Food Enzymes Market Analysis and Insights:

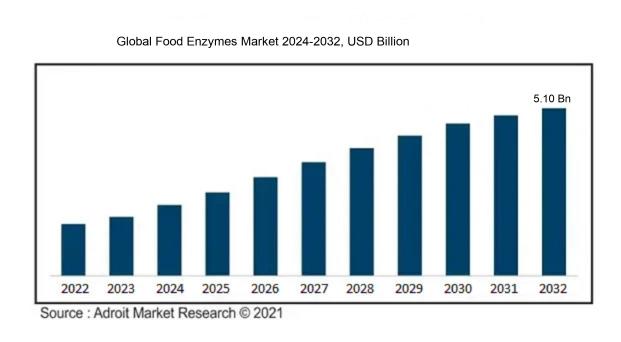

The size of the worldwide market for food enzymes was estimated at USD 3.03 billion in 2023 and is expected to increase at a compound annual growth rate (CAGR) of 8.01% to reach USD 5.10 billion by 2032.

The market for food enzymes is significantly influenced by the growing consumer inclination toward natural and organic food items, which has sparked an increased interest in the use of enzymes to enhance food quality and prolong shelf life. Furthermore, the escalation in consumer awareness regarding the health advantages of enzyme-rich foods fosters market growth, as these enzymes aid digestion and boost nutrient uptake, mirroring the broader shift toward healthier lifestyle choices.

Advancements in enzyme technology coupled with regulatory backing for their application in food production also play a crucial role in stimulating market expansion. The trend toward convenience foods and the swift pace of urbanization are reshaping food manufacturing practices, making enzymes vital for optimizing efficiency and ensuring product uniformity. Additionally, as the food and beverage sector moves toward clearer labeling, there's a growing incorporation of food enzymes, which act as natural substitutes for synthetic additives. Collectively, these elements indicate a profound transformation in consumer tastes and industry methodologies, driving both innovation and growth within the food enzymes market.

Food Enzymes Market Definition

Food enzymes are naturally occurring proteins that facilitate biochemical reactions within food, contributing to essential processes such as digestion and flavor enhancement. They are vital for improving the nutritional value and safety of a wide range of food items.

Enzymes in food production are essential for elevating the quality, taste, and nutritional profile of various products. They assist in numerous biochemical reactions, including digestion and fermentation, which enhance the texture and longevity of food items. By converting complex compounds into simpler substances, these enzymes promote nutrient absorption, contributing to improved health outcomes. Their utilization in sectors such as brewing, baking, and dairy processing enhances efficiency and minimizes waste. Furthermore, food enzymes support initiatives focused on cleaner labels by enabling producers to incorporate natural ingredients, aligning with consumer preferences for healthier, less processed options.

Food Enzymes Market Segmental Analysis:

Insights On Type

Carbohydrase

Carbohydrase is anticipated to dominate the Global Food Enzymes Market due to its extensive application in the food processing industry. This enzyme plays a crucial role in the breakdown of carbohydrates into simpler sugars, thereby enhancing flavor, texture, and shelf life of food products. The increasing demand for convenience foods, coupled with rising health consciousness, has led to the significant use of carbohydrases in brewing, bakery, and dairy products. Additionally, advancements in biotechnology have enabled the development of more efficient carbohydrases, further driving their adoption. The upward trend in the use of carbohydrate-rich foods reinforces the importance of this enzyme in meeting consumer demands.

Protease

Protease is another important enzyme in the food industry, primarily used for tenderizing meat and improving protein digestibility. This enzyme facilitates the breakdown of proteins into peptides and amino acids, making it essential for various food applications such as dairy products and meat processing. The focus on protein-rich diets has increased the demand for proteases in numerous food formulations. Innovations in protease formulation have led to enhanced functional properties that positively affect taste and texture. Moreover, the growing popularity of protein supplements in the fitness industry has expanded the use of proteases, contributing to its significance in the food enzymes market.

