Market Analysis and Insights:

The market for Global Extended Warranty Service was estimated to be worth USD xx billion in 2021, and from 2021 to 2031, it is anticipated to grow at a CAGR of xx%, with an expected value of USD xx billion in 2031.

.jpg)

The market for Extended Warranty Services is significantly influenced by multiple essential elements. Heightened consumer awareness about the advantages of extended warranties, such as protection from unexpected repair expenses, drives demand across various industries, notably in electronics and automotive sectors. The escalating costs associated with repairs, alongside the increasing intricacy of modern technology, motivate consumers to pursue additional coverage options. The growth of e-commerce platforms has also played a crucial role, enhancing the accessibility of warranty services while allowing consumers to easily acquire them alongside their purchases. Furthermore, the booming sales of consumer electronics—particularly items with limited operational lifespans—encourage the adoption of extended warranties. In times of economic uncertainty, consumers tend to seek financial reassurance through supplementary protection plans. Additionally, manufacturers are progressively providing extended warranty options as a strategic differentiator, further stimulating the expansion of this market. Collectively, these dynamics foster a strong environment for the ongoing growth of the extended warranty service sector.

Extended Warranty Service Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2018-2021 |

| Forecast Period | 2021-2031 |

| Study Period | 2020-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD xx billion |

| Growth Rate | CAGR of xx% during 2021-2031 |

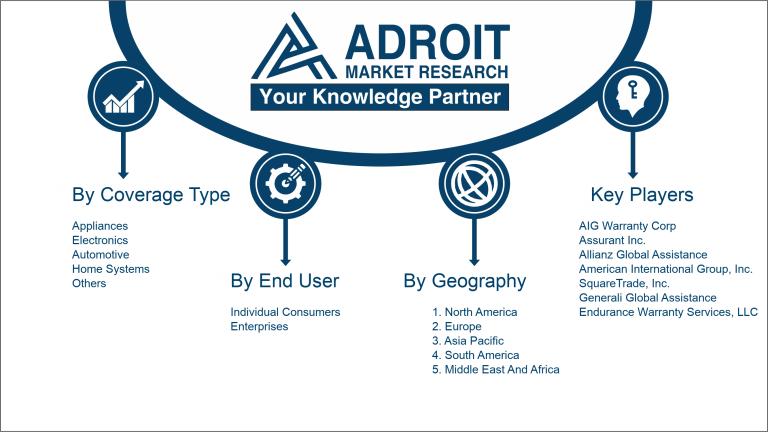

| Segment Covered | By Coverage Type, By End User, By Sales Channel, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | AIG Warranty Corp, Assurant Inc., Allianz Global Assistance, American International Group, Inc., SquareTrade, Inc., Generali Global Assistance, Endurance Warranty Services, LLC, Fidelity National Financial, Inc., ServicePlan, LLC, Warranty Holdings LLC, The Warranty Group, Inc., American Home Shield Corporation, Asurion LLC, and Tego Insurance Solutions. |

Market Definition

An extended warranty service is a contractual arrangement that grants further protection for a product once the initial warranty period has concluded. This service typically encompasses repairs and replacements for designated problems, thereby offering consumers reassurance by safeguarding them from unforeseen repair expenses that may arise after the original manufacturer's warranty has lapsed.

Extended warranty services are essential for safeguarding consumers by providing extra coverage beyond the typical warranty duration of products. They alleviate concerns by reducing the financial impact associated with unforeseen repairs or replacements, which can often be expensive. As today's appliances and electronics become more intricate, extended warranties offer consumers protection for their investments against possible defects and breakdowns. Additionally, these services frequently come with perks such as expedited service and enhanced support, which contribute to overall customer satisfaction. In essence, extended warranties act as a crucial safety measure, boosting confidence in both the acquisition and utilization of products.

Key Market Segmentation:

Insights On Key Coverage Type

Electronics

The Electronics category is expected to dominate the Global Extended Warranty Service Market due to the growing prevalence of electronic devices in everyday life. With rapid advancements in technology, consumers are increasingly investing in devices such as smartphones, laptops, and tablets, which often come with higher price points. The rising complexity of these electronics further necessitates extended warranty services to mitigate the risk of repair costs and technical failures. Moreover, the increasing consumer awareness regarding the benefits of extended warranty plans, alongside rising online sales, contributes to the anticipated growth and dominance of this sector within the market.

