Green Coatings Market Analysis and Insights:

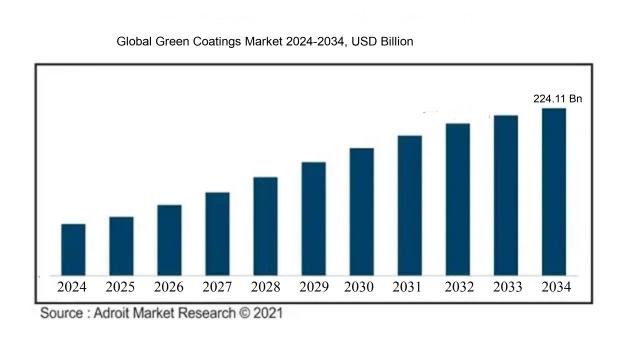

At a compound annual growth rate (CAGR) of 5.10%, the worldwide green coatings market is projected to reach a valuation of around USD 224.11 billion by 2034, having grown from USD 138.17 billion in 2024 to USD 145.06 billion in 2025.

The market for green coatings is largely influenced by ened environmental regulations and a rising consumer and industrial focus on sustainability. Legislative measures that advocate for environmentally friendly products motivate manufacturers to pursue innovation by developing sustainable coatings that utilize low levels of volatile organic compounds (VOCs) and renewable materials. The increasing appetite for eco-conscious products in industries such as construction, automotive, and consumer goods further accelerates market expansion. Furthermore, advancements in coating technologies, including options that are water-based and derived from biological sources, improve product performance while reducing ecological consequences. The trend towards green building and energy-efficient infrastructure also plays a role in the adoption of green coatings, as these solutions support the overarching objectives of decreasing carbon emissions and enhancing health and safety. Moreover, changing consumer preferences favor products that deliver efficacy alongside sustainability, driving ongoing investments and research into eco-friendly coating alternatives across diverse applications.

Green Coatings Market Definition

Eco-friendly coatings pertain to paint and finishing solutions designed with minimal volatile organic compounds (VOCs) and produced from sustainable resources. Their goal is to reduce ecological footprint while ensuring effective performance and longevity across different uses.

Eco-friendly coatings play a significant role in advancing environmental sustainability and curbing the adverse emissions linked to traditional paint options. These coatings are designed with minimal to no volatile organic compounds (VOCs), effectively lowering air pollution levels and enhancing indoor air quality. Furthermore, they frequently incorporate renewable materials and non-toxic components, thereby reducing their impact on the environment. Embracing these coatings allows industries to meet strict environmental standards while also improving the resilience and longevity of surfaces. By opting for environmentally responsible solutions, both consumers and manufacturers actively contribute to a healthier ecosystem and more sustainable construction methods, positioning eco-friendly coatings as an essential element of contemporary architecture and product innovation.

Green Coatings Market Segmental Analysis:

Insights On Type

Waterborne Coatings

Waterborne coatings are expected to dominate the Global Green Coatings Market due to their lower volatile organic compound (VOC) content, making them more environmentally friendly compared to other options. These coatings harness water as a solvent, which significantly reduces harmful emissions, thereby aligning with global sustainability standards and regulations. Their adaptability to various applications across industries, including automotive, construction, and consumer goods, further bolsters their market presence. The trend towards eco-friendly materials has surged, pushing manufacturers to innovate and enhance the performance of waterborne coatings. As industries increasingly prioritize sustainability, waterborne coatings stand out as the leading choice.

Powder Coatings

Powder coatings are gaining traction due to their efficiency and minimal environmental impact. They are typically applied electrostatically and cured under heat, which contributes to their durability and resistance to chipping, scratching, and fading. Unlike conventional paints, powder coatings contain negligible VOCs, which makes them more compliant with environmental regulations. This has a strong foothold in the automotive and furniture industries, where durability and finish quality are critical. Although their initial application costs may be higher, the long-term benefits, such as less wastage and improved lifecycle environmental performance, are becoming increasingly appealing for manufacturers.

High-Solids Coatings

High-solids coatings are recognized for their lower solvent content, which leads to reduced VOC emissions while maintaining the desired performance of traditional coatings. They provide excellent coverage and are effective in achieving a thick film in a single coat, resulting in faster project completion times. This is particularly useful in industrial and protective coatings, where durability and corrosion resistance are paramount. As businesses look for ways to comply with tightening regulations, the appeal of high-solids options is on the rise, albeit they currently hold a smaller share compared to waterborne coatings.