Lipase

Lipase holds a notable position in the food enzyme market, crucial for fat digestion and flavor enhancement in various food products. Its primary role involves the breakdown of fats into fatty acids and glycerol, improving the overall flavor and palatability of foods. With the rising trend towards healthy fats and oils, the demand for lipase is witnessing growth in categories like dairy, snacks, and specialty oils. The health benefits associated with lipase, alongside consumer awareness regarding dietary fats, make it an essential enzyme in developing healthy food products. As culinary trends evolve, lipase continues to be an important player in this.

Others

The "Others" category encompasses various enzymes that serve niche applications across the food industry, such as glucose oxidase and alpha-galactosidase. While not as prominent as carbohydrase, protease, or lipase, these enzymes contribute to enhancing food safety, quality, and processing efficiency. The growth in specialty diets, including gluten-free and low-carb options, has driven the demand for enzymes that cater to specific consumer needs. Innovations in this area, focused on improving food preservation and nutritional profiles, are likely to sustain a steady interest in this category. As food technology advances, the role of these enzymes is expected to gain more importance.

Insights On Application

Beverages

The Beverages application is expected to dominate the Global Food Enzymes Market due to a growing demand for functional beverages and health-focused choices among consumers. Enzymes play a key role in improving the quality, flavor, and shelf-life of beverages, such as juices, wines, and fermented drinks. The increasing trends towards natural and clean-label products have furthered the reliance on enzymes to meet consumer preferences for healthier options. With the continual rise of innovative beverage formulations, particularly in the areas of plant-based drinks and alcohol production, the beverage sector shows potential for substantial growth, leading it to be the front-runner in the food enzymes market.

Bakery

The bakery sector is another significant area in the food enzymes market, where enzymes are utilized extensively for improving the texture, shelf-life, and fermentation processes of baked goods. Enzymes such as amylases and proteases help enhance dough properties, making them essential for producing high-quality bread, cakes, and pastries. The rising trend towards artisanal and premium baked products is pushing bakeries to adopt enzyme technology to meet consumer demands for better taste and quality, but not at the scale seen in the beverage.

Dairy

In the dairy sector, enzymes play a crucial role in cheese making, milk processing, and enhancing the overall quality of dairy products. Lactases, proteases, and lipases are widely used to facilitate the coagulation process, improve texture, and develop unique flavors in cheese. Although the experiences steady demand due to the essential nature of dairy products, it lacks the explosive growth dynamics present in the beverages sector, making it a supportive but not leading player in the food enzymes market.

Processed Foods

Processed foods encompass a variety of products where enzymes aid in enhancing flavor, texture, and nutritional profile. Enzymatic reactions help improve the stability and mouthfeel of sauces, dressings, and snacks. While the processed foods market shows potential for growth, especially with the demand for convenience foods, it faces stiff competition from other categories that are experiencing higher innovation rates and consumer interest, particularly beverages which are more dynamic at this stage.

Others

The "Others" category includes miscellaneous applications such as animal feed, dietary supplements, and specialty food items where enzymes facilitate various biochemical processes. While these applications grow at a moderate pace, they lag significantly behind the main s. The diverse nature of the "Others" category adds value but isn’t enough to match the progress and consumer inclination observed in the beverage sector, making it less dominant overall in the food enzymes market.

Insights On Source

Microorganisms

Microorganisms are expected to dominate the Global Food Enzymes Market primarily due to their efficiency, cost-effectiveness, and versatility in producing a wide range of enzymes beneficial for various food processing applications. With advances in biotechnology and fermentation technology, microorganisms such as bacteria, yeast, and fungi provide enzymes like amylases, proteases, and lipases that cater to diverse needs in the food industry. Their ability to be genetically modified enhances the yield and performance of these enzymes under specific conditions, making them ideal for large-scale production. As the food industry increasingly focuses on clean labels and natural ingredients, enzymes derived from microorganisms are poised to experience significant growth, satisfying both regulatory standards and consumer preferences.

