Ethylene Market Analysis and Insights:

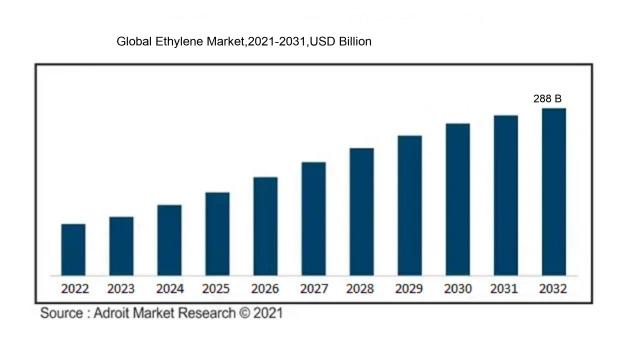

In 2023, the size of the worldwide Ethylene market was US$ 196.5 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 5.31% from 2024 to 2032, reaching US$ 288 billion.

The ethylene market is influenced by several pivotal factors. One primary driver is the strong demand from the plastics sector, especially for polyethylene, which finds applications in packaging, consumer products, and construction materials. Additionally, the growing emphasis on sustainability is encouraging the uptake of bio-based ethylene and recycling efforts, thus altering the market landscape. The automotive and electronics industries are also contributing to the increased need for ethylene-derived substances. Moreover, geopolitical issues and variations in crude oil prices play a significant role in affecting production expenses and overall market pricing. Innovations in manufacturing techniques, such as steam cracking and fluidized catalytic cracking, improve efficiency and output, thereby benefiting supply conditions. The growth of the Asia-Pacific region, propelled by swift industrialization and urban expansion, is another crucial element in market dynamics. Finally, the establishment of regulatory measures aimed at minimizing environmental impacts is fostering innovation and advancing the development of more eco-friendly ethylene production processes.

Ethylene Market Definition

Ethylene is a colorless and combustible gas that acts as a critical hormone in plants, influencing essential functions like growth, maturation, and blooming. Additionally, it plays a significant role in the manufacturing of a range of chemicals and plastics within the industrial industry.

Ethylene serves as an essential plant hormone that significantly influences a range of physiological functions within plants, such as the ripening of fruits, the wilting of flowers, and the shedding of leaves. This hormone is pivotal in the growth and development processes, facilitating fruit maturation and enhancing attributes like flavor and color. In addition to its biological importance, ethylene is also an important industrial compound, particularly in the synthesis of plastics like polyethylene, highlighting its critical role in manufacturing. In agricultural practices, managing ethylene concentrations can prolong the freshness of harvested produce and boost crop yields, ultimately affecting food supply chains and the broader economy. In summary, ethylene is a component in both agricultural and industrial domains.

Ethylene Market Segmental Analysis:

Insights On Feedstock

Ethane

Ethane is expected to dominate the Global Ethylene Market primarily due to its cost-effectiveness and the favorable economics of ethane-based ethylene production. With abundant ethane supplies, particularly in the U.S. due to shale gas production, companies are increasingly favoring ethane over other feedstocks. Ethane's production process has a lower carbon footprint, aligning with industry trends toward sustainability and regulatory compliance. Furthermore, advancements in ethane cracker technology have improved efficiency, making ethane a preferred choice among manufacturers. The economic conditions combined with technological advancements suggest that ethane will continue to lead the market for ethylene production in the coming years.

Naphtha

Naphtha remains a significant feedstock in the Global Ethylene Market due to its versatility and existing infrastructure in refineries and petrochemical complexes. While not as favored as ethane in recent years, naphtha is still widely used, especially in regions where ethane is less accessible. The complexity of refineries allows for naphtha to serve multiple petrochemical functions, providing flexibility in product output. However, compared to ethane, naphtha often presents higher production costs and environmental concerns due to the carbon emissions associated with its extraction and processing.

Propane

Propane is another alternative in ethylene production, though it occupies a smaller market share compared to ethane and naphtha. Propane's role has diminished in recent years as producers prioritize more cost-effective and environmentally friendly feedstocks. However, propane can still be an attractive option in areas where natural gas liquids are plentiful. Its use typically depends on the regional availability and pricing of propane compared to ethane. Additionally, propane provides a competitive advantage during fluctuations in feedstock prices, allowing flexibility for producers looking to diversify their sources for ethylene production.

