minimize their carbon footprint. Nevertheless, the effectiveness of evaporative cooling can be heavily dependent on external humidity levels, which may limit its application in more humid geographical areas, necessitating careful consideration by users.

Hybrid Cooling

Hybrid cooling systems combine various cooling techniques, offering flexibility and enhanced efficiency. By integrating both air and water cooling methods, they can adapt to changing environmental conditions and user requirements. This adaptability allows for optimized performance across various applications, especially in industries with fluctuating cooling needs. However, hybrid solutions may involve higher upfront investment and more complex maintenance compared to standard systems. Their potential for energy savings and improved operational efficiency makes them an attractive, albeit less common, option for specific industrial applications.

Insights On Function

Stationary Cooling

Stationary cooling systems are expected to dominate the Global Industrial Cooling Systems Market due to their widespread application across various sectors such as manufacturing, power generation, and chemical processing. This benefits from consistent demand driven by the need for efficient temperature control for machinery, electronics, and processes that enhance operational efficiency and product quality. With increasing industrial activities and a focus on energy efficiency, stationary cooling solutions, including chillers, cooling towers, and heat exchangers, are pivotal in maintaining optimal working conditions. This factor, combined with growing regulatory pressure for environmental sustainability, positions stationary cooling as a critical element that will likely lead market growth in the coming years.

Transport Cooling

Transport cooling systems, while important, typically serve a more niche market compared to stationary cooling. They are primarily utilized in the transportation of perishable goods, including food and pharmaceuticals, requiring temperature regulation during transit. The rise in global trade and a growing emphasis on food safety drive this 's demand. However, factors such as fluctuating fuel prices and competition from stationary solutions may limit its overall market share compared to stationary cooling options. Innovations in transport technologies and increased efficiency standards can help bolster this, but its growth trajectory remains conservative in the larger industrial cooling landscape.

Other Considerations

In the transport cooling category, refrigerated trucks and containers represent a significant aspect. These vehicles are essential in ensuring the freshness of perishable goods across supply chains. Regulatory standards for food safety necessitate robust and efficient cooling methods, leading to advancements in insulation and mobile refrigeration systems. However, the financial implications of maintaining and operating these specialized vehicles can be challenging for some businesses, impacting the 's broader acceptance and growth within the cooling market.

Insights On End User

Pharmaceuticals

The Pharmaceuticals sector is expected to dominate the Global Industrial Cooling Systems market primarily due to the ened demand for temperature-controlled environments to maintain drug efficacy and stability. As the pharmaceutical industry continues to expand, driven by the development of innovative biologics and vaccine production, the need for advanced cooling systems becomes critical. These cooling solutions are essential for ensuring the integrity and shelf-life of sensitive pharmaceuticals, especially in the context of temperature fluctuations and regulatory requirements. With increasing investments in pharmaceutical research and production facilities, the demand for efficient cooling systems tailored to this industry is set to rise significantly, solidifying its dominance in the market.

Food and Beverage

The Food and Beverage industry relies heavily on cooling systems for various processes such as preservation, fermentation, and storage. There is a growing emphasis on food safety and quality standards, which necessitate advanced cooling solutions to manage temperature-sensitive food products. Additionally, the increasing consumer demand for fresh, healthy food options drives the need for efficient cooling technologies in processing and distribution. As this industry evolves with trends such as the rise of plant-based foods and innovative food processing methods, the importance of robust cooling systems will remain a priority.

Chemical

In the Chemical sector, cooling systems play a pivotal role in managing exothermic reactions and maintaining optimal processing temperatures. The growing complexity of chemical manufacturing processes, coupled with stricter regulatory environments concerning environmental sustainability and safety, increases the requirement for efficient industrial cooling. Furthermore, as the development of new chemical products expands, the need for reliable cooling systems to ensure process stability and product quality becomes vital. The sustainability initiatives pursued by leading chemical manufacturers augment the necessity for improved cooling solutions to lower energy consumption and mitigate carbon footprints.

Utility and Power

The Utility and Power sector significantly depends on cooling systems for thermal power generation and renewable energy applications, particularly solar thermal and geothermal energy. As global energy demands rise and focus shifts toward cleaner energy solutions, innovative cooling technologies are essential for enhancing overall efficiency and reducing waste in energy production processes. Aging power infrastructure is also driving investments in upgrading cooling systems to improve operational performance while adhering to environmental regulations. Consequently, this sector is expected to see a substantial need for advanced cooling technology in the coming years.

Oil and Gas

In the Oil and Gas industry, cooling systems are critical for several operations, including refining and production. The need for thermal management arises from equipment that operates at high temperatures and pressures, which can present safety hazards and efficiency concerns. With ongoing efforts to enhance operational efficiency and mitigate environmental impacts, the demand for advanced cooling solutions in oil extraction and refining processes is likely to grow. Additionally, the industry's focus on adopting digital technologies and innovations further emphasizes the importance of efficient cooling to ensure seamless operations and adherence to strict safety standards.

