The size of the global market for Fixed Asset Management Software is expected to reach US$ 11.4 Billion by 2032, expanding at a compound annual growth rate (CAGR) of 10.6 %.

.jpg)

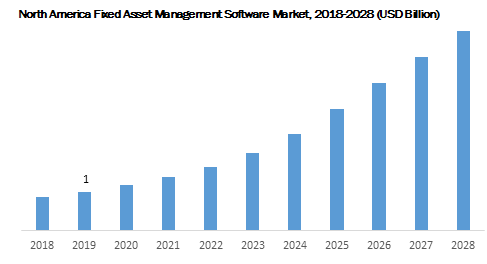

The market size for global fixed asset management (FAM) software is anticipated to reach USD 7 billion by 2028. The factors such as the rising need to reduce operational expenses and generate profits via efficient management of AI asset management are responsible for the growth of the industry. On the other hand, preventive maintenance service along with the Internet of Things (IoT) technology is likely to enhance the implementation of fixed asset management software, globally.

FAM software includes a set of processes by which businesses can store, organize, manage, and retrieve rights. It provides an advanced infrastructure to manage and preserve assets and also enables end-users to locate and identify assets from a set of database encryption records. Every database record includes metadata elucidating the information about its content. The fixed asset management software helps to manage and create the databases and facilitates the organizations to store them in a simplified manner.

Fixed Asset Management Software Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | US$ 11.4 Billion |

| Growth Rate | CAGR of 10.6 % during 2022-2032 |

| Segment Covered | Component, Organization Size, Deployment, Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | IBM, Infor, Microsoft, Oracle, SAP, Sage, Aptean, Maintenance Connection, Acumatica, IFS, eMaint, Ramco Systems, ABB, Tracet, Aveva, and Mainsaver. |

Key Segment Of The Fixed Asset Management Software Market

By Component

• Fixed Asset Management Software

• Fixed Asset Management Services

By Deployment

• Cloud Fixed Asset Management

• On-Premises Fixed Asset Management

By Organization Size

• Fixed Asset Management for Large Enterprises

• Fixed Asset Management for SMEs

By Vertical

• Fixed Asset Management for Energy and Utilities

• Fixed Asset Management for Manufacturing

• Fixed Asset Management for IT, Telecom, and Media

• Fixed Asset Management for Transportation and Logistics

• Fixed Asset Management for Healthcare and Life Sciences

• Fixed Asset Management for Other Verticals

Regional Overview

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

The demand for the Fixed Asset Management Software Market globally to witness considerable growth in the coming five years. Advancements in the energy & utilities, real estate, and manufacturing sectors are likely to generate lucrative growth prospects within the fixed asset management software industry. Technological developments across various industry verticals, such as Machine Learning, Cloud Computing, Artificial Intelligence, and many more, are likely to fuel the acceptance of fixed asset management software since these technologies deliver efficiency, agility, and scalability to businesses. Thus, the vendors within the industry are progressively introducing technologically innovative solutions to achieve maximum market traction. Conversely, the major interference in the implementation of fixed asset management software is experienced by SMEs, as they typically suffer from the economic crunch, owing to lower capital budgets. Hence, the industry participants should focus on serving the SMEs to overcome the difficulty in the implementation of the FAM solution for their assets.

Component Segment

The global Fixed Asset Management Software Market contains both software and service segment. The software segment possesses a significant market share within the global fixed asset management software solution market in 2019. The software allows organizations with various features, including depreciation management, asset lifecycle management, asset budgeting, disposal management, barcoding/Radio Frequency Identification (RFID), document management, asset tracking, tax management, and audit trail. Enterprises across industries are implementing FAM software since it helps them to increase operational efficiency and monitor their assets. On the other hand, the services segment is anticipated to grow at a significant growth rate from 2020 to 2028.

Organization Size Segment

Based on the organization size segment, the market is bifurcated into two sub-segments that are small & medium, and large enterprise. In 2019, the large enterprise segment gathered the largest market revenue and it is anticipated to govern the Fixed Asset Management Software Market throughout the forecast period. However, the small & medium segment is projected to grow at a significant growth rate over the forecast period.

Deployment Segment

Based on the deployment segment, the market is bifurcated into two sub-segments that are on-premise, and cloud. In 2019, the on-premise segment gathered the largest market revenue and it is anticipated to dominate the market throughout the forecast period. However, the cloud segment is anticipated to grow at a substantial growth rate over the forecast period. The cloud enables organizations with a unified platform with SaaS-based services providing improved security.

Application Segment

The global Fixed Asset Management Software Market contains both software and service segment. The software segment possesses a significant market share within the global fixed asset management software solution market in 2019. The software allows enterprises with various features, that include depreciation management, asset lifecycle management, disposal management, asset budgeting, document management, barcoding, Radio Frequency Identification, asset tracking, tax management, and audit trail. Enterprises across industries are implementing FAM software since it helps them to increase operational efficiency and monitor their assets. On the other hand, the services segment is anticipated to grow at a significant growth rate from 2020 to 2028.

The global Fixed Asset Management Software Market is a wide range to North America, Europe, APAC, South America, and the Middle East & Africa. North America is considered a mature market in the fixed asset management software applications, owing to an outsized presence of organizations with the availability of technical expertise and advanced IT infrastructure. The US and Canada are the highest contributory countries to the expansion of the Fixed Asset Management Software Market in North America.

The major players of the global Fixed Asset Management Software Market are IBM, Infor, Microsoft, Oracle, SAP, Sage, Aptean, Maintenance Connection, Acumatica, IFS, eMaint, Ramco Systems, ABB, Tracet, Aveva, and Mainsaver. The Fixed Asset Management Software Market is fragmented with the existence of well-known global and domestic players across the globe.