Gas Turbine Services Market Analysis and Insights:

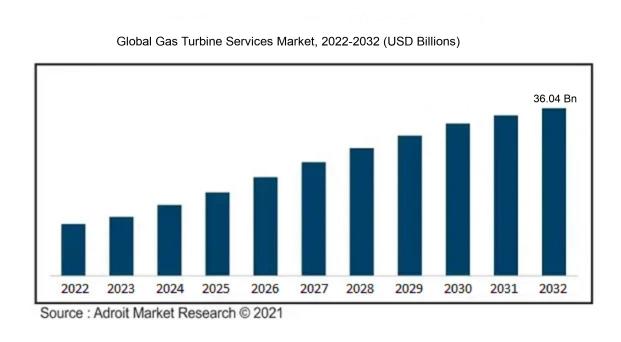

The market for Gas Turbine Services was estimated to be worth USD 19.58 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 6.7%, with an expected value of USD 36.04 billion in 2032.

The market for gas turbine services is experiencing growth influenced by various factors. Primarily, the growing global demand for electricity, particularly in developing nations, is a key driver for market expansion. Gas turbines are preferred for power generation due to their efficiency and environmentally friendly characteristics. Additionally, the increasing emphasis on renewable energy sources like wind and solar power is creating a need for gas turbine services to support intermittent renewable energy supply. The maintenance and repair requirements of aging gas turbine infrastructures in developed regions are also boosting market growth. Moreover, strict environmental policies aimed at curbing carbon emissions and promoting sustainable energy solutions are fueling demand for gas turbine services that offer emission control and efficiency enhancement solutions. Furthermore, ongoing advancements in gas turbine technology are spurring the demand for specialized services. In summary, the growth of the gas turbine services market is driven by escalating electricity demand, the transition towards cleaner energy sources, aging gas turbine assets, environmental mandates, and technological progress.

Gas Turbine Services Market Definition

Gas turbine services encompass a range of activities focused on the upkeep, repair, and enhancement of gas turbines utilized in industrial settings. The primary goal is to optimize the turbines' efficiency, performance, and longevity. Services include thorough inspections, diagnostics, component replacements, and performance improvements to guarantee the seamless and dependable operation of gas turbine systems.

Gas turbine maintenance plays a vital role in the operation and durability of gas turbines that serve essential functions in power generation and industrial settings. By conducting routine maintenance, repairs, and part replacements, these services facilitate the efficient operation of turbines, preventing expensive disruptions. Additionally, they enhance safety by recognizing risks and enacting preventive actions. Moreover, gas turbine services support eco-friendly practices through energy conservation, emission reduction, and regulatory compliance efforts. In sum, these services are integral to the reliable and sustainable provision of energy in today's complex energy sector.

Gas Turbine Services Market Segmental Analysis:

Insights On Type

Heavy Duty

The Heavy Duty type gas turbines are expected to dominate the Global Gas Turbine Services market. Heavy Duty gas turbines are designed for high power output applications and are commonly used in large-scale power plants and industrial facilities. These turbines have higher efficiency and durability, making them suitable for continuous operation over longer periods. With a growing demand for electricity and the need to replace aging power plants with more efficient technologies, the Heavy Duty gas turbine is projected to dominate the market due to its ability to meet the power requirements of large installations.

Industrial

The Industrial gas turbine type caters to a wide range of applications in various industries, including oil and gas, chemical manufacturing, and food processing. These turbines are typically used for onsite power generation, cogeneration, and mechanical drive applications. Although the Industrial gas turbine holds a significant share in the Global Gas Turbine Services market, it is expected to remain behind the Heavy Duty. This is primarily due to the increased emphasis on higher power output and efficiency provided by Heavy Duty gas turbines.

Aeroderivative

Aeroderivative gas turbines are derived from aircraft engines and are used in applications that require rapid start-up, flexible power generation, and compact design. These turbines find applications in the aviation, marine, and distributed power generation sectors. While the Aeroderivative gas turbine offers unique advantages in terms of mobility and flexibility, it is expected to have a smaller market share compared to the Heavy Duty. This is because their power output is generally lower than that of Heavy Duty turbines, making them more suitable for smaller power plants or emergency power backup systems.

