Green Ammonia Market Analysis and Insights:

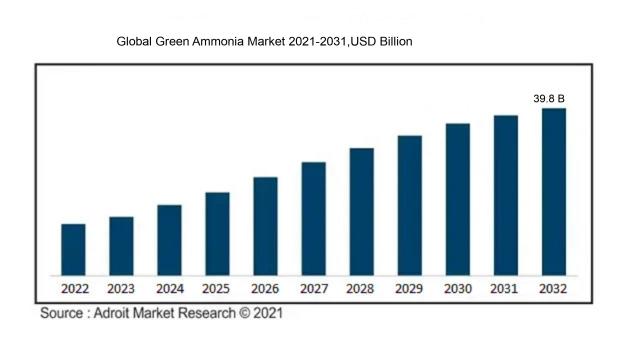

In 2023, the size of the Global Green Ammonia Market was US$0.7 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 73.41% from 2024 to 2032, reaching US$ 39.8 billion.

The Green Ammonia Market is significantly influenced by the escalating demand for eco-friendly fertilizers and the increasing priority placed on carbon neutrality within various industrial sectors. As agriculture moves towards sustainable methodologies, green ammonia, which is generated from renewable energy sources, stands out as a viable substitute for conventional ammonia, known for its high carbon emissions. Supportive government policies and regulatory measures aimed at minimizing carbon footprints further stimulate market growth, encouraging investments in technologies designed for green ammonia production. Moreover, progress in electrolyzer technology alongside the integration of renewable energy sources like solar and wind power is enhancing the financial feasibility of producing green ammonia. The growing focus on hydrogen as a clean energy medium also bolsters the emergence of green ammonia in energy storage and transport applications. Together, these dynamics foster strong growth and innovation within the green ammonia industry, establishing it as an essential element in the global shift toward sustainable energy practices.

Green Ammonia Market Definition

The green ammonia sector encompasses the production of ammonia utilizing environmentally friendly techniques, notably electrolysis driven by renewable energy sources, thereby eliminating dependence on fossil fuels. This industry aspires to lower carbon emissions and facilitate the shift towards a more sustainable future in agriculture and energy.

The market for green ammonia holds significant importance as it has the capacity to transform the global energy framework by offering an environmentally friendly method for producing and storing hydrogen. Serving as a carbon-free substitute for conventional ammonia production, green ammonia is essential for reducing carbon emissions in agriculture, where it functions as a sustainable fertilizer. Additionally, it supports the shift towards renewable energy by serving as an effective energy carrier. Its ability to integrate seamlessly with existing infrastructure also lowers the costs associated with the transition, making it a compelling choice for industries aiming to reduce their environmental impact.

Green Ammonia Market Segmental Analysis:

Insights On Key By Gasifier Technology

Proton Exchange Membrane Electrolysis

Proton Exchange Membrane (PEM) electrolysis is anticipated to dominate the Global Green Ammonia Market due to its high efficiency and rapid response times. The technology is more adept at producing hydrogen from renewable energy sources, making it especially suitable for scalable green ammonia production. Given the global shift towards sustainable energy systems, this technology aligns well with governmental policies favoring eco-friendly methods. Furthermore, PEM electrolyzers have a compact design and are well known for their durability and operational reliability, which enhances their appeal in industrial applications. Major investments in PEM technology are expected to further bolster its market position in the coming years.

Alkaline Water Electrolysis

Alkaline Water Electrolysis is characterized by its reliability and cost-effectiveness, making it a viable option in the market. Although it has slower response times compared to PEM technology, it is generally less expensive to operate and has a long lifespan. This makes it a preferred technology in large-scale, continuous ammonia production scenarios. The method's robustness and the availability of cheaper materials for its construction contribute to its appeal in developing economies where cost considerations are crucial.

Solid Oxide Electrolysis

Solid Oxide Electrolysis stands out due to its high efficiency at elevated temperatures and its ability to utilize waste heat sources, which can significantly improve overall system efficiencies. However, the technology is still in its developmental stage with limited commercial applications compared to other methods. The complexity and cost of the materials required for solid oxide stacks can pose challenges for widespread adoption. Nonetheless, ongoing research and development may enhance its applicability and market share in the long term, particularly in integrated energy systems that focus on maximizing resource utilization.

Insights On Key By Gasifier Application

Power Generation

Power generation is expected to dominate the Global Green Ammonia Market due to the increasing demand for renewable energy sources and the transition towards carbon-neutral electricity generation. Green ammonia acts as an energy carrier, enabling the storage and transport of renewable energy, which can be converted back into hydrogen for power generation. Additionally, advancements in ammonia production technologies will enhance its appeal for power plants aiming to reduce emissions. Governments are increasingly focusing on green initiatives, and as a result, the power generation sector's shift to sustainable practices strongly supports the growth of green ammonia applications. Overall, the integration of ammonia-based solutions in power generation aligns with global energy transition goals, ensuring its commanding position in the market.

