Fish Finders Market Analysis and Insights:

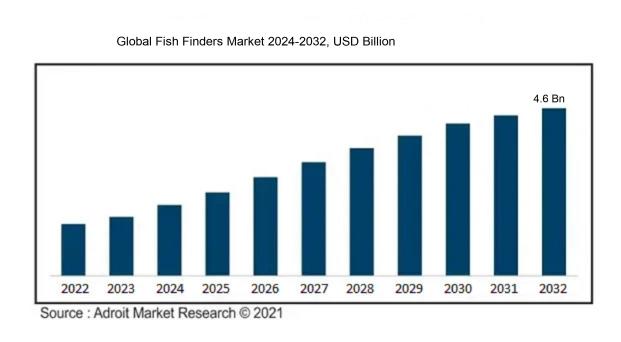

The market size for fish finders was projected to be 2.87 billion USD in 2022. With a projected CAGR (growth rate) of around 5.80% from 2024 to 2032, it is anticipated to increase from 3.10 (USD billion) in 2023 to 4.6 (USD billion) by 2032.

The Fish Finders Market is profoundly shaped by several key driving forces, including the increasing interest in recreational fishing and technological advancements. A rising number of individuals engaging in fishing, along with the burgeoning trend of eco-tourism, is driving up the demand for advanced fish detection tools. Innovations in technology, such as sonar systems and GPS features, improve the effectiveness and precision of fish finders, attracting both novice and seasoned anglers. Moreover, the emergence of portable and user-friendly models broadens their appeal, leading to greater market reach. Concerns regarding environmental sustainability are prompting manufacturers to develop eco-conscious products. Furthermore, the growth of e-commerce platforms is making a wide variety of fish finders more accessible, thus enhancing sales. Together, these dynamics are influencing the growth trajectory of the fish finders market, creating avenues for both veteran and new players within the field.

Fish Finders Market Definition

Fish finders are sophisticated electronic tools that employ sonar technology to identify objects submerged in water, such as fish. These devices offer crucial insights into various underwater conditions, including depth, terrain features, and the abundance of aquatic species.

Fish finders are essential tools in contemporary angling, utilizing sonar technology to identify subaqueous formations, fish congregations, and variations in water depth. This technology empowers fishermen to locate their targets with greater efficiency, significantly increasing their success rates and overall pleasure while fishing. By delivering instantaneous insights into the aquatic landscape, fish finders enable users to refine their fishing tactics, resulting in improved catch outcomes. Furthermore, these devices enhance safety measures by uncovering potential underwater dangers. In essence, fish finders not only simplify the fishing experience but also foster sustainable fishing practices by encouraging responsible behaviors.

Fish Finders Market Segmental Analysis:

Insights On Key Technology

Sonar Technology

Sonar Technology is anticipated to dominate the Global Fish Finders Market due to its widespread application and efficiency in underwater detection. This technology utilizes sound waves to locate and identify fish species, offering unparalleled depth and clarity in navigation. Its capability to provide real-time imaging significantly enhances fishing techniques, making it a preferred choice among both amateur anglers and professional fishers. Additionally, advancements in sonar technology, such as CHIRP sonar, have improved target separation and accuracy, further driving its adoption. Given these advantages, it is clear why Sonar Technology leads the market.

GPS Technology

GPS Technology has become increasingly popular in the fishing industry as it provides precise location tracking and navigation capabilities. This technology enables anglers to mark successful fishing spots and navigate easily between locations, significantly improving the efficiency of fishing trips. The integration of GPS with fish finders allows users to store waypoints and follow predetermined paths, helping to optimize the fishing experience. As more fishermen recognize the value of this technology, its adoption is expected to continue growing, albeit not as dominantly as sonar-based solutions.

Transducer Technology

Transducer Technology is crucial in the functionality of fish finders as it converts electrical signals into sound waves, enabling the detection of fish underwater. The performance and accuracy of fish finders largely depend on the quality of the transducers used. Advancements in transducer design, such as the development of multi-frequency and dual-frequency transducers, deliver enhanced imaging capabilities. Although this technology plays a supporting role rather than being the primary driver of the market, it remains a vital component that contributes to the overall effectiveness of fish finders.

Down Imaging Technology

Down Imaging Technology offers anglers detailed views of the underwater structure, providing images that assist in understanding fish habitats and behavior. By utilizing high-frequency sonar signals, this technology produces remarkable visual clarity, allowing users to see fish even in dense cover. While popular among many fishermen seeking improved visibility, it is often considered supplementary to traditional sonar technology. As it may not be as versatile and widely applicable as other technologies, Down Imaging continues to serve a niche market rather than commanding a dominant position in overall fish finder sales.