Insights On Service Type

Maintenance & Repair

Maintenance & Repair is expected to dominate the Global Gas Turbine Services market. This part plays a crucial role in ensuring the efficient functioning of gas turbines. Regular maintenance and repair activities help in maximizing the operational efficiency and extending the lifespan of gas turbine assets. In addition, the increasing adoption of gas turbines in industries such as power generation, oil & gas, and aviation further drives the demand for maintenance and repair services. By continuously monitoring the performance, diagnosing issues, and performing necessary repairs, companies can ensure the smooth and reliable operation of gas turbines, minimizing downtime and optimizing overall performance. Hence, Maintenance & Repair part is expected to have a dominant position in the Global Gas Turbine Services market.

Overhaul

While Maintenance & Repair is expected to dominate the Global Gas Turbine Services market, Overhaul also holds significance in the industry. Overhaul services involve the complete disassembly, inspection, repair, and reassembly of gas turbines to restore their functionality and efficiency. Overhaul activities are typically carried out at regular intervals or after a specific number of operating hours to address issues that cannot be resolved through routine maintenance. Gas turbine overhaul improves the performance and reliability of these assets, ensuring their compliance with stringent quality and safety standards. Although Overhaul part may not dominate the market like Maintenance & Repair, it still represents a substantial share of the Global Gas Turbine Services market, catering to the need for comprehensive servicing and refurbishment of gas turbines.

Spare Parts Supply

Spare Parts Supply has a unique role as it ensures access to genuine and reliable sectors for gas turbine maintenance and repair. While not expected to dominate the Global Gas Turbine Services market, the Spare Parts Supply part plays a vital supportive role. The availability of quality spare parts is crucial for timely repairs and smooth operations of gas turbines. Without a reliable supply of spare parts, the efficiency and durability of gas turbines can be compromised. Therefore, Spare Parts Supply services are significant in maintaining the integrity and functionality of gas turbine assets, contributing to the overall ecosystem of the Global Gas Turbine Services market.

Insights On Capacity

More than 200 MW

The More than 200 MW capacity is expected to dominate the Global Gas Turbine Services Market. This is due to the increasing demand for gas turbines with higher capacity in industries such as power generation, oil and gas, and industrial manufacturing. Gas turbines with a capacity of more than 200 MW are commonly utilized in large-scale power plants and industrial facilities, making them a crucial part of the energy infrastructure. As these turbines require regular maintenance, repair, and optimization, the demand for gas turbine services in the "More than 200 MW" is anticipated to be the highest. The market for gas turbine services is driven by the need to ensure optimal performance, maximize energy efficiency, and minimize downtime in these large-scale installations.

Less than 100 MW

The Less than 100 MW capacity of the Global Gas Turbine Services market is expected to have a somewhat smaller share compared to the More than 200 MW category. Gas turbines with a capacity of less than 100 MW are typically used in smaller power plants, distributed generation systems, and industrial facilities. While these turbines are in demand for their flexibility and compact size, the market for gas turbine services in this part is not as dominant as the larger capacity categories. Nonetheless, there will still be a significant demand for services such as maintenance, repairs, and operational optimization to ensure the reliable and efficient operation of gas turbines in this category.

100 to 200 MW

The 100 to 200 MW capacity of the Global Gas Turbine Services market is expected to have a relatively moderate share, falling between the More than 200 MW and Less than 100 MW categories. Gas turbines with a capacity of 100 to 200 MW are commonly used in medium-sized power plants, district heating systems, and industrial applications. While these turbines may not have the same scale as their larger counterparts, they still require regular maintenance and servicing to ensure optimal performance and operational reliability. As a result, the market for gas turbine services in the "100 to 200 MW" is expected to hold a significant position in the overall market, albeit slightly lower than the "More than 200 MW" category.