Transportation

Transportation is emerging as a noteworthy application for green ammonia, primarily as the sector seeks alternatives to fossil fuels. With the urgent need for decarbonization, ammonia is being explored as a cleaner fuel for ships and heavy-duty vehicles. Its high energy density and well-known handling processes make it a viable option for decarbonizing shipping and freight sectors. Several countries are initiating pilot projects to further explore ammonia’s potential as a transportation fuel. However, challenges like infrastructure development and regulatory frameworks must be addressed for broader adoption. Nonetheless, the drive for sustainable transport solutions indicates robust interest in green ammonia within this sector.

Industrial Feedstocks

The industrial feedstocks is also gaining traction for green ammonia usage, primarily driven by its application in fertilizers and chemicals. Ammonia plays a critical role in the agricultural sector as a primary ingredient for nitrogen-based fertilizers. As the agricultural industry increasingly shifts towards sustainable practices, the demand for green ammonia as a low-carbon fertilizer source has surged. Moreover, various chemical industries are integrating green ammonia into their processes to lower their carbon footprints. However, while this application has a significant market potential, it currently lags behind power generation, which offers a more transformative impact in terms of energy transition.

Global Green Ammonia Market Regional Insights:

North America

North America is projected to dominate the Global Green Ammonia Market, witnessing a growing focus on reducing greenhouse gas emissions, which bodes well for the green ammonia market. The U.S. and Canada are investing heavily in renewable energy technologies and prioritizing sustainable agricultural practices. A surge in government incentives for low-carbon technologies and partnerships among private entities to develop green ammonia production projects are vital factors anticipated to boost market growth in this region. However, compared to Asia Pacific, the pace of adoption may still be slower due to infrastructure challenges and the relatively higher cost of production.

Asia Pacific

Asia Pacific is expected to expand rapidly driven by rapid industrialization and increasing energy demands across the region. Countries like Japan, China, and Australia are at the forefront of implementing renewable energy sources and exploring sustainable fuel alternatives. The region’s government policies aimed at reducing carbon emissions and promoting green technology innovation further enhance its position. Major investments in research and development of hydrogen technologies and the supportive infrastructure for green ammonia production are anticipated to foster market growth significantly. With a sizeable population and high energy consumption rates, Asia Pacific's transition to a green economy will likely establish its dominance in the green ammonia market.

Europe

Europe has emerged as a key player in the green ammonia market, driven by ambitious environmental policies and regulations aimed at achieving carbon neutrality by 2050. The European Union's focus on sustainable energy transition and the Green Deal initiatives are encouraging investment in low-carbon technologies. Countries like Norway, Germany, and the Netherlands are actively piloting projects that aim to develop green ammonia as a crucial component of their energy strategies. While Europe ranks high in regulatory support, the market is constrained by competition and the dependence on imports for raw materials needed for production.

Latin America

Latin America presents a growing opportunity in the green ammonia market, primarily due to its abundant renewable energy resources like solar and wind. Countries such as Brazil and Chile are increasing efforts to harness these resources for green hydrogen and ammonia production. However, infrastructure and regulatory uncertainties may hinder acceleration in the sector. With recognition of the importance of sustainable energy solutions, governments are beginning to implement policies to foster investment, though the overall market growth remains slower compared to more developed regions like Asia Pacific and Europe.

Middle East & Africa

The Middle East & Africa region is gradually emerging in the green ammonia market, primarily driven by the Gulf states' initiatives to diversify their economies away from oil dependence. Countries like Saudi Arabia are keen on capitalizing on their solar power potential to produce green ammonia. However, challenges related to investment, technology adoption, and infrastructure may restrict faster advancements compared to other regions. The local market is still in its nascent stages, but growing international interest and collaboration could provide the necessary impetus for future growth.

Green Ammonia Market Competitive Landscape:

Prominent participants in the worldwide green ammonia sector are fueling innovation and manufacturing by investing in eco-friendly technologies and forming collaborations, thereby optimizing supply chains to address the growing demand. Their tactical efforts prioritize the reduction of carbon emissions while improving the effectiveness of ammonia synthesis methodologies.

Prominent entities within the green ammonia sector encompass Air Products and Chemicals, Inc., Yara International ASA, Nouryon, Siemens AG, Haldor Topsoe A/S, CF Industries Holdings, Inc., ACWA Power, Thyssenkrupp AG, GE Renewable Energy, and Aker Solutions. Notable players also include Cez Group, Enel Green Power, KBR, Inc., MAN Energy Solutions, Norwegian Green Ammonia, and HydrogenPro. Furthermore, firms such as Mitsubishi Power, Jason, Prismatic Energy, and Nel ASA are actively participating in the green ammonia landscape, aiding in the innovation and commercialization of sustainable ammonia solutions.

Global Green Ammonia Market COVID-19 Impact and Market Status:

The Covid-19 pandemic acted as a catalyst for innovation and financial commitment within the global green ammonia sector, prompting nations to emphasize sustainable energy alternatives and lessen their dependence on fossil fuels.

