Heavy Construction Equipment Market Analysis and Insights:

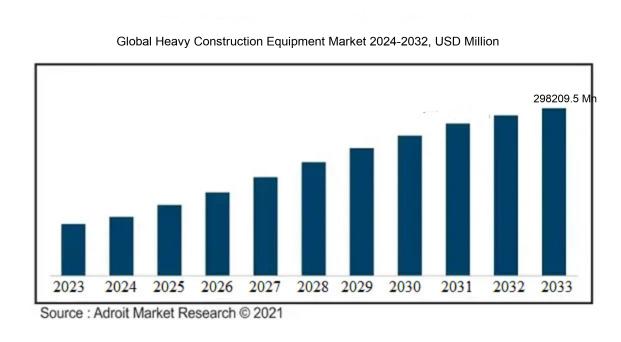

In 2023, the market for heavy construction equipment was estimated to be worth USD 196720.10 million. The market for heavy construction equipment is anticipated to develop at a compound annual growth rate (CAGR) of 5.6% between 2024 and 2032, from USD 206707.5 million in 2024 to USD 298209.5 million in 2032.

A number of crucial factors influence the market for heavy construction equipment. Primarily, the swift pace of urbanization and infrastructure advancements in developing nations fuels the need for heavy machinery like excavators, bulldozers, and cranes. The substantial financial commitments from governments toward public infrastructure initiatives—such as the construction of roads, bridges, and airports—greatly propel market expansion. Furthermore, technological innovations, including automation and telematics, improve the operational efficiency and safety of equipment, drawing additional investments. The growing emphasis on environmentally sustainable machinery, prompted by stricter emissions standards and a focus on sustainability, is also transforming the industry landscape. Additionally, the resurgence of the construction sector following the pandemic enhances machinery sales, paired with the increasing popularity of rental services, which provide cost-effective solutions for contractors. Collectively, these factors significantly boost the demand for heavy construction equipment, positioning the market for continued growth in the upcoming years.

Heavy Construction Equipment Market Definition

Heavy construction machinery encompasses robust, sizable equipment engineered for substantial lifting, digging, and material relocation at construction sites. This category of machines features bulldozers, excavators, cranes, and backhoes, all of which play a crucial role in the effective execution of extensive construction endeavors.

Heavy construction machinery is essential in the construction and infrastructure sectors, as it enables the smooth execution of extensive projects. Its importance is evident in boosting efficiency, lowering labor expenses, and promoting safety in various work environments. These machines perform critical tasks like digging, hoisting, and transporting materials, thereby optimizing operations and reducing the need for physical labor. Furthermore, they play a crucial role in speeding up project schedules, which allows for the timely development of vital infrastructures, including roads, bridges, and buildings. In summary, heavy construction machinery is a cornerstone of economic development, urban expansion, and societal progress, as it facilitates the construction of essential facilities.

Heavy Construction Equipment Market Segmentation:

Insights On Key Type

Earthmoving Equipment

Earthmoving equipment is expected to dominate the Global Heavy Construction Equipment Market due to its fundamental role in various construction, excavation, and grading jobs. This category includes machinery such as bulldozers, excavators, and backhoes which are essential for tasks like land clearing, digging foundations, and transporting materials. The rising demand for infrastructure development, urbanization, and commercial construction is propelling the growth of this equipment type. Furthermore, technological advancements such as automation and improved fuel efficiency are enhancing the capabilities and appeal of earthmoving machinery, making them indispensable in large-scale projects.

Material Handling

Material handling equipment is crucial for the efficient movement, protection, and storage of materials within construction sites. This category includes forklifts, conveyor systems, and cranes which are necessary for loading and unloading materials. The increase in construction activities and logistics operations drives the demand for material handling solutions. Moreover, innovations in warehouse automation and the need for safety compliance add to the 's significance, ensuring quick and safe material handling, which is essential for project timelines.

Heavy Vehicle

Heavy vehicles, which encompass trucks and specialized transportation equipment, play an essential role in the heavy construction equipment market as they are vital for transporting materials and equipment to and from sites. The growth in large civil projects like highways, bridges, and tunnels necessitates a robust fleet of heavy vehicles. Additionally, the booming e-commerce sector and increased demand for expedited delivery services further bolster the relevance of this category, as it optimizes logistics and distribution processes in construction environments.

