The global hook & loop fasteners market was valued at USD 467.7 million in 2018. Rising demand from industrial sector, and increasing use of hook & loop fasteners in several end use businesses are factors expected to drive growth of the global hook & loop fasteners market over the forecast period.

.png)

Depending on the applications, the performance of hook & loop fasteners varies in terms of grip, longevity, and resistance. Hook & loop fasteners are used in lightweight wind shirts and in heavy duty logging jackets providing superior quality and high performance.

The Hook & Loop Fasteners Market is expected to reach USD 3690.4 during the forecast period at a 5.8% CAGR.

Though apparel and consumer goods have the largest adoption, heavy duty hook & loop fasteners are in high demand in construction, manufacturing and space expeditions. Rapidly growing demand for tactical apparel and outwear, as extreme weather garments, coupled with increasing disposable income are factors expected boost growth of the global hook & loop fasteners market. Additionally, growing demand for shoes with hook and loop fasteners, particularly from pediatric and elderly population, as its comfort and ease are factors accelerating demand for hook & loop fasteners in footwear industry. Upswing in demand for athletic footwear and children’s footwear, along with increasing customer spending on premium shoes are other factors augmenting the market growth.

Hook & loop fasteners are also used in various business operations, including bundling products, arranging miles of network wire and in home and workplace maintenance. Growing demand for hook & loop fasteners in floriculture, agriculture, viticulture industry for plant and bundle ties, coupled with increasing use in the electronic industry for cable wires, wire harnesses, and laboratory ties are factors anticipated to support demand for hook and loop over the coming years.

Hook & Loop Fasteners Market Scope

| Metrics | Details |

| Base Year | 2020 |

| Historic Data | 2018-2019 |

| Forecast Period | 2021-2028 |

| Study Period | 2018-2028 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2028 | USD 3690.4 million |

| Growth Rate | CAGR of 5.8 % during 2021-2028 |

| Segment Covered | by type, by application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, Middle East and Africa, South America |

| Key Players Profiled | 3M, Kuraray Group, Binder, Ykk Corporation, Paiho North America Corporation, HALCO, Dunlap Industries INC., Heyi, Shingyi |

Key Segment Of The Hook & Loop Fasteners Market

by type, 2021-2028 (USD Million)

• Nylon

• Polyester

• Others

by application, 2021-2028 (USD Million)

• Footwear & Apparel

• Transportation

• Industrial Manufacturing

• Medical

• Other

Regional Overview, 2021-2028 (USD Million)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

Growing demand for hook & loop fasteners in healthcare applications

Hook & loop is widely used in variety of patient positioning solutions as well as in medical device. It is also deployed in long-term use devices including knee braces, ankle supports, cervical collars, wheelchairs, tension meters, surgical corsets, etc. Additionally, it is also used in clothing and single-use protective garments as well as in colostomy pouches. Other advantages associated with the use of hook & loop fasteners in medical devices is better device handling, improved stability and the resultant improved treatment and monitoring outcome. Manufacturers are also focusing on developing products that reduce skin irritation.

Hook & loop fasteners are used in blood pressure, pulse oxygen as well as fetal monitoring systems. Growing demand for these monitoring devices, owing to growing prevalence of cardiovascular diseases globally is prime factor driving the demand for hook & loop fasteners in the medical applications. According to the World Health Organization (WHO) data for 2019, an approximately 1.13 billion people across the globe had hypertension and, also being a major cause of premature death.

Furthermore, hook & loop is used in orthopedic braces and supports for shoulder, wrist, back, ankle and foot. It also finds applications in hot & cold therapy products, patient positioning equipment, wheelchair covers and stabilization belts. Increasing use of the product in respiratory devices and vascular devices, as it offers great adjustment and stability are industry adoption factors.

Top players engaged in the manufacturing of hook & loop fasteners includes Velcro BVBA, 3M, YKK Corporation, Dunlap Industries, Inc., Paiho North America, Lovetex Industrial Corp, HALCO, Krahnen & Gobbers GmbH, APLIX, and Gottlieb Binder GmbH & Co. KG.

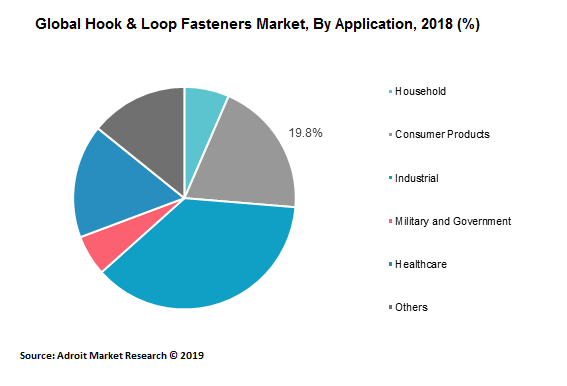

In terms of application, the global hook & loop fasteners market is segmented into household, consumer products, industrial, military and government, healthcare, and others. Industrial application segment held the largest market share in 2018, followed by consumer products, and healthcare. In terms of industry growth, household application is likely to offer favorable scope over the years.

Hook and loop fasteners find application in various industries, which include aerospace, automotive, electronics, etc. Increasing use of hook & loop fasteners in automotive industry for insulation blanket attachment, seat assembly coupled with rapidly growing demand for automobiles are factors driving the segment growth over the forecast period. For instance, the India motor vehicle production in 2018 was 5,175 thousand, marking an increase by 8.2% over the previous year.

Growing demand from automotive engineers for temporary and permanent protective covers and increasing use of the product in floor mat and carpet attachment, along increasing preference for buying luxury cars are other factors expected to support of growth of industrial application segment over the forecast period.

Consumer products application is expected to account for the second largest revenue share in the global market. Growing demand for hook & loop fasteners from footwear industry, growing number of sports events, along with growing popularity for hook & loop fastening shoes especially from children and elderly population are some factors driving growth of the consumers segment.

The military and government segment is expected to register steady growth over the forecast period. Growing demand for hook & loop fasteners in military products such as tactical apparel, load-bearing equipment and shelters, coupled with increasing government investments on using advance technologies in defense and aerospace projects are factors propelling segment growth over the forecast period.

The consumption of hook & fasteners has increased across the globe, with industrial application being a key consumption area, facilitating the growth of hook & loop fasteners across the region, followed by consumer products. North America, Europe, and Asia Pacific accounted for a significant market revenue share in the global hook & loop fasteners market for 2018 & 2025. Asia Pacific accounted for the largest revenue share and is projected to show a similar trend until 2025, followed by North America. Europe is projected to witness the fastest growth in the global hook & loop fasteners market, followed by North America.

Growing consumption of hook & loop fasteners for industrial applications, coupled with increasing public and private investment in healthcare are factors expected to propel the demand for hook & loop in North America. The U.S. accounted for a majority revenue share of about more than 50% in the year 2018 and is projected to show similar trend over the forecast period.

Asia Pacific accounted for significant revenue share in global market. Demand for hook and loop in footwear industry is expected to propel over the coming years, as Asia Pacific is leading consumer of footwear’s in the global. Presence of prominent players along with strong electronics hub in the region are other factors propelling demand for hook & loop fasteners in Asia Pacific. China and India accounted for majority of the market share in the region and is expected to maintain its dominance over the forecast period, owing to growing automotive and electronic industries.