Market Analysis and Insights:

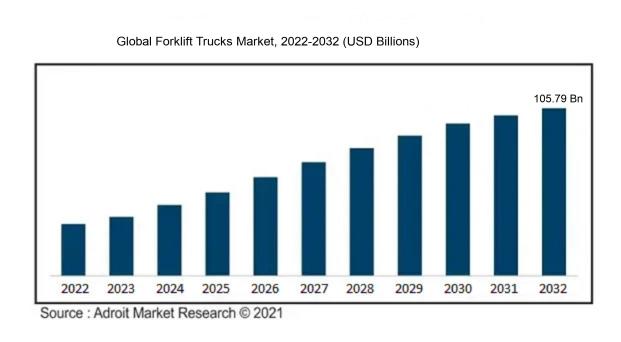

The market for Global Forklift Trucks was estimated to be worth USD 55.89 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 6.48%, with an expected value of USD 105.79 billion in 2032.

The market for forklift trucks is influenced by various factors. One primary driver is the rising demand for these vehicles across different industries like manufacturing, warehousing, and logistics. Forklift trucks play a critical role in effective material handling and transportation, making them indispensable in these sectors. Moreover, the increasing focus on ensuring workplace safety and complying with equipment usage regulations is propelling market growth.

Companies are investing more in forklift trucks to guarantee the well-being of their employees and adherence to occupational health and safety protocols. Additionally, advancements in forklift truck technology, including automation, telematics, and electric-powered models, are contributing significantly to market expansion. These features are being increasingly favored for their cost-effectiveness, eco-friendliness, and enhanced productivity. Furthermore, the surge of e-commerce and the necessity for efficient warehousing and distribution facilities are further fueling the demand for forklift trucks. Consequently, the forklift trucks market is projected to experience continual growth in the foreseeable future.

Forklift Trucks Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 105.79 billion |

| Growth Rate | CAGR of 6.48% during 2024-2032 |

| Segment Covered | By Type, By Application, By Technology, By Capacity, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Toyota Industries Corporation, KION Group AG, Jungheinrich AG, Hyster-Yale Materials Handling, Inc., Mitsubishi Nichiyu Forklift Co., Ltd., Crown Equipment Corporation, Anhui Forklift Group Co., Ltd., Hangcha Group Co., Ltd., Komatsu Ltd., and Doosan Corporation. |

Market Definition

Forklift trucks, also referred to as lift trucks, are specialized vehicles created for the task of elevating and relocating substantial loads. These trucks feature forks that are adjustable in , allowing for the precise positioning and transportation of materials in various settings such as warehouses, construction sites, and industrial environments.

Forklift trucks are vital assets across a variety of industries as they possess the capability to adeptly manage and transfer substantial loads. Their significance is evident in warehouse settings, construction projects, manufacturing facilities, and logistics operations, among other sectors. By facilitating the movement and stacking of materials, forklifts play a pivotal role in enhancing operational efficiency and curtailing the need for extensive manual labor. Particularly valuable for handling bulky or weighty items that would pose challenges or be unfeasible for human workers, these machines significantly bolster productivity. Furthermore, forklift trucks contribute to ened workplace safety by mitigating the hazards associated with manual lifting and carrying. With their versatility, maneuvering capabilities, and robust lifting capacity, forklifts serve as indispensable instruments for enterprises that rely on the smooth and effective transportation of goods and materials.

Key Market Segmentation:

Insights On Key Type

Class II

Class II forklift trucks are expected to dominate the Global Forklift Trucks Market. This type includes electric motor narrow aisle trucks used primarily indoors for high stacking, typically in warehouses or distribution centers. The growing trend towards efficient and space-saving warehouse operations favors the use of Class II forklift trucks. These trucks are designed to operate in narrow aisles and provide enhanced maneuverability, making them well-suited for tight spaces. Additionally, electric-powered Class II forklifts offer reduced operating costs, lower emissions, and quieter operations compared to other types. These advantages make Class II forklift trucks the preferred choice for modern warehouses, thereby driving their dominance in the global market.

Class I

Class I forklift trucks represent a significant type in the Global Forklift Trucks Market. This category includes electric motor rider trucks, which are commonly used for outdoor applications such as loading and unloading goods in warehouses, ports, and construction sites. Although Class I forklift trucks offer versatility and power, they face competition from other forklift types in certain scenarios. For example, in narrow aisle operations, Class II forklift trucks tend to be more efficient due to their compact design. Nonetheless, Class I forklift trucks continue to be widely used in various industries, especially where outdoor operations and heavy lifting are required.