Insights On Service Provider

Non-OEM

Non-OEM providers are expected to dominate the Global Gas Turbine Services Market. This is mainly due to the increasing demand for cost-effective alternatives in maintenance and repair services among end users. Non-OEM service providers offer a wide range of services, including maintenance, overhauls, and repair for gas turbines. They usually provide these services at a lower cost compared to OEM providers, making them more appealing to cost-conscious customers. Additionally, non-OEM providers have been able to enhance their technical capabilities and improve their service quality over time, further strengthening their position in the market.

OEM

OEM providers, although not expected to dominate the Global Gas Turbine Services Market, still hold a significant share and play a crucial role in the industry. OEM providers have an advantage in terms of specialized knowledge, expertise, and access to original equipment manufacturer components. This makes OEM services attractive to customers who prioritize reliability, warranty coverage, and guaranteed performance. However, the dominance of non-OEM providers can be attributed to their cost competitiveness and a more customer-centric approach. Non-OEM providers have positioned themselves as viable alternatives, especially for customers seeking maintenance and repair services at a lower cost without compromising on quality.

Insights On End-user

Power Generation

The Power Generation end-user is expected to dominate the Global Gas Turbine Services Market. Power generation companies form a significant part of the market as they extensively utilize gas turbines to generate electricity. These companies require regular maintenance, repair, and retrofitting services for their gas turbines to ensure uninterrupted power supply. With the increasing global demand for electricity and the growing focus on renewable energy sources, the power generation part is likely to witness substantial growth in the gas turbine services market.

Oil & Gas

The Oil & Gas end-user, although not expected to dominate the global gas turbine services market, still holds a significant share. The oil and gas industry heavily relies on gas turbines for various operations, including power generation, compression, and liquefaction processes. Gas turbines play a crucial role in the extraction, transportation, and refining of oil and gas. However, with the growing shift towards cleaner energy sources and the volatility in the oil and gas market, the demand for gas turbine services in this part may not grow as rapidly as in others.

Others

The Others category comprises various industries and sectors that use gas turbines for specific applications. This may include sectors such as marine, aviation, chemical, and manufacturing, among others. Although this part may have a smaller share compared to power generation and oil & gas, it still contributes to the overall gas turbine services market. The demand for gas turbine services in the Others part is driven by factors such as fleet maintenance, operational efficiency, and regulatory compliance. While the specific growth prospects may vary within this part, it is expected to witness moderate growth in the global gas turbine services market.

Global Gas Turbine Services Market Regional Insights:

Europe

Europe is expected to dominate the global gas turbine services market. The region has a strong presence of key market players and a well-established infrastructure for gas turbine operations and maintenance. Additionally, Europe has a high demand for gas turbine services due to the extensive deployment of gas turbines in various industries such as power generation, oil and gas, and manufacturing. The market growth in Europe can also be attributed to the increasing emphasis on renewable energy sources and the need to replace aging gas turbine units. Overall, Europe's favorable business environment, technological advancements, and robust industrial sector position it as the dominating region in the global gas turbine services market.

North America

North America is a significant player in the global gas turbine services market. The region has a mature and well-developed market for gas turbines, with a large number of installed units across the power generation and industrial sectors. North America also has a strong presence of gas turbine service providers and original equipment manufacturers (OEMs). The demand for gas turbine services in the region is driven by factors such as the need for efficient power generation, increasing investments in infrastructure development, and the adoption of advanced technologies. However, while North America holds a significant market share, it is anticipated that Europe will dominate the global gas turbine services market.

Asia Pacific

Asia Pacific is a rapidly growing market for gas turbine services. The region is witnessing substantial industrialization and urbanization, which has led to an increased demand for electricity and power generation. Many countries in Asia Pacific are investing heavily in the development of power infrastructure, including gas turbine plants, to meet the growing energy needs. Additionally, the region has a large number of gas reserves, driving the demand for gas turbine services in the oil and gas sector. Despite the strong growth potential, Asia Pacific is not anticipated to be the dominating region in the global gas turbine services market, with Europe expected to hold that position.

