Market Analysis and Insights:

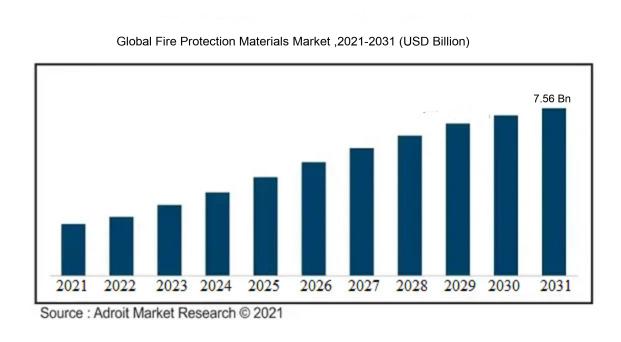

The market for Global Fire Protection Materials was estimated to be worth USD 3.61 billion in 2022, and from 2023 to 2031, it is anticipated to grow at a CAGR of 8.41%, with an expected value of USD 7.56 billion in 2031.

The surge in demand for fire protection materials arises from the growing emphasis on fire safety measures across various industries and sectors. The escalating number of fire incidents and their severe impact on life and property underscore the necessity for strong fire protection solutions. Furthermore, strict government regulations and mandates pertaining to fire safety have prompted organizations to invest in dependable fire protection materials such as fire-resistant coatings, fire-rated doors, fire extinguishers, fire alarms, and other related products.

The market growth is also supported by the rapid urbanization and industrialization in emerging economies, where the construction of residential, commercial, and industrial structures necessitates the integration of effective fire protection materials. Additionally, there is a rising focus on sustainable building practices and a preference for eco-friendly fire protection materials, which further drives market demand. Moreover, advancements in technology, notably the evolution of advanced fire detection and suppression systems, have contributed significantly to market expansion. Ultimately, the fire protection materials market is poised for substantial growth due to increased awareness of fire safety and the imperative for preventive measures.

Fire Protection Materials Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD 7.56 billion |

| Growth Rate | CAGR of 8.41% during 2023-2031 |

| Segment Covered | By Product, By Types of Fire,By Distribution Channel, By Application, By End-User,By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | 3M Company, DuPont de Nemours, Inc., BASF SE, Owens Corning, Kingspan Group, Firestone Building Products Company, Inc., Rockwool International A/S, W.R. Grace & Co., Archrock, Inc., and CertainTeed Corporation. |

Market Definition

Fire protection materials encompass substances or items crafted to inhibit or delay the propagation of fire and safeguard buildings and people from its detrimental consequences. This category of materials encompasses fire-retardant coatings, fire-resistant doors, fire extinguishers, and various fire suppression mechanisms. Materials designed for fire protection are crucial for their ability to prevent and mitigate the destructive impacts of fires. These materials serve as a crucial line of defense in safeguarding lives and assets by hindering the rapid spread of flames and heat. Incorporating fire-resistant materials like fire-retardant coatings, fireproof insulation, and fire-resistant textiles not only confines fires but also grants occupants crucial time for safe evacuation and enables firefighters to gain control effectively.

Moreover, these materials are indispensable in sectors handling or storing flammable substances, as they aid in averting mishaps and reducing the likelihood of explosions. Hence, prioritizing the integration and application of fire protection materials is indispensable as a foundational safety measure in any setting.

Key Market Segmentation:

Insights On Key Product

Adhesive and Sealant

Adhesive and Sealant is expected to dominate the Global Fire Protection Materials Market. This is primarily due to the widespread use of adhesive and sealant products in various applications for fire protection. Adhesive and sealant materials are extensively used for bonding and sealing purposes in building structures, including doors, windows, and joints, to prevent the spread of fire and smoke. These products offer excellent fire resistance, durability, and adhesion properties, making them essential components for ensuring fire safety. Additionally, the growing demand for fire protection materials in construction and infrastructure projects further drives the dominance of the Adhesive and Sealant in the market.

Intumescent Coatings

The Intumescent Coatings is another significant of the Global Fire Protection Materials Market. Intumescent coatings are widely utilized in fire protection systems to provide passive protection to structural elements. These coatings expand when exposed to fire, forming a protective char layer that insulates the underlying material and delays its structural failure. With an increasing emphasis on fire safety regulations and the need to protect critical infrastructure from fire hazards, the demand for intumescent coatings has witnessed significant growth. Their ability to provide fire-resistant protection to steel structures, such as beams, columns, and ceilings, makes the Intumescent Coatings a key player in the market.