Animals

Animal-derived enzymes, though less prominent than those produced by microorganisms, still hold a significant position in the food enzymes market. These enzymes, such as rennet and pepsin, are traditionally used in processes like cheese-making and meat tenderization. However, their growth is limited by ethical concerns and regulatory restrictions surrounding animal products. Also, the rise of vegetarianism and veganism has led to a decline in demand for animal-based ingredients in processed foods. Consequently, while they are critical for specific applications, animal-derived enzymes are not expected to see substantial growth compared to their microbial counterparts.

Plants

Plant-derived enzymes are gaining popularity, especially as consumer preferences shift towards natural and clean-label products. However, they represent a smaller portion of the global food enzymes market. Enzymes obtained from plants, such as bromelain from pineapples and papain from papayas, are often used in food processing for tenderizing and clarifying. While they boast natural origins, the challenge lies in their limited availability and higher production costs compared to microbial options. Additionally, the sourcing of these enzymes can be affected by seasonal variations, making their overall market presence less robust in comparison to the efficiency and adaptability of microorganisms.

Insights On Form

Liquid

Liquid forms are expected to dominate the Global Food Enzymes Market due to their ease of application and versatility across various sectors, including baking, dairy, and beverages. They allow for uniform dispersion in food matrices, enhancing efficiency and effectiveness in enzymatic reactions. Furthermore, the growing trend towards natural and clean-label products is driving demand for liquid enzymes, as they are often perceived as more natural and easier to process. Additionally, industries that require precise measurement and dosage benefit significantly from liquid enzymes, as they can provide consistent performance. The convenience factor, combined with the ability to maintain stability over extended periods, solidifies liquid enzymes’ leading position in the market.

Powder

Powdered enzymes represent a notable category within the Global Food Enzymes Market, appealing primarily to sectors where long shelf life and easy storage are priorities. These enzymes are often favored in applications like flour treatment in baking, where they can offer enhanced functionalities. However, the challenge with powdered enzymes lies in ensuring adequate solubility and consistent distribution within final products. While they may lack the immediate convenience of liquid enzymes, innovations in formulation techniques are continuously improving their efficacy. As manufacturers seek cost-effective and efficient solutions, powdered enzymes are poised for niche applications, though they remain secondary to liquid formulations overall.

Others

The "Others" category within the Global Food Enzymes Market includes forms such as granules, tablets, or encapsulated enzymes. These alternatives often cater to specific industry needs where controlled release or unique application methods are required. For instance, certain applications in the pharmaceutical or specialty food industries may benefit from encapsulated enzymes, which offer targeted delivery and protection against environmental factors. However, this is currently small compared to the liquid and powdered forms, indicating that while there's potential for growth, it remains a niche in the larger market scope. Overall, “Others” still trails behind the liquid and powdered options in terms of market share and widespread use.

Global Food Enzymes Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the Global Food Enzymes market due to the rapid growth of food and beverage industries in countries such as China, India, and Japan. These markets are increasingly adopting enzyme technologies to enhance food quality, improve nutritional value, and extend shelf life. The increasing population, along with rising disposable incomes, is driving the demand for processed and convenience foods, which utilize various enzymatic processes. Moreover, the strong emphasis on food safety and regulatory compliance is prompting manufacturers to incorporate food enzymes, further bolstering the market within the region. The region’s advancements in biotechnology, coupled with ongoing R&D initiatives, ensure a continuous supply of innovative enzymes tailored for diverse applications, securing its prominence in the global market.

North America

In North America, the food enzymes market is significantly driven by the increasing consumer demand for clean label products and healthier food options. The United States and Canada are at the forefront of adopting enzyme technologies to improve food processing efficiency and product quality. Furthermore, advanced research and development in enzyme manufacturing, alongside supportive regulatory frameworks, empower companies to introduce innovative enzyme solutions tailored to meet consumer preferences. The region is characterized by established players who are constantly investing in new technologies and formulations to capture the growing health-conscious consumer base.