Side Imaging Technology

Side Imaging Technology allows for a wider perspective of the underwater environment by providing lateral imaging, which helps fishers view areas away from the direct vertical plane below the boat. This technology is beneficial for scouting large swathes of water and identifying structures that fish may inhabit. However, despite its unique advantages, it is typically used in combination with other types of sonar imaging, making it less essential on its own. While still valuable for specific situations, it does not hold the same overall market influence as the leading technologies.

Insights On Key Type

Portable Fish Finders

Portable fish finders are projected to dominate the Global Fish Finders Market due to their versatility and ease of use. As recreational fishing continues to grow in popularity among individuals who are looking for convenience and mobility, portable devices provide anglers with the ability to carry them to different fishing locations without the hassle of installation. These devices often come with advanced features such as smartphone connectivity, GPS capabilities, and sonar technology, making them user-friendly and appealing to a wider audience. Furthermore, as technology continues to evolve, enhancements in portability and functionality will likely further solidify their position as the market leader.

Fixed Fish Finders

Fixed fish finders serve a different market primarily aimed at professional anglers and commercial fishermen who require reliable performance in a stationary setting. These devices offer advanced features, more significant functionality, and higher durability than most portable models. As they are installed on boats or docks, fixed fish finders often offer superior sonar technology, allowing for more precise readings and effective fish tracking. However, their market demand is constrained by the need for permanent installation, limiting their appeal to casual and recreational fishers who prefer flexibility.

Integrated Fish Finders

Integrated fish finders represent a merging of sonar technology and navigation systems, appealing mostly to serious anglers utilizing larger vessels. These devices often include additional features such as chart plotting, GPS, and radar capabilities, making them essential for navigation as well as fish finding. The appeal of integrated models is primarily to boat manufacturers and advanced fishing enthusiasts. However, their high cost and complexity may deter the average consumer, limiting their market reach compared to portable options. As a result, while they hold a niche appeal, their market share remains smaller compared to the more accessible portable fish finders.

Insights On Key End User

Recreational Fishing

Recreational Fishing is expected to dominate the Global Fish Finders Market due to the growing popularity of fishing as a leisure activity among a diverse demographic. As people increasingly seek outdoor activities, particularly post-pandemic, the demand for fishing-related equipment, including fish finders, has surged. Innovations in technology, such as sonar and GPS capabilities, make fishing more accessible and enjoyable, encouraging enthusiasts to invest in high-quality fish finders. Furthermore, the rise of social media and online platforms that promote fishing excursions and share techniques has amplified interest in recreational fishing, solidifying its market dominance.

Commercial Fishing

Commercial Fishing remains a significant part of the Global Fish Finders Market, driven by the need for efficiency and sustainability in capturing fish stocks. Commercial operations require advanced technology to maximize catch rates while adhering to regulatory standards, and fish finders are essential tools in this endeavor. The increasing pressure for responsible fishing practices and the depletion of fish stocks en the demand for sophisticated equipment that can help identify fish populations accurately.

Research Survey

The Research Survey plays a critical role in the Global Fish Finders Market, particularly for institutions and organizations focused on marine biology, ecology, and fisheries management. Fish finders are essential for data collection, allowing researchers to monitor fish behavior, track migrations, and assess populations. However, this is generally less prominent in terms of market size compared to recreational and commercial fishing, as the demand is more niche. Nonetheless, advances in technology that enhance data accuracy continue to spur interest in fish finders among research communities.

Insights On Key Application

Fishing Charters

Fishing Charters is anticipated to dominate the Global Fish Finders Market due to the increasing popularity of recreational fishing activities among individuals and groups seeking guided fishing experiences. The demand for advanced fish finding technologies is rising as charters aim to enhance their service quality and maximize catch rates for clients. Additionally, with the growing trend of social fishing trips and the advent of high-end charter services that prioritize customer satisfaction, the usage of technologically advanced fish finders is projected to escalate. Fishing charters also benefit from strong marketing strategies and customer loyalty, which further drives demand in this specific area.

Water Sports

Water Sports is another notable application area within the Global Fish Finders Market, with a focus on using fish finders to enhance various aquatic recreational activities. As recreational boating and water sports gain traction, enthusiasts are increasingly incorporating fish finders for both navigation and sport fishing purposes. The integration of fish finding technologies in water sports lends itself to a more engaging experience, allowing individuals to locate fish while enjoying activities such as jet skiing, kayaking, or sailing. Nevertheless, while growing, this still lags behind fishing charters in terms of overall market dominance.