Butane

Butane is lesser-known but holds potential as a feedstock in the Global Ethylene Market. While it does not dominate like ethane, it can be utilized effectively in specific applications due to its unique properties. The integration of butane in certain petrochemical processes offers a different product slate that can cater to niche markets. However, its limited availability compared to ethane and naphtha may restrict its broader adoption in ethylene production, making it less favorable for large-scale operations. In light of economic developments, butane could see some growth, primarily in regions where it is more concentrated.

Others

The "Others" category encompasses various alternative feedstocks such as biomass and synthetic gas. These materials are gaining traction due to increasing environmental regulations and a growing demand for sustainable production methods. However, their market presence remains relatively small compared to the more established feedstocks like ethane and naphtha. The variability in the quality and performance of these alternative feedstocks may impede their widespread acceptance, limiting their impact in the ethylene market. While promising, these options will need further technological advancements and cost reduction to become significant players in the industry.

Insights On Application

Polyethylene [HDPE, LDPE, LLDPE]

Polyethylene, particularly high-density polyethylene (HDPE), is expected to dominate the Global Ethylene Market due to its extensive application in packaging, construction, and consumer goods. Driven by the growing demand for lightweight and durable materials, HDPE exhibits superior strength and chemical resistance. The rising trend towards sustainable packaging solutions further amplifies LDPE and LLDPE usage, catering to environmentally conscious consumers and manufacturers. Additionally, rapid industrialization and urbanization in emerging economies have increased the need for polyethylene products, substantially boosting their market share. This surge is supported by advancements in production technologies making polyethylene more cost-effective and versatile, cementing its leading position.

Ethylene Oxide

Ethylene oxide follows polyethylene in importance, primarily due to its significant role in the production of antifreeze, ethylene glycol, and various surfactants. The chemical is integral in manufacturing anti-freeze for the automotive industry, ensuring a stable demand in sectors reliant on these products. Additionally, it serves as a precursor for many chemicals, thus broadening its market scope. With increased focus on improving processes and formulations in the textile and agricultural industries, ethylene oxide remains pivotal for many industrial applications. The increase in health and hygiene products, further necessitated by global health challenges, also stimulates its demand.

Ethylbenzene

Ethylbenzene is an essential intermediate in the production of styrene, a component used in the manufacturing of polystyrene plastics and resins. Due to the robust growth in the packaging, automotive, and construction industries, the demand for styrene has seen a notable increase. This uptick bolsters ethylbenzene consumption as it directly correlates with polystyrene requirements. Furthermore, the shift towards lightweight materials and sustainable production techniques has led to innovations in styrene applications, subsequently promoting ethylbenzene usage in developing countries. The steady growth trajectory of the global styrene market ensures ethylbenzene remains a vital player in the ethylene applications landscape.

Ethylene Dichloride

Ethylene dichloride is primarily utilized in the production of vinyl chloride monomer (VCM), which is crucial for making PVC (polyvinyl chloride). As PVC is widely used in construction, plumbing, and electrical applications, there is steady demand for ethylene dichloride in the market. The construction industry's growth worldwide, coupled with the rising popularity of PVC for its durability and cost-effectiveness, plays significantly into the increasing requirements for ethylene dichloride. As new infrastructure projects and housing developments arise, sustained growth is projected for ethylene dichloride in conjunction with evolving regulations on environmental standards, augmenting safe production methods.

Vinyl Acetate

Vinyl acetate is primarily used to produce polyvinyl acetate and polyvinyl alcohol, critical for adhesives, paints, and coatings. The increasing trend towards environmentally friendly products encourages manufacturers to explore more sustainable adhesive solutions, bolstering the demand for vinyl acetate. As the construction and automotive sectors focus on innovative bonding and sealing products, vinyl acetate's relevance rises. Moreover, advancements in application technologies and the growing popularity of vinyl acetate copolymers enhance its adaptability in various applications, ensuring it maintains a stable growth trajectory. Its versatile use in the consumer goods sector also supports its prominent market position in the ethylene derivatives landscape.

