Fructose Market Analysis and Insights:

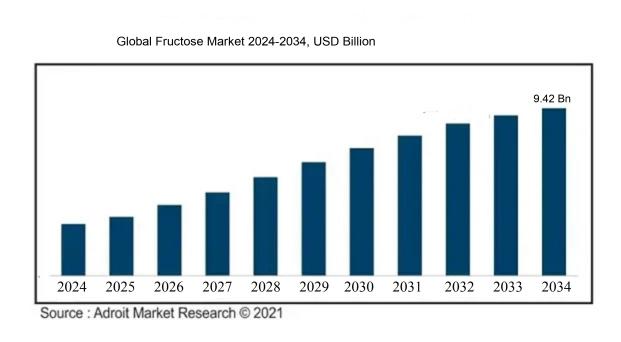

In 2024, the worldwide fructose market was valued at USD 6.10 billion; by 2025, it had grown to USD 6.50 billion; and by 2034, it is projected to reach around USD 9.42 billion, with a compound annual growth rate (CAGR) of 5.12%.

The fructose market is primarily propelled by the increasing demand for natural sweeteners in the food and beverage sector, as consumers increasingly gravitate towards healthier substitutes for conventional sugars. The rising popularity of low-calorie and sugar-free options is further accelerating the adoption of high-fructose corn syrup (HFCS) and various fructose-derived sweeteners. Additionally, greater awareness of the adverse health effects linked to high sugar intake has led to a shift in consumer preferences favoring products that offer reduced glycemic impacts. Advancements in food technology and processing techniques are enhancing the quality and versatility of fructose, expanding its applications across different industries, including pharmaceuticals and cosmetics. Furthermore, supportive regulations for natural sweeteners, coupled with globalization and enhanced accessibility of fructose-based products, significantly bolster market expansion. The growing trend towards organic and non-GMO sources of fructose is becoming an influential factor, catering to the interests of health-focused consumers and those prioritizing eco-friendly options.

Fructose Market Definition

Fructose is a type of simple carbohydrate, specifically a monosaccharide, that occurs naturally in fruits, honey, and root vegetables. Renowned for its sweetness, it is frequently utilized as a sweetening agent in a wide array of food items.

Fructose, a monosaccharide, occurs naturally in a variety of fruits, honey, and root vegetables and is essential for energy metabolism. It is sweeter than glucose, which makes it a favored sweetener in numerous food items. Beyond serving as a rapid energy source, fructose uniquely impacts insulin sensitivity and the way the body stores fat compared to other sugars. Its metabolism predominantly occurs in the liver, which may affect lipid levels and the processes governing lipid metabolism. Furthermore, the intake of fructose can support the growth of beneficial gut bacteria and is integral to the composition of specific carbohydrates and other compounds.

Fructose Market Segmental Analysis:

Insights On Source

Fruits

Fruits are expected to dominate the Global Fructose Market due to their high natural sugar content and consumer preference for sweeteners derived from natural sources. The increasing inclination towards healthier eating habits and clean label products has propelled demand for fruit-based sweeteners. Popular fruits used for fructose extraction, such as apples, pears, and berries, are not only abundant but also align well with the rising trend of incorporating wholesome, recognizable ingredients into food products. Additionally, the versatility of fruit-derived fructose in various applications, including beverages, baked goods, and confectioneries, further enhances its market share, making it the most significant contributor to the fructose landscape.

Vegetables

Vegetables have a limited role in the Global Fructose Market primarily because they typically contain lower sugar content compared to fruits. However, certain vegetables like sweet potatoes and carrots do provide some fructose, but their contribution remains minor when considering the overall market. The functional benefits of vegetable-derived sugars are more focused on fiber and nutrient content rather than sweetness. Therefore, while there is some usage of vegetables in sectors emphasizing health and nutrition, they do not resonate strongly with the demand for sweet taste in the same manner that fruits do, limiting their market presence.

Honey

Honey is another source of fructose but is primarily valued for its distinct flavor profile and health benefits rather than as a leading source of fructose in consumer products. While honey contains fructose, the market dynamics are driven more by trends in natural sweeteners and alternatives to sugar. The perception of honey as a premium product also means it caters to a niche market, focused on organic and artisanal categories. Overall, honey does contribute to the fructose market, but its position is overshadowed by fruits due to consumer preferences toward versatility and lower costs associated with fruit-derived sweeteners.