Others

The 'Others' category encompasses various industries and applications that utilize cooling systems, such as mining, metal processing, and waste management. Although this does not dominate the market, its growth is driven by the need for cooling solutions in diverse industrial applications. For example, mining operations require cooling to maintain equipment efficiency and worker safety in high-temperature environments. As various industries recognize the importance of temperature regulation in enhancing process efficiency, this sector will continue to grow, contributing to the overall demand for industrial cooling systems.

Global Industrial Cooling Systems Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Industrial Cooling Systems market due to rapid industrialization and urbanization driving demand for efficient cooling solutions. Countries like China, India, and Japan are experiencing significant growth in sectors like manufacturing, IT, and energy, increasing the need for cooling systems to manage heat generated by extensive machinery and processes. Additionally, government initiatives aimed at promoting energy efficiency and sustainable industrial practices are propelling the market further. As a result, the presence of numerous manufacturing facilities and growing investment in infrastructure solidifies Asia Pacific's leading position in the global industrial cooling landscape.

North America

North America is a strong contender in the industrial cooling systems market, driven by advanced technology and significant investments in infrastructure. The region's focus on sustainability and energy efficiency has led to increased adoption of innovative cooling solutions, particularly in industries such as pharmaceuticals, food and beverage, and electronics. The presence of players, robust regulatory frameworks, and a strong emphasis on research and development also contribute to North America's growth potential. However, despite its strength, North America will likely play a secondary role compared to the rapid advancements seen in the Asia Pacific.

Europe

Europe remains a significant player in the industrial cooling systems market, driven by stringent environmental regulations and a strong focus on sustainability. Countries like Germany and the UK are at the forefront of adopting energy-efficient cooling technologies, propelled by governmental initiatives aimed at reducing carbon footprints. The presence of well-established manufacturing sectors, especially in automotive and pharmaceuticals, fuels the demand for advanced cooling solutions. However, growth in this region may be tempered by economic uncertainties and competition from more rapidly developing markets, limiting Europe’s ability to lead compared to the Asia Pacific.

Latin America

Latin America shows potential in the industrial cooling systems market; however, it faces challenges such as economic volatility and infrastructural constraints. The region is witnessing growth in industries such as mining and agriculture, which can benefit from improved cooling technologies, especially in countries like Brazil and Mexico. Efforts to boost manufacturing may lead to a rising demand for cooling systems, but overall market penetration remains lower than in North America, Europe, or Asia Pacific. As economies stabilize and infrastructure improves, the region might carve out a more substantial market share in the future.

Middle East & Africa

The Middle East & Africa present a nascent market for industrial cooling systems largely reliant on sectors like oil and gas and growing manufacturing. Rapid urbanization and increasing industrial activities in countries such as the United Arab Emirates and South Africa create opportunities for cooling solutions. However, challenges like high energy costs and inconsistent regulatory frameworks can hinder market growth. While potential exists, the region currently lacks the level of maturity found in the Asia Pacific and North America, making it less dominating in the global context of industrial cooling systems.

Industrial Cooling Systems Market Competitive Landscape:

Prominent entities in the worldwide Industrial Cooling Systems sector foster innovation by creating effective and eco-friendly cooling solutions. They also engage in competitive strategies to increase their market share, emphasizing alliances and broadening their international reach. These players are essential in tackling issues related to energy usage and environmental sustainability, all while catering to the varied requirements of multiple industries.

Prominent entities within the Industrial Cooling Systems sector comprise Alfa Laval, Johnson Controls International plc, Thermal Care, Inc., SPX Cooling Technologies, Evapco, Inc., Trane Technologies plc, Carrier Global Corporation, Lennox International Inc., Baltimore Air Coil Company, Daikin Industries, Ltd., Siemens AG, Mitsubishi Heavy Industries, Ltd., Ecolab Inc., and GEA Group AG.

Global Industrial Cooling Systems Market COVID-19 Impact and Market Status:

The outbreak of COVID-19 profoundly impacted the Global Industrial Cooling Systems market by causing disruptions in supply chains and changing demand dynamics, which resulted in postponements of installation and maintenance processes.

The COVID-19 pandemic profoundly influenced the market for industrial cooling systems, presenting both obstacles and prospects. During the extensive lockdowns and interruptions to manufacturing, the demand for cooling solutions experienced a temporary downturn as numerous industries reduced their output or ceased operations entirely. Nonetheless, as nations began their recovery and adaptation processes, a significant transition emerged towards energy-efficient and sustainable cooling options. This shift was propelled by new regulations and a ened awareness of environmental concerns. Moreover, the increase in remote work and shifting operational focuses compelled businesses to reassess their cooling requirements, leading to a growing interest in innovative technologies such as modular and portable cooling systems. The pandemic also underscored the critical role of effective cooling in healthcare settings, prompting investments in upgraded systems. As the market begins to stabilize and economic activities revive, emphasis is expected to continue on energy efficiency and sustainability, thus influencing the trajectory of industrial cooling systems moving forward.