Insights On End Use Industry

Chemicals

The chemicals industry is poised to dominate the global ethylene market primarily due to the rising demand for various chemical products and intermediates that are derived from ethylene. Ethylene serves as a feedstock for producing essential chemicals such as ethylene oxide, ethylene glycol, and vinyl chloride. Given its versatility and critical role in the manufacturing of several chemical products, the chemicals industry significantly drives ethylene consumption. The ongoing industrial expansion, especially in emerging economies, continues to bolster the growth and dependency on chemical applications, creating a robust market scenario for ethylene.

Packaging

The packaging industry represents a significant portion of the global ethylene market due to the increasing demand for flexible and durable packaging materials. Ethylene-derived polymers, such as polyethylene, are widely used in various forms of packaging, including films, containers, and bags. The rapid growth of e-commerce and consumer goods demands efficient, sustainable packaging solutions, which directly influences ethylene consumption. Moreover, the emphasis on lightweight and recyclable materials in packaging further fuels advancements in ethylene-based products, driving this industry’s growth.

Automotive

The automotive sector is an essential component of the ethylene market, primarily driven by the need for advanced materials in vehicle manufacturing. Ethylene-based materials, such as polyethylene and ethylene-vinyl acetate, are frequently utilized in car components, including dashboards, bumpers, and insulation. With the automotive industry pushing toward lightweight vehicles for enhanced fuel efficiency and emissions reduction, the demand for ethylene-derived materials is expected to rise, bolstering ethylene's presence in this sector.

Building & Construction

The building and construction industry utilizes ethylene materials extensively for various applications, including pipes, insulation, and roofing. Ethylene copolymers are crucial in creating durable, weather-resistant products that enhance structural integrity and longevity. Increased investments in infrastructure development and housing projects globally, coupled with urbanization trends, positively influence the demand for ethylene. This industry will continue to benefit from sustainable building practices and the growing need for energy-efficient building materials.

Agrochemical

In the agrochemical sector, ethylene plays a crucial role in the production of herbicides, insecticides, and fertilizers. Ethylene-derived compounds enhance crop productivity and protection, responding to the global demand for increased agricultural yields. With growing concerns over food security and sustainable agricultural practices, the agrochemical market is expected to expand, driving further consumption of ethylene and its derivatives for effective crop management solutions.

Textile

The textile industry relies on ethylene for producing synthetic fibers like polyethylene terephthalate (PET), which is essential for creating garments, upholstery, and technical textiles. As fashion trends shift toward synthetic materials due to durability and cost-effectiveness, the demand for ethylene in textile applications is anticipated to grow. Additionally, innovations in fiber technologies that enhance the performance and sustainability of textiles add further impetus to ethylene's role in this industry.

Rubber & Plastics

The rubber and plastics sector is a significant consumer of ethylene, which is essential for producing various synthetic rubber and plastic products. Ethylene-derived materials are widely utilized in tires, seals, and a plethora of plastic goods. The booming automotive and consumer goods industries directly enhance demand for rubber and plastics, thereby increasing ethylene consumption. Continuous advancements in tire technology and sustainable plastic solutions will keep this industry relevant and growing, fostering a robust link with ethylene.

Soaps & Detergents

In the soaps and detergents market, ethylene-derived surfactants are critical components in formulating various cleaning products. The rising demand for effective and biodegradable cleaning agents drives the use of ethylene in this. Consumer preferences are continuously shifting towards environmentally friendly and effective products, influencing the growth of ethylene derivatives in the formulation of soaps and detergents. This trend will likely maintain the relevance of ethylene in the cleaning sector, as product innovation meets sustainability goals.

Global Ethylene Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the global ethylene market due to a combination of factors that include significant industrial growth, rising demand for plastics, and an expanding consumer base in countries like China and India. The region's notable petrochemical production capabilities, along with favorable government policies supporting infrastructure and manufacturing, have played a significant role in enhancing ethylene output. Moreover, the rapid urbanization and increasing disposable incomes in Asia Pacific countries are driving the demand for ethylene derivatives, particularly in industries such as automotive, construction, and packaging. Thus, Asia Pacific not only holds a substantial market share but is also projected to experience the highest growth in ethylene production and consumption in the coming years.