Insights On Form

Liquid Fructose

Liquid Fructose is expected to dominate the Global Fructose Market due to its increasing applications in the food and beverage industry. The growing trend towards low-calorie and health-conscious products has led manufacturers to opt for liquid fructose as a sweetener because of its high solubility and ease of mixing. Moreover, Liquid Fructose’s sweetening efficiency is higher than traditional sugars, making it a favored option for formulating beverages, particularly soft drinks and fruit juices. The rising demand for convenient and cost-effective liquid sweeteners in various culinary applications further solidifies its market leadership, catalyzing widespread adoption.

Crystalline Fructose

Crystalline Fructose holds relevance mainly within specialized applications where a higher purity and distinct solid form are beneficial. Despite its growing recognition, its applications are somewhat limited compared to Liquid Fructose, primarily in baked goods and confections. Crystalline Fructose may attract some manufacturers for certain products where high sweetness is required in a solid form, but overall demand remains less significant than its liquid counterpart. Additionally, the production costs associated with Crystalline Fructose may deter some potential users from fully incorporating it into their products.

Insights On Product

High Fructose Corn Syrup

High Fructose Corn Syrup (HFCS) is expected to dominate the Global Fructose Market due to its widespread use in the food and beverage industry. It is favored for its cost-effectiveness and versatility, serving as a sweetener, preservative, and flavor enhancer. Applications in soft drinks, snacks, and processed foods drive its demand significantly. Furthermore, HFCS can be produced in large quantities and is compatible with various manufacturing processes, making it a preferred choice for manufacturers. As consumer preferences shift towards more sugary products, HFCS’s ease of incorporation and stable supply chain positions it as a leading product in the global market.

Fructose Syrups

Fructose Syrups are gaining traction but are not expected to take the lead in the Global Fructose Market. Their appeal lies in their natural sweetness and lower glycemic index compared to traditional sugars, making them popular among health-conscious consumers. Application areas include baking and natural sweetening for cereals and energy drinks. However, their production costs remain higher than HFCS, limiting widespread adoption. Consequently, while they meet the growing demand for healthier ingredient alternatives, they are likely to remain a smaller portion of the overall market.

Fructose Solids

Fructose Solids, while valuable, are projected to have a minor role in the Global Fructose Market. They are primarily utilized in specialized applications where concentrated sweetness is necessary, such as in dietary supplements and certain pharmaceutical formulations. Despite their advantages, the higher production costs and lower volume applications hinder significant market uptake. Trends towards healthier eating and reduced sugar consumption can create niches for Fructose Solids but will not likely challenge the dominance of High Fructose Corn Syrup in the broader market context.

Insights On Application

Beverages

The beverages category is poised to dominate the Global Fructose Market due to the increasing consumer preference for sweetened drinks, health-conscious choices, and enhancements in product formulations. Fructose, with its high sweetness and low glycemic index, is frequently used as a sweetener in a variety of beverages, including soft drinks, juices, and energy drinks. Additionally, the growing trend of flavored functional beverages and the rising popularity of low-calorie alternatives further bolster fructose demand. As beverage manufacturers increasingly seek to offer improved taste along with health benefits, the reliance on fructose is anticipated to expand alongside these consumer trends, positioning beverages as the key contributor in the market.

Dairy Products

The dairy products category benefits from a growing interest in healthier eating patterns and indulging in functional dairy items. Fructose is utilized in yogurts, flavored milk, and dairy desserts to enhance sweetness without excessive calorie content. The trend towards low-fat and low-calorie dairy options encourages manufacturers to adopt fructose for improved flavor profiles while maintaining health benefits. Moreover, increasing innovations in dairy product formulations that incorporate healthier sweeteners further drive fructose adoption in this category.

Baked Goods

The baked goods market incorporates fructose to improve texture and maintain moisture in products such as bread, pastries, and cakes. The trend towards healthier baking options fuels the demand for alternative sweeteners, including fructose, as a means to provide sweetness without excess sugar. Furthermore, as consumers demonstrate a preference for cleaner-label ingredients, baked goods manufacturers are increasingly reformulating recipes to include fructose, aiding its growth within this category.

Cosmetics and Personal Care

In cosmetics and personal care, fructose is being recognized for its moisturizing properties and potential skin benefits. Its ability to retain moisture makes it an attractive ingredient in lotions, creams, and other personal care products. The rising consumer awareness regarding the benefits of natural and organic ingredients has prompted brands to use fructose to appeal to health-conscious consumers. As a result, this market showcases a steady uptick in the utilization of fructose, catering to consumer demands for hydration and skin nourishment.

Sports Nutrition

The sports nutrition market shows fruitful opportunities for fructose acceptance due to its role as an energy source. Many athletes and fitness enthusiasts seek products that provide quick energy release and recovery solutions, making fructose a popular choice in energy drinks and gels. Moreover, with the rise of endurance sports, the demand for carbohydrate blends that include fructose has surged, positioning it strategically within this market for performance-enhancing formulations.

Drug Formulations

In drug formulations, fructose serves as a sweetening agent and stabilizer for various medicinal syrups and solutions. The appeal of fructose lies in its palatability, encouraging compliance, particularly among pediatric patients who may be sensitive to unpleasant tastes. However, the growth in this is comparatively slower due to stringent regulations and the specific nature of pharmaceutical applications. Nonetheless, the ongoing trend towards more pleasant medicinal products plays a role in engaging formulations that include fructose.

Other Applications

Other applications of fructose encompass niche markets that utilize this sugar in food products, sauces, dressings, and various condiments. The growing trend of natural sweeteners is creating opportunities for fructose in these categories as consumers gravitate towards healthier, more sustainable options. The versatility of fructose allows it to fit into diverse food products while still adhering to cleanliness in ingredient labeling, facilitating its use among food manufacturers targeting conscientious consumers.

Global Fructose Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Fructose Market due to its rapidly growing food and beverage industry, which is being driven by an expanding population and increasing disposable incomes. Countries such as China and India have seen a substantial rise in the demand for processed foods, beverages, and sweeteners, leading to a higher consumption of fructose. Moreover, the region is witnessing significant investments in the food manufacturing sector, further enhancing fructose production and distribution capabilities. The trend towards healthier food options, along with rising consumer awareness about the benefits of high-fructose corn syrup, positions Asia Pacific as the leader in the global fructose market.

North America

North America holds a significant share of the global fructose market, primarily due to the high demand for sweeteners in the food and beverage industry. The region has a well-established food processing infrastructure, and fructose, particularly high fructose corn syrup (HFCS), has long been a staple sweetener in many products. However, increasing health concerns regarding sugar consumption and a shift towards natural sweeteners could pose challenges to market growth. Nonetheless, innovations and product diversifications in the North American market will continue to play a crucial role in its sustenance.

Europe

Europe is witnessing consistent growth in its fructose market, driven by a shift towards healthier lifestyle choices and the increasing demand for low-calorie sweeteners. Many European nations have implemented regulations encouraging reduced sugar consumption, impacting the use of fructose in various products. The health-conscious attitude of European consumers, combined with rising demand for clean-label products, presents challenges and opportunities for fructose manufacturers. Additionally, firms are focusing on product innovation to cater to the growing trend of organic and natural sweeteners, thereby ensuring potential market stability.

Latin America

Latin America is emerging as a promising market for fructose, with a surge in demand for processed foods and beverages among its population. The expanding middle-class demographic signifies potential growth opportunities for fructose application in various sectors. However, the market’s growth is hampered by varying levels of regulatory standards across countries and economic fluctuations affecting consumer purchasing power. Nevertheless, companies are optimistic about the region's growth trajectory with increasing investments in food technology and manufacturing practices aligning with local tastes.

Middle East & Africa

In the Middle East & Africa, the fructose market remains relatively untapped, with growth potentials driven by urbanization and changing dietary habits. However, challenges such as limited awareness of fructose products and regulatory hurdles in food safety standards impede substantial growth. Efforts to diversify food sources and improved distribution networks are expected to create opportunities for fructose market players. Despite these challenges, the region's demographic changes and increasing interest in functional foods may propel the fructose market forward in the coming years.

Fructose Competitive Landscape:

Influential entities within the worldwide fructose sector, including producers and suppliers, significantly impact manufacturing methods and product accessibility. They play a vital role in fostering innovation and establishing pricing patterns. By forming strategic partnerships and embracing technological progress, these key players actively mold market conditions and boost competitive advantages to meet the shifting preferences of consumers.

Prominent companies in the fructose industry consist of Archer Daniels Midland Company, Tate & Lyle PLC, Cargill, Incorporated, DuPont de Nemours, Inc., Sunwin Stevia International, Inc., Ingredion Incorporated, Merisant Company, Gelymar S.A., Nissin Foods Holdings Co., Ltd., and Associated British Foods PLC.

Global Fructose COVID-19 Impact and Market Status:

The Covid-19 pandemic significantly impacted the global fructose market, leading to disruptions in supply chains and changes in consumer preferences, especially within the food and beverage industry.

