Market Analysis and Insights:

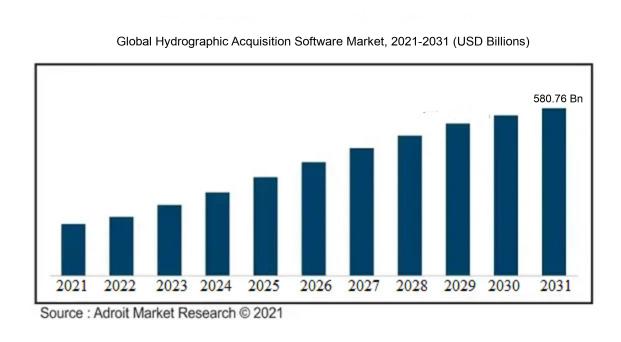

The market for Hydrographic Acquisition Software was estimated to be worth USD 120.52 million in 2021, and from 2021 to 2031, it is anticipated to grow at a CAGR of 14.38%, with an expected value of USD 580.76 billion in 2031.

The hydrographic acquisition software market is being propelled by various factors. One key aspect is the rapid progression of technology and the rising acceptance of digital mapping and surveying systems, which have intensified the need for hydrographic acquisition software. This type of software facilitates precise and effective data collection, processing, and visualization, all of which are essential for hydrographic surveys and mapping activities. Furthermore, there is a growing requirement for enhanced navigation and safety in maritime sectors like maritime transportation, offshore oil and gas exploration, and coastal management, which contributes to the market's momentum.

Hydrographic acquisition software provides real-time monitoring and analysis capabilities that play a vital role in ensuring safe navigation and averting accidents in these industries. Moreover, the ened emphasis on environmental conservation and sustainable management of marine resources has augmented the demand for hydrographic acquisition software, as it supports the monitoring and evaluation of marine ecosystems and resources.

Lastly, investments by governments in marine infrastructure projects and stringent regulatory standards concerning maritime safety have also played a part in fostering market growth. Overall, the hydrographic acquisition software market is primed for substantial expansion due to these critical factors driving its advancement.

Hydrographic Acquisition Software Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD 580.76 billion |

| Growth Rate | CAGR of 14.38% during 2021-2031 |

| Segment Covered | By Type, By Application, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | CARIS, HYPACK, Teledyne CARIS, Fugro, Chesapeake Technology, QPS BV, Sonardyne, The MathWorks, and C&C Technologies. |

Market Definition

Hydrographic Acquisition Software is a sophisticated software application designed for hydrographic survey operations, facilitating the comprehensive collection, manipulation, and evaluation of data pertaining to aquatic or marine settings. This software plays a crucial role in meticulously charting submerged landscapes, capturing vital details on ocean depths, submerged structures, and other pertinent data essential for navigation, resource assessment, or environmental surveillance purposes.

Hydrographic Acquisition Software holds significant importance due to several factors. Primarily, it facilitates precise and efficient data collection essential for hydrographic survey tasks aimed at mapping and comprehending underwater terrains. Equipped with advanced functionalities such as seamless data integration, real-time data visualization, and quality assurance mechanisms, this software guarantees data reliability and precision. Moreover, by optimizing data acquisition processes, it minimizes operational expenditures and enhances productivity for survey teams. Its intuitive interface further ensures accessibility for professionals across various technical proficiency levels. In essence, Hydrographic Acquisition Software serves as a critical tool in ensuring the acquisition of precise and trustworthy data, thereby aiding informed decision-making within industries like marine navigation, offshore exploration, and underwater construction.

Key Market Segmentation:

Insights On Key Type

64-bit Processor

The 64-bit Processor type is expected to dominate the Global Hydrographic Acquisition Software Market. With the increasing complexity and volume of data in hydrographic surveys, the demand for powerful and high-performance processors has risen. The 64-bit processors offer larger addressable memory space, improved processing speed, and enhanced multitasking capabilities compared to their 32-bit counterparts. These advantages make 64-bit processors more suitable for handling the large data sets and advanced algorithms required in hydrographic acquisition software. As a result, the 64-bit Processor part is expected to dominate the market in terms of market share and revenue.