Latin America

Latin America is an emerging market for gas turbine services. The region is experiencing steady economic growth, leading to increased investments in infrastructure development and industrial activities. Gas turbines are widely used in power generation and oil and gas sectors in Latin American countries. Additionally, the focus on renewable energy sources is expected to drive the demand for gas turbine services in the region. Although Latin America has significant growth opportunities, it is not projected to dominate the global gas turbine services market.

Middle East & Africa

Middle East & Africa is a region with substantial potential for the gas turbine services market. The region is home to some of the world's largest oil and gas producers and has a significant installed base of gas turbines. The demand for gas turbine services in the region is driven by the need to ensure efficient and reliable operation of gas turbine units in the oil and gas sector and power generation plants. Moreover, the Middle East & Africa region is also investing in renewable energy sources, creating opportunities for gas turbine services in the transition towards cleaner energy. However, it is not expected to dominate the global gas turbine services market, with Europe positioned as the dominating region.

Global Gas Turbine Services Market Competitive Landscape:

Prominent entities within the international Gas Turbine Services industry significantly contribute to the provision of maintenance, repair, and overhaul services for gas turbines. Their primary focus lies in enhancing the performance and efficiency of these turbines while also delivering technical assistance and innovative resolutions to combat operational hurdles, thus reducing downtime for clients.

Prominent companies to the Gas Turbine Services industry comprise General Electric Company, Siemens AG, Mitsubishi Hitachi Power Systems, Ltd., Ansaldo Energia S.p.A., Kawasaki Heavy Industries, Ltd., Bharat Heavy Electricals Limited, Doosan Škoda Power, Solar Turbines Incorporated, Sulzer Ltd, and MAN Energy Solutions SE.

Global Gas Turbine Services Market COVID-19 Impact and Market Status:

The global gas turbine services market has been profoundly affected by the Covid-19 pandemic, causing a decrease in demand and presenting operational hurdles for service providers.

The gas turbine services market has been significantly impacted by the COVID-19 pandemic. The global implementation of strict lockdown measures has led to the closure or reduced capacity of industries, resulting in a reduced demand for energy. This decreased demand has directly affected the gas turbine services sector, with lower utilization rates and operating hours being observed. In addition, travel restrictions and the limited access of service technicians to sites have caused delays or cancellations of maintenance and repair activities. Despite these challenges, the pandemic has also brought about some positive developments in the gas turbine services industry. As focus shifts towards renewable energy sources and cleaner energy solutions, gas turbine operators are exploring opportunities for retrofits and upgrades to enhance efficiency and lower emissions. Moreover, the increased need for uninterrupted power supply in critical facilities such as healthcare centers and data centers has created a demand for gas turbine services to ensure reliable operations. In conclusion, while the COVID-19 pandemic has introduced obstacles for the gas turbine services market, it has also stimulated opportunities for innovation and adjustment in response to evolving market conditions.

Recent Trends & Innovations in the Gas Turbine Services Market:

- In April 2021, Siemens Energy announced the acquisition of Marine Current Turbines Ltd., a UK-based tidal turbine technology company, to enhance its renewable energy portfolio.

- GE Renewable Energy revealed its plans in March 2021 to integrate its onshore wind business with the clean energy company, CIP to create a strategic partnership focusing on developing renewable energy projects.

- In February 2021, Mitsubishi Hitachi Power Systems (MHPS) and Turboden S.p.A. collaborated to develop and commercialize a new system to produce electricity from heat recovered from industrial processes at temperatures below 250°C.

- Siemens Energy and Linde Engineering partnered in September 2020 to develop solutions for decarbonizing the petrochemical industry, aiming to supply hydrogen from renewable energy sources for the production of ammonia.

- In August 2020, GE Power announced a contract of approximately $600 million with NTPC Ltd., an Indian energy company, to supply and install advanced coal-fired power generation technology.

- MAN Energy Solutions and Wärtsilä signed a cooperation agreement in June 2020 to develop and sell medium-speed marine engines fueled by ammonia, aiming to offer a carbon-free alternative for the shipping industry.

