Market Analysis and Insights:

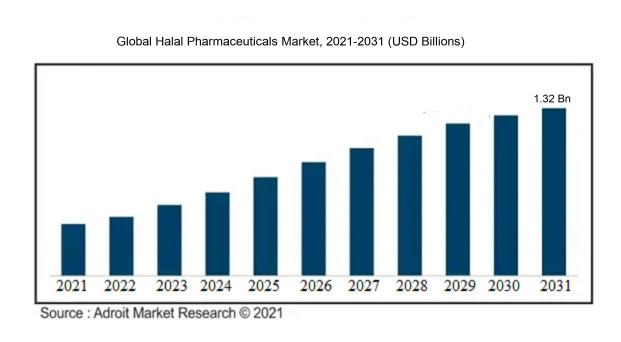

The market for Halal Pharmaceuticals was estimated to be worth USD 390.32 million in 2022, and from 2023 to 2031, it is anticipated to grow at a CAGR of 12.42%, with an expected value of USD 1.32 billion in 2031.

The rise of the Halal Pharmaceuticals sector can be attributed to various key drivers. Primarily, the increasing demand for Halal products, particularly in regions with a significant Muslim population, stems from religious and cultural customs that mandate adherence to Halal criteria. This demand extends to the pharmaceutical realm, where consumers are actively seeking medications that align with Islamic principles. Furthermore, the expanding global Muslim population, accompanied by growing incomes, is intensifying the need for Halal Pharmaceuticals. Heightened consumer awareness about the significance of Halal certification and transparency within the pharmaceutical industry is also influencing market growth. Consequently, pharmaceutical firms are dedicating resources to research and development to ensure the manufacture of Halal-compliant drugs. Additionally, governmental and regulatory authorities in Muslim nations are instituting more stringent protocols concerning Halal certifications, thereby propelling the Halal Pharmaceuticals market forward. These factors collectively drive the upward trajectory and widespread expansion of the Halal Pharmaceuticals market on a global scale.

Halal Pharmaceuticals Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD 1.32 billion |

| Growth Rate | CAGR of 12.42% during 2024-2031 |

| Segment Covered | By Drug Class, By Type, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | CCM Pharmaceuticals, Abbott Laboratories, Pharmaniaga, Chemical Company of Malaysia, Jamjoom Pharmaceuticals, Temmler Group, Bosnalijek, INET Pharma, and NoorVitamins, among other notable entities |

Market Definition

Halal Pharmaceuticals refer to medicines and healthcare items created, developed, and packaged following Islamic principles and regulations. They guarantee the absence of any components or methods deemed unacceptable in Islam. These items receive halal certification from reputable organizations, offering consumers assurance of their compliance with halal criteria.

Pharmaceuticals that adhere to Islamic principles and are certified as halal are gaining significance in response to the growing Muslim population and the escalating demand for Sharia-compliant goods. These medications are devoid of any elements that are forbidden in Islam, such as alcohol or pork derivatives, ensuring their permissibility for consumption in accordance with Islamic law. By adhering to religious beliefs and dietary requirements, halal pharmaceuticals offer reassurance to Muslim consumers. Moreover, these products appeal to a broader demographic beyond the Muslim community, as they are perceived as being more hygienic and produced with greater ethical considerations. The emergence of halal pharmaceuticals signifies a shift towards more inclusive and culturally respectful healthcare options, providing consumers with a wider array of choices while honoring their religious and cultural preferences.

Key Market Segmentation:

Insights On Key Drug Class

Endocrine Drugs

Endocrine Drugs are expected to dominate the Global Halal Pharmaceuticals Market. Endocrine drugs are designed to treat hormonal imbalances and disorders, which are prevalent worldwide. The growing prevalence of diseases such as diabetes, thyroid disorders, and hormonal deficiencies is fueling the demand for these drugs. Additionally, the increasing awareness and preference for halal-certified pharmaceuticals among Muslim consumers further contribute to the dominance of Endocrine Drugs in the global market. With advancements in drug formulations and an expanding target patient population, the demand for halal-certified Endocrine Drugs is expected to continue growing in the coming years.

Allergies

The Allergies category within the Drug Class is also anticipated to show significant growth in the Global Halal Pharmaceuticals Market. Allergic diseases, such as allergic rhinitis, asthma, and food allergies, affect a substantial portion of the global population. The rising incidence of allergies, combined with the increased recognition of halal standards and practices, drives the demand for halal-certified medications to alleviate allergy symptoms. As a result, pharmaceutical companies are focusing on developing and manufacturing halal-certified allergy drugs to cater to this growing demand, further contributing to the expansion of this part in the global market.