North America

North America showcases a robust ethylene market characterized by advanced technology and significant investments in shale gas production. The United States, as a player, has leveraged its shale gas resources to supply cost-effective feedstock for ethylene production, making it one of the world's leading producers. Additionally, the established infrastructure and demand for ethylene derivatives in various industries bolster market growth. However, regional dynamics, including fluctuating energy prices and environmental regulations, can pose challenges to sustained dominance in the long term.

Europe

Europe's ethylene market is primarily driven by stringent environmental regulations and a transition towards sustainable practices. The region's focus on reducing carbon emissions has led to an increased emphasis on bio-based ethylene and recycling initiatives, which may impact traditional ethylene production routes. Additionally, Europe grapples with high production costs and dependency on imports, which hinder its competitiveness in the global market. Despite these challenges, innovation in the petrochemical sector and supportive government policies toward sustainability could provide new growth opportunities in niche s.

Latin America

Latin America’s ethylene market faces challenges due to economic volatility and underdeveloped infrastructure in certain areas. While Brazil and Mexico have significant production facilities, the region's overall capabilities are hindered by limited investment and reliance on imports. The growing demand for plastics in consumer markets poses potential for growth; however, logistical issues and regulatory hurdles need to be addressed to fully capitalize on these opportunities. As the region develops its industrial base, a gradual improvement in the ethylene market may be anticipated, but it lags behind more established regions.

Middle East & Africa

The Middle East & Africa region has untapped potential in the ethylene market driven by abundant natural gas reserves, especially in Gulf Cooperation Council (GCC) countries. The region has made considerable investments in petrochemical complexes, aiming to position itself as a ethylene exporter. However, demand within Africa remains relatively low due to economic constraints and limited industrial activity. The future growth of the ethylene market in this region will depend on further investment in both infrastructure and downstream applications, allowing it to utilize its resource advantages effectively.

Ethylene Market Competitive Landscape:

Leading entities in the worldwide ethylene sector, including large petrochemical firms, play a crucial role in the production, refinement, and distribution of ethylene. They are also at the forefront of innovation and adhere to environmental standards. Their strategic collaborations and investments are essential for maintaining supply chain stability and addressing the growing global demand for ethylene-based products.

The major participants in the ethylene industry encompass ExxonMobil Chemical Company, Dow Inc., SABIC (Saudi Basic Industries Corporation), LyondellBasell Industries N.V., Ineos Group Limited, Chevron Phillips Chemical Company LLC, Shell Chemicals, Nippon Shokubai Co., Ltd., Formosa Plastics Corporation, BASF SE, TotalEnergies SE, Reliance Industries Limited, Braskem S.A., Eastman Chemical Company, and Eni S.p.A. These firms play a pivotal role in the manufacturing and supply of ethylene, significantly influencing the worldwide ethylene marketplace.

Global Ethylene Market COVID-19 Impact and Market Status:

The Covid-19 pandemic brought about major disturbances in the worldwide ethylene market, resulting in variable supply chains and decreased demand stemming from slowdowns in essential sectors such as automotive and construction.

The COVID-19 pandemic had a profound effect on the ethylene market, causing significant disruptions in global supply chains, limiting production capabilities, and altering consumer demand patterns. At the outset, lockdown measures and safety protocols led to the temporary cessation of petrochemical operations, which in turn resulted in a reduction in ethylene production levels. industries that heavily rely on ethylene derivatives, such as automotive and construction, experienced notable slowdowns, further impacting overall demand for ethylene.

Nevertheless, as economies started to recover and reopen, the market began to bounce back, driven by a renewed demand in sectors like packaging, hygiene, and healthcare, which heavily utilize ethylene-based products. Ethylene prices displayed variability, largely influenced by changes in feedstock costs, especially the prices of crude oil. In addition, a growing emphasis on sustainability and the principles of a circular economy has spurred investments in eco-friendlier alternatives and innovative practices within the sector, leading to a transformation in the ethylene market as it adjusts to the new post-pandemic environment.

Latest Trends and Innovation in The Global Ethylene Market:

- In July 2021, ExxonMobil announced its plans to invest $15 billion in expanding its ethylene production facilities in the U.S. Gulf Coast region, aiming to meet increasing demand for ethylene and polyethylene products as part of a broader strategy to boost its chemical business.

