The global fiber to the home market was valued at USD 13.3 billion and the subscriber’s base counted to 455.1 million in 2017. Internet of things (IoT) devices, remote education, smart home automation, VoIP applications and digital entertainment to drive the growth of global fiber to the home market.

Over the past decade internet has exploded all over the place and conventional copper infrastructure is being incompetent for meeting the increasing demands for high speed internet services. This has created an opportunity for FTTH networks that are low on latency issues. Using light signal for transmission over longer distance is the reason for reduced latency and thus fiber to the home infrastructure is capable of delivering higher bandwidth of network to the internet savvy consumers.

The global Fiber to the Home market is projected to reach US$ 53,898.7 Mn by 2029, growing at a CAGR of 14.7%

.jpg)

Internet has penetrated all over the world and now has become an important part of the value chain of many businesses. For instance, e-commerce industry is widely dependent on high speed internet service to optimize their value chain and to deliver a better virtual shopping experience. Similarly banking & financial services and e-governance are also dependent on high speed internet services. Owing to the above, end users of these services are likely to shift to high speed internet services, thus driving the growth of the global FTTH market during the forecast period.

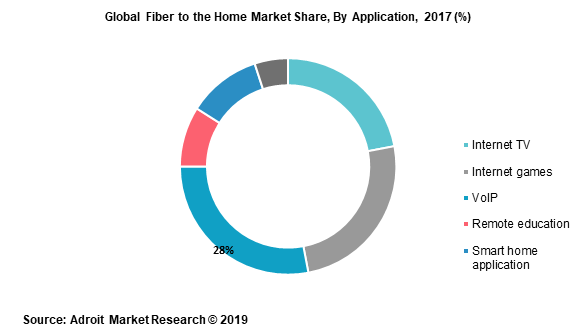

More than 1Gbps speed segment was valued at USD 5.3 billion in the year 2017 .The reasons for the growth of this segments is because the end users are expected to demand faster speeds as the devices and applications they use such as gaming consoles, internet TV, 4K video streaming and other on demand entertainment services will be requiring high speed internet for its optimal functioning.

VoIP applications FaceTime, Google Voice, Line, WeChat, Facebooks audio & video calls have surged in demand as need for worldwide communications has increased and they offer better connectivity for end users. The VoIP application segment was valued at USD 3.7 billion in 2017. VoIP’s applications are now offering features such as call monitoring, call analytics, call reporting, integrating with security systems are the reason they are predicted to grow during the forecast period. This increased features will be needing high speed internet such as fiber to the home driving the growth of the global FTTH market during the estimated period.

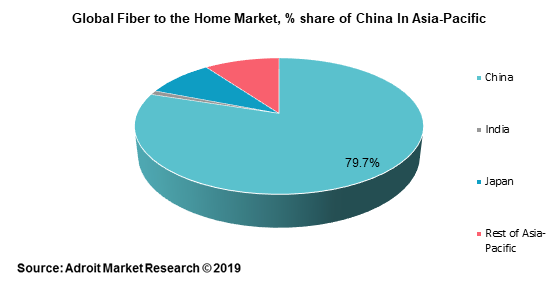

By geography Asia Pacific was valued highest at USD 9 billion and the number of subscriber were 377 Million in the year 2017.The reason for the strong growth in the region is due to the increased penetration of fiber to the home in China. Additionally, countries from Asia Pacific such as China, South Korea and Japan have been the early adopters of fiber to the home and thus have made developments in terms of speed they offer. For instance, major players in the region such as China Telecommunication Corporation, NTT offer speeds of 1 Gbps.

-2017.png)

China was valued at USD 7.2 billion in the year 2017. The strong presence of VoIP applications in the region coupled with government initiatives are driving the FTTH market growth in the region. For instance, in 2016, Chinese State Council announced “Broadband China” initiative, promised an investment of USD 182 billion to boost high speed of internet for businesses and citizens by 2017.

Significant players linked with are market are China Telecommunications Corporation, China Mobile Limited, Nippon Telegraph and Telephone Corporation, China Unicom, Google Fiber Inc., Verizon Fios, AT&T Inc., Vodafone Group Plc, Telefónica.

Partnership is the key strategy adopted by the key players in the market to fortify their market position. For instance, in March 2018, Vodafone Group plc and CityFibre Infrastructure Holdings PLC signed a strategic partnership. This partnership aims to provide Vodafone Group plc with fibre network build by CityFibre Infrastructure Holdings PLC to provide service to 5 million homes in U.K. by 2025.

Reasons for the study

- To understand the distribution of global fiber to the home subscribers.

- To recognize speed of fiber to the home prevalent in regions and countries.

- Understanding the governmental initiatives to boost fiber adoption.

- To study the pricing pattern of fiber to the home plans by companies.

- We had been tracking the subscription base since 2014 and wanted to understand the growth parameter for the substantial growth in numbers.

- Demand for smart devices has surged and we wanted to understand the positive impact on the demand for fiber to the home.

- Understanding the restraints or any threats from substitutes during the forecast period.

- Understanding factors such as political, environment, social, technological, economical and legal factors that are projected to impact the market.

- To study the impacts of end users such as businesses who have been shifting to cloud services and consumers who are widely using VoIP and internet games & TV on the Fiber to the home market.

- During the course of the research on a regional and country level, we analyzed the demand patterns for each of its applications. Additionally, we took the periodic demand patterns into account (2014 – 2016) in order to analyze the past and present effects on the industry and evaluate the forecast effects (2018 – 2025).

Fiber to the Home Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2029 |

| Study Period | 2018-2029 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2029 | US$ 53,898.7 Mn |

| Growth Rate | CAGR of 14.7% during 2019-2029 |

| Segment Covered | By Download Speed, By Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | China Telecom Corporation Limited, China Mobile Ltd., Verizon Communications Inc., AT&T Inc., Vodafone Group Plc., Nippon Telegraph and Telephone Corporation, SoftBank Group Corp., Deutsche Telekom AG, Telefonica S.A., America Movil |

Key Segment Of The Fiber to the Home Market

By Download Speed (USD Million)

• Less than 50 Mbps

• 50 Mbps to 100 Mbps

• 100 Mbps to 1 Gbps

• More than 1 Gbps

By Application, (USD Million)

• Internet TV

• VoIP

• Interactive Gaming

• VPN on Broadband

• Virtual Private LAN Service

• Remote Education

• Smart Home Application

By End User, (USD Million)

• Single Family Homes

• Multiple Dwelling Units

• Small Office Home Office

Regional Overview, (USD Million)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa