Market Analysis and Insights:

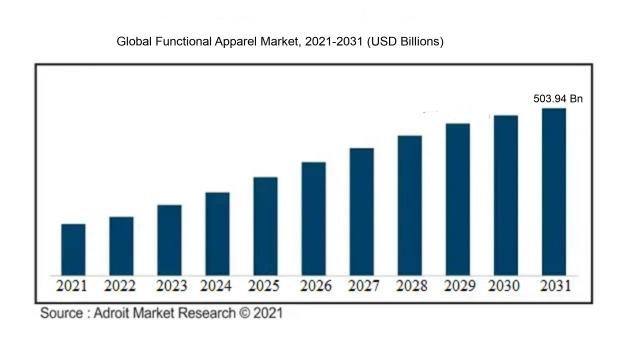

The market for Functional Apparel was estimated to be worth USD 302.74 billion in 2022, and from 2023 to 2031, it is anticipated to grow at a CAGR of 7.01%, with an expected value of USD 503.94 billion in 2031.

Key drivers behind the growth of the Functional Apparel Market encompass a multitude of factors. Primarily, the escalating consumer consciousness and inclination towards fitness and health-oriented lifestyles have been pivotal in propelling the market forward. Consumers now prioritize apparel that not only ensures comfort but also offers practical advantages such as moisture-wicking properties, UV protection, and odor control. Furthermore, the surge in outdoor pursuits like hiking, trekking, and various sports endeavors has further bolstered the demand for functional apparel. Moreover, technological progressions have played a critical role in steering market expansion. The incorporation of cutting-edge technologies like temperature regulation, biometric monitoring, and GPS tracking into functional clothing has captured considerable consumer interest. Additionally, the burgeoning e-commerce sector has facilitated broad consumer access to functional apparel. The embrace of functional apparel by the fashion industry has also amplified its appeal as consumers increasingly seek a fusion of style and utility. In essence, the upsurge in health awareness, outdoor engagements, technological innovations, and enhanced availability through online platforms collectively propel the functional apparel market.

Functional Apparel Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD 503.94 billion |

| Growth Rate | CAGR of 7.01% during 2023-2031 |

| Segment Covered | By Layer, By Function, By Technology, By Technology, By Polymer Type, By Application, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Nike Inc., Adidas AG, Under Armour Inc., Puma SE, Columbia Sportswear Company, The North Face, Patagonia Inc., Lululemon Athletica Inc., VF Corporation, and Anta Sports Products Limited. |

Market Definition

Functional garments are apparel items or accessories that are created with specialized characteristics or advancements to fulfill a utilitarian function, such as controlling moisture, shielding against UV rays, or managing temperature, while also offering an aesthetic appeal. These practical aspects elevate the efficiency, comfort, and utility of the clothing for diverse activities or environments.

Practical clothing serves an essential role in meeting the diverse needs and desires of today's fast-paced and ever-changing consumer landscape. The evolution of technology and a ened focus on well-being have led individuals to search for garments that surpass mere visual appeal. Functional attire encompasses a range of practical features including moisture-wicking capabilities, thermal regulation, odor resistance, and UV protection, all designed to improve comfort and performance across a variety of pursuits. Whether catering to athletes in search of performance-boosting sportswear or professionals in need of breathable, wrinkle-free attire, functional clothing serves a pivotal function in meeting specific demands. Moreover, the rise in popularity of functional clothing among individuals with medical conditions highlights its ability to cater to unique requirements through specialized designs. In essence, functional apparel stands as a crucial tool in addressing the requirements of contemporary consumers by providing tangible advantages that enhance their overall experience.

Key Market Segmentation:

Insights On Key Product

Sportswear

Sportswear is expected to dominate the Global Functional Apparel Market. Sportswear is a popular choice for individuals engaged in various physical activities such as running, fitness training, and sports. These garments are designed to provide comfort, flexibility, and breathability, making them suitable for active individuals. Additionally, the increasing awareness of the importance of a healthy lifestyle and the rise in participation in sports and fitness activities contribute to the growing demand for sportswear. The incorporation of advanced textile technologies that offer moisture-wicking, UV protection, and odor control further enhances the appeal of sportswear among consumers.

Activewear

Activewear is another significant player in the Global Functional Apparel Market. Activewear refers to apparel designed for both physical activities and casual wear. It offers comfort and flexibility for various activities, including yoga, gym workouts, and outdoor adventures. The rising trend of athleisure, where activewear is worn as a fashion statement, has contributed to the growth of this . Moreover, the increasing focus on wellness and self-care has led to an upsurge in demand for activewear, as it combines functionality with fashion.

Protective Clothing

Protective Clothing plays a vital role in industries such as manufacturing, construction, and healthcare. This part comprises garments that offer protection against hazards such as chemicals, extreme temperatures, and biological agents. The stringent safety regulations in different sectors drive the demand for protective clothing. With the emphasis on worker safety and the implementation of safety protocols, there is an increasing need for functional and durable protective clothing.

Footwear

Footwear, specifically designed for various physical activities, is an essential part of the Global Functional Apparel Market. Athletes, fitness enthusiasts, and individuals engaged in outdoor activities require footwear that provides support, cushioning, and grip. The demand for functional footwear is driven by the growing interest in sports and fitness activities, as well as the increasing awareness of foot health. Innovative technologies in cushioning, stability, and material strength contribute to the dominance of footwear in the functional apparel market.

Others

The Others in the Product category includes various functional apparel products that do not fall under the specific categories mentioned above, such as accessories, swimwear, and specialized apparel for specific activities. Although these products cater to niche markets and have their own consumer base, they are not expected to dominate the Global Functional Apparel Market. However, within this part, specific products with unique features or targeted marketing efforts may experience growth in demand and capture a significant market share.

Insights On Key Application

Professional Athletic

The Professional Athletic application is expected to dominate the Global Functional Apparel Market. Professional athletes are known to have specific requirements for their apparel, such as enhanced performance, durability, and comfort. As they push their bodies to the limit, they need functional apparel that can keep up with their intense training and competitive performances. This part includes clothing for sports like football, soccer, basketball, tennis, and more. With the increasing popularity of sports and the growing number of professional athletes across the globe, the demand for functional apparel tailored to their needs is expected to rise significantly.

Amateur Athletic

The Amateur Athletic application is another important player of the Global Functional Apparel Market. With the increasing interest and participation in sports and recreational activities among the general population, there is a growing demand for functional apparel designed for amateur athletes. This part includes clothing for gym workouts, running, cycling, yoga, and other individual and team-based activities. While professional athletes may require higher-performance apparel, amateur athletes still value functionality, comfort, and durability in their activewear. The availability of a wide range of functional apparel options specifically designed for amateur athletes contributes to the strong presence of this part in the market.

Others

The Others comprises a diverse range of applications within the Global Functional Apparel Market. This category includes functional apparel used for various purposes other than professional or amateur athletic activities. It encompasses clothing for outdoor adventures, travel, camping, hunting, fishing, and leisure activities. This part caters to individuals who seek functional apparel that provides protection, comfort, and convenience during their outdoor pursuits. While it may not dominate the market like the Professional Athletic and Amateur Athletic parts, the demand for functional apparel among individuals engaged in other activities is still significant and contributes to the overall growth of the Global Functional Apparel Market.

Insights On Key Distribution Channel

Online

The Online distribution channel is expected to dominate the Global Functional Apparel Market. As consumers increasingly turn to e-commerce platforms for their shopping needs, the convenience and accessibility of purchasing functional apparel online have become highly appealing. The online channel offers a wide range of options, allowing consumers to explore various brands, compare prices, and read reviews, all from the comfort of their own homes. Additionally, advancements in technology, such as secure payment methods and hassle-free return policies, have further encouraged the growth of online sales in the functional apparel market. With the ease of online shopping and the increasing demand for functional apparel, the online distribution channel is poised to dominate the industry.

Supermarkets/Hypermarkets

Supermarkets and hypermarkets are likely to attract a significant portion of the Global Functional Apparel Market. These large-scale retail stores offer a wide variety of products, including functional apparel, making it convenient for consumers to purchase all their household needs in one place. Supermarkets and hypermarkets often feature dedicated sections for clothing and accessories, providing consumers with easy access to functional apparel. Moreover, these stores have a long-established presence and existing customer base, which can help promote the sales of functional apparel. While online shopping is gaining popularity, supermarkets and hypermarkets still play a crucial role in the market, particularly for consumers who prefer a physical shopping experience.

Convenience Store

Although convenience stores typically focus on providing everyday necessities and quick purchases, they may have a limited presence in the Global Functional Apparel Market. Due to their smaller size and limited shelf space, convenience stores may only offer a limited selection of functional apparel items. Additionally, convenience stores may prioritize items with higher consumer demand, such as food, beverages, and basic household goods over specialized clothing. Therefore, while convenience stores may cater to customers seeking immediate purchases or emergency needs, they are less likely to dominate the overall market for functional apparel.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the Global Functional Apparel market. This region has witnessed significant growth in the demand for functional apparel due to various factors such as favorable climatic conditions, increasing disposable income, and changing consumer preferences. Additionally, the presence of a large population in countries like China and India has led to a substantial market size for functional apparel. Furthermore, the region is home to several major manufacturers and suppliers of functional apparel, further contributing to its dominance in the global market. With a growing focus on health and fitness, as well as an increasing number of sports and outdoor activities, the demand for functional apparel in Asia Pacific is projected to continue its upward trajectory.

North America

North America is one of the key regions in the global functional apparel market. This region is characterized by a high level of health consciousness among consumers, a strong sports culture, and a growing emphasis on fitness and outdoor activities. The United States and Canada are the major contributors to the market in this region, with a significant presence of renowned brands and manufacturers catering to the demand for functional apparel. Furthermore, the region is witnessing an increasing adoption of athleisure wear, which combines functionality with style, further fueling the market growth. With the availability of innovative technologies and the presence of a large consumer base, North America is expected to exhibit steady growth and maintain a substantial share in the global functional apparel market.

Europe

Europe is another prominent region in the global functional apparel market. This region is witnessing a rising trend of health and wellness, where consumers are increasingly adopting an active lifestyle and participating in various sports and fitness activities. Countries such as Germany, France, and the United Kingdom are the major contributors to the market growth in Europe. There is a growing demand for technologically advanced and functional clothing, driven by factors like increasing disposable income, rising awareness about the benefits of functional apparel, and changing fashion trends. With the presence of well-established brands, a strong retail infrastructure, and a growing consumer base, Europe is expected to play a significant role in the global functional apparel market.

Latin America

Latin America is an emerging market for functional apparel, driven by factors like increasing disposable income, urbanization, and a growing focus on health and fitness. Countries such as Brazil, Mexico, and Argentina are key contributors to the market in this region. There is a rising awareness among consumers about the benefits of functional apparel, leading to growing demand for products such as activewear, sports shoes, and outdoor gear. Additionally, the region is witnessing the entry of international brands and the establishment of new manufacturing facilities, further fueling market growth. While the market size is currently smaller compared to other regions, Latin America holds significant growth potential in the global functional apparel market.

Middle East & Africa

The Middle East & Africa region is gradually emerging as a potential market for functional apparel. Factors such as an increasing emphasis on fitness and an active lifestyle, rising disposable income, and a growing awareness about health benefits are driving the demand for functional apparel in this region. Countries like Saudi Arabia, UAE, and South Africa are witnessing a surge in the number of fitness-conscious individuals and sports enthusiasts, contributing to the market growth. However, the market size for functional apparel in this region is relatively smaller compared to other regions. Nevertheless, with changing consumer preferences and an expanding middle-class population, the Middle East & Africa region is expected to experience steady growth in the global functional apparel market.

Company Profiles:

Prominent companies in the worldwide Functional Apparel sector are vital contributors to fostering progress and delivering cutting-edge technologies that improve performance and comfort during sports and outdoor pursuits. Their dedication to research and development, strategic collaborations, and innovative marketing strategies has enabled them to solidify their market position and meet the changing needs of consumers.

Major key players within the functional apparel sector encompass renowned names such as Nike Inc., Adidas AG, Under Armour Inc., Puma SE, Columbia Sportswear Company, The North Face, Patagonia Inc., Lululemon Athletica Inc., VF Corporation, and Anta Sports Products Limited. These established entities are acknowledged for their dominance in the field and hold a notable portion of the market. They specialize in a diverse array of functional apparel items like performance-driven sportswear, athletic footwear, outdoor garments, and accompanying accessories. Their success can be attributed to their inventive designs, cutting-edge technologies, and robust brand recognition, all of which contribute significantly to their achievements in the industry. These key players remain dedicated to satisfying consumer needs for top-tier and functional attire, leading to a fiercely competitive and perpetually evolving marketplace.

COVID-19 Impact and Market Status:

The worldwide market for functional apparel has experienced notable impacts due to the Covid-19 pandemic, resulting in decreased demand and interruptions in the supply chain.

The global functional apparel market has been significantly influenced by the COVID-19 pandemic. The imposition of lockdowns and travel restrictions by various countries to curb the spread of the virus resulted in a decline in the demand for functional apparel categories such as activewear, sportswear, and athleisure. The closure of gyms and sports facilities further limited people's opportunities to partake in physical activities that typically necessitate functional apparel. Additionally, the increase in remote work arrangements led to a reduced need for professional and formal attire, while there was a corresponding rise in demand for comfortable clothing. This shift in consumer behavior toward casual and loungewear is projected to have a lasting impact on the functional apparel market, with an emphasis on comfort and versatility poised to remain key considerations even in a post-pandemic landscape. Market participants are now directing their efforts towards introducing innovative collections that strike a balance between functionality and comfort. However, the market is currently grappling with challenges stemming from disrupted supply chains and lower consumer expenditure, resulting in decreased production and sales. Consequently, the recovery of the functional apparel market is expected to be gradual, with substantial implications for the industry in both the short and medium terms.

Latest Trends and Innovation:

- In September 2021, Under Armour announced the acquisition of MyFitnessPal, a popular health and fitness app, to enhance its digital capabilities and offer personalized experiences to its customers.

