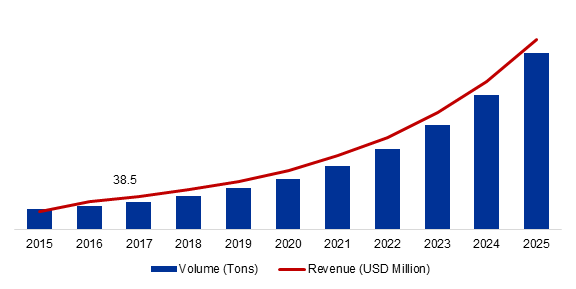

The global graphene market size was estimated at USD 38.5 million in 2017 owing to its unique combination of superior properties such as electrical conductivity and heat resistance which has paved the way for its expansion in a wide spectrum of applications. Additionally, rising demand from the electronics industry has created favorable growth opportunities for graphene across the globe.

Global Graphene Market Volume and Value, 2015-2025 (Tons), (USD Million)

Graphene is a single carbon layer with a graphite structure that is only one atom thick but 150 times stronger than the same steel weight. Graphene is one million times thinner than paper and more flexible than rubber. Graphene is more than 200 times efficient in conducting electricity than silicone and is entirely made of carbon, the fourth most abundant element in the world. The unique thinness and conductivity properties of graphene have led to an increased focus on research to expand its usefulness in a wider range of applications. One of the main hurdles in the industrial production of graphene is the complexity of the process and the high cost of its production, which is expected to inhibit the growth of the global graphene market size.

The global market for the Graphene is anticipated to develop at a compound annual growth rate (CAGR) of 44.7% throughout the course of the forecast, to reach US$ 2,152.9 million by 2028.

Graphene exhibits excellent properties of thinness and conductivity, which has triggered extensive R&D to develop a wide range of applications for this market. In April 2018, experts from the University of Exeter developed a pioneering technique that embeds graphene in traditional nanotechnology concrete production. The new composite material, more than twice as strong and four times more water resistant than existing concrete, can be used directly by the construction industry on sites. The concrete samples tested to comply with British and European construction standards. This new technique could pave the way for the incorporation of other nanomaterials into concrete and further modernize the building industry, globally. Finding greener ways of building is an important step towards reducing carbon emissions worldwide and helping to protect the environment. The stronger and more durable concrete used in the graphene can revolutionize the construction industry, thus, driving the global graphene market size.

Graphene oxide generated revenues worth USD 15.20 million in 2017 within the global graphene market. Graphene oxide has an oxygen functionality that facilitates easy dispersion in water and other organic solvents. The presence of oxygen functionalities helps graphene oxide to easily disperse in organic solvents, water, and different matrixes. Its property of high electrical conductivity has expanded the applicability of graphene oxide in solar cells, composites, batteries, supercapacitors, catalytic oxidation, biotechnology, electronic devices, and as a surfactant in industrial applications. This is expected to drive the global graphene oxide market over the forecast period.

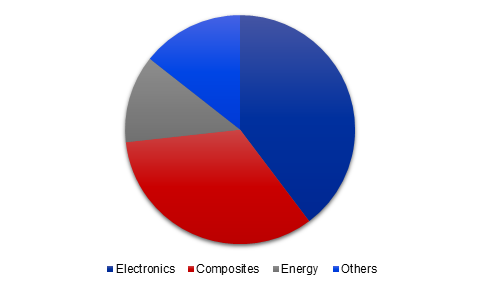

Global Graphene Market Share, by Application, 2017 (%)

The global graphene market analysis on the basis of applications reveals that the electronics application held a market share of more than 35% in 2017 and is projected to witness rapid growth in the future. Graphene is considered as a miraculous material with the great potential to transform the world with its limitless applications. The electronics industry is likely to witness considerable growth in the coming years in emerging economies on account of increased manufacturing which has stimulated the demand for graphene. The future of electronics lies in flexible devices that are bendable, stretchable, foldable, wearable and transparent. Graphene is also highly flexible and transparent, in addition to its powerful electrical properties. This makes it ideal for portable electronics applications. Smartphones and tablets are much more durable using graphene and could possibly be folded like paper. The growing popularity of wearable electronic devices has, thus, boosted the demand for graphene across the globe.

Asia Pacific accounted for 30.8% of the global graphene market share, in terms of revenue generation, in 2017 and is projected to grow at a CAGR exceeding 25% during the forecast period. Asia Pacific is expected to witness rapid growth over the forecast period driven by the expanding electronics sector and increasing investments in renewable power generation sector. In view of favorable government support for investment in the manufacturing sector, China is expected to emerge as a promising market over the forecast period. Increased research and development as a result of strong government policies have also driven the regional demand. For instance, Ningbo Morsh Technology in China has invested USD 300 million in a 300-ton production line. Furthermore, the dominance of China and India in graphite production is another major factor driving the growth of the graphene market in the region. In 2017, China was the world's largest graphite producer, with 780,000 MT of graphite accounting for 65% of world graphite mining and 35% of consumption, according to the US Geological Survey.

The global graphene market analysis covers the players having a regional and global presence. Companies such as Graphenea S.A., XG Sciences, Inc., Vorbeck Materials, Applied Graphene Materials plc, ACS Materials LLC, NanoXplore Inc., BGT Materials Limited, Ltd, Grafoid Inc., Thomas Swan & Co. Ltd., and Global Graphene Group among others have a broader presence within the global graphene market. Expansion is one of the key strategies adopted by key players to further aid growth. For instance, XG Sciences, Inc. announced in October 2018 that it had completed its first expansion phase in its newest 64,000 square foot facility. The expansion added production capacity of 90 metric tons of graphene nanoplatelets. The expansion of production capacity has allowed it to reach higher-volume customers and helped to develop innovative solutions for the customers.

Graphene Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2028 |

| Study Period | 2018-2028 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2028 | US$ 2,152.9 million |

| Growth Rate | CAGR of 44.7 % during 2021-2028 |

| Segment Covered | by Product Type, by Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, Middle East and Africa, South America |

| Key Players Profiled | Graphensic AB, BGT Materials Limited, Graphenea SA, Graphene Square Inc., ACS Material, LLC, Chongqing Moxi Technology Co., Ltd, Grolltex Inc., CealTech AS, Thomas Swan & Co. Ltd, and XG Sciences Inc. |

Key segments of the Global Graphene Market

Type Overview, 2015-2025 (Tons) (USD Million)

- Graphene Nanoplatelets

- Graphene Oxide

- Others

Application Overview, 2015-2025 (Tons) (USD Million)

- Electronics

- Composites

- Energy

- Others

Regional Overview, 2015-2025 (Tons) (USD Million)

- North America

- U.S.

- Canada

- Europe

- UK

- Spain

- Rest of Europe

- Asia Pacific

- India

- China

- Rest of APAC

- Rest of the World

Key Players analysed in the report include

- Graphenea S.A.

- Applied Graphene Materials plc

- XG Sciences, Inc.

- Vorbeck Materials

- ACS Materials LLC

- Others