The COVID-19 pandemic had a profound effect on the fructose market, altering its supply and demand landscape. The implementation of lockdowns and restrictions hampered production and distribution systems, resulting in temporary shortages. Concurrently, the health crisis ened consumer awareness about health, prompting a trend toward products with reduced sugar levels, including fructose. The food and beverage industry, a primary consumer of fructose, saw mixed demand patterns; while s like dining out suffered declines, the demand for packaged and processed foods surged. Additionally, disruptions in agricultural supply chains limited the accessibility of raw materials essential for fructose production. As recovery advances, a continued emphasis on health and wellness is anticipated to support the demand for fructose, especially as reformulations aimed at lowering sugar content gain traction across diverse product categories. Nevertheless, the market continues to contend with persistent issues related to supply chain stability and shifting consumer trends.

Latest Trends and Innovation in The Global Fructose Market:

- In June 2022, Tate & Lyle announced a collaboration with Kellogg's to develop a range of healthier snacks and cereals that include their new low-calorie sweeteners derived from fructose, aiming to reduce sugar content by up to 30% in selected products.

- In October 2022, Cargill completed the acquisition of the U.S. production facilities of the specialty sweeteners producer, J.R. Simplot Company, which significantly expanded Cargill's capabilities in producing high-fructose corn syrup and other sweetening agents.

- In March 2023, Ingredion Incorporated launched its innovative BioZin technology for producing high fructose corn syrup, which utilizes enzymatic processes that reduce energy consumption and costs in the production cycle, significantly minimizing the environmental footprint of the manufacturing process.

- In September 2023, Archer Daniels Midland Company (ADM) announced a strategic partnership with the biotechnology firm Genomatica to develop sustainable high fructose corn syrup using bio-based feedstocks, reflecting a growing trend towards sustainability in food and beverage industries.

- In August 2023, the French company Roquette Frères introduced a new line of fructose-based solutions targeted specifically for the dietary food sector, promoting lower glycemic index alternatives aimed at health-conscious consumers.

- In January 2023, the German firm Südzucker AG reported an increase in the production capacity of its rolling high-fructose production plants in response to the surging demand for natural sweeteners, positioning itself as a leader in the European fructose market.

Fructose Market Growth Factors:

The expansion of the fructose market is propelled by a ened consumer preference for natural sweeteners, an increased awareness of health issues, and the growth of the food and beverage sector.

The fructose market is witnessing notable expansion, influenced by multiple factors. The growing preference for natural sweeteners, particularly among health-oriented consumers, is encouraging the increased use of fructose as a substitute for sugar. With a rising incidence of obesity and diabetes, there is a notable trend towards lower-calorie sweeteners, and fructose is often regarded as a healthier choice due to its lower glycemic index relative to sucrose. Furthermore, the growth of the food and beverage sector, especially in emerging markets, is leading to a higher utilization of fructose in items like soft drinks, baked products, and processed food. Innovations in extraction and production techniques have improved the cost-effectiveness and purity of fructose, making it more widely available. Additionally, fructose's growing application in functional foods and dietary supplements underscores its adaptability beyond conventional uses. Regulatory approvals and increasing recognition among manufacturers regarding the advantages of employing fructose as a sweetener further bolster market growth. As consumers increasingly pursue options that reflect health-conscious trends, the fructose market stands poised to benefit from these shifting preferences, promising sustained growth in the years ahead.

Fructose Market Restaining Factors:

The primary constraints impacting the fructose market encompass rising health apprehensions associated with high sugar intake and growing regulatory oversight regarding sweeteners.

The fructose industry encounters a variety of challenges that could hinder its development and usage. A primary concern is the growing awareness of health issues among consumers, prompting a decline in high-sugar diets in response to escalating rates of obesity and associated health conditions like diabetes and heart disease. Additionally, increasing regulatory scrutiny is leading governments to enforce stricter regulations on sugar content in food and beverages, consequently restricting the application of fructose.

The market is also grappling with saturation and fierce competition from alternative sweeteners, particularly natural variants such as stevia and monk fruit, which adds further pressure on fructose producers. Price fluctuations and disruptions in the supply chain, often driven by climate change and farming methods, can complicate production processes and elevate costs. Negative sentiments surrounding high fructose corn syrup (HFCS) may also discourage manufacturers from using fructose in their products.

Nonetheless, advancements in processing technologies and a growing inclination towards healthier formulations could open doors for the fructose market to adapt and prosper. As consumers increasingly look for balanced options, there remains significant potential for fructose to carve out a role in a more health-conscious food environment.

Key Segments of the Fructose Market

By Source

- Fruits

- Vegetables

- Honey

By Form

- Liquid Fructose

- Crystalline Fructose

By Product

- High Fructose Corn Syrup

- Fructose Syrups

- Fructose Solids

By Application

- Dairy Products

- Baked Goods

- Beverages

- Cosmetics and Personal Care

- Sports Nutrition

- Drug Formulations

- Other Applications

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America