Market Analysis and Insights:

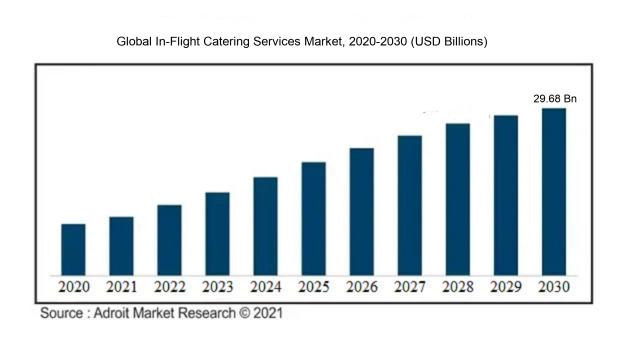

The market for Global In-Flight Catering Services was estimated to be worth USD 13.73 billion in 2021, and from 2022 to 2030, it is anticipated to grow at a CAGR of 9.26%, with an expected value of USD 29.68 billion in 2030.

The progression of the In-Flight Catering Services Market is steered by various factors. Chiefly, the consistent advancement of the aviation sector serves as a significant stimulant for market demand. As the number of air travelers continues to rise, there is a corresponding increase in the need for in-flight catering services. Furthermore, the augmented disposable income of individuals and the escalating trend of frequent travel also contribute to the market's expansion. Additionally, the surging preference for nutritious and premium food choices among passengers has prompted airlines to focus on delivering a wide range of high-quality in-flight catering services. The proliferation of international tourism and the upsurge in corporate travel have further bolstered market growth. The integration of cutting-edge technologies like intelligent food ordering systems and personalized meal selections has added a new dimension to the market outlook. The market landscape is fiercely competitive, compelling catering service providers to prioritize innovation, menu diversification, and customer contentment to secure a competitive advantage. Lastly, the escalating international trade and globalization have paved the way for catering service providers to form alliances with airlines and extend their services globally, thereby propelling the expansion of the in-flight catering services market.

In-Flight Catering Services Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 29.68 billion |

| Growth Rate | CAGR of 9.26% during 2022-2030 |

| Segment Covered | By Flight Type, By Aircraft Class, By Catering Type, By Airlines, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Gate Gourmet, LSG Sky Chefs, DO & CO, Flying Food Group, Newrest International Group, SATS Ltd., Air Culinaire Worldwide, Journey Group plc, dnata, Cathay Pacific Catering Services, and Emirates Flight Catering. |

Market Definition

The offering of food and drinks to passengers during a flight, known as in-flight catering services, aims to provide a delightful and fulfilling dining experience. Tailored to accommodate passengers' dietary needs and restrictions, these services uphold rigorous standards of cleanliness and excellence.

In-flight dining services are essential components of the airline industry, providing passengers with a convenient and enjoyable culinary experience while in transit. These services are imperative for a variety of reasons. Firstly, they significantly elevate the overall customer experience and satisfaction levels, as the quality of food and beverages is pivotal in ensuring a comfortable and pleasant air travel experience. Passengers greatly value having access to an array of culinary choices that cater to their dietary needs and preferences. Secondly, in-flight dining services play a pivotal role in shaping the brand image and reputation of airlines. By offering well-crafted, diverse, and delectable dining options, airlines can effectively distinguish themselves from competitors and foster a positive perception among passengers. Furthermore, these services also serve as a source of revenue for airlines through the sale of food and beverages, thereby helping to offset operational costs. By prioritizing the enhancement of the quality and variety of their dining offerings, airlines can effectively attract more passengers and improve their financial performance. Overall, in-flight dining services are critical as they not only boost customer satisfaction and fortify brand perception but also contribute to the economic prosperity of airlines.

Key Market Segmentation:

Insights On Key Flight Type

Full-Service Carrier

The full-service carrier flight type is expected to dominate the Global In-Flight Catering Services Market. Full-service carriers typically offer a higher level of service and amenities to passengers, including a complete range of in-flight catering options. These carriers cater to a broad range of customers and often provide meals as part of the overall travel experience. With a focus on enhancing customer satisfaction, full-service carriers prioritize the quality and variety of their in-flight catering offerings. As a result, they are likely to have a significant share of the market.