Aquaculture

Aquaculture represents a critical where fish finders are employed for monitoring and managing fish farming operations. With the rising importance of sustainable and efficient fish farming practices, the demand for fish finders in aquaculture is expected to increase. Fish finders are utilized to monitor water conditions, track fish movement, and ensure optimal feeding practices, which are essential for maximized output in aquaculture settings. However, while the aquaculture sector is significant, it has not achieved the same level of market traction as fishing charters, primarily due to regulatory complexities and specific technological requirements within fish farming operations.

Global Fish Finders Market Regional Insights:

North America

North America is poised to dominate the Global Fish Finders market due to several critical factors. The region is characterized by a high level of technological advancement, a strong fishing culture, and a large number of recreational and commercial fishing activities. Additionally, the penetration of innovative fish-finding technologies, such as CHIRP sonar and smartphone integration, has significantly ened customer interest. The presence of key players, along with favorable regulatory frameworks, has also contributed to the growth of the market. Collectively, these elements create a robust environment for fish finders, leading to North America's preeminent position in the global market.

Latin America

Latin America is an emerging region in the Global Fish Finders market, driven by its rich biodiversity and increasing popularity of fishing as a recreational activity. Countries such as Brazil and Chile have expansive coastlines and a growing interest in outdoor sports, prompting demand for advanced fish-finding technology. However, market growth is inhibited by limited access to cutting-edge technology, particularly in rural areas, and relatively lower income levels compared to more developed regions. Nonetheless, governmental initiatives aimed at promoting sustainable fishing practices may offer opportunities for expansion in the sector.

Asia Pacific

The Asia Pacific region is experiencing considerable growth in the Fish Finders market, largely due to an increasing interest in both commercial and leisure fishing. Rapid urbanization, coupled with rising disposable incomes, has led to higher demand for fishing equipment among the population. Countries like Japan, Australia, and India are key markets where advanced fish-finding technologies are being widely adopted. Additionally, the growing trend of eco-tourism and fishing tourism has further boosted market prospects. Nonetheless, varying levels of technological adoption among countries within the region present challenges that may affect overall growth.

Europe

Europe has a strong presence in the Fish Finders market, with a deep-rooted fishing culture and a significant number of fishing enthusiasts. The region is home to many developed markets, particularly in Scandinavia and the UK, where technology adoption is high. Environmental protections and regulations have raised awareness about sustainable fishing practices, driving consumers toward modern fish finders that aid in responsible angling. However, the competitive landscape is becoming increasingly saturated, which may limit growth potential. Innovations related to user experience and integration with mobile platforms could serve as differentiators for companies operating in this region.

Middle East & Africa

The Middle East & Africa region is in the nascent stages of growth in the Global Fish Finders market, primarily due to vast coastal areas and a growing interest in fishing among local populations. While recreational fishing is becoming more popular, economic disparities and lower technological adoption rates pose significant challenges. Additionally, limited awareness about advanced fish-finding technologies restricts growth prospects. However, initiatives aimed at promoting fishing as part of biodiversity conversations and sustainable practices may foster growth in localized markets. As adoption increases, the region holds potential for future market development.

Fish Finders Competitive Landscape:

Prominent entities in the Global Fish Finders sector, including Garmin, Humminbird, and Lowrance, are at the forefront of innovation and product advancement. They focus on improving sonar technology and enhancing the user experience. Additionally, these companies pursue strategic alliances and marketing strategies to extend their market presence and increase sales.

Prominent participants in the fish finders industry consist of Garmin Ltd., Humminbird (a subsidiary of Johnson Outdoors Inc.), Lowrance (which operates under Navico), Raymarine (part of FLIR Systems), Furuno Electric Co., Ltd., Simrad (also belonging to Navico), Deeper, AIRMAR Technology Corporation, Fish Finder Finder, and Hawkeye Fishtrax. Other significant entities include Eagle FishEasy (another brand of Johnson Outdoors), Vexilar, Robalo Boats, Fish Hunter, and Yamaha Marine.

Global Fish Finders COVID-19 Impact and Market Status:

The Covid-19 pandemic significantly impacted the Global Fish Finders market, leading to disruptions in supply chains and a decline in consumer interest, largely as a result of limitations placed on recreational fishing.

The fish finders market experienced considerable disruption due to the COVID-19 pandemic, primarily caused by interruptions in supply chains and manufacturing activities. The implementation of lockdowns and various restrictions resulted in factory shutdowns and a shortage of essential components, which adversely impacted production timelines and availability of products. In addition, the pandemic led to a decrease in recreational fishing activities, as public health concerns and travel limitations kept many potential anglers at home, leading to a dip in demand for fish finders.

