Industrial Automation Market Analysis and Insights:

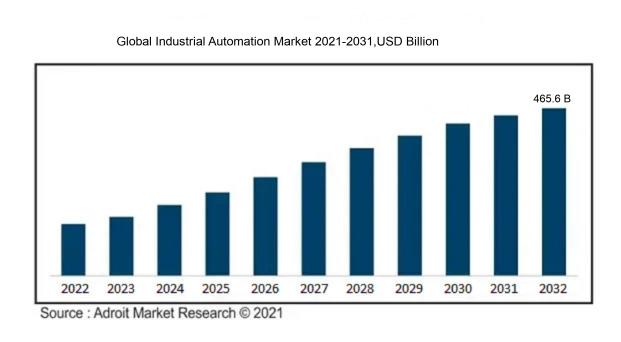

In 2023, the size of the worldwide Industrial Automation market was US$212.8 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 8.97% from 2024 to 2032, reaching US$ 465.6 billion.

The industrial automation sector is largely propelled by several critical elements, prominently the drive for enhanced operational efficiency and ened productivity within manufacturing systems. Companies are increasingly turning to automation technologies to decrease human error, lower labor expenses, and improve product quality. Meanwhile, swift advancements in robotics, artificial intelligence, and the Internet of Things (IoT) have catalyzed this movement, facilitating real-time data analysis and more informed decision-making processes. The rising expectation for bespoke products and adaptable manufacturing lines further compels enterprises to integrate automated solutions. Compliance with safety and environmental regulations also necessitates the modernization of industry practices. In addition, the ongoing transition toward Industry 4.0 and various digital transformation projects stimulate investments in automation technologies. The COVID-19 pandemic has underscored the importance of having resilient and contactless operations, thus amplifying the urgency for industries to embrace automation to meet evolving challenges.

Industrial Automation Market Definition

The industrial automation sector includes a range of technologies and systems designed to optimize manufacturing operations through the use of control systems like computers and robotics, facilitating equipment and machinery operation with little to no human involvement. The primary objectives of this industry are to boost efficiency, decrease labor expenditures, and improve product quality across numerous sectors.

The market for industrial automation plays a crucial role in boosting operational efficiency and productivity in multiple sectors by reducing the likelihood of human errors and streamlining processes. By incorporating cutting-edge technologies like robotics, artificial intelligence, and the Internet of Things (IoT), enterprises can attain greater accuracy, lower production expenses, and enhanced safety measures. Additionally, this market supports real-time data analytics and intelligent manufacturing strategies, allowing organizations to swiftly respond to fluctuations in the market and the evolving preferences of consumers. Moreover, as industries pursue sustainable practices, automation is instrumental in decreasing waste and energy usage, thereby becoming vital for maintaining a competitive edge in the modern economy.

Industrial Automation Market Segmental Analysis:

Insights On Key Component Type

Hardware

The hardware component is expected to dominate the Global Industrial Automation Market due to its critical role in enabling physical processes within manufacturing and industrial environments. Components like sensors, programmable logic controllers (PLCs), and robotic systems are pivotal for real-time monitoring and control, leading to higher productivity, efficiency, and safety in operations. Additionally, the increasing adoption of IoT devices and smart machinery in various sectors contributes to the rising demand for hardware. Manufacturers are investing significantly in advanced hardware solutions to optimize processes, reduce downtime, and improve operational performance, thus positioning this category as the most influential within the market.

Software

The software category is increasingly important in the industrial automation landscape, providing the necessary intelligence to enhance operational capabilities. Software solutions such as Manufacturing Execution Systems (MES), advanced data analytics, and machine learning algorithms enable businesses to monitor performance and make data-driven decisions effectively. As industries pursue digital transformation, the demand for sophisticated software tools to integrate and manage smart hardware components is gaining traction. This trend results in an ongoing evolution of software offerings tailored to meet industry-specific needs, although it currently trails behind the hardware in terms of market dominance.

Service

The service component within the industrial automation market encompasses consultation, maintenance, and support services essential for the deployment and sustainability of automation systems. As industries increasingly transition to automated processes, the need for reliable services ensuring system uptime and efficiency grows in importance. While services are vital for maximizing the effectiveness and longevity of deployed hardware and software, their market share reflects ongoing reliance on hardware technologies. Despite the growth potential driven by industry requirements for regular updates and training for operators, the service sector faces stiff competition from rapid advancements in hardware and software technologies.

Insights On Key Control System

SCADA

Supervisory Control and Data Acquisition (SCADA) systems facilitate real-time data collection and control in remote operations and is expected to dominate the Global Industrial Automation Market. SCADA is used extensively in utilities, water treatment, and manufacturing industries, where continuous monitoring and automation are vital. The increasing emphasis on smart grids and real-time monitoring solutions boosts SCADA's relevance. However, it faces competition from the more customizable and adaptable PLC systems. Despite its importance in specific applications, SCADA is not expected to lead the market due to the growing preference for PLC technology that offers enhanced integration with modern industrial solutions.