- In April 2022, LyondellBasell Industries and the U.S.-based startup, PureCycle Technologies, forged a partnership to advance recycling technologies. This collaboration focused on developing advanced recycling processes for plastic waste, targeting the ethylene market by providing alternative feedstock solutions sourced from recycled plastic.

- In January 2023, BASF announced the commissioning of its new ethylene production unit in Freeport, Texas, with a capacity of 1.7 million metric tons per year. This expansion is part of a broader initiative to enhance BASF's presence in North America and cater to the growing demand for lightweight materials in automotive and packaging applications.

- In March 2023, Dow Chemical revealed plans to develop the world's largest single-train ethylene cracker in Sarnia, Ontario, which is expected to increase production capacity significantly and reduce greenhouse gas emissions through the integration of renewable feedstocks.

- In September 2023, Saudi Basic Industries Corporation (SABIC) announced its acquisition of a minority stake in the Chinese company Jiangsu Sailboat Petrochemical Co. This strategic investment aims to bolster SABIC’s presence in the rapidly growing Chinese ethylene market and enhance its supply chain operations.

- In October 2023, Shell and Chevron completed a merger of certain petrochemical assets, which included collaborative efforts to optimize ethylene production and distribution processes, allowing both companies to leverage their technologies and market reach more efficiently.

Ethylene Market Growth Factors:

The expansion of the ethylene market is fueled by rising demand from sectors like packaging, automotive, and construction, as well as innovations in manufacturing techniques.

The ethylene industry is on the verge of substantial expansion, influenced by several critical elements. Firstly, the escalating need for polyethylene, which is a primary derivative of ethylene, in sectors such as packaging, automotive, and construction stimulates growth in production capacity. The surge in the consumer goods market and the rise of e-commerce necessitate effective packaging solutions, which in turn enhances the demand for polyethylene. Moreover, technological advancements in processes like catalytic and steam cracking significantly improve the efficiency of ethylene production while lowering operational costs, thereby supporting market growth.

The trend toward sustainability has also spurred the creation of bio-based ethylene, which resonates with eco-conscious consumers and industries alike. Additionally, the swift urbanization and infrastructure progress in developing nations amplify the requirement for plastic products derived from ethylene. A significant trend in the automotive industry involves the adoption of lightweight yet robust materials, which further benefits ethylene-based products. Lastly, the increasing implementation of automation and digital technologies within manufacturing operations improves productivity and operational efficiencies, providing a competitive advantage. Collectively, these drivers highlight the promising growth potential of the ethylene market in the coming years, propelled by advancements in technology and evolving consumer preferences.

Ethylene Market Restaining Factors:

The ethylene market faces significant challenges from variable feedstock costs and growing regulatory demands concerning environmental effects.

The ethylene market encounters a variety of constraints that may influence its growth trajectory. A primary restricting factor is the volatility in the prices of raw materials, notably natural gas and naphtha, which are critical inputs for ethylene synthesis. This price instability can adversely affect profit margins and deter investment in necessary infrastructure. Additionally, the implementation of stringent environmental regulations aimed at minimizing greenhouse gas emissions presents further challenges, as the production of ethylene is inherently carbon-heavy.

Geopolitical risks and trade disputes may also disrupt supply chains, affecting both procurement and distribution processes. Furthermore, the rise of alternative materials, including bio-based and recycled plastics, threatens to diminish the demand for ethylene. The current shift towards sustainable practices necessitates that manufacturers adapt swiftly, often requiring substantial capital investments in innovative technologies.

Despite these obstacles, the ethylene market is poised for positive evolution, driven by ongoing advancements in production methodologies, ened demand in emerging economies, and the increasing application of ethylene derivatives across various sectors such as packaging, automotive, and agriculture. These dynamic changes create opportunities for growth and adaptation, suggesting a promising outlook for the ethylene industry despite its inherent challenges.

Segments of the Ethylene Market

By Feedstock

• Naphtha

• Ethane

• Propane

• Butane

• Others

By Application

• Polyethylene

? HDPE

? LDPE

? LLDPE

• Ethylene Oxide

• Ethylbenzene

• Ethylene Dichloride

• Vinyl Acetate

• Others

By End Use Industry

• Packaging

• Automotive

• Building & Construction

• Agrochemical

• Textile

• Chemicals

• Rubber & Plastics

• Soaps & Detergents

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America