Crushers

Crushers are significant in the heavy construction sector as they are pivotal for reducing the size of large rocks and materials when preparing aggregates for different applications. They are essential in recycling materials and ensuring efficient site cleanup. The growing emphasis on sustainability in construction practices enhances the market for crushers, as they support the reuse of materials and reduce waste. Demand for crushed stone and recycled aggregates in construction projects ensures that this remains relevant and vital.

Others

The "Others" category includes various equipment that, while not as prominent, plays supporting roles in heavy construction operations. This may encompass generators, compactors, and road rollers, which are necessary for site preparation and maintenance tasks. Despite not dominating the market, this equipment is essential for enhancing operational efficiency and ensuring compliance with safety regulations. The growth in niche applications and specialized construction processes will likely contribute to a steady demand for these types of machinery in the broader heavy construction context.

Insights On Key Application

Excavation & Demolition

Excavation & Demolition is expected to dominate the Global Heavy Construction Equipment Market due to the increasing demand for infrastructure development across various sectors, including residential, commercial, and industrial s. Urbanization and rapid population growth have elevated the need for new buildings, roads, and public facilities, driving the demand for heavy construction equipment specifically designed for excavation and demolition tasks. Additionally, the push towards modernizing outdated infrastructure in developed countries further fuels this trend. The versatility and necessity of excavation and demolition projects in large construction undertakings solidify their position as the leading application in the market.

Material Handling

Material Handling is another significant application in the heavy construction equipment sector. This category includes equipment like forklifts, cranes, and hoisting devices that are critical for transporting materials on construction sites. The growth in logistics and e-commerce industries has also contributed to the rising demand for material handling equipment, as the movement of goods and raw materials is integral to construction processes. Additionally, advances in technology, such as automated material handling systems, have enhanced efficiency and safety, further solidifying this application’s relevance.

Heavy Lifting

Heavy Lifting is a vital application, especially concerning large-scale projects that require the movement of heavy components like steel beams, precast elements, and large machinery. The increasing complexity and of modern buildings demand specialized heavy lifting equipment such as cranes and hoists. Furthermore, the growth of renewable energy projects, like wind farms, necessitates heavy lifting operations for turbine installation, expanding the market considerably. This application remains essential for ensuring that lifting operations are conducted safely and effectively within stringent timelines.

Recycling & Waste Management

Recycling & Waste Management play a crucial role in the sustainability efforts within the heavy construction sector. With the rise in environmental regulations and a growing focus on eco-friendly practices, the demand for equipment designed for recycling construction materials and managing waste has surged. This response to global climate change reflects the industry's shift toward more sustainable construction methods. Heavy construction companies are increasingly looking to invest in machinery that facilitates material recovery and minimizes landfill waste, ensuring this application remains relevant.

Tunneling

Tunneling is an application that caters primarily to the infrastructure development of transport networks such as subways, highways, and underground utilities. The increasing need for improved urban transportation systems and the expansion of underground infrastructure have driven demand for tunneling machines. Technological advancements, such as Tunnel Boring Machines (TBMs), have made tunneling more efficient, enabling the construction of deeper and longer tunnels. Therefore, while important, this application remains niche compared to the broader demand seen in excavation and demolition.

Insights On Key End Use

Infrastructure

Infrastructure is expected to dominate the Global Heavy Construction Equipment Market due to the increasing investment by governments and private entities in developing and upgrading infrastructure projects. The rise in urbanization and the growing demand for transportation networks, roads, bridges, and utilities are significant factors driving this. Additionally, large-scale projects such as smart cities and renewable energy installations require advanced machinery, which further incentivizes growth in the heavy construction equipment sector. Given the strategic importance of infrastructure in facilitating economic growth, its substantial share in the overall market can be anticipated over the coming years.

Metal

The metal sector is important in the heavy construction equipment market as it drives demand for machinery used in metal extraction and processing. As industries continue to expand and demand for metals rises, more equipment is needed for mining operations, material handling, and processing. The growth in construction activities often correlates with a higher demand for metals like steel and aluminum, further contributing to the use of heavy machinery. This provides a steady and robust market for equipment specifically designed to handle metal production processes.