Sheets and Boards

The Sheets and Boards another important component of the Global Fire Protection Materials Market. Sheets and boards made from fire-resistant materials, such as gypsum, mineral wool, and calcium silicate, are extensively used for fireproofing applications. These materials are widely employed as fire barriers, insulation, and in the construction of fire-resistant itions, walls, and ceilings. The Sheets and Boards caters to the need for effective fire retardant materials in the building and construction industry. The increasing implementation of stringent fire safety regulations in various regions is driving the demand for fire protection sheets and boards, contributing to the prominence of this in the market.

Foam

The Foam is an integral of the Global Fire Protection Materials Market. Fireproof foam materials are utilized for thermal insulation, firefighting, and fire suppression applications. These foams are designed to release a fire-extinguishing agent upon contact with heat, extinguishing flames and preventing further spread. Fire suppression foams are widely used in industries or areas where rapid fire containment is vital, such as in petroleum refineries, airports, and chemical plants. The Foam addresses the need for effective fire suppression and fire retardant materials, supporting its significant presence in the market.

Putties, Mortar, Fire Blocks

The Putties, Mortar, Fire Blocks plays a crucial role in the Global Fire Protection Materials Market. Putties, mortar, and fire blocks are used for sealing gaps, cracks, and joints in fire-resistant structures to prevent fire and smoke spread. These materials possess excellent fire-resistant properties and are suitable for both interior and exterior applications. They contribute to the overall fire protection and integrity of a building by ensuring that potential fire pathways are sealed. The Putties, Mortar, Fire Blocks caters to the need for fireproofing materials to enhance passive fire protection and is thus a significant in the market.

Cementitious Spray

The Cementitious Spray is an important component of the Global Fire Protection Materials Market. Cementitious sprays are applied as fireproof coatings on structural elements, providing thermal insulation and protecting the underlying materials from fire. These sprays are commonly used in industries where high fire resistance is required, such as oil and gas plants, power plants, and industrial facilities. The ability of cementitious sprays to withstand extreme temperatures and provide durable fire protection makes them indispensable in fire safety systems. The Cementitious Spray serves the demand for reliable fire-resistant coatings and is a key player in the market.

Fire Safe Pipe Penetrations

The Fire Safe Pipe Penetrations is a significant of the Global Fire Protection Materials Market. Fire safe pipe penetrations are essential components for maintaining the integrity of fire-rated walls and barriers. These products are installed around pipes and conduits that pass through fire-rated barriers, preventing the spread of fire and smoke through gaps. The use of fire safe pipe penetrations ensures that fire protection systems are effective and comply with safety regulations. With growing concerns regarding fire safety in buildings and infrastructure, the Fire Safe Pipe Penetrations holds a crucial position in the market.

Others

The Other encompasses various fire protection materials that do not fall into the dominantly mentioned s. This category may include niche products or emerging technologies that are yet to gain significant market share. While the specific products and materials within this may vary, their overall contribution to the Global Fire Protection Materials Market is relatively smaller compared to the dominating s. However, it is important to monitor this closely as it may include innovative solutions and products that could potentially disrupt the market in the future.

Insights On Key Types of Fire

Cellulosic Fires

Cellulosic Fires are expected to dominate the Global Fire Protection Materials Market. Cellulosic fires refer to fires that involve materials derived from plants, such as wood, paper, and textiles. These types of fires are commonly found in residential and commercial buildings, as well as in manufacturing facilities. Due to the widespread usage of cellulose-based materials, the demand for fire protection materials for cellulosic fires is expected to be high. Fire protection materials for cellulosic fires include fire-resistant coatings, fire retardant-treated wood, and firestop systems. These materials play a crucial role in preventing the spread of fire and reducing its intensity, making them essential in fire safety measures. Therefore, it can be concluded that the dominance of cellulosic fires in the Global Fire Protection Materials Market is anticipated.

