GPU database processes huge data volumes quicker and more effectively than CPUs because they operate in parallel instead of in sequence. GPUs speed up location-based services and in-memory analysis, machine learning, and AI. With thousands of computing cores readily accessible on a single card, it is possible to execute functions in parallel, using brute force to solve complex analytics operations that conventional databases are grappling with. Aggregations, sorting, and grouping operations are intensive workloads for the CPU but can operate in parallel to the GPU database.

The global GPU Database market is anticipated to increase at a 19.1% CAGR to reach value USD 1,357.4 Million in 2028

.jpg)

The global GPU Database market revenue is projected to reach close to USD 1,481.1 Million by 2028. The key drivers driving the GPU Database market include significant data generation through the BFSI, banking, media, and entertainment sectors. In addition to this, the massive usage of GPU databases for the GRC, fraud detection & avoidance, threat intelligence, SCM, and CEM are expected to spur industry trends for the GPU Database in the coming years. The massive popularity of GPU accelerated databases and tools in banks, insurance agencies, and many other financial institutions will make a huge contribution to GPU Database market revenue in the forthcoming years.

However, the lack of adequate technological competence and domain knowledge is likely to hamper the market growth. Furthermore, the increasing preference of enterprises toward AI and machine learning-enabled workloads is anticipated to be an opportunity for the GPU Database market.

GPU Database Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2028 |

| Study Period | 2018-2028 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2028 | USD 1,357.4 Million |

| Growth Rate | CAGR of 19.1% during 2018-2028 |

| Segment Covered | On the basis of deployment, On the basis of application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, Middle East and Africa, South America |

| Key Players Profiled | OmniSci, Inc.; SQream Technologies; Kinetica DB Inc.; Neo4j, Inc.; NVIDIA Corporation; Brytlyt; Jedox Inc.; Blazegraph; BlazingSQL, Inc.; Zilliz.; HeteroDB; H2O.ai.; FASTDATA; Fuzzy Logix, Inc; Graphistry; Anaconda Inc.; GIGA-BYTE Technology Co., Ltd; SAPPHIRE Technology Limited; EVGA Corporation; ASUSTEK COMPUTER INC |

Key Segments of the Global GPU Database Market

Component Overview (USD Million)

- Tools

- GPU-Accelerated Databases

- GPU-Accelerated Analytics

- Services

Deployment Overview (USD Million)

- On-Premises

- Cloud

Application Overview (USD Million)

- Governance, Risk, And Compliance

- Customer Experience Management

- Threat Intelligence

- Fraud Detection And Prevention

- Predictive Maintenance

- Supply Chain Management

- Others

Industry Vertical Overview (USD Million)

- BFSI

- Retail and Ecommerce

- Healthcare and Pharmaceuticals

- Telecommunications and IT

- Transportation and Logistics

- Government and Defense

- Others

Regional Overview (USD Million)

North America

- U.S.

- Canada

Europe

- UK

- Germany

- France

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia-Pacific

Middle East and Africa

- UAE

- South Africa

- Rest of Middle East and Africa

South America

- Brazil

- Rest of South America

Reasons for the study

- The purpose of the study is to give an exhaustive outlook of the global GPU database market. Benchmark yourself against the rest of the market.

- Ensure you remain competitive as innovations by existing key players to boost the market.

What does the report include?

- The study on the global GPU database market includes qualitative factors such as drivers, restraints, and opportunities

- The study covers the competitive landscape of existing/prospective players in the GPU database industry and their strategic initiatives for the product development

- The study covers a qualitative and quantitative analysis of the market segmented based on solution, service, and industry vertical. Moreover, the study provides similar information for the key geographies.

- Actual market sizes and forecasts have been provided for all the above-mentioned segments.

Who should buy this report?

- This study is suitable for industry participants and stakeholders in the global GPU database market. The report will benefit: Every stakeholder involved in the GPU database market.

- Managers within the GPU database industry looking to publish recent and forecasted statistics about the global GPU database market.

- Government organizations, regulatory authorities, policymakers, and organizations looking for investments in trends of global GPU database market.