Mineral

The mineral sector represents a significant area within the heavy construction equipment market. Mining operations for minerals such as gold, copper, and rare earth elements necessitate the use of various heavy machinery for extraction and processing. As demand for minerals increases, especially in electronics and renewable energy technologies, the need for specialized equipment, including excavators, loaders, and drills, also rises. This is further bolstered by global initiatives aimed at sustainable mining practices, which require advanced equipment to minimize environmental impact.

Coal

The coal involves heavy construction equipment utilized in both the extraction and transportation of coal. Despite the shift towards renewable energy sources, coal remains an essential energy resource in many countries, driving demand for specialized heavy machinery. Equipment designed for coal handling, such as draglines, shovels, and haul trucks, is crucial for efficient mining operations. Investment in cleaner coal technologies and production methods may stimulate further growth in this area, sustaining interest in heavy construction machinery tailored for coal extraction and processing.

Aggregate

The aggregate sector is a key area for heavy construction equipment, as it includes machinery used to extract and process construction materials such as sand, gravel, and crushed stone. The ongoing demand for aggregates in construction, road-building, and infrastructure development propels the need for equipment like crushers, screeners, and conveyors. Additionally, as urban development continues to expand, the requirement for high-quality aggregates further fuels the market, making it an essential for heavy machinery manufacturers focused on improving aggregate production efficiency.

Real Estate

The real estate plays a crucial role in terms of heavy construction equipment, with the growth of residential, commercial, and industrial developments calling for various machinery. As cities expand and populations grow, the demand for new housing projects, office buildings, and infrastructure increases significantly, driving the need for heavy equipment like excavators, bulldozers, and cranes. The effect of economic recovery post-pandemic is also fostering real estate growth, further solidifying its relevance in the heavy machinery market.

Oil & Gas

In the oil and gas sector, heavy construction equipment is vital for exploration, extraction, and infrastructure development. There is a substantial requirement for cranes, drilling rigs, and transport vehicles to support operations in this industry. Fluctuations in oil prices and global energy demands often influence this, impacting investment levels. However, increased focus on energy diversification and sustainable practices may lead to advanced machinery tailored for environmentally responsible operations, which ensures ongoing demand for construction equipment in this sector.

Mining

The mining taps into equipment required for extracting various resources, including metals and minerals. Heavy machinery, including trucks, loaders, and drilling equipment, is essential for effective mining operations. As global demands for natural resources continue to grow, the mining sector gains more importance, leading to an increased investment in advanced machinery with enhanced capabilities for efficiency and safety. The push for innovative technologies further strengthens this 's position in the heavy construction equipment market.

Forestry & Agriculture

The forestry and agriculture sector also utilizes heavy construction equipment for various processes, including timber harvesting and land preparation. Equipment such as excavators, harvester equipment, and specialized tractors are essential for efficient operations in these fields. As the world moves towards sustainable practices and increased food production, the demand for advanced heavy machinery capable of maximizing productivity in forestry and agricultural applications is expected to grow. This sector provides unique opportunities for innovation in the heavy construction equipment market.

Insights on Regional Analysis for Heavy Construction Equipment Market:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Heavy Construction Equipment market, primarily due to rapid urbanization, increasing infrastructure development, and substantial investments in both residential and commercial construction projects across the countries in this region. Nations like China and India are at the forefront, with ambitious government-driven initiatives such as the "Belt and Road Initiative" and "Housing for All," which significantly boosts heavy equipment demand. Additionally, the growth of the manufacturing sector and increased foreign direct investments further contribute to the rising need for heavy construction equipment in this region. The combination of a large population, economic growth, and government stimulus programs positions Asia Pacific as the frontrunner in the heavy construction sector.

North America

North America has a robust heavy construction equipment market, primarily driven by extensive infrastructure projects and advancements in technology. The region benefits from strong financial capabilities, allowing for significant investments in construction projects such as highways, bridges, and urban development. Moreover, the growing adoption of advanced equipment containing smart technologies and automation enhances operational efficiency, making it attractive for companies to invest in modern heavy construction machinery. However, while North America holds substantial market share, it is unlikely to surpass the unparalleled growth seen in the Asia Pacific region.