PLC

The Programmable Logic Controller (PLC) market is expected to expand rapidly in the Global Industrial Automation Market due to its unparalleled flexibility, reliability, and scalability in various industrial applications. PLCs provide real-time processing capabilities, enabling efficient management of complex automation systems and integration with other technologies. Industries such as manufacturing, automotive, and food processing increasingly rely on PLCs for their ability to withstand harsh environments and their cost-effectiveness. Additionally, advancements in IoT and Industry 4.0 initiatives further emphasize the necessity for flexible control systems, placing PLCs at the forefront of this growing sector.

DCS

Distributed Control Systems (DCS) play a crucial role in managing large-scale industrial processes. They offer enhanced control and monitoring capabilities, essential for industries like oil & gas, chemicals, and power generation. With a focus on process automation, DCS ensures operational efficiency through centralized control and analytics. Its architecture allows for seamless integration of various control modules, enabling better data analysis and decision-making. Although it may not dominate like PLCs, the DCS market continues to hold significant value due to its robust design and reliability in complex environments.

Others

The “Others” category encompasses various control technologies not classified as DCS, PLC, or SCADA, which includes technologies such as safety instrumented systems and advanced regulatory controllers. These systems are increasingly important in applications requiring specialized parameters or integrated safety features. However, while they contribute to certain niche markets within industrial automation, they do not possess the comprehensive capabilities or market share that PLC, DCS, and SCADA offer. As such, this category remains a smaller, with limited growth compared to the leading control systems.

Global Industrial Automation Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Industrial Automation Market due to rapid industrialization, a growing manufacturing sector, and significant investments in automation technologies. Countries like China, Japan, and India are aggressively adopting automation to enhance productivity, improve efficiency, and maintain competitive advantage on a global scale. Moreover, the region benefits from a robust supply chain, availability of skilled labor, and favorable government initiatives promoting technological advancements. The increasing demand for smart manufacturing and the rise of the Internet of Things (IoT) are also pushing industries in this region to invest more in automation solutions, further solidifying its leading position in the market.

North America

North America holds a significant position in the Global Industrial Automation Market, primarily driven by the presence of advanced technology companies and a highly developed manufacturing infrastructure. The U.S. leads in automation adoption across industries such as automotive, electronics, and food and beverage, focusing on error reduction and safety improvements. Furthermore, government initiatives and investments in research and development are expected to fuel growth. With a growing emphasis on smart factories, the automation market in North America continues to evolve rapidly but is currently outpaced by the potential growth seen in the Asia Pacific region.

Europe

Europe remains a strong player in the Global Industrial Automation Market as manufacturers strive to increase efficiency and reduce operational costs. Countries such as Germany, with its strong engineering heritage and a focus on Industry 4.0 initiatives, are leading the charge in automation technologies like robotics and AI. The increasing regulatory pressure related to sustainability and productivity improvements is driving investment in automation solutions. While Europe has well-established industrial bases, its growth is hampered compared to the rapidly expanding Asia Pacific market, making it difficult to outpace the advancements observed in that region.

Latin America

Latin America exhibits a growing interest in industrial automation but currently lags behind more developed regions. Nations like Brazil and Mexico are beginning to embrace automation technologies to modernize their manufacturing processes and improve operational efficiency. Economic challenges and political instability have hindered growth; however, sectors such as automotive and consumer goods are gradually adopting automation solutions. As awareness and investment in automation rise, the region is expected to experience steady growth, yet it remains far from dominating the Global Industrial Automation Market when compared to Asia Pacific and other regions.

Middle East & Africa

The Middle East and Africa show potential in the Global Industrial Automation Market but face challenges due to infrastructural and economic constraints. Countries like the UAE are investing in smart factories and automation to diversify their economies away from oil dependency. Nonetheless, many nations in this region have limited technological infrastructure, which hampers rapid adoption. As businesses in sectors like oil, manufacturing, and food processing begin to realize the importance of automation, growth may occur, yet the region currently remains behind other regions, particularly Asia Pacific, in terms of market dominance.

Industrial Automation Market Competitive Landscape:

Leading entities in the Global Industrial Automation Market, including Siemens, Honeywell, and Rockwell Automation, are at the forefront of innovation by leveraging cutting-edge technologies and solutions. Their initiatives aim to boost operational efficiency and productivity within diverse sectors. Emphasizing the integration of connectivity, data analytics, and automation, they strive to address the changing needs of manufacturing and enhance their competitive edge.

Prominent participants in the Industrial Automation Sector consist of Siemens AG, Rockwell Automation, Inc., Schneider Electric SE, ABB Ltd., Honeywell International Inc., Mitsubishi Electric Corporation, Emerson Electric Co., Yokogawa Electric Corporation, Bosch Rexroth AG, KUKA AG, FANUC Corporation, Omron Corporation, General Electric Company, Endress+Hauser AG, and Advantech Co., Ltd.

