Ethylene Glycol Market Analysis and Insights:

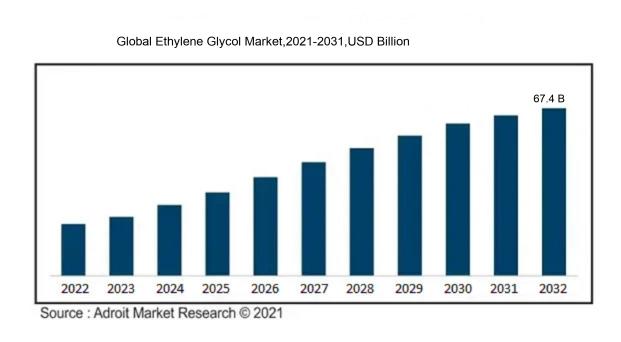

In 2023, the size of the worldwide Ethylene Glycol market was US$ 37.8 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2032, reaching US$ 67.4 billion.

The ethylene glycol market experiences significant growth driven by its high demand for use in antifreeze and coolant formulations, especially within the automotive industry, where it is essential for effective temperature management. The rapid industrial and urban development in the Asia-Pacific region further propels demand as developing nations pursue optimized industrial solutions. Additionally, increasing environmental awareness has ened interest in sustainable, bio-based ethylene glycol alternatives, leading to innovations in eco-friendly manufacturing processes. Other influencing factors include the variable costs of crude oil and related raw materials, which affect production expenses, along with technological advancements that improve the efficiency of ethylene glycol production. Collectively, these aspects define the dynamics of the ethylene glycol market, emphasizing its vital role across diverse industries.

Ethylene Glycol Market Definition

Ethylene glycol is a transparent, odorless liquid with a sweet flavor, widely utilized as an antifreeze and coolant in vehicles.

Ethylene glycol is an essential industrial substance predominantly utilized as an antifreeze in automotive cooling systems and as a precursor in the creation of polyethylene terephthalate (PET), a material for the fabrication of plastic bottles and containers. Furthermore, it plays a crucial role in the synthesis of various chemicals, such as solvents and resins, thereby expanding its range of industrial uses. Its importance extends to the textile sector through its application in the production of polyester fibers, underscoring its versatile functions across numerous industries, including automotive, chemical manufacturing, and consumer products.

Ethylene Glycol Market Segmental Analysis:

Insights On Product

Monoethylene Glycol (MEG)

Monoethylene glycol (MEG) is expected to dominate the Global Ethylene Glycol market due to its extensive applicability in various industries. The rising demand for these products, driven by the growth in the automotive, construction, and consumer goods sectors, contributes significantly to MEG's market dominance. Furthermore, increased consumer preference for lightweight materials in the automotive industry and advancements in production technologies enhance MEG's production efficiency, making it a preferred choice among manufacturers. Overall, its unique properties and widespread uses solidify MEG's leading position in the market.

Diethylene Glycol (DEG)

The chemical's ability to enhance the performance characteristics of end-products in the automotive and construction sectors enhances its market presence. Additionally, DEG finds applications in the production of lubricants and hydraulic fluids, which further sustain demand. However, its market share is consistently overshadowed by MEG, owing to MEG's broader applicability and higher production volumes.

Triethylene Glycol (TEG)

Triethylene glycol (TEG) holds a niche position in the Global Ethylene Glycol market. TEG is primarily used as a dehydrating agent in natural gas processing and in the production of certain types of antifreeze and solvent applications. Its unique properties make it suitable for specific industrial applications, including in the manufacturing of cosmetics and pharmaceuticals. While TEG is essential for particular applications, its demand is limited when compared to the widespread uses of MEG and DEG. Consequently, it maintains a smaller market share, primarily driven by specialized industrial needs rather than mass-market applications.

Insights On Application

PET resins

The PET resins category is projected to dominate the Global Ethylene Glycol Market. This is primarily due to the increasing demand for polyethylene terephthalate (PET) in packaging applications, particularly in the beverage, food, and consumer products sectors. PET's exceptional properties, such as clarity, strength, and recyclability, make it an ideal material for bottles and containers. As environmental sustainability becomes more important, the use of recycled PET is also on the rise, further amplifying the demand for ethylene glycol as a component in its production. Growth in the packaging industry, coupled with a rise in consumer awareness regarding sustainable materials, solidifies PET resins as the leading application for ethylene glycol.