Europe

Europe is characterized by a mature heavy construction equipment market, influenced by stringent regulations on emissions and sustainability. The demand for eco-friendly equipment has led manufacturers to invest in green technologies, impacting market dynamics. The ongoing renovation and refurbishment of aging infrastructure across Western and Eastern Europe further drives this market. Despite its stability and regulatory frameworks that encourage innovation, Europe faces competition from the rapidly expanding markets in Asia and the aggressive infrastructural investments being made in developing countries.

Latin America

Latin America’s heavy construction equipment market shows promising growth potential, driven by ongoing infrastructure initiatives, particularly in countries like Brazil and Mexico. These nations are focusing on enhancing their transportation networks and urban infrastructure to stimulate economic growth. However, challenges such as political instability and economic volatility may hinder some projects, affecting the overall market performance. Despite these obstacles, investment in construction activities remains high as governments continue to prioritize infrastructure development, indicating a steady demand for heavy equipment.

Middle East & Africa

The Middle East & Africa region presents a mixed bag for the heavy construction equipment market. While there is a significant push for mega infrastructure projects, particularly in the Gulf Cooperation Council (GCC) countries, the market is often influenced by fluctuating oil prices and economic uncertainties. Nevertheless, countries like the UAE and Saudi Arabia have ambitious development plans like "Vision 2030," which drive demand for heavy construction machinery. However, the overall proliferation of heavy equipment may be slower relative to more rapidly developing regions like Asia Pacific.

Heavy Construction Equipment Market Company Profiles:

Prominent companies within the global heavy construction equipment sector, including Caterpillar, Komatsu, and Volvo, are pivotal in fostering innovation and advancing market expansion through the creation of sophisticated machinery and collaborative alliances. Their impact plays a crucial role in establishing industry benchmarks, improving operational effectiveness, and addressing the changing needs of worldwide infrastructure projects.

Prominent participants in the Heavy Construction Equipment sector consist of Caterpillar Inc., Komatsu Limited, Deere & Company, Volvo Construction Equipment, Hitachi Construction Machinery Co., Ltd., Liebherr Group, Doosan Infracore, Terex Corporation, CNH Industrial N.V., JCB, SANY Group Co., Ltd., Hyundai Heavy Industries, XCMG Construction Machinery Co., Ltd., Ashok Leyland, and Manitou Group.

COVID-19 Impact and Market Status for Heavy Construction Equipment Market:

The Covid-19 pandemic profoundly impacted the global heavy construction equipment sector, resulting in disruptions to supply chains, shortages of labor, and delays in project schedules, which temporarily lowered both demand and revenue.

The COVID-19 pandemic profoundly impacted the heavy construction equipment sector, presenting a mix of obstacles and opportunities. In the early stages, extensive lockdowns and disruptions in supply chains hindered production and affected delivery schedules, leading to project postponements and a decline in equipment demand. Nonetheless, as economic recovery commenced and infrastructure funding surged—particularly in areas prioritizing construction rejuvenation—there was a notable resurgence in the demand for heavy machinery. This period also saw a notable shift towards automation and digitalization, with manufacturers channeling investments into advanced equipment aimed at improving both efficiency and safety standards. Additionally, the increasing focus on sustainable construction has spurred innovation within the market, giving rise to eco-friendly machinery. In summary, while the pandemic created temporary challenges, it has ultimately catalyzed modernization and strengthened the industry's resilience, resulting in a more dynamic market landscape for the future.

Heavy Construction Equipment Market Latest Trends and Innovation:

- In March 2023, Caterpillar announced its acquisition of the software development company HCSS, which specializes in construction management software. This move aims to enhance Caterpillar's digital solutions and productivity tools for heavy construction equipment users.

- In July 2023, Volvo Construction Equipment revealed its partnership with 3D printing company ICON. This collaboration focuses on utilizing advanced 3D printing technology to create sustainable construction materials and innovative building techniques.