Global Industrial Automation Market COVID-19 Impact and Market Status:

The Covid-19 pandemic accelerated the integration of industrial automation technologies as manufacturers aimed to improve efficiency and lessen dependence on human labor in response to workforce interruptions.

The COVID-19 pandemic had a profound effect on the landscape of industrial automation, underscoring the urgent need for improved efficiency and safety in operations. A multitude of industries encountered significant interruptions in their supply chains and workforce availability, which led to ened investments in automation technologies aimed at addressing these hurdles. In an effort to reduce human interaction and maintain operational continuity, there was a substantial uptick in the integration of robotics, Internet of Things (IoT), and artificial intelligence (AI) solutions. The crisis catalyzed a shift towards digital transformation, encouraging organizations to adopt automation for remote oversight and management of their processes. Analysts observed a surge in the demand for automation across various industries, including manufacturing, logistics, and healthcare, propelled by the imperative to boost productivity and retain a competitive edge in an evolving economic environment. As organizations move towards recovery, there is an expectation that the emphasis will continue to be on harnessing automation to create more robust infrastructures, fostering sustainable growth within the industrial automation sector.

Latest Trends and Innovation in The Global Industrial Automation Market:

- In December 2021, Siemens announced the acquisition of the electrical and automation business of C&S Electric, enhancing Siemens' product portfolio in industrial automation and electrification in India.

- In March 2022, Schneider Electric launched its EcoStruxure Automation Expert software, leveraging AI and IoT technologies to optimize industrial operations and improve process efficiency.

- In July 2022, Rockwell Automation completed the acquisition of Fiix Software, a cloud-based maintenance software provider, to enhance its asset management solutions within the industrial automation sector.

- In October 2022, ABB introduced its Ability Genix Industrial Analytics and AI suite, aiming to empower digital transformation in industry by providing enhanced data analysis capabilities.

- In February 2023, Honeywell announced a partnership with Microsoft to integrate Honeywell's industrial automation solutions with Microsoft Azure, aiming to enhance cloud-based industrial operations.

- In June 2023, Emerson acquired the industrial software company, Nozomi Networks, to bolster its portfolio in cybersecurity and enhance the safety and efficiency of industrial operations.

- In September 2023, Siemens unveiled a partnership with Amazon Web Services (AWS) to provide new cloud-based automation solutions focused on accelerating the digital transformation for manufacturers.

Industrial Automation Market Growth Factors:

The expansion of the Industrial Automation sector is propelled by the rising need for enhanced operational efficiency, technological innovations, and a ened focus on safety and productivity within manufacturing operations.

The industrial automation sector is witnessing remarkable growth, fueled by several pivotal elements. Primarily, the swift integration of Industry 4.0 concepts and intelligent manufacturing solutions is boosting operational effectiveness, enabling organizations to refine their production methods and lower expenses. Moreover, there is a rising need for automation across multiple industries, including automotive, electronics, and pharmaceuticals, as businesses strive to enhance safety and product quality while reducing the likelihood of human error.

The evolution of technologies such as robotics, artificial intelligence, and the Internet of Things (IoT) is also paving the way for the creation of advanced automation options, attracting further investment into the market. Additionally, an increasing focus on sustainability is prompting organizations to adopt automated systems that promote resource conservation and energy efficiency.

The demand for real-time data insights and process supervision is another driver of automated system integration in manufacturing environments, leading to improved decision-making and productivity gains. Finally, the global trend toward workforce optimization, in response to labor shortages and rising labor costs, is encouraging companies to turn to automation technologies, significantly propelling the growth of the industrial automation market. Together, these dynamics are reshaping the landscape and fostering continuous innovation and investment across various sectors in automation technologies.

Industrial Automation Market Restaining Factors:

Critical challenges in the Industrial Automation sector involve substantial upfront capital expenditures and apprehensions regarding potential cybersecurity risks.

The growth of the Industrial Automation Market is hindered by several obstacles. One major challenge is the substantial upfront investment required for automation technologies, such as robotics and sophisticated software, which can dissuade small and medium enterprises from embracing these innovations. Additionally, the difficulty of seamlessly integrating new automated systems with pre-existing infrastructures presents significant hurdles, often necessitating specialized skills and training that can result in operational disruptions during the transition process.

Concerns about cybersecurity are also prevalent, as ened connectivity may expose industrial systems to potential risks. Moreover, regulatory complexities and inconsistent compliance requirements across different regions can further complicate the adoption of automation solutions. Finally, a potential shortage of skilled workforce in automation technologies may restrict companies' capacity to fully utilize these advanced systems.

Ongoing technological advancements in automation, coupled with a growing demand for enhanced efficiency and productivity across various sectors, are creating pathways for innovations that could address these challenges. This bodes well for a positive future for the Industrial Automation Market.

Key Segments of the Industrial Automation Market

By Component Type

- Hardware

- Software

- Service

By Control System

- DCS (Distributed Control System)

- PLC (Programmable Logic Controller)

- SCADA (Supervisory Control and Data Acquisition)

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America