Hydrogen Fires

Hydrogen fires, although not expected to dominate the Global Fire Protection Materials Market, still hold significance in certain industries. Hydrogen is a highly flammable gas used in various applications, including fuel cells, chemical production, and laboratory experiments. While the overall demand for fire protection materials specific to hydrogen fires may not be as high as cellulosic fires, certain industries like the energy sector and chemical industry may have a substantial need for such materials. Fire protection measures for hydrogen fires include the use of specialized extinguishing agents, ventilation systems, and explosion-proof equipment. Understanding the unique properties and risks associated with hydrogen fires is crucial for implementing effective fire safety measures in the industries that utilize this gas.

Jet Fires

Jet fires, caused by the release of flammable substances in the form of a high-velocity jet, are another of the Global Fire Protection Materials Market. Jet fires are commonly found in industries such as oil and gas, where the release of highly flammable hydrocarbons can result in catastrophic fires. While jet fires do not hold the dominating position in the fire protection materials market, they require specialized fire protection measures. These measures include the use of fire-resistant materials for structures and equipment, as well as systems for rapid fire suppression and cooling. Industries that deal with jet fires invest in fire protection materials and technologies that can effectively mitigate the risks associated with such fires, ensuring the safety of personnel and assets.

Insights On Key Distribution Channel

E-Commerce

E-Commerce is expected to dominate the Global Fire Protection Materials Market.With the rapid growth of online shopping, E-Commerce platforms have become the preferred channel for consumers to purchase various products, including fire protection materials. The convenience, accessibility, and wide range of options offered by E-Commerce platforms make them highly attractive to consumers. Additionally, E-Commerce allows suppliers to reach a global market, further boosting sales. As a result, E-Commerce is projected to hold the largest market share in the Global Fire Protection Materials Market.

B2B

B2B, or Business-to-Business, is another significant of the By Distribution Channel category in the Global Fire Protection Materials Market. B2B transactions involve the purchase and supply of fire protection materials between businesses. This primarily serves industries such as construction, manufacturing, and oil and gas, which require fire protection materials on a large scale. B2B transactions often involve bulk orders, long-term contracts, and customized solutions to meet specific business requirements. While E-Commerce dominates the market, B2B transactions still play a crucial role in serving the needs of businesses across various industries.

Others

The "Others" comprises various distribution channels that are not categorized under E-Commerce or B2B. This includes traditional brick-and-mortar retail, direct sales, and third- y distributors. Although this may not have the same level of dominance as E-Commerce or B2B, it still holds significance in certain geographic regions or specific markets.Traditional retail outlets provide a physical presence for customers to view and purchase fire protection materials. Direct sales, such as door-to-door marketing or in-person demonstrations, offer personalized customer experiences.Third- y distributors act as intermediaries between manufacturers and end-users, providing additional reach and expertise. While these channels may not have the largest market share, they continue to cater to specific customer preferences and market dynamics.

Insights On Key Application

Structural Steel Fireproofing

Structural Steel Fireproofing is expected to dominate the Global Fire Protection Materials Market. This involves the application of fire protection materials specifically designed for use on structural steel elements in buildings and infrastructure. The demand for structural steel fireproofing is driven by the increasing construction activities, especially in commercial and industrial sectors, where fire safety is a top priority. Additionally, stringent regulations and building codes mandating fire protection measures contribute to the dominance of this . Structural steel fireproofing materials provide vital fire resistance, preventing structural failure and protecting lives and property during a fire incident. With the growing emphasis on fire safety and the construction of high-rise buildings globally, the demand for structural steel fireproofing materials is expected to remain high.

Pipe

Pipe fireproofing is an important of the Global Fire Protection Materials Market. This application involves the use of fire protection materials for pipes to prevent fire spread and maintain the integrity of the piping system.

Pipe fireproofing is crucial in industries such as oil and gas, petrochemical, and power generation, where fire incidents can have severe consequences. The demand for pipe fireproofing materials is driven by the need for risk mitigation, compliance with safety regulations, and the protection of critical infrastructure. The global expansion of industries such as oil and gas exploration and the growth of infrastructure projects contribute to the demand for pipe fireproofing materials.

Duct

Duct fireproofing is another significant of the Global Fire Protection Materials Market. This application involves the use of fire-resistant materials to protect HVAC (Heating, Ventilation, and Air Conditioning) ductwork from fire hazards. Duct fireproofing is essential in commercial and residential buildings, ensuring the safe operation of HVAC systems and preventing fire spread through ventilation ducts. The demand for duct fireproofing materials is influenced by the construction of new buildings, the renovation of existing structures, and the increasing focus on fire safety regulations. As the construction industry continues to grow and fire protection requirements become more stringent, the demand for duct fireproofing materials is expected to rise.