Class III

Class III forklift trucks, also known as electric motor hand or walk-behind trucks, constitute another important type in the Global Forklift Trucks Market. These trucks are mainly utilized for light-duty material handling tasks in smaller spaces, such as retail stores or manufacturing facilities with limited floor space. While they offer maneuverability and ease of operation, Class III forklift trucks have a limited capacity compared to other classes. Therefore, they are primarily employed for low-volume handling operations. Despite their lower capacity, Class III forklift trucks play a crucial role in industries that require efficient and cost-effective handling of lighter loads.

Class IV

Class IV forklift trucks are expected to have a smaller market share in the Global Forklift Trucks Market compared to other types. This category includes internal combustion engine trucks with cushion tires, commonly used for indoor and smooth surface applications. Class IV forklift trucks excel in maneuverability and tight-turning radius, making them suitable for warehouse operations that require quick and precise movements. However, their reliance on internal combustion engines and relatively limited terrain capabilities limit their market dominance, especially in industries that prioritize environmental sustainability and versatility.

Class V

Class V forklift trucks, characterized by their pneumatic tires, are also expected to have a smaller presence in the Global Forklift Trucks Market compared to other types. These trucks are well-suited for outdoor applications, including rough terrains such as construction sites and lumber yards. However, their bulky design and higher operating costs compared to other classes make them less dominant in the overall market. Class V forklift trucks are often used in industries that require heavy lifting and off-road capabilities, but their market share is limited due to the specific nature of their applications and the availability of more cost-effective alternatives for certain industries.

Insights On Key Application

Logistics

The Logistics application is expected to dominate the Global Forklift Trucks market. With the rapid growth in e-commerce and the increasing demand for efficient and fast delivery services, logistics companies are constantly seeking ways to improve their operations. Forklift trucks play a crucial role in warehouse management and material handling, enabling smooth and efficient movement of goods. The need for automated systems in logistics, combined with the rising adoption of electric forklifts for reduced emissions and noise pollution, has significantly boosted the demand for forklift trucks in the logistics sector. As a result, the Logistics part is projected to dominate the Global Forklift Trucks market.

Mining

The Mining application in the Global Forklift Trucks market holds its importance due to the heavy-duty applications required in mining operations. Forklift trucks play a vital role in material handling, transportation, and inventory management, facilitating the extraction and movement of minerals and ores. However, compared to the Logistics part, the Mining part is expected to have a relatively smaller market share. This can be attributed to the specialized nature of the mining industry, which limits the overall demand for forklift trucks compared to other sectors.

Construction

In the Global Forklift Trucks market, the Construction application holds significance due to the need for material handling and equipment transportation at construction sites. Forklift trucks enable the movement of heavy construction materials, such as bricks, concrete blocks, and steel beams, providing efficiency and productivity in construction operations. However, the Construction part is expected to have a relatively smaller market share compared to the dominant Logistics part. The demand for forklift trucks in construction is dependent on the growth and investment in the construction industry, which may vary across regions.

Food & Beverage

The Food & Beverage application in the Global Forklift Trucks market plays a vital role in ensuring efficient handling, storage, and transportation of food and beverage products. Forklift trucks are extensively used in warehouses, distribution centers, and food processing plants to move goods, stack pallets, and manage inventory. However, the Food & Beverage part is not expected to dominate the Global Forklift Trucks market. The demand for forklift trucks in the food and beverage industry is significant but is relatively smaller compared to the Logistics part due to the broader scope and scale of logistics operations.

Natural Resources

The Natural Resources application in the Global Forklift Trucks market encompasses industries such as forestry, agriculture, and mining. Forklift trucks are used in these industries for various material handling tasks, including loading and unloading of goods, transport of harvested crops, and managing raw materials. While the Natural Resources part holds importance, it is unlikely to dominate the Global Forklift Trucks market as these industries have more specialized material handling requirements compared to the broader logistics sector.

Manufacturing

The Manufacturing application is critical in the Global Forklift Trucks market as forklift trucks are extensively used in manufacturing facilities for material handling, machine loading, and finished goods transportation. However, the Manufacturing part is expected to have a smaller market share compared to the dominant Logistics part. The demand for forklift trucks in the manufacturing sector is influenced by factors such as industrial automation, production levels, and product demand. While significant, the manufacturing industry's reliance on forklift trucks is not expected to surpass the demand seen in the logistics sector.