Pain Medications

Pain Medications, another category within the Drug Class, is projected to have a considerable share in the Global Halal Pharmaceuticals Market. Chronic pain conditions, including musculoskeletal pain, neuropathic pain, and cancer-related pain, are prevalent worldwide. The increasing geriatric population and the rising prevalence of chronic diseases contribute to the growing demand for pain medications. With the rise in halal-conscious consumers, there is a need for halal-certified pain medications in the global market, propelling the growth of this part.

Respiratory Drugs

While the dominance of the Global Halal Pharmaceuticals Market lies with the Endocrine Drugs class, Respiratory Drugs also play a significant role. Respiratory diseases, such as asthma, COPD, and respiratory tract infections, affect millions of individuals globally. The demand for halal-certified respiratory medications is driven by the increasing awareness of halal standards among Muslim consumers and the need for effective treatment options for respiratory disorders. As a result, the part of Respiratory Drugs is expected to have a notable presence in the Halal Pharmaceuticals Market, albeit not dominating like Endocrine Drugs.

Insights On Key Type

Tablet

Tablets are expected to dominate the Global Halal Pharmaceuticals Market. Halal pharmaceutical products in tablet form have gained significant traction in recent years due to their convenience, ease of consumption, and longer shelf life. Tablets offer precise dosing and are available in various strengths, making them suitable for a wide range of medical conditions. Additionally, tablet formulations often undergo rigorous testing and certification processes to ensure compliance with halal standards, which further enhances their appeal among the Muslim population. As a result, tablet-based halal pharmaceuticals are anticipated to have the largest market share in the Global Halal Pharmaceuticals Market.

Capsule

Capsules are another important player within the Type category of the Global Halal Pharmaceuticals Market. Although tablets are expected to dominate the market, capsules still hold a significant share due to their unique benefits. Capsules offer a variety of advantages, such as effective absorption, easy swallowing, and customized formulations. They are often preferred for individuals with difficulty swallowing solid tablets, including children and the elderly. Moreover, capsules allow for the combination of multiple active ingredients, enabling the development of innovative pharmaceutical formulations. While they may not dominate the market like tablets, capsules are expected to maintain a substantial presence in the Global Halal Pharmaceuticals Market.

Syrup

While both tablets and capsules are projected to dominate the Global Halal Pharmaceuticals Market, syrups are expected to have a smaller market share. Syrups are typically favored for pediatric patients and individuals who have difficulty swallowing solid dosage forms. They offer ease of administration and accurate dosing for specific patient populations. However, the preference for syrups is often limited to certain age groups or specific medical conditions where alternatives like tablets or capsules may be less suitable. Therefore, while syrups play an important role in the Halal Pharmaceuticals Market, they are not anticipated to have the same level of dominance as tablets or capsules.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the Global Halal Pharmaceuticals market. The region has a large Muslim population, particularly in countries such as Indonesia, Malaysia, and Pakistan, where the demand for halal products is significant. Additionally, the growing awareness and adoption of halal-certified pharmaceuticals in the region contribute to its dominance. The increasing disposable income, improving healthcare infrastructure, and rising healthcare expenditure also support the growth of the halal pharmaceuticals market in Asia Pacific. Furthermore, countries like China and India are witnessing a surge in the pharmaceutical industry and are investing in halal pharmaceuticals to cater to the needs of their Muslim population. Overall, these factors make Asia Pacific the dominant region in the Global Halal Pharmaceuticals market.

North America

North America has a substantial Muslim population, but the demand for halal pharmaceuticals is relatively lower compared to other regions. The halal pharmaceuticals market in North America is primarily driven by the presence of Muslim immigrants and a small portion of the population seeking halal-certified medications. However, the market potential in North America is still limited due to the lesser awareness and availability of halal pharmaceuticals. Pharmaceutical companies in the region may need to invest in research and development, certification, and marketing strategies to cater to the specific needs of the Muslim population and stimulate the growth of the halal pharmaceuticals market.

Europe

In Europe, the market for halal pharmaceuticals is growing at a moderate pace. The region has a significant Muslim population, particularly in countries such as France, Germany, and the UK. The demand for halal-certified medications is driven by the increasing awareness and religious observance of the Muslim community. The market growth is also supported by the presence of pharmaceutical companies focused on halal products and collaborations with halal certification bodies. However, the market potential in Europe is limited compared to other regions due to various factors, including cultural diversity, regulatory challenges, and a fragmented market. Nevertheless, efforts to meet the growing demand for halal pharmaceuticals in Europe are expected to drive its growth in the coming years.