- In February 2021, Lululemon Athletica, a leading athletic apparel retailer, acquired MIRROR, an in-home fitness technology company, to expand its digital and interactive offerings.

- In December 2020, Columbia Sportswear Company completed the acquisition of OutDry Technologies, a leading provider of waterproof and breathable technologies for performance apparel.

- In October 2020, Nike launched its Nike Refurbished program, offering customers refurbished sneakers at discounted prices as part of its sustainability efforts.

- In August 2020, VF Corporation, the parent company of The North Face and Vans, announced its acquisition of Supreme, a popular streetwear brand, for a deal worth $2.1 billion.

- In June 2020, Puma introduced its Puma Fit Intelligence (Fi) line of self-lacing shoes, incorporating technology for personalized fit and customizable comfort.

- In January 2020, Adidas unveiled the Futurecraft Loop, a fully recyclable running shoe, as part of its efforts to reduce plastic waste through sustainable manufacturing.

- In November 2019, HanesBrands acquired Alternative Apparel, a lifestyle apparel brand known for its sustainable practices, to expand its product portfolio and sustainability initiatives.

- In September 2019, Gap Inc. announced plans to create a new company, called NewCo, by separating its Old Navy brand from the rest of its portfolio in an effort to focus on each brand's unique strengths.

- In July 2019, Patagonia introduced its Regenerative Organic Certification program, aiming to promote soil health and environmental responsibility in agriculture.

Significant Growth Factors:

The expansion catalysts propelling the functional clothing industry comprise ened consumer consciousness regarding health and wellness, growing interest in activewear and athleisure, and progress in textile innovation aimed at boosting both performance and comfort levels.

The Functional Apparel Market is witnessing substantial expansion, propelled by an array of influential factors. Initially, a ened emphasis on health and well-being is driving a surge in demand for functional garments that support fitness and exercise endeavors. Consumers are seeking out apparel that boasts attributes like moisture-wicking capabilities, UV protection, and odor control to optimize their performance during physical exertions. Concurrently, the escalating engagement in sports and outdoor pastimes, alongside a boost in disposable income, is fueling the market for functional attire. Consumers are on the lookout for attire that not only delivers comfort but also showcases durability and flexibility essential for various active pursuits. Moreover, there's a burgeoning inclination towards athleisure fashion, where functional clothing doubles as everyday wear, seamlessly amalgamating style and utility. This shift has broadened the market's scope, drawing in fashion-conscious individuals who desire both aesthetic appeal and practicality. Additionally, advancements in textile engineering have facilitated the creation of avant-garde materials and fabrics endowed with enhanced performance attributes such as elasticity, thermal regulation, and breathability. These breakthroughs in technology have played a pivotal role in propelling the functional apparel market's expansion. Finally, the mounting emphasis on sustainability and eco-conscious products has propelled the demand for functional attire crafted from recycled or organic materials.

Consumers are increasingly mindful of the environmental ramifications of their clothing choices, underscoring a preference for sustainable functional garments. In essence, the significant growth of the functional apparel market stems from a confluence of factors including the wellness trend, ened physical activity involvement, athleisure fashion movement, textile innovation, and the hunger for sustainable alternatives.

Restraining Factors:

The functional apparel market's potential growth could be hindered by the restricted supply of cutting-edge textile materials and manufacturing technologies.

The market for functional clothing is witnessing noteworthy expansion, driven by the rising consumer inclination towards garments that combine style with practicality. Nevertheless, various factors are impeding the extensive growth of this market. Primarily, the elevated price point of functional apparel presents a hurdle for many consumers, particularly in developing economies where cost sensitivity is prominent. Moreover, the limited presence of functional clothing in conventional retail settings constrains the reach of these items to a broader clientele. Additionally, a lack of awareness and comprehension regarding the advantages of functional clothing persists, resulting in a sluggish uptake amongst consumers. Furthermore, sustainability issues within the functional apparel sector, including the utilization of synthetic materials and the environmental ramifications of production, provoke concerns among environmentally-conscious buyers. Lastly, the existence of counterfeit merchandise in the marketplace undermines consumer trust and brand integrity. However, notwithstanding these challenges, the functional apparel sector harbors substantial potential for expansion. With increased investments in research and development by companies to introduce innovative and cost-effective functional attire, alongside enhanced consumer education initiatives, the obstacles in this market are gradually diminishing. Given the burgeoning interest in health, fitness, and active lifestyles, the demand for functional clothing is poised to surge, offering market entities opportunities to surmount challenges and flourish in this industry.

Key Segmentation:

Product Overview

• Sportswear

• Activewear

• Protective Clothing

• Footwear

• Others

Application Overview

• Professional Athletic

• Armature Athletic

• Others

Distribution Channel Overview

• Supermarkets/Hypermarkets

• Convenience store

• Online

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America