Cable and Wire Tray Fireproofing Cable and wire tray fireproofing is a vital of the Global Fire Protection Materials Market. This application involves the use of fire-resistant coatings, wraps, or barriers to protect electrical cables and wire trays from fire damage. Cable and wire tray fireproofing ensures the uninterrupted functioning of electrical systems during a fire incident, minimizing the risk of electrical failures and potential hazards. The demand for cable and wire tray fireproofing materials is driven by the increasing need for fire safety in various sectors, including commercial, industrial, and residential. Furthermore, the growth of smart infrastructures and the integration of advanced electrical systems contribute to the demand for effective fire protection solutions in this .

Doors, Windows, Glasses, Others While the s of doors, windows, glasses, and others are significant in the Global Fire Protection Materials Market, they are not expected to dominate the overall market. These applications involve fire-resistant doors, windows, glass, and other fire protection materials used in buildings to prevent fire spread and provide safe escape routes. The demand for fire-resistant doors, windows, and glass is driven by building regulations, safety requirements, and the need for evacuation systems. However, these s are influenced by the construction industry's overall growth and the implementation of fire safety regulations, rather than being dominant forces in the market.

Insights On Key End-User

Residential

The Residential is expected to dominate the Global Fire Protection Materials Market. This can be attributed to the increasing demand for fire protection materials in residential buildings such as houses, a ments, and condominiums. With the rising awareness about fire safety measures and the implementation of stringent building codes and regulations, there is a growing need for fire protection materials in the residential sector. Additionally, the increasing construction activities in the residential housing sector, especially in emerging economies, further contribute to the dominance of the Residential in the global market.

Commercial

The Commercial of the By End-User category holds significant potential in the Global Fire Protection Materials Market. Commercial buildings, including offices, retail spaces, hotels, and restaurants, have stringent fire safety requirements. The large-scale construction of commercial establishments and the need to comply with fire safety regulations drive the demand for fire protection materials in this . Moreover, the advancements in building technology and the adoption of fire protection measures to minimize property damage and safeguard occupants further contribute to the growth of the Commercial .

Institutional

The Institutional of the By End-User category also plays a significant role in the Global Fire Protection Materials Market. Institutions such as schools, hospitals, government buildings, and cultural establishments require fire protection materials to ensure the safety of occupants and protect valuable assets. The increasing focus on fire prevention and mitigation in institutional settings drives the demand for fire protection materials. Furthermore, regulations and standards specific to institutional buildings further emphasize the need for these materials, consolidating the dominance of the Institutional .

Infrastructure

While the Residential, Commercial, and Institutional s dominate the Global Fire Protection Materials Market, the Infrastructure also holds considerable importance. Infrastructure projects encompass various sectors such as transportation, energy, and utilities. These include bridges, tunnels, airports, power plants, and water treatment facilities, which require fire protection materials to mitigate fire risks and ensure the safety of critical infrastructure. As governments invest in infrastructure development worldwide, the demand for fire protection materials in this is expected to rise. Therefore, the Infrastructure holds a significant share in the global market.

Insights on Regional Analysis:

Europe

Europe is expected to dominate the global fire protection materials market. This region is home to several developed economies, stringent safety regulations, and advanced infrastructure, which contribute to the growth of the fire protection materials market. Countries like Germany, France, and the United Kingdom have a strong focus on fire safety in various industries such as construction, automotive, and manufacturing. The high adoption of fire protection materials, including fire-resistant coatings, fire doors, and fire extinguishers, in these industries is driving the market growth. Moreover, the increasing renovation and retrofit activities in the existing buildings to enhance fire safety are further fueling the demand for fire protection materials in Europe.

North America

North America is a significant player in the global fire protection materials market due to its developed infrastructure, strict fire safety regulations, and advanced technologies. The United States and Canada are the major contributors to the market growth in this region. The presence of key market players, continuous innovations in fire protection technologies, and the need for fire safety in various industrial sectors such as oil and gas, petrochemicals, and power generation drive the demand for fire protection materials in North America. The rising emphasis on safeguarding lives and properties from fire accidents in residential, commercial, and industrial settings further boosts the market growth.