- Analysts, researchers, educators, strategy managers, and academic institutions looking for insights into the market to determine future strategies.

Frequently Asked Questions (FAQ) :

A Graphics Processing Unit (GPU) is a single-chip processor that is often used to control and improve the performance of video and graphics. GPU is not only found on a video card or motherboard PC but is also used on smartphones, adapters, displays, workstations, and gaming consoles. GPUs are increasing exponentially to accelerate high performance for parallel data computing. Significant use of GPU databases for GRC, threat intelligence, fraud detection & prevention, and CEM is expected to push industry trends for GPU Database in the coming years. Besides, with the introduction of a supercomputer, demand for a GPU database is gaining traction around the world for successful data processing and reliable performance. However, a lack of awareness of the benefits of the GPU database limits business development owing to the failure of the embedded GPU to promote intensive graphic design software.

Component Segment

In terms of components, the market is bifurcated into tools and services. The tools segment further segment into In GPU-accelerated databases, and GPU-accelerated analytics. In the year 2020, the tools hold the largest market share and it is likely to keep its position throughout the forecast years. This is primarily due to the high-performance computing capabilities of GPU-accelerated databases that expand their distribution across diverse business applications. The need for technologies to handle intense analytics workloads without cost-effective companies is also required to build an appetite for GPU-accelerated analytics solutions thereby boosting the market growth.

Deployment Segment

In terms of deployment, the market is bifurcated into on-premises and cloud. The on-premises segment is expected to record the highest CAGR during the forecast period. On-premises deployment of a GPU database solution helps companies to own their records, comply with external regulatory criteria, and handle risks. . The growth of the on-premises deployment model is mainly due to the ability to tailor solutions as per dynamic enterprise needs, data protection, and privacy.

Application Segment

Based on the application segment, the market is segmented into governance, risk, and compliance, customer experience management, threat intelligence, fraud detection and prevention, predictive maintenance, supply chain management, and others. The customer experience management segment leads the market growth in 2020 and it is anticipated to hold its position during the forecast years. The market growth of this segment is mainly attributed to the growing need for real-time insights into customer data and service chain performance.

Industry Vertical Segment

In terms of the industry vertical segment, the market is segmented into BFSI, retail and eCommerce, healthcare and pharmaceuticals, telecommunications and it, transportation and logistics, government and defense, and others. In 2019, the BFSI segment accumulated the major market share and it is expected to do so over the forecast years. The BFSI vertical, consisting of banks, financial institutions, and insurance providers, are the leading adaptors of GPU-accelerated tools. This vertical generates a huge amount of data and has adopted advanced data analytics supercomputers since the launch of high-performance computing technology.

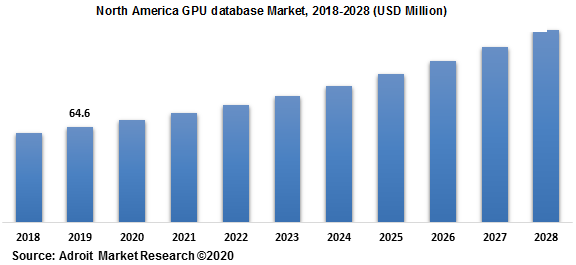

The North America region dominated the overall market in 2019 and it is projected to keep its position during the forecast years 2021-2028. However, the Asia-Pacific region is anticipated to gather the highest growth over the forecast years. The market growth in this region is mostly ascribed to the significant use of weather forecasting supercomputers and massive use of new technology in banking sectors in countries like India, Japan, and China, along with an increasing need for stable solutions in a multitude of financial institutions across these emerging economies.

The major players of the global GPU database market are Kinetica, OmniSci, SQream, Neo4j, NVIDIA, Brytlyt, Blazegraph, BlazingDB, Zilliz, and Jedox. Moreover, the market comprises several other prominent players in the GPU database market that are HeteroDB, H2O.ai, FASTDATA.io, Fuzzy Logix, and Anaconda. The GPU database market consists of well-established global as well as local players. Also, the previously recognized market players are coming up with new and advanced strategic solutions and services to stay competitive in the global market.