- In April 2023, Komatsu completed its acquisition of the Canadian firm, Soilmec, known for its specialized equipment in foundation engineering. This acquisition strengthens Komatsu's portfolio in the ground engineering sector and enhances its global market reach.

- In June 2023, Deere & Company introduced its new line of electric compact construction equipment, including the John Deere 210G LE Electric excavator, as part of its commitment to sustainability and reducing emissions in heavy construction operations.

- In September 2023, Hitachi Construction Machinery announced a strategic alliance with Atonomi for integrating blockchain technology into their supply chain management. This development aims to increase transparency and efficiency in equipment tracking and ownership.

- In February 2023, Liebherr launched its new LTM 1750-9.1 mobile crane, featuring advanced lifting technology and enhanced fuel efficiency. This innovation represents Liebherr’s ongoing investment in energy-efficient solutions in heavy construction machinery.

- In August 2023, Doosan Infracore unveiled its latest line of Next Generation excavators, equipped with AI-driven features that improve operational efficiency and reduce fuel consumption, showcasing their commitment to technological advancement in the heavy equipment sector.

- In May 2023, Terex Corporation announced its merger with Manitowoc Cranes to expand its offerings in the crane market, combining resources and expertise to enhance product development and market presence worldwide.

Heavy Construction Equipment Market Significant Growth Factors:

The market for heavy construction equipment is mainly propelled by a surge in infrastructure progress, growing urban development, and innovations in machinery technology.

The heavy construction equipment sector is witnessing robust expansion, fueled by several pivotal elements. Firstly, global infrastructure investment is surging, largely driven by urbanization and proactive government policies. Nations are prioritizing the improvement of transportation systems, energy production, and housing developments, which collectively en the demand for heavy machinery.

Secondly, ongoing technological innovations—such as automation, telematics, and the increasing adoption of electric and hybrid machinery—are enhancing efficiency and minimizing environmental impacts, thereby attracting further investments in advanced equipment. The shift towards leasing equipment rather than outright purchasing is also playing a crucial role, especially in developing areas, where access to high-quality machinery is made possible without significant upfront costs.

Furthermore, the flourishing mining, oil, and gas industries are a major factor, as they require specialized heavy equipment for various extraction and exploration operations. Lastly, the growing focus on sustainable construction methods is encouraging advancements in machinery design and functionality, which in turn supports market growth. Collectively, these dynamics are transforming the heavy construction equipment industry, fostering a conducive environment for ongoing development through 2023 and into the future.

Heavy Construction Equipment Market Restraining Factors:

The heavy construction equipment sector faces significant limitations primarily due to substantial upfront capital requirements and the complexities associated with adhering to regulatory standards.

The Heavy Construction Equipment Market encounters a variety of challenges that could hinder its growth potential. Significant initial investments and ongoing maintenance expenses often discourage smaller construction companies from modernizing their equipment, thus limiting their ability to enter the market. Moreover, rigorous government regulations regarding emissions and safety compliance require ongoing capital for adherence, which can place a financial strain on both manufacturers and operators. Economic volatility further complicates matters, as declines in the construction sector have a direct impact on equipment demand.

Additionally, the swift pace of technological progress, particularly the transition towards electric and autonomous machinery, necessitates considerable spending on research and development, potentially exhausting financial resources. Labor shortages in certain regions intensify these difficulties, affecting productivity and inflating costs. Supply chain interruptions, highlighted by recent global crises, also disrupt the availability of essential components for heavy construction machinery, leading to delays and increased project expenditures.

Nonetheless, the market remains resilient, with continuous innovations and an emerging emphasis on sustainable construction techniques creating avenues for new growth. As industry stakeholders navigate these evolving circumstances, the heavy construction equipment sector is set for a transformative journey that could enhance both growth and operational efficiency.

Key Segments of the Heavy Construction Equipment Market

By Type

- Earthmoving Equipment

- Material Handling

- Heavy Vehicle

- Crushers

- Others

By Application

- Excavation & Demolition

- Material Handling

- Heavy Lifting

- Recycling & Waste Management

- Tunneling

By End Use

- Metal

- Mineral

- Coal

- Aggregate

- Infrastructure

- Real Estate

- Oil & Gas

- Mining

- Forestry & Agriculture

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America