The green ammonia sector has experienced considerable alterations due to the COVID-19 pandemic, affecting both its supply chains and demand patterns. The implementation of lockdowns and various restrictions caused significant disruptions in production and logistics, resulting in extended project timelines and ened operational expenses. Conversely, this crisis highlighted the critical role of sustainable energy solutions, stimulating investments in green ammonia as an environmentally friendly hydrogen carrier and alternative to traditional fertilizers. In addition, escalating geopolitical concerns over energy security have amplified interest in strategies for decarbonization. As nations recover from the pandemic, there is an increased focus on green technologies, supported by government initiatives and stimulus programs designed to encourage sustainable practices. As a result, the green ammonia market is set for expansion, as industries aim to move away from fossil fuels and lower their carbon footprints, positioning it as a crucial component in the global transition towards a sustainable and resilient energy landscape.

Latest Trends and Innovation in The Global Green Ammonia Market:

- In April 2023, Yara International announced a partnership with Haldor Topsoe to develop a new process for producing green ammonia using renewable hydrogen and captured CO2, aiming to improve the carbon footprint of ammonia production.

- In March 2023, Siemens Energy and Acron Group signed an agreement to create a joint venture focused on large-scale production of green ammonia in Russia, leveraging Siemens' technology to enhance energy efficiency in the process.

- In February 2023, New Fortress Energy completed the acquisition of the green ammonia production facility from Energy & Commodities, aiming to expand its renewable energy portfolio and establish a foothold in the green ammonia market.

- In January 2023, OCI N.V. announced the successful commissioning of its green ammonia production facility in Texas, which uses renewable energy sources to produce ammonia and is expected to significantly reduce carbon emissions compared to traditional processes.

- In December 2022, CF Industries signed an agreement with Mitsubishi Power to collaborate on the development of a green ammonia plant in Louisiana, with an estimated production capacity of 3 million tons per year, expected to scale up by 2025.

- In November 2022, MAN Energy Solutions unveiled a new technology for ammonia fueled engines, enabling vessels to use green ammonia as a sustainable marine fuel, reflecting the increased interest in decarbonizing shipping.

- In October 2022, Wilson Sons Limited announced plans to develop a green ammonia production facility in Brazil, which will be integrated with renewable energy generation, further bolstering the country’s sustainable energy initiatives.

- In September 2022, Aker Horizons and the Norwegian government began efforts to create an ecosystem for green hydrogen and ammonia production on the Norwegian coast, after securing funding to advance the project through the Innovation Norway program.

Green Ammonia Market Growth Factors:

The expansion of the green ammonia sector is fueled by a ened need for eco-friendly fertilizers, progress in renewable energy innovations, and escalating governmental backing for initiatives aimed at reducing carbon emissions.

The Green Ammonia Market is witnessing remarkable expansion driven by several pivotal elements. Primarily, the worldwide emphasis on sustainability and decarbonization has amplified the interest in green ammonia as a cleaner substitute for conventional ammonia production methods, which are notable for their high carbon emissions. The growing focus on renewable energy technologies, including solar and wind, is propelling the advancement of green ammonia as a viable solution for energy storage and transportation, thus increasing its attractiveness. Additionally, improvements in electrolysis technology, essential for generating green hydrogen, are enhancing production efficiency and lowering costs, making green ammonia more competitive against ammonia derived from fossil fuels. Supportive government policies and incentives designed to decrease greenhouse gas emissions and encourage green technologies are also critical in stimulating investment and research in this field. Furthermore, sectors such as agriculture and maritime transport are progressively acknowledging the advantages of green ammonia for fertilizer production and as a zero-emission fuel, respectively. Collectively, these elements are driving the momentum of the green ammonia market, aligning with global sustainability ambitions and presenting substantial opportunities for stakeholders involved.

Green Ammonia Market Restaining Factors:

The primary challenges hindering the growth of the Green Ammonia sector encompass elevated manufacturing expenses, insufficient distribution infrastructure, and rivalry from traditional ammonia production methods reliant on fossil fuels.

The green ammonia market faces several obstacles that limit its growth potential. First, the substantial production costs related to green ammonia—largely driven by the need for renewable energy sources and sophisticated technology—create economic barriers to its widespread implementation. Additionally, the insufficient infrastructure for both storage and transportation presents challenges in distribution and scalability, requiring considerable investment to improve facilities and logistics. Furthermore, the prevailing reliance on traditional ammonia production methods, which are well-established and cost-efficient, complicates the transition to more sustainable options. Regulatory challenges and inconsistent governmental policies across countries can also hinder market expansion, as a lack of stable support may discourage investment. Moreover, the nascent state of green ammonia technology contributes to a general lack of awareness and understanding among essential stakeholders, further complicating efforts to achieve widespread industry acceptance. However, ongoing progress in renewable energy technologies and growing global concerns about climate change and sustainability are driving a shift toward greener alternatives. This trend, supported by initiatives from both government and private sectors, suggests a promising future for the green ammonia market, with potential for significant innovation and growth in minimizing carbon emissions.

Key Segments of the Green Ammonia Market

By Gasifier Technology

• Alkaline Water Electrolysis

• Proton Exchange Membrane Electrolysis

• Solid Oxide Electrolysis

By Gasifier Application

• Power Generation

• Transportation

• Industrial Feedstocks

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America