Others

The Others category in the Global Forklift Trucks market encompasses diverse industries and applications that do not fall under the specific categories mentioned above. This includes sectors such as retail, wholesale, automotive, and healthcare, where forklift trucks are used for various material handling and logistics purposes. However, the Others part is not expected to dominate the Global Forklift Trucks market. The demand for forklift trucks in these industries is spread across multiple sectors, lacking the concentrated market share seen in the Logistics part.

Insights On Key Technology

Internal Combustion Engine Powered

Internal Combustion Engine Powered forklift trucks are expected to dominate the Global Forklift Trucks Market. This is primarily due to their versatility and ability to handle heavy loads in various environments. They are well-suited for outdoor applications, such as construction sites, warehouses, and cargo yards, where electric powered forklifts might face limitations in terms of range and refueling options. Internal Combustion Engine Powered forklifts also offer higher lifting capacities and faster acceleration, making them more suitable for heavy-duty operations. Additionally, the relatively lower initial cost and ease of maintenance of these forklifts contribute to their dominance in the market.

Electric Powered

While Internal Combustion Engine Powered forklift trucks currently dominate the market, Electric Powered forklift trucks are rapidly gaining traction and are expected to experience significant growth. This is largely driven by the increasing emphasis on environmental sustainability, as electric forklifts produce zero emissions during operation. They are also quieter, making them suitable for indoor applications and noise-sensitive environments.

Furthermore, advancements in battery technology, including longer battery life and faster charging options, are overcoming the range and charging limitations previously associated with electric forklifts. As companies strive to reduce their carbon footprint and comply with stringent emissions regulations, the demand for Electric Powered forklift trucks is predicted to steadily rise. Overall, while Internal Combustion Engine Powered forklift trucks currently dominate the Global Forklift Trucks Market, Electric Powered forklift trucks are expected to capture a larger market share in the future as environmental concerns and technological advancements continue to drive the shift towards electric mobility.

Insights On Key Capacity

Below 5 tons

The below 5 tons capacity is expected to dominate the Global Forklift Trucks Market. Forklift trucks with a capacity below 5 tons are commonly used in various industries such as manufacturing, warehousing, and logistics. These forklifts are versatile and suitable for handling lighter loads in smaller spaces. The demand for below 5-ton capacity forklifts is expected to be high due to the growing e-commerce industry and the need for efficient material handling in warehouse operations. Additionally, the increasing emphasis on automation and the deployment of forklifts in narrow aisles further drive the demand for below 5-ton capacity forklift trucks.

Above 5 tons

The above 5 tons capacity is expected to be a significant sector of the Global Forklift Trucks Market; however, it is not expected to dominate the market. Forklift trucks with a capacity above 5 tons are typically used for heavy-duty applications in industries such as construction, shipping, and cargo handling. These forklifts are designed to handle larger and heavier loads in demanding environments. While there is a demand for above 5-ton capacity forklift trucks, their utilization is relatively limited compared to the below 5-ton capacity . Factors such as higher costs, specialized requirements, and specific market niches contribute to a lower market share for forklift trucks above 5 tons capacity.

Insights on Regional Analysis:

Europe

Europe is expected to dominate the Global Forklift Trucks market due to several factors. Firstly, Europe has a highly developed industrial sector, with countries like Germany, France, and Italy being major manufacturing hubs. This leads to a high demand for forklift trucks to facilitate material handling and logistics operations in these industries. Additionally, Europe has stringent health and safety regulations, which necessitate the use of efficient and safe material handling equipment like forklift trucks. Furthermore, Europe has well-established distribution networks and a strong transportation infrastructure, further driving the demand for forklift trucks. With a combination of a robust manufacturing sector, regulatory requirements, and infrastructure support, Europe is positioned to dominate the Global Forklift Trucks market.

North America

In North America, the market for forklift trucks is expected to remain strong. The region has a mature industrial sector, with the United States being one of the largest manufacturing economies in the world. This, coupled with the presence of major companies in various sectors, drives the demand for forklift trucks. Moreover, North America has a well-developed e-commerce industry, which requires efficient material handling equipment for storage and distribution centers. The region also emphasizes safety standards, creating a need for advanced forklift trucks equipped with safety features. Although Europe dominates the global market, North America will continue to be a significant player in the forklift truck industry.

