It’s being expected that by 2030, the Immuno Oncology Assays market cap will hit $ 11.74 billion at a CAGR growth of about 11.87%.

.jpg)

The global immuno oncology assays market was valued at USD 3.6 billion in 2019 and is expected to grow at a CAGR of 12.4% over the forecast period. With the population 's rising average life expectancy, 14 million new cases of cancer are reported worldwide globally. The following examples are intended to demonstrate the immense power of treatment options for immune oncology in addressing these cases.

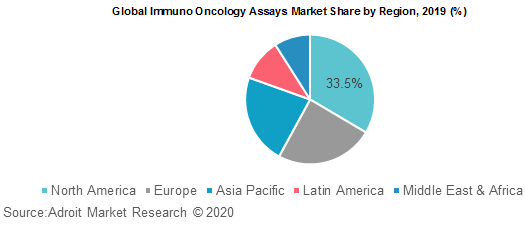

The global immuno oncology assays market is categorized based on product, technology, indication, and applications. Region wise, North America was the largest market in 2018; however, Asia Pacific is expected to be the fastest growing region by 2028, with a CAGR of over 13%.

Key players serving the global immuno oncology assays market include F. Hoffmann-La Roche Ltd., Abbott, Merck KGaA, Agilent Technologies, Thermo Fisher Scientific, Inc., QIAGEN, bioMérieux SA, Illumina, Inc., PerkinElmer Inc., Randox Laboratories Ltd. among other prominent players.

Immuno Oncology Assays Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | $11.74 billion |

| Growth Rate | CAGR of 11.87% during 2020-2030 |

| Segment Covered | by Product, by Technology, by Indication, by Application, Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Agilent Technologies, Inc., F. Hoffmann-La Roche Ltd, HTG Molecular Diagnostics, Inc., Illumina, Inc., Merck KGaA, PerkinElmer Inc., Thermo Fisher Scientific Inc., Qiagen, Sartorius AG, NanoString Technologies, Inc. |

Key Segment Of The Immuno Oncology Assays Market

Based on Product (USD Billion)

• Reagents and Antibodies

• Instruments

• Software

• Consumables and Accessories

Based on Technology (USD Billion)

• Checkpoint Inhibitors

• Cytokines & Immunomodulators

• Monoclonal Antibodies

• Other Technologies

Based on Indication (USD Billion)

• Melanoma

• Colorectal Cancer

• Lung Cancer

• Other Cancers

Based on End-Users (USD Billion)

• Hospitals

• Clinics

• Cancer Research Centers

Based on Application (USD Billion)

• Research Applications

• Clinical Diagnostics

Regional Overview (USD Billion)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

All the researchers across the globe are in quest of researching modern techniques for effective cancer care such as immuno-oncology, which use the body's natural defenses to kill & eliminate cancer cells. Due to their specificity, adaptability and durability, immuno-oncology has become an exciting new approach to cancer treatment over the past decade. However, many challenges remain to the development of new immunotherapies. In this highly complex tumor microenvironment, proper instruments are needed to accurately map the diverse interactions between immune cells and tumor cells. In Western developed countries tumor disorders are one of the most frequent causes of death. Immune oncological strategies help accelerate new rates of curative cancer diagnosis, which can also contribute to certain forms of cancer being eradicated, but creation of such techniques involves precise, responsive bioanalytical methods which specialized oncology assays.

The therapeutic cancer world is now experiencing a fascinating transition, as the scope of accessible drugs has extended to a number of modern molecularly based therapies beyond chemotherapy. Although traditional therapeutics attacked all cell types in previous years, new treatment approaches are now aimed at tumor cells. Although medications paired with specific antibodies (ADC, Antibody-Drug conjugates) carry the tumor-killing agent to its position primarily to remove tumor cells, new immune oncological therapeutic options manipulate the immune system to eliminate cancer cells.

The global immuno oncology assays market has been segmented based on product, technology, indication, applications. One the basis of product, the global market is bifurcated into software & consumables. In the year 2019, consumables segment accounted for the majority of the market share and is projected to witness highest CAGR over the forecast period from 2020 to 2028. The market dominancy is attributed to growing usage of reagents in several oncology therapeutic treatments coupled with rising R&D on cancer immunotherapy.

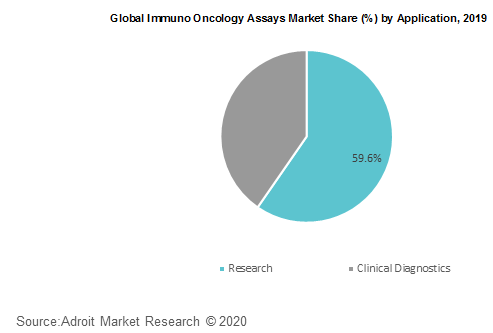

Based on the application segment, the global immuno-oncology assays market is sub-segmented into research & clinical diagnostics. In the year 2019, research segment held the majority of the market share owing to growing prominence of biomarker-based drug development coupled with the emergence of cancer immunotherapy. The global immuno oncology assays market for research-based applications is projected to witness highest CAGR over the forecast period from 2020 to 2028.

Based on regions, the global immuno oncology assays market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa. The introduction of experimental immunotherapies in cancer therapy has significantly changed the oncology sector environment. New advancements in checkpoint inhibitor therapies, tumor-infiltrating lymphocyte therapies, T-cell receptor chimeric antigen therapies, and cancer vaccines have shown great potential for major improvements in cancer treatments. Immunotherapy works on distinct immune response measures to improve the body's innate capacity to detect, track, and kill cancer cells. Combination therapies with immunotherapies and other modalities aim to activate immune response, decrease immunosuppression, and target signaling and resistance pathways in order to provide a more durable , long-lasting treatment as compared to traditional cancer therapies and immunotherapies.

North America currently holds majority of the market share followed by Europe, while Asia Pacific region is anticipated witness highest growth rate over the forecast period. Cancer is the second leading cause of death in the United States and continues to significantly affect populations worldwide. Traditional therapies for cancer have been based on the patient’s tumor type and stage with treatment variations of surgery, radiation, and/or chemotherapy. However, even with the advancements in medicine, many patients progress and succumb to cancer. A relatively new field of cancer therapy includes immunotherapy. Immunotherapy aims to harness the immune system’s ability to recognize, target, and destroy cancerous cells