32-bit Processor

The 32-bit Processor type, although not expected to dominate the market, still holds significance in certain areas of the Global Hydrographic Acquisition Software Market. While the demand for 32-bit processors has declined due to the increasing requirements of large-scale hydrographic surveys, there are still certain applications and environments where 32-bit processors are utilized. These may include simpler or less resource-intensive hydrographic tasks, budget-constrained operations, or compatibility with legacy systems. Therefore, although the market share for 32-bit processors is expected to be smaller compared to 64-bit processors, they continue to serve specific needs in the hydrographic acquisition software market.

Insights On Key Application

Industrial

The Industrial application is expected to dominate the Global Hydrographic Acquisition Software market. This is primarily due to the increasing demand for hydrographic acquisition software in industries such as oil and gas, maritime, and mining. These industries heavily rely on accurate and up-to-date hydrographic data for various operations, including resource exploration, offshore construction, and environmental monitoring. The industrial sector also requires specialized software features, such as real-time data processing, multi-platform compatibility, and advanced mapping capabilities, which are offered by hydrographic acquisition software. As a result, the Industrial part is expected to have the highest market share and influence the overall growth of the Global Hydrographic Acquisition Software market.

Windfarms

The Windfarms application is anticipated to have a significant presence in the Global Hydrographic Acquisition Software market. With the growing emphasis on renewable energy sources and the increased development of windfarm projects globally, there is a rising need for accurate hydrographic data for site selection, planning, and maintenance of wind turbines. Hydrographic acquisition software enables efficient surveying, mapping, and monitoring of the underwater environment, aiding in the installation and operation of windfarms. While the Windfarms part may not dominate the market compared to the Industrial part, it will still play a crucial role in the growth of the Global Hydrographic Acquisition Software market.

Off-Shore Infrastructure

The Off-Shore Infrastructure application is expected to be a significant player in the Global Hydrographic Acquisition Software market. Offshore infrastructure projects, such as oil and gas exploration, pipeline laying, and submarine cable installations, require accurate hydrographic data for planning, construction, and maintenance purposes. Hydrographic acquisition software offers features like bathymetric mapping, object detection, and real-time data processing that can greatly facilitate these projects. While the Off-Shore Infrastructure part may not have the highest market share compared to the Industrial part, it will contribute significantly to the overall growth and adoption of Hydrographic Acquisition Software in the global market.

Others

The Others category comprises various applications that do not fall under the dominant categories of Windfarms, Industrial, and Off-Shore Infrastructure. These may include sectors such as coastal zone management, scientific research, marine archaeology, and environmental monitoring. While the Others part may have niche applications and a limited market share, it still plays a valuable role in the Global Hydrographic Acquisition Software market. The demand for hydrographic acquisition software in these diverse applications is driven by the need for accurate and detailed underwater mapping, assessment of marine ecosystems, and research activities. Although the Others part is unlikely to dominate the market, it showcases the versatility and wide-ranging utility of Hydrographic Acquisition Software.

Insights on Regional Analysis:

Europe

Europe is expected to dominate the Global Hydrographic Acquisition Software market. This can be attributed to the presence of a strong maritime industry and the increasing demand for advanced hydrographic surveying and mapping solutions in the region. Europe has a well-established infrastructure for hydrographic surveys and a high adoption rate of technology in the maritime sector. Countries like the United Kingdom, Norway, and Germany have a significant focus on maritime activities and hence, contribute to the dominance of Europe in the global market for hydrographic acquisition software.

North America

North America holds a significant share in the global hydrographic acquisition software market. The region has a thriving maritime industry, particularly in countries such as the United States and Canada. With a strong focus on research and development, North America is witnessing the adoption of advanced technologies in hydrographic surveying and mapping. The presence of key market players in the region further contributes to its dominance. Additionally, the increasing need for accurate hydrographic data for navigation, coastal zone management, and offshore oil and gas exploration drives the demand for hydrographic acquisition software in North America.