Nonetheless, with the relaxation of these restrictions and a resurgence in outdoor pursuits, the market began to recover significantly. A large number of consumers turned to fishing as a safer way to engage in leisure activities, which ened the demand for high-tech fish finders. The ongoing trend of digital integration in outdoor recreation, along with advancements like smartphone connectivity and improved sonar technology, is anticipated to foster long-term growth in this sector. In summary, while the initial repercussions of COVID-19 were detrimental to the market, the subsequent resurgence indicates a strong consumer interest and an increasing popularity of recreational fishing.

Latest Trends and Innovation in The Global Fish Finders Market:

- In January 2023, Garmin announced the acquisition of the innovative fishing technology company, ActiveCaptain, aiming to enhance their fish finder offerings with advanced social sharing features and community-driven fishing data.

- In March 2023, Lowrance launched the Elite FS series, incorporating Live Sight Sonar technology that allows real-time viewing of fish movement, emphasizing a significant innovation in fish-finding capabilities.

- In April 2023, Humminbird revealed updates to their HELIX series, with the integration of i-Pilot Link technology for seamless control of trolling motors, further advancing user experience in fishing.

- In June 2023, Raymarine introduced their new Axiom 2 Pro fish finder, featuring enhanced CHIRP sonar capabilities and improved touch-screen technology, marking a considerable leap in user interface and sonar accuracy.

- In September 2023, Simrad announced the expansion of their NSS EVO3S range, integrating improved connectivity options for pairing with other devices, thereby enhancing the overall ecosystem for anglers.

- In October 2023, FishFinder Tech launched a new AI-driven software update for existing fish finder models, allowing real-time fish tracking and behavioral analysis, showcasing the intersection of artificial intelligence and fishing technology.

Fish Finders Market Growth Factors:

The market for fish finders is expanding, propelled by innovations in sonar technology, a growing enthusiasm for recreational fishing, and the increasing prevalence of smart devices.

The Fish Finders Market is undergoing remarkable expansion, influenced by several significant factors. Innovations in sonar and imaging technologies have markedly improved the precision and effectiveness of fish detection, attracting both professional and leisure anglers. The surging interest in recreational fishing has further driven demand as a growing number of individuals aim to enhance their fishing outings. Additionally, the emergence of smart fishing devices that integrate GPS and mobile applications provides users with real-time tracking and data, which contributes to the growth of the market. Increasing awareness of environmental sustainability is encouraging anglers to embrace advanced technologies that promote responsible fishing practices. The rise in disposable incomes and urban development has also broadened participation in outdoor activities, including fishing. Furthermore, the trend of eco-tourism is playing a role in the market's growth, with fishing trips becoming a favored choice for travelers. The proliferation of e-commerce platforms is simplifying access to advanced fish finder products, consequently boosting sales. Collectively, these elements establish a dynamic landscape for the Fish Finders Market, indicating strong potential for future development as innovations advance and consumer enthusiasm in the sector escalates.

Fish Finders Market Restaining Factors:

Significant constraints in the Fish Finders industry encompass the elevated expenses associated with cutting-edge technologies and a lack of consumer awareness in developing markets.

The fish finder industry encounters various challenges that could hinder its growth potential. One primary obstacle is the high price of sophisticated fish finder technology, which could discourage potential users, particularly in emerging markets where financial limitations are common. Moreover, the intricate functionalities of contemporary fish finders might overwhelm inexperienced fishermen, resulting in hesitation to invest in such equipment. A lack of knowledge and familiarity with fish finders among traditional fishermen can also impede market expansion, as many continue to depend on age-old fishing methods. Additionally, the presence of alternative fishing practices, such as handlining and net fishing, introduces further competition against technology-driven solutions. Regulatory constraints and environmental issues regarding fishing practices may serve to tighten the market's growth as well. However, the rising interest in recreational fishing, along with technological advancements that enhance the ease of use of fish finders, offers a promising perspective for the industry. As public awareness improves and innovation progresses, there is considerable potential for market development, cultivating a more informed and engaged community of anglers looking to elevate their fishing endeavors. This optimistic trend illustrates the fish finder market’s ability to navigate these challenges and capitalize on emerging opportunities.

Key Segments of the Fish Finders Market

By Technology:

• Sonar Technology

• GPS Technology

• Transducer Technology

• Down Imaging Technology

• Side Imaging Technology

By Type:

• Portable Fish Finders

• Fixed Fish Finders

• Integrated Fish Finders

By End User:

• Recreational Fishing

• Commercial Fishing

• Research Survey

By Application:

• Water Sports

• Fishing Charters

• Aquaculture

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America