Appliances

In the Appliances category, the growing focus on home automation and smart appliances contributes to a robust market presence, though it falls short of the Electronics. Homeowners are investing significantly in durable goods such as refrigerators, washers, and dryers, which are essential for daily life. Moreover, as these appliances become increasingly sophisticated and equipped with advanced features, they also become pricier and may require maintenance. This drives interest in extended warranties as consumers seek protection against potential repair costs, though the overall growth remains behind Electronics.

Automotive

The Automotive is experiencing steady growth, primarily driven by rising vehicle ownership rates and increased spending on vehicle maintenance. Additionally, extended warranties are sought after for their role in safeguarding consumers against unforeseen mechanical failures or costly repairs, particularly for modern vehicles laden with complex technology. However, the market is also influenced by factors such as the increased popularity of used cars and the rising prices of new vehicles. Despite these advantages, this category faces competition from the Electronics sector, which currently takes the lead in market dominance.

Home Systems

Home Systems, which include products such as HVAC systems and security systems, also present a notable market for extended warranties. As homeowners increasingly invest in higher-quality home systems, the demand for protection against breakdowns is on the rise. Consumers often seek peace of mind, knowing that costly repairs for systems crucial to their home's functionality will be covered. Nevertheless, this lacks the expansive reach and consumer engagement seen in the Electronics sector, limiting its growth and ensuring it remains a smaller player within the overall market landscape.

Others

The Others category encompasses various miscellaneous products and services that do not fit neatly into the previously mentioned areas. While this category may show potential growth due to niche markets, it ultimately lacks the breadth and consumer familiarity that define the dominant players such as Electronics. Many consumers may overlook warranties for unconventional items, resulting in slower adoption rates. This limits the impact of the Others on the overall Global Extended Warranty Service Market, ensuring its position remains significantly lower than that of Electronics and Appliances, among others.

Insights On Key End User

Enterprises

The of Enterprises is expected to dominate the Global Extended Warranty Service Market due to several compelling factors. Enterprises often make significant investments in equipment, technology, and critical assets that necessitate extended protection against unforeseen failures or damages. The growing trend of ensuring business continuity and reducing operational risks is driving enterprises to adopt extended warranty services for their machinery, electronic devices, and IT infrastructure. This typically has larger budgets for such services, allowing companies to customize their warranty plans according to individual requirements. Additionally, the increasing complexity and cost of enterprise equipment make extended warranties an essential aspect of risk management strategies for businesses of all sizes.

Individual Consumers

The Individual Consumers represents a considerable portion of the Global Extended Warranty Service Market. With rising consumer awareness regarding product longevity and repair costs, many individuals seek extended protection plans for personal electronics, appliances, and vehicles. The growing reliance on expensive gadgets such as smartphones and laptops drives consumers to invest in additional warranties to safeguard their investments. Promotions and marketing strategies that emphasize consumer protection and peace of mind effectively attract this demographic. While this may not match the volume of the Enterprises, its growth potential remains strong due to the increasing cost of consumer goods and the desire for added security against malfunctions.

Insights On Key Sales Channel

Direct Sales

Direct Sales is expected to dominate the Global Extended Warranty Service Market due to its ability to foster a strong relationship between the provider and the consumer. This method allows for personalized interaction and tailored service options, which are increasingly favored by consumers seeking comprehensive coverage. Additionally, with the rise of digital platforms, companies can streamline their sales processes and engage directly with customers more efficiently. The transparency and immediacy of communication enhance trust, making customers more likely to opt for direct purchasing. This trend aligns with consumer preferences for convenience, further solidifying Direct Sales as the preferred channel in the market.

Third Party Administrators

Third Party Administrators serve an essential role in the Global Extended Warranty Service Market by acting as intermediaries that enhance efficiency. They manage the administration of warranty programs and streamline claims processing, making it a convenient option for consumers and businesses alike. Their established relationships with various vendors can also improve service offerings, allowing for broader coverage options. However, their presence is often considered supplementary, as they primarily depend on partnerships with direct sales channels or retailers to reach consumers effectively. Despite their importance, they lack the direct consumer engagement that makes other channels more appealing.