Latin America

The Latin America region has a relatively smaller Muslim population compared to other regions, which limits the market potential for halal pharmaceuticals. However, there is a growing awareness among the Muslim community regarding the consumption of halal products, including pharmaceuticals. Countries such as Brazil, Argentina, and Colombia have witnessed a rising demand for halal-certified products due to the presence of Muslim immigrants and an increasing number of Muslim tourists. The market growth in Latin American countries is also stimulated by the availability of halal-certified pharmaceuticals imported from Muslim-majority countries. While the market size for halal pharmaceuticals in Latin America is relatively smaller, it is expected to experience gradual growth in the coming years.

Middle East & Africa

The Middle East & Africa region has a significant Muslim population, making it a potential market for halal pharmaceuticals. Islamic principles and religious beliefs play a crucial role in shaping the consumer demand in this region. The demand for halal-certified pharmaceuticals is driven by the need for products that comply with Islamic guidelines and are considered permissible. Countries such as Saudi Arabia, the United Arab Emirates, and Qatar are witnessing a rapid growth in the halal pharmaceuticals market, driven by rising disposable income, improving healthcare infrastructure, and government initiatives promoting the halal industry. The market potential in the Middle East & Africa region remains promising, with opportunities for local and international pharmaceutical companies to cater to the specific needs of the Muslim population.

Company Profiles:

Prominent stakeholders within the worldwide Halal Pharmaceuticals sector are essential contributors to the production and dispersion of pharmaceutical goods that adhere to Halal regulations, addressing the unique requirements of Muslim customers globally with a strong emphasis on quality and adherence to regulatory guidelines. Their pivotal role includes facilitating the availability of pharmaceutical products that align with Islamic principles, thus fostering confidence and reliability among Muslim consumers within the pharmaceutical realm.

Prominent companies in the Halal Pharmaceuticals sector comprise CCM Pharmaceuticals, Abbott Laboratories, Pharmaniaga, Chemical Company of Malaysia, Jamjoom Pharmaceuticals, Temmler Group, Bosnalijek, INET Pharma, and NoorVitamins, among other notable entities. These organizations play a vital role in manufacturing and disseminating Halal pharmaceuticals to various regions, catering specifically to the needs of Muslim consumers. Their presence underlines the escalating demand for Halal pharmaceuticals and the mounting emphasis on delivering healthcare solutions in accordance with Islamic principles and guidelines. These entities are consistently involved in research and development endeavors to unveil pioneering Halal pharmaceutical products and extend their reach in the global Halal Pharmaceuticals sector.

COVID-19 Impact and Market Status:

The global Halal Pharmaceuticals market has been greatly affected by the Covid-19 pandemic, causing disturbances in supply chains, manufacturing setbacks, and ened need for vital medications.

The Halal Pharmaceuticals sector has been significantly influenced by the global COVID-19 pandemic. This particular branch of the pharmaceutical industry, distinguished by its adherence to Islamic principles in the production of medications and healthcare goods, has encountered various repercussions stemming from the ongoing health crisis. The impacts on the industry have been dual-fold. A notable surge in the demand for halal pharmaceutical products has been witnessed due to an escalated consciousness regarding hygiene and cleanliness among consumers. Particularly, the Muslim community has been actively seeking products that align with their religious beliefs, causing a spike in the requirement for medications certified as halal. Conversely, the disruption in supply chains induced by the pandemic - encompassing logistical hurdles and scarcities of raw materials - has impeded the manufacturing and distribution processes of these specialized products.

Moreover, the enforcement of lockdown measures and prevailing economic uncertainties have led to diminished consumer purchasing power, thereby affecting the overall demand for pharmaceuticals, including halal variants. It is imperative to acknowledge the industry's resilience and adaptability in the face of such challenges by introducing innovative strategies such as digital platforms and e-commerce models to efficiently reach consumers. With the gradual global recovery from the pandemic, there is anticipation for the halal pharmaceutical market to revive and sustain its growth momentum, ensuring the availability of secure and compliant medications to meet evolving consumer needs.

Latest Trends and Innovation:

- In November 2020, Alive Pharmaceuticals announced a strategic partnership with Halal Research Council to develop and manufacture a range of halal-certified pharmaceutical products.

- In February 2021, Kuwait Saudi Pharmaceutical Industries (KSP) launched a new line of halal pharmaceutical products, catering to the growing demand in the halal pharmaceuticals market.

- In June 2021, Al-Hana Pharmaceuticals introduced a new technology innovation in the form of halal gelatin capsules, providing more options for Muslim consumers seeking halal-certified medications.

- In September 2021, Tabros Pharma signed an agreement to acquire Halal Pharmaceuticals, expanding its portfolio and strengthening its presence in the halal pharmaceuticals market.

- In October 2021, IBA Halal Care acquired XYZ Pharmaceuticals, broadening its range of halal-certified skincare and personal care products.

- In November 2021, AJ Pharma collaborated with Umm Al-Quraa University to develop halal vaccines, addressing the need for halal-certified vaccines among Muslim communities.

- In December 2021, Global Pharma launched a new halal-certified pain relief medication, meeting the increasing demand for halal alternatives in pain management.

- In January 2022, Meds Halal Pharmaceuticals announced a successful clinical trial for its halal-certified diabetes medication, positioning the company as a leader in halal treatments for chronic conditions.

Significant Growth Factors:

Factors contributing to the expansion of the Halal Pharmaceuticals Market comprise a surge in the request for halal-certified commodities, a rise in the Muslim populace, and a mounting recognition among consumers regarding the advantages of halal items.

The market for halal pharmaceuticals is witnessing substantial growth as a result of various key factors. The increase in the global Muslim population, along with a greater awareness among consumers regarding halal-certified products, is fueling the demand for such pharmaceuticals. This trend is particularly notable in countries with predominantly Muslim populations, where there is a strong preference for products that adhere to Islamic principles.

Additionally, the surge in halal tourism, notably in nations like Malaysia and the UAE, is leading to a ened need for halal medications and healthcare items to cater to Muslim travelers. Moreover, governments and regulatory bodies across different regions are acknowledging the significance of halal pharmaceuticals and are enacting policies to support their manufacturing and distribution. For example, Malaysia has introduced the Malaysian Halal Certification (JAKIM) to ensure adherence to halal standards. Furthermore, the global pharmaceutical sector is increasingly recognizing the value of halal certification, enabling companies to access a lucrative market and address the requirements of Muslim consumers. Consequently, pharmaceutical firms are investing in research and development efforts to create halal-certified drugs, supplements, and healthcare products. In essence, these factors are driving substantial expansion in the halal pharmaceuticals market, presenting extensive opportunities for manufacturers and consumers within the industry.

Restraining Factors:

A notable obstacle impeding the expansion of the Halal Pharmaceuticals Market is the absence of universally standardized Halal certification guidelines throughout various geographical regions.

The global Halal Pharmaceuticals Market is currently witnessing notable expansion, with various factors acting as impediments to its advancement. One key challenge stems from the absence of uniform regulations and standards governing the production and certification of halal pharmaceuticals, resulting in disparities in quality and adherence across different territories.

Moreover, a lack of awareness and comprehension among healthcare professionals and consumers regarding halal pharmaceuticals is limiting the market's growth potential. This dearth of knowledge leads to lower acceptance rates, with individuals often preferring traditional pharmaceuticals they are more familiar with. Additionally, the relatively higher prices of halal pharmaceuticals compared to their non-halal counterparts may discourage budget-conscious consumers from opting for them. Finally, strict import/export regulations and geographical constraints create obstacles for halal pharmaceutical companies striving to expand globally. Nevertheless, despite these challenges, the Halal Pharmaceuticals Market offers substantial avenues for expansion. Governments and regulatory bodies are inclining towards acknowledging the significance of standardized halal certifications and are enacting measures to outline and enforce clear directives. With increasing awareness surrounding halal pharmaceuticals, healthcare professionals and consumers are displaying more openness towards these products, potentially stimulating higher adoption rates. Initiatives to reduce production costs and introduce cost-effective alternatives are being pursued to address the price sensitivity challenge. Furthermore, technological advancements and improvements in logistics are streamlining import/export procedures and mitigating geographical barriers. These favorable developments, coupled with the rising demand for halal goods, signal a promising future for the Halal Pharmaceuticals Market.

Key Segments of the Halal Pharmaceuticals Market

Drug Class Overview

• Allergies

• Endocrine Drugs

• Pain Medications

• Respiratory Drugs

Type Overview

• Capsule

• Syrup

• Tablet

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America