Asia Pacific

Asia Pacific is a rapidly growing region in terms of the fire protection materials market. The increasing construction activities, urbanization, and industrialization in countries such as China, India, and Japan are driving the demand for fire protection materials in this region. The growing awareness about fire safety, strict government regulations, and the need to protect valuable assets from fire accidents are further propelling market growth in Asia Pacific. The expanding automotive, manufacturing, and energy sectors in this region also contribute to the rising demand for fire protection materials.

Middle East and Africa

The Middle East and Africa region has witnessed significant growth in the fire protection materials market due to the increasing construction activities, icularly in countries like the United Arab Emirates, Saudi Arabia, and South Africa. The rapid infrastructure development, including commercial buildings, hotels, and residential complexes, drives the demand for fire protection materials in this region. Additionally, the stringent fire safety regulations imposed by the government further boost the market growth. The Middle East and Africa region is also experiencing a rise in industrialization and the oil and gas sector, which require effective fire protection measures, generating market opportunities for fire protection materials.

Latin America

Latin America is a growing market for fire protection materials, driven primarily by Brazil, Mexico, and Argentina. The increasing industrialization, construction activities, and infrastructure development contribute to the demand for fire protection materials in this region. The rising emphasis on fire safety regulations and the need to protect assets from fire accidents in various industries such as oil and gas, pharmaceuticals, and manufacturing further boost market growth in Latin America. The growing awareness about fire safety and the implementation of stringent safety measures also drive the adoption of fire protection materials in this region.

Company Profiles:

Prominent figures within the Global Fire Protection Materials sector are instrumental in the advancement and production of cutting-edge fire protection materials. These individuals are dedicated to safeguarding assets and individuals from fire risks while actively aking in research and development initiatives aimed at improving fire protection technologies and meeting rigorous safety criteria.

Prominent entities within the Fire Protection Materials Market encompass 3M Company, DuPont de Nemours, Inc., BASF SE, Owens Corning, Kingspan Group, Firestone Building Products Company, Inc., Rockwool International A/S, W.R. Grace & Co., Archrock, Inc., and CertainTeed Corporation. These entities hold notable positions as suppliers of fire protection materials and exhibit substantial engagement within the sector. Their offerings span a diverse array of fire prevention products, encompassing fire-resistant coatings, fire barriers, fire-retardant panels, and insulation materials. These key market participants wield significant influence in advancing the growth and innovation of fire protection materials, serving a variety of sectors including construction, manufacturing, and automotive industries.

COVID-19 Impact and Market Status:

The global need for fire protection materials has decreased as a result of the Covid-19 pandemic, primarily because of disturbances in construction projects and the general economic downturn. The global market for fire protection materials has been significantly impacted by the COVID-19 pandemic, presenting a mix of challenges and prospects.

The sector has faced setbacks from construction project delays and supply chain disruptions, stemming from facility closures and trade limitations. These factors have impeded the manufacturing and distribution of fire protection resources, compounded by budget constraints due to the economic downturn affecting the procurement of fire safety equipment. Conversely, the crisis has brought into focus the critical need for fire safety in buildings and infrastructure, fostering increased recognition among individuals and institutions about the necessity for robust fire protection measures. This surge in awareness has fueled the demand for advanced fire protection materials such as fire-resistant coatings, fire-rated glass, and fire suppression systems.

Furthermore, stricter fire safety regulations enforced by governmental and regulatory bodies have accelerated the adoption of fire protection materials to adhere to these standards. Although the COVID-19 pandemic has introduced impediments to the fire protection materials market, it has also catalyzed new opportunities for advancement and innovation.

Latest Trends and Innovation:

- In October 2020, Armstrong World Industries completed the acquisition of Architectural Components Group, Inc., a leading provider of fire-rated and smoke-rated glazing systems.

- In September 2020, 3M announced the acquisition of Scott Safety, a division of Johnson Controls, expanding their portfolio of fire protection products.

- In August 2020, United Technologies Corporation (UTC) merged with Raytheon Company to form Raytheon Technologies Corporation, strengthening their position in the fire protection materials market.