Radiation Cure Coatings

Radiation cure coatings are specialized formulations that cure upon exposure to ultraviolet (UV) light or electron beams. These coatings offer rapid curing times, leading to increased productivity and reduced processing costs. Due to their unique properties, they are well-suited for applications in the electronics, automotive, and graphics industries. However, the high initial setup costs and the need for specialized equipment can limit their widespread adoption compared to other coatings. Nevertheless, their ability to produce durable and high-quality finishes keeps them competitive, particularly for niche applications that require specific performance characteristics.

Insights On Source

Vegetable Oil

Vegetable oil is projected to dominate the Global Green Coatings Market due to its renewable nature and eco-friendly characteristics. The rising demand for sustainable products and stringent regulations concerning volatile organic compounds (VOCs) are pushing manufacturers to seek greener alternatives. Vegetable oils, such as linseed and canola, serve as effective binders and thickeners in coatings, providing excellent performance. Furthermore, advancements in the processing technology of vegetable oils have enhanced their stability, reducing issues like yellowing and oxidation. As industries transition towards more sustainable practices, vegetable oils are emerging as a preferred choice for a multitude of applications within the green coatings sector.

Soy Bean

Soy bean oil has gained traction within the green coatings market due to its abundance and low-cost sourcing. Rich in polyunsaturated fatty acids, soy oil serves effectively as a binder and drying agent, promoting product performance. The growing awareness of environmental sustainability and health benefits associated with natural products are further bolstering the utilization of soy bean oil in coatings. As manufacturers increasingly focus on eco-friendly formulations, soy bean oil will likely continue to play a significant role in the development of green coatings.

Castor Oil

Castor oil offers unique properties that make it valuable in the formulations of green coatings. Its high viscosity and drying capabilities enable manufacturers to produce coatings with improved gloss and flexibility. As industries increasingly emphasize sustainable materials, castor oil can contribute significantly to bio-based coatings, meeting the market demand for greener options. Additionally, the castor plant's ability to thrive in diverse climates ensures a stable supply, making it an attractive choice for manufacturers seeking to reduce their environmental impact while maintaining product performance.

Clay

Clay serves as an important mineral component in the development of sustainable coatings. It is prized for its availability and non-toxicity, making it an ideal alternative for reducing harmful VOC emissions. Clay can enhance the rheological and mechanical properties of coatings, leading to better overall performance. With the rising emphasis on green materials, the utilization of clay is likely to grow, especially in applications requiring superior adhesion and durability. Its effectiveness in improving the sustainability profile of coatings positions clay as a key player in eco-friendly formulations within the coatings market.

Other Sources

The category of "Other Sources" encompasses a range of alternative materials that can potentially serve as eco-friendly options in coatings. These may include sources like natural waxes, resins, or certain biodegradable polymers that can contribute to sustainable practices in manufacturing. Although not as widely recognized as vegetable oils or specific natural oils, these alternatives are gaining attention, driven by the growing demand for diverse environmentally-friendly solutions. As research and development continue to unveil new sustainable materials, the significance of this category is likely to increase, opening new avenues for innovation in green coatings.

Insights On End-Use Industry

Architectural

Architectural applications are projected to dominate the Global Green Coatings Market due to increasing environmental concerns and the growing demand for sustainable building materials. Many regions are implementing stringent regulations regarding VOC emissions, prompting architects and developers to opt for eco-friendly coatings. Furthermore, the trend towards green buildings and energy-efficient designs is necessitating the use of high-performance coatings that offer durability, protection, and sustainability. Consumers are also increasingly prioritizing aesthetics and health-related factors, making eco-friendly architectural coatings a critical choice in the market, ultimately driving growth and innovation in this.

Industrial

The industrial sector plays a significant role in the green coatings market, as industries seek to comply with regulations while maintaining operational efficiency. There is an increasing investment in sustainable manufacturing processes and low-VOC coatings to reduce environmental impact. This sector encompasses a vast range of applications, including machinery, equipment, and infrastructure, where protective coatings are essential. As industries strive towards sustainability and minimizing their carbon footprint, the demand for eco-friendly industrial coatings continues to rise, highlighting their importance in the overall market landscape.

Automotive

In the automotive industry, the shift towards sustainability has driven interest in green coatings, although it faces challenges such as rigorous performance standards and the need for high durability. Automakers are increasingly focusing on eco-friendly solutions to enhance the sustainability profile of vehicles. The rising consumer demand for environmentally friendly vehicles promotes the adoption of water-based and bio-based coatings that meet industry specifications. Despite being a significant player, the automotive 's growth is relatively slower compared to architectural applications due to existing stringent performance criteria that green coatings must meet.