Retailers

Retailers play a critical part in the Global Extended Warranty Service Market as they provide easy access to warranty options at the time of product purchase. This immediate availability can encourage customers to consider extended warranties as they make buying decisions, thereby increasing impulse purchases of services. Retailers often bundle these warranties with electronic and major appliances, making it a convenient choice for consumers. However, the dependence on in-store traffic and the limitations of geographical reach can constrain their growth potential compared to direct sales avenues. As consumer habits shift towards online shopping, the impact of retailers may even diminish further in the long term.

Insights on Regional Analysis:

North America

North America is poised to dominate the Global Extended Warranty Service market due to its highly developed economy, a strong consumer base, and sophisticated retail landscape. With a high penetration rate of consumer electronics, automotive products, and appliances, the demand for extended warranty services is elevated. Additionally, technological advancements in service delivery, alongside higher disposable income levels, contribute to an increasing preference for extended warranties in this region. The presence of leading warranty providers and a well-established regulatory framework further enhances market growth, making North America the foremost leader in the Global Extended Warranty Service market.

Latin America

Latin America is witnessing a gradual increase in the adoption of extended warranty services, primarily driven by a growing middle class and ened consumer awareness. While the market is still developing compared to North America, a rising number of electronics and automotive purchases indicates a potential for growth. Emerging economies within the region, like Brazil and Mexico, are exhibiting signs of increased demand, but challenges like economic instability and low penetration rates persist, hindering rapid market development.

Asia Pacific

Asia Pacific is experiencing significant growth in the Extended Warranty Service market due to rapid urbanization, increasing disposable incomes, and rising consumer electronics sales. Countries like China and India are at the forefront, with a burgeoning middle class that seeks additional protection for their purchases. However, diverse regulations, cultural differences, and varying levels of consumer awareness pose challenges to uniform market growth across the region. Despite these obstacles, the overall trajectory remains upward, bolstered by innovative service offerings and collaborations with manufacturers.

Europe

In Europe, the Extended Warranty Service market is characterized by a mature consumer base and stringent regulations that dictate warranty standards. The region exhibits varied levels of adoption in different countries, with Western Europe typically outperforming Eastern Europe. Factors such as high-quality manufacturing standards and consumer protection laws contribute to the demand for extended warranties. However, competition is intense, and market players must continually innovate to offer differentiated services that appeal to diverse consumer needs across the continent.

Middle East & Africa

The Middle East & Africa region is in the nascent stage of developing its Extended Warranty Service market. Although there is a potential for growth due to rising economic conditions and increasing sales of electronics and automotive products, challenges like low market awareness and variable purchasing power across the region impede widespread adoption. However, improvements in infrastructure and a growing focus on customer service are encouraging trends, signaling a future increase in demand for warranty services in select markets within this region.

Company Profiles:

The primary actors within the Global Extended Warranty Service sector, comprising insurance firms and service contract providers, play a crucial role in safeguarding consumers from unforeseen repair expenses by delivering customized protection solutions. These entities pursue strategic collaborations and embrace technological advancements to improve the quality of their service offerings and elevate the overall user experience.

Prominent entities in the Extended Warranty Service sector encompass AIG Warranty Corp, Assurant Inc., Allianz Global Assistance, American International Group, Inc., SquareTrade, Inc., Generali Global Assistance, Endurance Warranty Services, LLC, Fidelity National Financial, Inc., ServicePlan, LLC, Warranty Holdings LLC, The Warranty Group, Inc., American Home Shield Corporation, Asurion LLC, and Tego Insurance Solutions.

COVID-19 Impact and Market Status:

The Covid-19 pandemic greatly expedited the embrace of digital service platforms and underscored the vital role of extended warranty services, particularly as consumer electronics usage surged and online shopping became more prevalent.

The COVID-19 pandemic had a profound impact on the extended warranty service sector, resulting in several notable transformations. At the outset, the economic downturn and prevailing uncertainties led to a decline in consumer expenditure on discretionary items, which in turn adversely affected sales of electronics, home appliances, and vehicles—typical products that fall under extended warranty coverage. Nevertheless, as consumers increasingly turned to online shopping and digital payment methods during lockdowns, there was a notable uptick in the demand for warranty services that assured financial security and peace of mind against unexpected breakdowns. Furthermore, an increased awareness surrounding the longevity of products and the necessity of regular maintenance encouraged some consumers to invest in extended warranties for added protection. The pandemic also catalyzed technological innovation within the warranty industry, resulting in the rise of digital platforms for the management of claims and policy acquisitions. In summary, despite the hurdles faced, the extended warranty market exhibited remarkable resilience and adaptability, indicating a promising potential for growth as consumer habits continue to shift in the post-pandemic landscape.