Asia Pacific

Asia Pacific is a rapidly growing market for forklift trucks. The region's significant population and expanding industrial sector contribute to the increasing demand for forklift trucks. Countries like China, Japan, and India have witnessed substantial industrial growth, which necessitates efficient material handling equipment. Additionally, the e-commerce sector in Asia Pacific is booming, driving the need for forklift trucks in warehouses and distribution centers. Furthermore, the region's focus on manufacturing and export-oriented industries drives the demand for forklift trucks. While Europe currently dominates the global market, Asia Pacific holds tremendous potential for growth in the forklift truck industry.

Latin America

Latin America represents a promising market for forklift trucks. The region is witnessing growth in various sectors, including manufacturing, construction, and logistics. Countries like Brazil, Mexico, and Argentina are investing in infrastructure development, which increases the demand for forklift trucks for material handling purposes. Additionally, the expanding e-commerce industry in Latin America further drives the need for efficient warehouse operations. While Europe is currently the dominant region in the global market, Latin America is emerging as a significant player in the forklift truck industry.

Middle East & Africa

The Middle East & Africa region shows potential for growth in the forklift truck market. The region has been witnessing significant infrastructure development, including construction projects and transportation networks. This creates a demand for material handling equipment like forklift trucks for construction and logistics purposes. Additionally, countries in the Middle East, such as the United Arab Emirates and Saudi Arabia, are investing in the manufacturing and industrial sectors. As these sectors grow, so does the need for efficient material handling equipment. While Europe is currently leading the global market, the Middle East & Africa region is poised for growth in the forklift truck industry.

Company Profiles:

The prominent figures in the international Forklift Trucks industry are tasked with the creation, production, and delivery of forklift trucks tailored to cater to the wide-ranging material handling requirements across various sectors. Their pivotal functions include spearheading advancements, upholding standards, and broadening market penetration.

Prominent companies in the forklift trucks industry comprise Toyota Industries Corporation, KION Group AG, Jungheinrich AG, Hyster-Yale Materials Handling, Inc., Mitsubishi Nichiyu Forklift Co., Ltd., Crown Equipment Corporation, Anhui Forklift Group Co., Ltd., Hangcha Group Co., Ltd., Komatsu Ltd., and Doosan Corporation. Toyota Industries Corporation holds a top position globally in the sector of forklift production, while KION Group AG is recognized for its innovative forklift and warehouse technology solutions. Jungheinrich AG provides an extensive array of materials handling products, and Hyster-Yale Materials Handling, Inc. is renowned for its high-quality forklifts and complementary equipment. Both Mitsubishi Nichiyu Forklift Co., Ltd. and Crown Equipment Corporation are key figures in the industry. Anhui Forklift Group Co., Ltd., Hangcha Group Co., Ltd., Komatsu Ltd., and Doosan Corporation are also significant manufacturers of forklifts, playing crucial roles in the market landscape.

COVID-19 Impact and Market Status:

The global forklift trucks market has experienced adverse effects due to the Covid-19 pandemic, resulting in a decrease in market demand and disturbances in the supply chain.

The global forklift trucks market has been significantly influenced by the emergence of the COVID-19 pandemic. The enforcement of lockdown measures and restrictions on business operations has notably impacted industries such as warehousing, logistics, and manufacturing, which heavily depend on forklift trucks for their operations. Disruptions in global supply chains, reduced workforce availability, and decreased operational capacities have resulted in a diminished demand for forklift trucks. Furthermore, the economic downturn and uncertainties stemming from the pandemic have led to a decline in investments and capital expenditure by businesses, further affecting the market. Nonetheless, the increased demand for warehousing and logistics services driven by the necessity for essential goods and the rise of e-commerce and online retail have generated a surge in demand for forklift trucks. As the world gradually progresses towards recovery from the pandemic, the market is anticipated to bounce back, although the speed of recovery may vary depending on the effectiveness of containment measures and the resurgence of specific industries in different regions. In essence, the COVID-19 pandemic has presented significant challenges to the forklift trucks market; however, it has also paved the way for growth opportunities and innovation.

Latest Trends and Innovation:

- In December 2020, Toyota Material Handling acquired Vanderlande, a global market leader in automated material handling solutions.

- In November 2020, KION Group unveiled its latest forklift model, the Linde H20-H35 EVO IC truck, which features improved fuel efficiency and reduced emissions.

- In September 2020, Hyster-Yale Materials Handling announced the expansion of its electric forklift range with the introduction of the J60-80XN electric lift truck.