Low-Cost Carrier

Although not expected to dominate, the low-cost carrier flight type still holds a significant portion of the Global In-Flight Catering Services Market. Low-cost carriers often follow a no-frills approach, offering limited in-flight services at lower prices. While these carriers may not provide meals as part of their standard offerings, they do offer onboard snacks and beverages for purchase, which can still generate revenue. The overall market share of low-cost carriers in in-flight catering services is likely to be substantial, given their increasing popularity among budget-conscious travelers.

Other

The other category refers to carriers that do not fall specifically into the full-service or low-cost categories. This part includes niche carriers, regional airlines, and charter flights. While they may not have the same level of dominance as full-service carriers, this part still contributes to the Global In-Flight Catering Services Market. These carriers cater to specialized markets and may offer customized catering options based on passenger preferences or charter specifications. Although the overall market share of this part may be relatively smaller, it plays a significant role in meeting the unique catering needs of specific customer s.

Insights On Key Aircraft Class

Premium Economy Class

Premium Economy Class is expected to dominate the Global In-Flight Catering Services market. It is a part that sits between Business Class and Economy Class, offering passengers enhanced comfort and services at a more affordable price compared to First and Business Class. With the rise in demand for air travel and increasing preferences for value-added services, the popularity of Premium Economy Class has been steadily growing. This caters to passengers who are willing to pay slightly more for additional amenities such as wider seats, extra legroom, upgraded meals, and priority boarding. Airlines are increasingly introducing Premium Economy options to meet the needs of this expanding market , leading to a higher demand for in-flight catering services.

First Class

While Premium Economy Class is expected to dominate the Global In-Flight Catering Services market, First Class remains a significant aircraft class for certain airlines and routes. First Class caters to the most discerning passengers who desire the utmost luxury and personalized services during their flight. Although the number of First Class seats on aircraft is limited, the exclusivity and high price point attached to this part contribute to its importance in the market. First Class passengers often expect gourmet meals, a wide selection of fine wines, and an exceptional dining experience overall. Therefore, even though First Class may not dominate the overall market, it serves as a crucial offering for airlines targeting premium and luxury travelers.

Business Class

Business Class, another sector within the Aircraft Class category, is favored by corporate and frequent travelers seeking a balance between comfort and cost. While it may not dominate the Global In-Flight Catering Services market, Business Class holds a significant market share due to its popularity among business travelers. These passengers often require efficient and convenient dining options that can be tailored to their schedules and preferences. Business Class meals typically feature a diverse range of international cuisines, premium beverages, and high-quality presentation. As corporate travel rebounds and the demand for premium services grows, the Business Class part is expected to experience steady growth in the in-flight catering market.

Economy Class

Economy Class is the largest aircraft class in terms of passenger volume but may have a relatively lower impact on the overall Global In-Flight Catering Services market compared to Premium Economy, First, or Business Class. Passengers traveling in Economy Class prioritize affordability and practicality over luxury, which typically translates to standardized and cost-effective meal options. While airlines strive to enhance the in-flight dining experience for Economy Class passengers, such as offering pre-order meal options or introducing new menu choices, the sheer volume of passengers and the need for efficient service may limit the level of customization and variety available in this part. Nonetheless, due to its significant passenger numbers, Economy Class still represents a substantial market share in the in-flight catering industry.

Insights On Key Catering Type

Meals

The Meals is expected to dominate the Global In-Flight Catering Services Market. This can be attributed to the fact that meals are the primary catering type served during flights and are often included in the ticket price for passengers. Airlines strive to provide a variety of meal options that cater to different dietary preferences and cultural needs of their passengers. The Meals has a significant influence on the overall customer experience and satisfaction during flights, making it a crucial aspect of in-flight catering services.