Packaging

The packaging sector is witnessing a gradual shift towards green coatings as consumers and manufacturers become more environmentally conscious. The demand for sustainable packaging solutions is on the rise, promoting the use of eco-friendly coatings. Biodegradable and recyclable packaging materials are gaining traction, and green coatings are essential in this transition. However, while the packaging industry presents opportunities for growth, it is currently secondary to architectural applications in terms of market dominance, given that the architectural sector leads in the implementation of comprehensive sustainability strategies.

Other End-Use Industries

Other end-use industries, including electronics and furniture, are gradually adopting green coatings to meet sustainability goals and consumer demands. This encompasses a diverse range of applications, each striving to reduce environmental impact. However, while there is a notable interest in eco-friendly coatings within these areas, they do not yet compete effectively with the dominant architectural. The overall growth of green coatings in these industries is positive, but they currently represent a smaller portion of the market compared to the leading sectors, which are more heavily driving demand for sustainable solutions.

Global Green Coatings Market Regional Insights:

Asia Pacific

Based on comprehensive research and current market trends, Asia Pacific is expected to dominate the Global Green Coatings market. This region's rapid industrialization, coupled with increasing environmental awareness and stricter regulations regarding volatile organic compounds (VOCs), drives the demand for sustainable and eco-friendly coatings. Countries like China, India, and Japan are investing heavily in green technologies and sustainable practices, which enhances the market presence of green coatings in construction, automotive, and consumer goods sectors. Additionally, a growing population and urbanization in these countries lead to higher construction activities, further boosting the demand for green coatings.

North America

North America possesses a substantial market for green coatings, driven by stringent environmental regulations and the increasing adoption of sustainable practices. The United States and Canada are at the forefront of developing innovative eco-friendly products, prompting significant investment in research and development. The presence of key players in the chemical and coatings industries, along with ened consumer awareness regarding health and environmentally responsible practices, further accelerates the green coatings market in this region.

Europe

Europe is another significant region in the green coatings market, propelled by stringent environmental policies and the European Union's commitment to sustainability. The push for low-VOC and waterborne coatings, along with increasing funding for green building initiatives, fosters growth in this sector. Larger companies in Europe are also committed to sustainability, driving innovation and making green coatings an important aspect of the construction, automotive, and industrial markets within the region.

Latin America

In Latin America, the green coatings market is gradually gaining traction due to rising environmental awareness among consumers and growing investments from both private and public sectors in sustainable construction. Countries like Brazil and Mexico are increasingly turning to eco-friendly products while experiencing economic growth, which is slowly translating into more sustainable practices in various industries. However, the region still has challenges such as regulatory inconsistencies and limited access to green technologies, which may impede quicker market growth.

Middle East & Africa

The Middle East & Africa region is still emerging in the green coatings market, with growth mainly driven by increasing urbanization and developments in infrastructure. While interest in sustainable and environment-friendly products is growing, the market faces challenges such as limited regulations and lack of awareness about the benefits of green coatings. However, initiatives by governments to promote sustainability and attract investments in green technologies can potentially enhance the market's development in the coming years.

Green Coatings Competitive Landscape:

Leading entities in the Global Green Coatings sector, including producers and suppliers, are advancing innovation through the creation of environmentally friendly products and sustainable production methods. Meanwhile, distributors are essential in advocating for and distributing these eco-conscious coatings across multiple industries. Their partnership fosters a shift towards more sustainable practices within the coatings industry.

Prominent participants in the Green Coatings Market comprise AkzoNobel N.V., PPG Industries, Inc., Sherwin-Williams Company, BASF SE, Masco Corporation, RPM International Inc., Axalta Coating Systems Ltd., Beckers Group, Valspar Corporation, Dow Inc., Huntsman Corporation, Nippon Paint Holdings Co., Ltd., DuPont de Nemours, Inc., Kansai Paint Co., Ltd., Futura Coatings, and Jotun A/S.

Global Green Coatings COVID-19 Impact and Market Status:

The Covid-19 pandemic had a significant impact on the Global Green Coatings industry, leading to production delays and interruptions in supply chains. At the same time, there was a ened demand for environmentally friendly products, as the focus on sustainability grew during the recovery phase.

The COVID-19 pandemic had a profound effect on the market for green coatings, revealing both obstacles and potential for growth. Initially, the industry faced significant hurdles due to supply chain disruptions, factory closures, and a decrease in demand from key sectors like automotive and construction, which hindered market expansion. However, as nations began to emphasize environmental sustainability in light of the pandemic, there emerged a ened interest in eco-friendly alternatives. Government-backed initiatives promoting sustainable building practices and green manufacturing further fueled interest in coatings that are low in volatile organic compounds (VOCs) and environmentally safe. Furthermore, a growing consumer consciousness about minimizing carbon footprints has contributed to the rising demand for these coatings. As companies adjust to the new realities post-pandemic, the green coatings market is poised for recovery and growth, driven by advancements in technology and materials, along with an increased dedication to sustainability throughout various industries.