Latest Trends and Innovation in The Global Industrial Cooling Systems Market:

- In May 2023, Carrier Global Corporation announced the acquisition of the company B away Air, which specializes in innovative HVAC solutions aimed at enhancing energy efficiency in industrial cooling systems.

- In April 2023, Trane Technologies launched a new line of eco-friendly chillers that utilize low global warming potential (GWP) refrigerants, showcasing a significant technological innovation in sustainable cooling systems.

- In March 2023, Daikin Industries, Ltd. expanded its product portfolio by introducing advanced heat pump technology designed for industrial applications, which improves temperature control and energy efficiency.

- In February 2023, Johnson Controls International plc unveiled a cutting-edge control platform for HVAC systems that integrates AI and IoT technologies, allowing for enhanced monitoring and predictive maintenance of industrial cooling systems.

- In January 2023, Liebherr Group completed the acquisition of the Italian cooling system manufacturer, J.P. Refrigeration, to expand its influence in the European industrial cooling market and enhance its product offerings.

- In December 2022, Emerson Electric Co. achieved a significant milestone by developing a new predictive maintenance tool that uses machine learning to minimize downtime in industrial cooling systems, representing an important advancement in operational efficiency.

- In November 2022, Mitsubishi Electric Corporation introduced a new series of high-efficiency cooling units, marking a commitment to innovation within the industrial cooling and aiming to reduce energy consumption significantly.

- In October 2022, Flowserve Corporation announced a strategic partnership with Siemens AG to develop next-generation cooling technologies focusing on reducing environmental impact while maintaining performance in industrial applications.

- In September 2022, Siemens acquired a controlling stake in the software company, Ultrasonic Industrial, which specializes in real-time monitoring solutions for industrial cooling systems, enhancing data-driven decision-making in the market.

- In August 2022, GEA Group made headlines with the launch of a new modular cooling system designed for large-scale industrial applications, emphasizing energy savings and sustainability.

Industrial Cooling Systems Market Growth Factors:

Critical drivers for the Industrial Cooling Systems sector encompass a rising need for energy efficiency, rigorous environmental regulations, and innovations in cooling technology.

The Industrial Cooling Systems sector is witnessing significant progress due to various influential factors. A rising need for effective cooling mechanisms across diverse industries, such as manufacturing, energy, and chemical processing, is propelling the growth of the market. As companies increasingly emphasize energy efficiency and sustainability, the use of innovative cooling technologies, including evaporative cooling and absorption chillers, is becoming more prevalent. Additionally, mounting regulatory pressures aimed at minimizing energy consumption and environmental footprints are motivating organizations to enhance their cooling systems to meet strict regulations.

The advent of industrial automation and smart technology is another critical factor, as these innovations lead to optimized cooling operations and improved system oversight. The expanding food and beverage sector, where precise temperature management is crucial, is also significantly boosting market demand. Furthermore, investments in infrastructure and the growth of data centers—necessary for maintaining operational efficacy—require reliable cooling solutions, adding to the market’s momentum. Finally, the increasing preference for modular and portable cooling systems is attracting businesses that desire adaptability and scalability in their operations, further contributing to market expansion. Collectively, these elements establish a promising outlook for the Industrial Cooling Systems Market.

Industrial Cooling Systems Market Restaining Factors:

The primary challenges facing the Industrial Cooling Systems market are the substantial initial capital expenditures and rigorous environmental regulations.

The market for industrial cooling systems is confronted with numerous obstacles that could hinder its expansion. A primary concern is the substantial upfront investment and ongoing expenses linked with cutting-edge cooling technologies, which may discourage small and medium-sized enterprises from implementing these systems. Additionally, stringent environmental regulations regarding energy use and emissions can complicate compliance measures, resulting in ened operational challenges for manufacturers.

Furthermore, issues related to the reliability and maintenance of cooling systems are critical, as subpar systems can cause production halts and elevate energy costs. The effectiveness of certain cooling technologies is also influenced by geographic constraints and varying climate conditions, which may render them less effective or economical in particular locations. Furthermore, the increasing emphasis on environmentally friendly solutions may cause traditional cooling methods to become outdated unless they are adapted in a timely manner.

Despite these hurdles, the market is ripe with opportunities for innovation and advancement, as progress in cooling technologies and sustainable practices is poised to generate new prospects that stimulate growth and enhance efficiency. With industries placing greater importance on energy-saving solutions, the demand for advanced cooling systems is expected to rise, ultimately fostering a more sustainable future in industrial cooling.

Segments of the Industrial Cooling Systems Market

By Product Type

- Air Cooling

- Evaporative Cooling

- Water Cooling

- Hybrid Cooling

By Function

- Stationary Cooling

- Transport Cooling

By End User

- Food and Beverage

- Chemical

- Pharmaceuticals

- Utility and Power

- Oil and Gas

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America