Asia Pacific

Asia Pacific is experiencing rapid growth in the global hydrographic acquisition software market. The region has a large coastline and a significant maritime industry, promoting the demand for efficient hydrographic surveying and mapping solutions. Coastal countries such as China, Japan, South Korea, and Australia are investing in the development of their maritime infrastructure, further driving the adoption of advanced hydrographic acquisition software. Rising offshore activities, particularly in the oil and gas sector, also contribute to the growth of the market in Asia Pacific.

Latin America

Latin America is witnessing steady growth in the hydrographic acquisition software market. Countries like Brazil, Mexico, and Argentina have a substantial coastline and are investing in hydrographic surveying to support activities such as coastal zone management, navigation, and marine resource exploration. The adoption of advanced technology and software solutions for hydrography is increasing in the region, driving the demand for hydrographic acquisition software. Additionally, the growing tourism industry and the need to ensure safety and efficiency in coastal areas contribute to the market's growth in Latin America.

Middle East & Africa

The Middle East & Africa region is also witnessing significant growth in the hydrographic acquisition software market. Key countries in the region, such as Saudi Arabia, United Arab Emirates, and South Africa, have a well-developed maritime industry and are investing in advanced technology for hydrographic surveying and mapping. The expanding offshore oil and gas industry in the region also drives the demand for accurate hydrographic data. Furthermore, the presence of major ports and the need for effective coastal zone management contribute to the growth of the market in the Middle East & Africa.

Company Profiles:

Prominent figures within the Global Hydrographic Acquisition Software industry are tasked with the creation and delivery of cutting-edge software solutions designed to gather and interpret hydrographic data, facilitating optimal maritime navigation and research expeditions. Their contributions are vital in facilitating precise cartography and comprehension of subaquatic terrains, benefiting multiple sectors including marine exploration, offshore energy, and naval operations.

Prominent companies in the Hydrographic Acquisition Software Market comprise CARIS, HYPACK, Teledyne CARIS, Fugro, Chesapeake Technology, QPS BV, Sonardyne, The MathWorks, and C&C Technologies. These industry leaders deliver cutting-edge software solutions tailored for the acquisition and processing of hydrographic data. Renowned for their market presence and innovation, these organizations consistently enhance their product offerings to stay ahead of the competition. With specialization in surveying, mapping, and navigation tools, these key stakeholders are instrumental in facilitating precise and effective data gathering and interpretation across diverse marine sectors.

COVID-19 Impact and Market Status:

The outbreak of the Covid-19 pandemic has caused a deceleration in the worldwide market for Hydrographic Acquisition Software, marked by a reduction in demand and interruptions in supply chains.

The outbreak of COVID-19 has brought about substantial repercussions across multiple sectors, including the sector of hydrographic acquisition software. This particular market encompasses software solutions designed for the collection and analysis of data pertaining to bodies of water, such as oceans, rivers, and lakes. The global implementation of social distancing regulations and widespread lockdowns has led to the suspension or postponement of numerous hydrographic survey projects, resulting in a decrease in the demand for hydrographic acquisition software. Furthermore, the economic instability stemming from the pandemic has prompted governments and organizations to impose budgetary constraints and reduce investments in infrastructure and construction endeavors, thereby impeding market expansion. Despite these adverse effects, the pandemic has also spurred some favorable developments within the market. The necessity for remote monitoring and asset management has surged due to the challenges faced regarding on-site visits and inspections. As a result, this has presented an opportunity for the integration of sophisticated hydrographic acquisition software capable of facilitating remote operations, streamlining data collection and analysis processes. To sum up, while the hydrographic acquisition software market has been adversely affected by the COVID-19 pandemic, there are emerging prospects driven by the growing demand for remote operational capabilities within the industry.

Latest Trends and Innovation:

- In May 2020, Teledyne Technologies Incorporated completed the acquisition of CARIS, a leading provider of hydrographic software solutions, to enhance their marine capabilities.