Europe

Europe holds a substantial share of the Global Food Enzymes market, largely due to stringent food safety regulations and a robust emphasis on natural ingredients. The demand for organic and sustainably sourced food products is high in countries like Germany, France, and the UK, fostering the growth of enzyme applications that facilitate these market trends. Furthermore, European companies are actively involved in ongoing research to enhance the functionalities of food enzymes, expanding their applications in dairy, baking, and processed foods. The region is recognized for its innovation in enzyme production, positioning it as a vital player in the competitive landscape.

Latin America

Latin America presents significant growth potential for the food enzymes market, driven primarily by the increasing consumption of processed foods. Rising urbanization, changing dietary patterns, and a growing middle-class population are key factors contributing to this trend. Countries like Brazil and Mexico are witnessing an upsurge in food processing activities, encouraging manufacturers to adopt enzyme technologies for improved product quality and cost-efficiency. Additionally, as awareness regarding food safety and health benefits of enzyme applications grows, the region is likely to see increased investment in food enzyme production and usage.

Middle East & Africa

The Middle East & Africa region is gradually emerging in the Global Food Enzymes market, motivated by growing food processing sectors and evolving consumer preferences. The demand for improved food preservation methods and better-quality products is driving the adoption of enzymes in various applications, particularly in bread-making and beverage production. While the region currently lags behind others in terms of market size and growth, increasing investments in food technology and processing, as well as rising awareness of health and nutrition, suggest a promising future for food enzymes in this region. However, challenges such as varying regulatory landscapes and limited research initiatives may need addressing to fully unlock the market potential.

Food Enzymes Competitive Landscape:

Leading entities in the global food enzymes sector are fostering innovation by creating sophisticated enzyme formulations that improve both the efficiency of food processing and the quality of the final products. Additionally, they engage in partnerships with manufacturers to customize solutions that address unique consumer preferences and adhere to regulatory requirements.

The prominent participants in the food enzymes industry encompass Novozymes A/S, DuPont de Nemours, Inc., BASF SE, DSM Nutritional Products, Chr. Hansen Holding A/S, AB Enzymes GmbH, Kerry Group plc, Specialty Enzymes & Biotechnologies Co., Associated British Foods plc, and Cargill, Incorporated. Additionally, other significant players in the market include Ingredion Incorporated, Burcon NutraScience Corporation, Enzyme Development Corporation, and PT. Aloha Aina Biotech. Further companies of interest are M. D. G. Enzymes, Biocatalysts Limited, along with enzyme manufacturers like Ginkgo BioWorks and Advanced Enzymes Technologies Limited.

Global Food Enzymes COVID-19 Impact and Market Status:

The Covid-19 pandemic caused substantial upheaval in the worldwide market for food enzymes, resulting in supply chain difficulties and shifts in consumer preferences regarding processed food products.

The COVID-19 pandemic had a profound effect on the food enzymes industry, presenting both hurdles and avenues for growth. In the early stages, disruptions in supply chains and shortages in labor hindered production and distribution, resulting in delays and elevated costs. However, as the food sector adjusted to changing consumer behaviors—most notably, an increase in demand for processed and ready-to-eat foods—the requirement for food enzymes rose, especially those that improve shelf life and nutritional value. Manufacturers began to concentrate on enzymatic solutions tailored to health-oriented consumers, promoting products with reduced sugar levels and enhanced nutritional profiles. Moreover, the ened focus on food safety and hygiene during the pandemic led to a greater acceptance of food enzymes as natural preservatives. In summary, despite the challenges posed by the pandemic, it also fostered innovation and adaptability in the food enzymes market, paving the way for growth that aligns with shifting consumer preferences and a greater emphasis on food quality and safety.

Latest Trends and Innovation in The Global Food Enzymes Market:

- In October 2021, Novozymes announced a strategic partnership with Unilever to focus on developing enzymes aimed at improving the efficiency of laundry detergents, aiming at better environmental sustainability.