- In May 2020, Siemens Gas and Power announced a breakthrough in the 3D printing of gas turbine blades, utilizing advanced Additive Manufacturing technology to enhance performance and reduce production time.

- General Electric (GE) completed the acquisition of Alstom's Power and Grid businesses in November 2015, strengthening its position in the gas turbine market and expanding its portfolio of power generation solutions.

- Siemens acquired Dresser-Rand Group Inc., a leading supplier of rotating equipment solutions in the oil and gas industry, in June 2015, diversifying its product offerings and strengthening its position in the service market.

Gas Turbine Services Market Growth Factors:

The expansion of the gas turbine service sector is predominantly fueled by the rising need for effective and dependable electricity production options.

The gas turbine services industry is forecasted to experience considerable growth in the upcoming years for several reasons. One factor contributing to this growth is the escalating demand for electricity, propelled by rapid urbanization and industrialization, leading to a higher utilization of gas turbines in power generation. Additionally, the increasing awareness and enforcement of strict environmental policies are stimulating the need for maintenance and repair services to ensure the environmentally sustainable operation of gas turbines. The aging gas turbine fleet necessitates regular maintenance and upgrades, thereby presenting opportunities for service providers within the market. Advancements in gas turbine technology, such as sophisticated monitoring systems and predictive maintenance solutions, are also propelling market expansion. The rise in adoption of combined cycle power plants, which rely on gas turbines, is anticipated to further drive market growth. Moreover, the transition to renewable energy sources is creating a demand for flexible, quick-starting gas turbines that require ongoing maintenance and support services. Furthermore, the market is being steered by the increasing emphasis on reducing downtime and optimizing gas turbine performance to enhance efficiency and decrease operational costs. In conclusion, the gas turbine services market is primed for notable growth due to escalating power requirements, environmental regulations, aging infrastructure, technological innovations, and the global shift towards renewable energy sources.

Gas Turbine Services Market Restraining Factors:

Factors such as the substantial expense associated with maintenance and the scarcity of proficient workers stand as primary restrictions impeding the expansion of the Gas Turbine Services Market.

The gas turbine services market is encountering various obstacles that are impeding its expansion prospects. One major hindrance is the substantial initial investment necessary for the installation and upkeep of gas turbines, which serves as a deterrent for numerous small-scale enterprises. The expenses linked to procuring and maintaining gas turbines, encompassing routine assessments, repairs, and spare parts, can be considerable. Additionally, the surge in availability of alternative energy sources like solar and wind power is prompting some industries to favor these cleaner and more sustainable alternatives over gas turbines. This trend towards renewable energy sources is resulting in a decreased demand for gas turbine services. Moreover, stringent environmental regulations and emission standards instituted by governments globally are presenting challenges for the gas turbine sector. Adhering to these standards demands expensive adjustments and enhancements to the existing turbines, potentially dissuading prospective clients. Furthermore, the fluctuating nature of fuel prices can impact the profitability of operating gas turbines, complicating the prediction of long-term operational costs. Nevertheless, despite these challenges, the gas turbine services market holds substantial growth opportunities. The demand for gas turbines is anticipated to escalate in developing economies owing to increased industrialization and rising energy requirements. Furthermore, advancements in technology have enhanced turbine efficiency and reduced emissions, rendering gas turbines a more competitive choice. As organizations concentrate on creating innovative maintenance and repair services, the gas turbine services market possesses the potential to surmount these impediments and achieve sustained growth in the foreseeable future.

Key Segments of the Gas Turbine Services Market

Type Overview

• Heavy Duty

• Industrial

• Aeroderivative

Service Type Overview

• Maintenance & Repair

• Overhaul

• Spare Parts Supply

Capacity Overview

• Less than 100 MW

• 100 MW and 200 MW

• More than 200 MW

Service Provider Overview

• OEM

• Non-OEM

End-User Overview

• Power Generation

• Oil & Gas

• Others

Regional Overview

North America

• United States

• Canada

• Mexico

Europe

• Germany

• France

• United Kingdom

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• United Arab Emirates

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America