- In October 2019, QPS BV launched Qimera 2.0, an upgraded version of their popular hydrographic data processing software, offering improved performance and new features.

- In March 2019, Esri partnered with Kongsberg Maritime AS to integrate their hydrographic data acquisition software, Kognifai, with Esri's ArcGIS platform, enabling seamless data sharing and analysis.

- In January 2018, HYPACK Inc. released HYPACK 2018, the latest version of their hydrographic survey software, incorporating advancements in multibeam and mobile mapping technologies.

- In November 2017, Trimble Inc. acquired eCognition, a provider of advanced image analysis software, to enhance their geospatial portfolio and improve hydrographic data processing capabilities.

Significant Growth Factors:

Key drivers of the Hydrographic Acquisition Software Market are the rising need for cutting-edge technology in conducting hydrographic surveys and the requirement for precise seafloor mapping and navigation solutions.

The hydrographic acquisition software sector is experiencing notable expansion attributed to several critical drivers. Initially, the surge in the need for precise and comprehensive marine mapping and charting across various industries, including oil and gas, underwater exploration, and maritime transportation, is steering the uptake of hydrographic acquisition software. This software facilitates the precise collection and processing of data pertaining to water depth, coastlines, and other crucial marine characteristics, empowering organizations to make well-founded decisions. Secondly, the escalation in the deployment of unmanned underwater vehicles (UUVs) and autonomous surface vehicles (ASVs) is further propelling the market's advancement. These vehicles, equipped with hydrographic acquisition software, provide effective and economical approaches for executing marine surveys and mapping. Furthermore, the evolution of technologies like cloud computing, artificial intelligence, and machine learning has significantly bolstered the functionalities of hydrographic acquisition software, thereby enhancing data precision and processing efficiency. Additionally, the escalating emphasis on ocean preservation and environmental assessments has resulted in amplified utilization of hydrographic acquisition software for the surveillance and evaluation of marine ecosystems. What's more, the continual enhancements in software attributes, encompassing real-time visualization, data amalgamation, and compatibility, are catalyzing market expansion. Nonetheless, challenges such as high implementation expenditures, dearth of proficient personnel, and apprehensions regarding data privacy are impeding the market's progress. In a bid to surmount these obstacles, firms are devoting resources to research and development endeavors aimed at crafting cost-efficient and user-centric solutions while embracing rigorous security protocols. On the whole, the hydrographic acquisition software domain is projected to experience notable advancement in the foreseeable future, driven by escalating demands for accurate marine mapping, technological breakthroughs, and ening environmental consciousness.

Restraining Factors:

Key challenges facing the Hydrographic Acquisition Software Market stem from the lack of comprehensive understanding among prospective users and the significant upfront capital requirements.

The market for hydrographic acquisition software is experiencing notable growth, but it is also encountering various obstacles. A significant challenge is the steep expenses linked with these software products, rendering them inaccessible to smaller entities or those operating on constrained budgets. Furthermore, the intricate nature of the software can impede users lacking technical proficiency from harnessing its full functionality effectively. Another inhibiting factor is the limited interoperability of hydrographic acquisition software with diverse hardware and operating platforms, constraining deployment possibilities and market penetration. Additionally, a lack of industry awareness regarding the advantages and uses of hydrographic acquisition software acts as a deterrent to market expansion. Finally, concerns about data security, such as unauthorized access or cyber breaches, can present hurdles for organizations contemplating the integration of these software solutions.

Notwithstanding these challenges, there are optimistic prospects for the hydrographic acquisition software market. Increased investments in research and development by industry participants aim to tackle these impediments, leading to the creation of more economical solutions, user-friendly interfaces, enhanced compatibility, and fortified data protection measures. This continuous drive for innovation seeks to establish a more accessible and effective market for hydrographic acquisition software, facilitating broader adoption and stimulating industry growth.

Key Segments of the Hydrographic Acquisition Software Market

Type Overview

• 32-bit Processor

• 64-bit Processor

Application Overview

• Windfarms

• Off-Shore Infrastructure

• Industrial

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America