- In July 2020, Johnson Controls introduced the ANSUL NFF Fast-Speed Dual Agent Fire Suppression System, a technology innovation designed to quickly suppress fires.

- In June 2020, Halma plc acquired Maxtec, LLC, a provider of oxygen analysis and delivery products, to expand their fire protection and safety offerings.

- In May 2020, Tyco Fire Protection Products, a subsidiary of Johnson Controls, launched the UL Listed TYCO DV-5A Deluge Valve, a new fire protection solution.

- In March 2020, Honeywell International Inc. announced the launch of Xtralis VESDA-E VEP, a new range of advanced smoke detectors with early warning capabilities.

- In January 2020, Siemens acquired Enlighted Inc., a provider of intelligent IoT (Internet of Things) solutions for buildings, enhancing their fire protection technology

- In November 2019, Hochiki Corporation introduced the Smoke Control Panel (SCP), a state-of-the-art fire protection system designed to regulate and monitor smoke extraction in buildings.

- In September 2019, Johnson Controls launched the ANSUL-CHECK Piston Flow Switch, an advanced technology that provides reliable monitoring and control for fire suppression systems.

Significant Growth Factors:

Factors bolstering the Fire Protection Materials Market comprise the escalating enforcement of safety regulations, ened recognition of fire risks, and the swift growth of the construction sector.

The market for fire protection materials is poised for substantial growth in the foreseeable future, propelled by several key drivers. In icular, a rising awareness concerning fire safety and an increasing attention to building codes and regulations are stimulating the demand for fire protection materials.

Governments and regulatory bodies are actively enhancing fire safety standards, leading to a surge in the need for fire-resistant materials like fireproof coatings, fire retardant fabrics, and fire-resistant glass. Moreover, the rapid urbanization and industrialization observed in developing nations are bolstering the construction industry, consequently driving the demand for fire protection materials.

Furthermore, a growing number of fire incidents across residential, commercial, and industrial settings are underscoring the necessity for robust fire protection measures, thus fostering market growth. The advent of cutting-edge fire protection technologies such as fire sprinkler systems, fire alarms, and fire suppression systems is also poised to propel market expansion.

These innovative technologies provide enhanced safety measures and are being widely embraced across various sectors. In summary, the escalating emphasis on fire safety, alongside the burgeoning construction industry and advancements in technology, are the primary growth catalysts for the fire protection materials market.

Restraining Factors:

A primary obstacle hindering the expansion of the Fire Protection Materials Market pertains to the rigorous regulatory requirements governing fire safety standards.

The market for fire protection materials is anticipated to encounter various challenges that may impede its future growth.

One significant challenge is the elevated cost of these materials, making them less accessible to small businesses and individuals. Moreover, manufacturers are confronted with stringent regulatory standards and requirements for using fire protection materials, necessitating compliance with a range of regulations to adhere to the prescribed norms. Furthermore, limited awareness regarding the significance and advantages of fire protection materials in certain geographic areas could hinder market expansion. The market is also saturated, leading to intense competition among established players and potentially inhibiting new entrants from gaining substantial market share. The global economic downturn in certain countries, coupled with uncertain economic conditions worldwide, may lead to reduced investments in fire protection materials, thereby decelerating market growth. Despite these obstacles, the fire protection materials market harbors opportunities for growth. Rising government initiatives aimed at enhancing fire safety measures, increasing awareness about the importance of fire protection, and escalating construction activities in emerging markets are projected to boost market expansion. Additionally, advancements in technology and innovations in fire protection materials, including environmentally friendly and cost-effective alternatives, have the potential to contribute to a positive growth trajectory for the market.

Key Segments of the Fire Protection Materials Market

Product Overview

• Adhesive and Sealant

• Intumescent Coatings

• Sheets and Boards

• Foam

• Putties

• Mortar

• Fire Blocks

• Cementitious Spray

• Fire Safe Pipe Penetrations

• Others

Types of Fire Overview

• Cellulosic Fires

• Hydrogen Fires

• Jet Fires

Distribution Channel Overview

• E-Commerce

• B2B

• Others

Application Overview

• Pipe

• Duct

• Structural Steel Fireproofing

• Cable and Wire Tray Fireproofing

• Doors

• Windows

• Glasses

• Others

End-User Overview

• Residential

• Commercial

• Institutional

• Infrastructure

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America