Latest Trends and Innovation:

In June 2023, Assurant acquired the extended warranty provider, Loop, expanding its offerings in the appliance and electronics sectors to bolster its position in the warranty market.

In March 2023, SquareTrade, a subsidiary of Allstate, announced a partnership with Samsung to provide comprehensive protection plans for their consumer electronics, enhancing its reach in the tech device warranty market.

In September 2022, Allianz Partners launched a new extended warranty product for electric vehicles, addressing the growing demand for EV-related protections, showcasing their commitment to innovation in the automotive warranty.

In April 2022, Progressive Insurance introduced a new extended warranty service for home appliances, stepping into the home service warranty space to complement its existing auto insurance offerings.

In January 2022, The Warranty Group rebranded as Assurant Global Benefits and announced strategic partnerships with major retail chains, increasing accessibility to their extended warranty plans for consumers.

In December 2021, Liberty Mutual Insurance expanded its warranty services through the acquisition of a technology-driven warranty provider, increasing its technological capabilities and market reach in the extended warranty landscape.

In November 2021, SquareTrade launched a blockchain-based claims management system, increasing efficiency in processing extended warranty claims, demonstrating innovation in customer service technology.

In July 2021, Hyundai Motor America revealed its new extended service plan tailored for electric vehicles, supporting the manufacturer's shift towards eco-friendly automobiles and catering to an evolving market.

Significant Growth Factors:

The growth of the Extended Warranty Service Market can be attributed to the surging sales of consumer electronics, a ened awareness regarding the importance of product protection, and the demand for economical maintenance alternatives.

The market for Extended Warranty Services has seen substantial expansion due to several key influences. Firstly, there is a marked increase in consumer knowledge regarding the durability of products and the costs of maintenance, driving a demand for extended warranties as individuals aim to reduce the financial risks associated with potential repairs or replacements. Furthermore, the rising intricacy of contemporary products—particularly in industries like electronics and automotive—creates a need for additional protective coverage against likely malfunctions.

The advent of online shopping platforms has also simplified access to extended warranty offerings, thus reaching a wider customer base. The popularization of subscription models further boosts the attractiveness of extended warranties, seamlessly incorporating them into the purchasing habits of consumers. Moreover, technological advancements, such as the utilization of smart technology and data analytics, empower providers to deliver more personalized and adaptable warranty solutions that cater to a variety of consumer preferences.

Economic elements, including increased disposable income, allow more people to consider investing in extended warranty options. Additionally, the growth of retail networks and collaboration between manufacturers and warranty service providers notably contributes to the market's evolution by building consumer confidence and streamlining the buying experience. Collectively, these dynamics foster a strong foundation for the continuous growth of the Extended Warranty Service Market.

Restraining Factors:

Significant barriers influencing the Extended Warranty Service Market encompass prevalent consumer doubts about the effectiveness of warranties and the growing competition posed by alternative protection solutions.

The Extended Warranty Service Market encounters numerous obstacles that may limit its growth trajectory. A significant factor is the skepticism among consumers regarding the necessity and actual benefits of these warranties, often stemming from negative prior experiences or prevalent narratives about claim denials. This doubt can deter potential purchases. Additionally, the increasing expenses related to delivering these services present difficulties for providers who must find a balance between competitive pricing and profitability. The often intricate nature of warranty terms and conditions can further perplex consumers, leading to lower demand as individuals find the details too convoluted. Furthermore, the market must navigate a landscape of regulatory challenges, where diverse laws across different regions can complicate service provision and introduce operational difficulties. Economic changes can also affect discretionary spending, prompting consumers to forgo extended warranties as part of efforts to reduce expenses. Nonetheless, advancements in technology and a growing consumer understanding of product durability present avenues for growth through improved transparency, customized offerings, and enhanced customer service, empowering the market to evolve and succeed despite these challenges.

Key Segments of the Extended Warranty Service Market

By Coverage Type

- Appliances

- Electronics

- Automotive

- Home Systems

- Others

By End User

- Individual Consumers

- Enterprises

By Sales Channel

- Direct Sales

- Third Party Administrators

- Retailers

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America