Bakery & Confectionary

The Bakery & Confectionary catering type, while not expected to dominate the Global In-Flight Catering Services Market, plays a significant role in enhancing the overall in-flight dining experience. This part caters to passengers' cravings for bakery items such as bread, pastries, and desserts. Airlines often offer a selection of fresh bakery products or pre-packaged options to provide a touch of indulgence during the flight. While not the dominating part, Bakery & Confectionary adds an essential element of comfort and enjoyment to the overall in-flight catering experience.

Beverages

The Beverages catering type, although not expected to dominate the Global In-Flight Catering Services Market, is a vital component of in-flight service. This part includes a range of beverages, such as water, soft drinks, juices, tea, coffee, and alcoholic beverages. Airlines aim to provide a variety of options to meet passengers' refreshment needs and preferences. By offering a selection of beverages, airlines ensure that passengers are adequately hydrated and have a satisfying in-flight experience. While not the dominating part, Beverages contribute significantly to the overall in-flight catering services.

Others

The Others category encompasses a range of catering types that do not fall specifically into the Bakery & Confectionary, Meals, or Beverages categories. It may include items such as snacks, special dietary meals (e.g., vegetarian, gluten-free), and customized menus for premium cabin classes. While the specific offerings may vary depending on the airline and the target audience, the Others part serves to address specific passenger requirements and preferences. Although not expected to dominate the Global In-Flight Catering Services Market, the Others part caters to niche demands and provides additional options for passengers with specific dietary needs or tastes.

Insights On Key Airlines

Large Airlines

Large airlines are expected to dominate the Global In-Flight Catering Services Market. This is primarily due to their extensive route networks, high passenger volumes, and the ability to offer a wide range of in-flight catering options to meet diverse customer preferences. Large airlines have the resources and infrastructure to provide a variety of meals, beverages, and snacks, catering to different dietary requirements and cultural preferences. With their long-haul flights and numerous international destinations, large airlines can also showcase global cuisines and offer premium dining experiences. Additionally, large airlines often have partnerships with renowned chefs and restaurants, further enhancing the quality and variety of their in-flight catering services.

Medium Airlines

Medium airlines, although not expected to dominate the market, still play a significant role in the Global In-Flight Catering Services Market. They cater to a sizeable passenger base, operating in both domestic and regional markets. While they may not have the extensive route networks and passenger volumes of large airlines, medium airlines focus on providing efficient and satisfactory in-flight catering services to their passengers. They offer a range of meals and snacks, keeping in mind affordability and regional preferences. Medium airlines strive to maintain a balance between cost-effectiveness and customer satisfaction, ensuring that their in-flight catering services meet the expectations of their passengers.

Small Airlines

Small airlines, while not the dominant force, have a niche market in the Global In-Flight Catering Services Market. These airlines typically operate in specific regions or serve niche markets, offering unique experiences to their passengers. Small airlines often prioritize personalized service and exclusivity, aiming to differentiate themselves from larger competitors. In terms of in-flight catering services, small airlines may focus on specialty cuisines, upscale dining options, or unique dining experiences to attract customers. While their passenger volumes may be lower compared to large and medium airlines, small airlines capitalize on their ability to provide tailored and memorable in-flight dining experiences to cater to specific customer preferences.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the Global In-Flight Catering Services market. This region is home to rapidly expanding economies such as China and India, which have witnessed significant growth in air travel and tourism. The rising disposable incomes and changing lifestyles of the middle-class population in these countries have led to an increasing demand for air travel and subsequently, in-flight catering services. Moreover, countries like Singapore, Thailand, and Malaysia are major aviation hubs in the region, attracting a large number of international passengers. The presence of numerous low-cost carriers further fueled the demand for in-flight catering services. Additionally, the improving standard of living and the rising preference for high-quality food and comfort during air travel are also contributing to the growth of the in-flight catering market in Asia Pacific.

North America

While Asia Pacific is expected to dominate the global in-flight catering services market, North America holds a significant share in the industry. The region has a well-developed aviation industry and a large number of domestic and international airlines. The United States, in particular, is a major market for in-flight catering services due to its large number of air travelers. Moreover, the presence of global airlines and a high level of passenger spending on air travel contribute to the growth of the in-flight catering services market in North America.

Europe

Europe is another prominent market for in-flight catering services. The region has a well-established aviation industry and is home to major international airports such as London Heathrow, Frankfurt, and Paris Charles de Gaulle. Moreover, Europe has a strong tourism sector, attracting a large number of international visitors. The demand for in-flight catering services is further supported by the presence of a significant number of full-service and low-cost carriers in the region. The focus on providing unique dining experiences and high-quality food offerings by airlines in Europe also contributes to the growth of the in-flight catering market.

Latin America

Latin America is witnessing significant growth in the in-flight catering services market. The region has a growing air travel market, with countries like Brazil, Mexico, and Argentina experiencing increasing passenger numbers. The expanding middle-class population, improving living standards, and rising tourism in Latin America are driving the demand for in-flight catering services. Furthermore, the presence of international airlines and the emergence of low-cost carriers in the region have further boosted the market.

Middle East & Africa

Middle East & Africa, specifically the Gulf countries, have established themselves as significant players in the in-flight catering services market. The region is known for its luxurious and high-quality airline services, attracting a large number of affluent international travelers. The presence of major airline hubs like Dubai and Doha, along with the increasing air traffic in the region, contributes to the growth of the in-flight catering services market in the Middle East & Africa. Additionally, the growth in tourism and the expanding aviation sector in countries like UAE and Saudi Arabia further propel the demand for in-flight catering services in the region.

Company Profiles:

Global In-Flight Catering Services are pivotal entities within the aviation industry, responsible for delivering a wide array of top-tier culinary choices to airlines, thereby guaranteeing passenger contentment and elevating the in-flight journey.

Prominent companies in the in-flight catering sector consist of Gate Gourmet, LSG Sky Chefs, DO & CO, Flying Food Group, Newrest International Group, SATS Ltd., Air Culinaire Worldwide, Journey Group plc, dnata, Cathay Pacific Catering Services, and Emirates Flight Catering. These organizations offer a variety of catering solutions to airlines across the globe, ensuring passengers are served top-notch meals and beverage choices during their air travels. With a global presence and established partnerships with major airlines, they deliver an array of culinary selections and customized menus that accommodate various dietary constraints and preferences. These leading entities in the in-flight catering industry play a crucial role in enriching the overall flying experience for passengers.

COVID-19 Impact and Market Status:

The global market for in-flight catering services has been profoundly affected by the Covid-19 pandemic, with a decrease in demand resulting from diminished air travel and ened health and safety considerations.

The global in-flight catering services industry has faced substantial repercussions due to the outbreak of the COVID-19 pandemic. Various governments around the world have implemented travel restrictions and lockdown protocols, leading to a significant drop in air travel and passenger numbers within the aviation sector. Consequently, the demand for traditional in-flight catering services has plummeted as airlines strive to reduce operational costs, resulting in either limited or suspended catering offerings aboard flights. This downturn has severely impacted the revenue streams of in-flight catering companies that heavily depended on partnerships with airlines. Furthermore, concerns surrounding hygiene and safety have added another layer of complexity to the current situation. Passengers are exhibiting ened caution towards consuming in-flight meals and beverages, further depressing the demand for catering services. In response to these challenges, in-flight catering companies are proactively exploring new strategies to adapt and diversify their service offerings. Several companies have begun offering pre-packaged meal options, implementing stringent food safety protocols, and exploring alternative distribution channels like home delivery services. While these innovative approaches seek to alleviate the adverse effects of the pandemic on the industry, the recovery of the in-flight catering services market is anticipated to be gradual and contingent upon the overall revival of the aviation sector.

Latest Trends and Innovation:

- April 2021: Emirates Flight Catering and CCL Holdings merged to form a joint venture named 'Emirates Flight Catering - CCL' with the aim of expanding their in-flight catering services globally.

- March 2021: Gategroup, a leading provider of in-flight products and services, launched the 'Gategroup Dining Experience', an innovative concept aimed at enhancing the in-flight catering experience for passengers.