Latest Trends and Innovation in The Global Green Coatings Market:

- In October 2021, PPG Industries announced the launch of its new line of sustainable coatings, called PPG EcoClear, which significantly reduces the environmental impact of coatings used in commercial and industrial applications.

- In February 2022, Sherwin-Williams completed its acquisition of Tremco CPG, expanding its portfolio in the green coatings and enhancing its capabilities in providing sustainable solutions for construction projects.

- In April 2022, AkzoNobel revealed a partnership with the University of Science and Technology in South Korea to develop eco-friendly coatings using bio-based materials, aiming to reduce reliance on petrochemicals in their products.

- In July 2022, Covestro AG introduced its new line of water-based coatings that utilize high-performance raw materials sourced from renewable resources, marking a significant step toward increasing sustainability in protective coatings.

- In March 2023, BASF announced the expansion of its EcoFit line of coating resins, designed to provide superior performance while being compliant with global environmental regulations, highlighting the company’s commitment to sustainability.

- In June 2023, RPM International Inc. launched a new product line under its Rust-Oleum brand, focusing on low-VOC and zero-VOC coatings for homeowners and professionals, enhancing the eco-friendliness of its offerings.

- In August 2023, Axalta Coating Systems introduced new technology that incorporates recycled materials into its automotive paint formulations, aiming to reduce waste and improve sustainability in the automotive coatings market.

Green Coatings Market Growth Factors:

The expansion of the green coatings sector is propelled by ened environmental legislation, growing consumer interest in sustainable goods, and innovations in environmentally friendly technologies.

The Green Coatings Market is witnessing significant expansion, primarily fueled by rising environmental awareness and strict regulations on volatile organic compounds (VOCs). As both consumers and businesses increasingly prioritize sustainability, the demand for environmentally friendly paints and coatings has escalated, encouraging manufacturers to innovate and create sustainable alternatives. Additionally, the construction and automotive sectors are adopting green options to adhere to government regulations and bolster their brand image. Innovations in bio-based materials and recycling techniques have further propelled market growth, resulting in high-performance coatings that reduce environmental harm. Increased funding in research and development is also leading to the introduction of new formulations that enhance durability and functionality, catering to a wider array of applications. Furthermore, the ened awareness of health risks linked to conventional coatings drives consumer preference towards greener choices, which are generally less harmful and promote better indoor air quality. These combined factors, along with an ongoing shift towards sustainable architecture and design, position the Green Coatings Market for considerable growth in the foreseeable future, aligning with global sustainability initiatives and consumer demands.

Green Coatings Market Restaining Factors:

Major constraints in the green coatings industry involve elevated manufacturing expenses and restricted access to raw materials.

The Green Coatings Market encounters several challenges that could hinder its expansion. Primarily, the elevated production costs associated with green coatings compared to traditional options often dissuade manufacturers from embracing these eco-friendly alternatives. Additionally, the scarcity of raw materials that comply with sustainability certification standards can create obstacles, resulting in prolonged lead times and higher expenses. Moreover, a general lack of consumer awareness regarding the advantages of green coatings can restrict market growth, as many individuals still opt for conventional products due to their established presence. Regulatory complexities and compliance requirements add another layer of difficulty, as manufacturers must navigate a myriad of environmental regulations that differ across regions. Furthermore, there is a lingering perception that green coatings do not perform or last as well as traditional coatings, which contributes to reluctance among potential adopters. Nonetheless, despite these hurdles, technological advancements and a rising consumer appetite for sustainable options are spurring innovation and investment in this field. Ongoing research and development initiatives are expected to improve the performance of green coatings, rendering them more appealing to both manufacturers and consumers. As awareness increases and economies shift towards more sustainable practices, the green coatings market is anticipated to gain traction in the years ahead, fostering a more sustainable future for the coatings sector.

Key Segments of the Green Coatings Market

By Type

- Waterborne Coatings

- Powder Coatings

- High-Solids Coatings

- Radiation Cure Coatings

By Source

- Vegetable Oil

- Soy Bean

- Castor Oil

- Clay

- Other Sources

By End-Use Industry

- Industrial

- Architectural

- Automotive

- Packaging

- Other End-Use Industries

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America