- In March 2020, Mitsubishi Logisnext unveiled its new range of electric forklifts, including the FB16PNT-FB20PNT series, featuring improved energy efficiency and advanced safety features.

- In January 2020, Crown Equipment Corporation introduced the Crown SHC 5500 Series of sit-down counterbalance forklifts, designed for improved operator comfort and productivity.

- In December 2019, Jungheinrich launched its new EKS 412s high-level order picker, equipped with advanced safety features and improved energy efficiency.

- In October 2019, Doosan Industrial Vehicle announced the release of its new lineup of 3-wheel electric forklifts, featuring enhanced maneuverability and operator comfort.

- In June 2019, Clark Material Handling Company introduced the CLARK NPX series of electric forklifts, designed for improved performance and energy efficiency.

- In April 2019, Heli Forklift Co., Ltd. unveiled its new series of lithium-ion electric forklifts, offering improved productivity and reduced maintenance costs.

- In February 2019, Hangcha Group launched the A series of electric forklifts, featuring advanced technology for improved performance and efficiency.

Significant Growth Factors:

The expansion drivers for the forklift trucks industry involve a growing need for effective material handling solutions and a surging uptake of automation and technological advancements in warehouses and logistics operations.

The forklift trucks industry is primed for substantial growth in the forthcoming years due to a variety of factors. Foremost among these is the escalating need for effective material handling machinery in sectors like construction, logistics, and manufacturing. Forklift trucks excel in offering superior maneuverability and user-friendly operation, rendering them indispensable for the transportation of bulky goods and pallets. Additionally, the surge in e-commerce activities and the expanding integration of automation within warehouses and distribution hubs have amped up the requisition for forklift trucks. These vehicles facilitate seamless movement of merchandise, enhancing warehouse efficiency and curbing labor expenditures. Furthermore, the burgeoning global trade landscape and the imperative for streamlined goods transportation have contributed significantly to the market's upward trajectory. As the logistics and freight forwarding sectors continue to expand, the demand for forklift trucks has seen a notable uptick. Moreover, the escalating emphasis on workplace safety and the enforcement of stringent regulations concerning material handling equipment have acted as catalysts for market growth. End-users are increasingly favoring forklift trucks equipped with cutting-edge safety functionalities such as anti-slip mechanisms and collision detection systems. Ultimately, the expansion of the forklift trucks market can be attributed to the rising clamor for efficacious and secure material handling machinery across diverse industries, underpinned by technological progressions and automation enhancements.

Restraining Factors:

The growth of the forklift trucks market is impeded by the scarcity of proficient forklift truck operators.

The market for forklift trucks encounters various impediments that impede its growth potential. Primarily, the substantial expenses associated with purchasing and maintaining forklift trucks act as a significant obstacle for small and medium-sized enterprises (SMEs) operating within constrained budgets.

Furthermore, the scarcity of proficient operators and the necessity for adequate training present difficulties, necessitating considerable investments in training schemes and certifications. This is compounded by the restricted maneuverability of forklifts in compact spaces, restricting their effectiveness and applicability in specific industrial settings. In addition, the emergence of alternative technologies like automated guided vehicles (AGVs) and robotic forklifts poses competitive challenges to traditional forklift trucks, as businesses seek more sophisticated, efficient, and economical solutions. The reliance on fossil fuels to power forklift trucks also raises apprehensions regarding environmental repercussions and sustainability. Nevertheless, despite these hindrances, the forklift truck market demonstrates encouraging prospects. The demand for forklifts is anticipated to increase steadily with the continuous growth of e-commerce, propelling the necessity for streamlined warehousing and logistics operations. Furthermore, advancements in technology such as electric forklifts and fuel cell-powered forklifts are emerging as environmentally conscious alternatives, addressing sustainability concerns while diminishing operational costs. The global forklift trucks market is also witnessing expansion opportunities in burgeoning markets, propelled by industrialization and infrastructural enhancements that drive the need for material handling equipment. Consequently, although the forklift trucks market faces adversities, these challenges can be alleviated through innovative practices, educational endeavors, and the implementation of sustainable technologies, promising a favorable trajectory for the industry's future.

Key Segments of the Forklift Trucks Market

Type Overview

• Class I

• Class II

• Class III

• Class IV

• Class V

Application Overview

• Mining

• Logistics

• Construction

• Food & Beverage

• Natural Resources

• Manufacturing

• Others

Technology Overview

• Electric Powered

• Internal Combustion Engine Powered

Capacity Overview

• Below 5 tons

• Above 5 tons

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America