- November 2020: dnata, which provides catering services to over 120 airlines, acquired the Qantas Airways' catering businesses in Australia, including Q Catering and Snap Fresh. This acquisition strengthened dnata's position in the Australian in-flight catering market.

- October 2020: LSG Group, a leading in-flight catering and retail solutions provider, introduced a digital pre-order solution called 'LSG Group Pre-Order', allowing passengers to customize their meals and order them in advance.

- July 2020: Do & Co, an Austrian catering company, signed a contract with Turkish Airlines to supply in-flight catering services on all international flights departing from Istanbul. This partnership expanded Do & Co's presence in the Turkish in-flight catering market.

- January 2020: SATS, a leading provider of food solutions and gateway services, collaborated with Dnata to establish a joint venture called 'Dnata SATS' in Singapore. This venture aimed to offer enhanced in-flight catering services and establish Singapore as a major Asia-Pacific hub for such services.

Significant Growth Factors:

The expansion of the In-Flight Catering Services Industry is driven by the rising demand for air travel and the development of customizable menus to meet a wide range of passenger tastes.

The in-flight catering industry is poised for substantial expansion in the foreseeable future, driven by several key factors. The escalating global air passenger traffic is a primary catalyst for this growth. As the number of individuals opting for air travel rises, airlines are placing emphasis on enriching passengers' overall journey experience by offering top-notch meals and tailoring catering services to accommodate diverse preferences. Furthermore, the increasing disposable income levels and expanding middle-class demographic in developing nations are fostering a surge in air travel demand, thereby bolstering the in-flight catering sector. This trend is further amplified by the upsurge in tourism, spanning both domestic and international spheres.

Travelers often select airlines that provide exceptional in-flight dining choices, consequently spurring the need for catering services. Additionally, the escalating focus on dietary requirements and preferences like vegan, gluten-free, and halal meals has prompted airlines to partner with specialized catering providers to offer a broad array of meal options. Lastly, the integration of cutting-edge technologies in the aviation realm, such as pre-order meal facilities and in-flight entertainment systems, is also driving the expansion of the in-flight catering domain, as airlines aim to deliver a seamless and tailored travel experience to their passengers.

Restraining Factors:

Constraints in storage capacity and stringent food safety regulations present challenges for the In-Flight Catering Services Industry.

The growth and profitability of the In-Flight Catering Services Market are influenced by various factors that act as constraints. One major challenge is the significant financial investment required to establish and maintain in-flight kitchens, which creates hurdles for catering service providers. The expenses associated with specialized equipment, skilled personnel, and strict safety and quality standards contribute to the overall operational costs. Furthermore, the uncertainty in fuel prices and operational expenses of airlines can constrain the funds allocated by budget carriers for in-flight catering, often leading them to reduce or outsource these services. Another aspect affecting the market is the growing practice of passengers bringing their own meals or purchasing snacks and meals from airport terminals, leading to a decrease in demand for in-flight catering services. The COVID-19 pandemic has had a profound impact on the aviation sector, resulting in reduced air travel and subsequently affecting the need for in-flight catering services. This situation has also prompted the implementation of new health and safety guidelines, such as reduced physical contact and pre-packaged meal offerings, necessitating additional adjustments and expenses for catering providers. Despite these obstacles, the In-Flight Catering Services Market can explore opportunities in novel services like offering healthier meal choices, personalized menus, and catering to various dietary requirements. By continuously innovating and tailoring their services to align with changing consumer preferences, in-flight catering providers can successfully overcome these challenges and contribute to the market's growth.

Key Segments of the In-Flight Catering Services Market

Catering Type Overview

• Bakery & Confectionary

• Meals

• Beverages

• Others

Flight Type Overview

• Full-Service Carrier

• Low-Cost Carrier

• Other

Aircraft Class Overview

• First Class

• Business Class

• Premium Economy Class

• Economy Class

Airlines Overview

• Large Airlines

• Medium Airlines

• Small Airlines

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America