- In December 2021, DuPont completed the acquisition of the microbial food business from the company MetaVi, enhancing its capabilities in enzyme production for food applications.

- In February 2022, BASF introduced a new line of enzymes called 'Enzymatic Solutions,' specifically designed for the bakery sector, focusing on enhancing dough quality and shelf life.

- In March 2022, AB Enzyme, a subsidiary of ABF Ingredients, launched a new enzyme product for plant-based proteins to improve their texture and binding properties.

- In April 2022, Chr. Hansen announced the completion of its merger with the natural food ingredients company, UAS Labs, enhancing its portfolio of enzymes for fermented foods.

- In June 2022, DSM announced a collaboration with the food technology company, Cosun Beet Company, to develop innovative enzyme solutions for sugar extraction, helping in efficient sugar processing.

- In August 2022, eniZyme GmbH launched a new range of proteases for dairy applications, earning recognition for its potential to improve cheese production efficiency.

- In September 2023, AEB Group acquired a majority stake in the enzyme producer, BioVittoria, which specializes in enzyme solutions for the beer brewing industry, further strengthening AEB's position in the beverage sector.

- In October 2023, Novozymes unveiled a breakthrough in enzyme technology with its new "Zymplex" product line, targeting improved fermentation processes for various food and beverage applications.

Food Enzymes Market Growth Factors:

The expansion of the food enzymes market is primarily fueled by a surging consumer appetite for natural food offerings, progress in enzyme technology, and an enhanced emphasis on ensuring food safety and quality.

The Food Enzymes Market is witnessing notable expansion due to several influential factors. Heightened consumer awareness regarding health and nutrition has spurred a growing preference for natural and functional food items that leverage enzymes to enhance nutrient accessibility and aid digestion. The movement towards clean label products, which prioritize ingredient transparency, further amplifies the demand for enzymes, as they frequently act as natural substitutes for synthetic additives.

Moreover, the food processing sector is increasingly integrating enzymes to boost production efficiency, expedite fermentation, and improve the sensory characteristics of food items. Ongoing advancements in enzyme technology and the introduction of innovative enzyme solutions designed for particular food categories are also aiding market growth. The rising preference for convenience foods, alongside the growing adoption of plant-based diets, is fostering the utilization of enzymes across a variety of food applications, such as baking, dairy products, and beverages.

In addition, stringent food safety regulations and a commitment to quality assurance compel manufacturers to adopt enzymes that contribute to maintaining product uniformity and safety. Collectively, these elements foster a dynamic environment conducive to the continued growth of the Food Enzymes Market.

Food Enzymes Market Restaining Factors:

Significant obstacles facing the food enzymes market consist of regulatory hurdles, variations in raw material prices, and rigorous standards for quality assurance.

The food enzymes industry faces numerous obstacles that could impede its growth and acceptance. A primary issue is the rigorous regulatory framework related to food safety and labeling, which can complicate the approval of enzymes and escalate manufacturing costs. Furthermore, the elevated expenses associated with enzyme production and the requirement for specific storage conditions may hinder access for smaller enterprises. Additionally, the rising consumer preference for clean-label goods can limit the incorporation of certain additives, including enzymes that may be viewed as unconventional. Variability in enzyme performance, influenced by factors such as temperature, pH levels, and substrate specificity, can further complicate consistency, leading to unease among food manufacturers. Moreover, competition from alternative processing techniques that do not rely on enzymes could divert funding from enzyme-related research and development. Nevertheless, the food enzymes sector has significant growth potential, bolstered by advancements in biotechnology, an increasing emphasis on sustainable food production, and ened health awareness among consumers, creating numerous opportunities for innovation and growth in this vibrant market.

Key Segments of the Food Enzymes Market

By Type

• Carbohydrase

• Protease

• Lipase

• Others

By Application

• Bakery

• Dairy

• Beverages

• Processed Foods

• Others

By Source

• Microorganisms

• Animals

• Plants

By Form

• Liquid

• Powder

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America