Polyester fibers

The polyester fibers category is another significant application of ethylene glycol. It plays a crucial role in the production of various textiles, including clothing and household products. The demand for polyester fibers is driven by the growing fashion industry and the increasing preference for synthetic fabrics due to their durability and ease of care. Additionally, the rising trend of eco-friendly textiles is fostering innovations in polyester production, including the use of recycled materials. However, while this category shows promise, its growth rate has been slower compared to PET resins, which leads to its secondary position in the market.

Antifreeze & coolants

Antifreeze and coolants represent a vital utilization of ethylene glycol, especially in the automotive and industrial sectors. Ethylene glycol is a primary component in the formulation of these products, providing essential thermodynamic properties that prevent freezing and control engine temperatures. Despite the steady demand for antifreeze and coolants, this application is heavily influenced by the automotive industry's cyclical nature, which can limit its overall growth potential. The increasing incorporation of alternative materials and the shift toward electric vehicles can also have an impact on the future demand for antifreeze, placing it behind PET resins and polyester fibers.

Others

The "Others" category encompasses various applications of ethylene glycol, including solvents, plasticizers, and hydraulic fluids. While this presents diverse opportunities, it generally accounts for a smaller market share compared to the more dominant applications. Innovations in chemical formulation and the development of niche applications might propel this category's growth; however, it lacks the large-scale demand seen in PET resins and polyester fibers. As companies explore unique applications, this may see increased interest, but it remains significantly overshadowed by others in terms of market size and growth potential.

Insights On End Use

Chemical Industry

The chemical industry is expected to dominate the Global Ethylene Glycol Market due to its extensive use as a raw material in manufacturing antifreeze, coolant, and as a ingredient in the production of various chemicals. Ethylene glycol serves as an essential building block in synthesizing polyethylene terephthalate (PET), which is extensively used in the packaging and textile industries, further underlining its importance. The rising demand for plastic products and textiles, particularly in emerging economies, is anticipated to fuel the growth of ethylene glycol consumption in the chemical sector.

Textile Industry

The textile industry also plays a significant role in the consumption of ethylene glycol, primarily due to its use in producing polyester fibers. Polyester is one of the most widely used materials in clothing and home textiles, and its popularity is driven by its durability, resistance to wrinkles, and ease of care. With the rise of fast fashion and increasing demand for sustainable textiles, the textile industry's need for ethylene glycol is projected to grow steadily, enhancing its impact on the overall market.

Automotive Industry

The automotive industry utilizes ethylene glycol mainly in the production of antifreeze and coolant formulations. As vehicles become more sophisticated and emissions regulations tighten, the need for efficient engine cooling and thermal management solutions rises. Ethylene glycol's properties are critical in ensuring the performance and reliability of automotive cooling systems, thus contributing significantly to the market, especially with the transition toward electric vehicles that still require effective cooling systems.

Healthcare and Pharmaceuticals

In the healthcare and pharmaceuticals sector, ethylene glycol is utilized in various applications, including drug formulations and as a solvent for medications. Its role in the formulation of ointments, creams, and various pharmaceutical products ensures consistent demand from this sector. The growing healthcare industry, driven by advancements in medical research and pharmaceutical development, is projected to further boost the consumption of ethylene glycol.

Industrial Applications

The industrial applications of ethylene glycol encompass its use in de-icing agents, hydraulic fluids, and as a solvent in various chemical processes. Its versatility makes it an integral component across multiple industrial sectors, including construction and manufacturing. As infrastructure development continues globally, the increasing demand for industrial products that utilize ethylene glycol is anticipated to lead to a steady growth in this area.

Packaging Industry

In the packaging industry, ethylene glycol is primarily utilized in producing PET, a popular plastic material for bottles and containers. The growing emphasis on sustainable packaging solutions and the rising demand for convenience foods and beverages are poised to increase the need for PET packaging. As a result, ethylene glycol's role in fabricating these materials underscores its relevance in the packaging industry's expanding market dynamics.

Construction Industry

In the construction industry, ethylene glycol is mainly used in concrete, as an antifreeze agent during colder months, and as a component in various construction materials. The rise in global infrastructure projects and the ongoing developments in the residential and commercial sectors are anticipated to drive demand in this area. However, compared to other industries, the relative consumption of ethylene glycol in construction is less pronounced, positioning it as a smaller part of the overall market.

Global Ethylene Glycol Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the global ethylene glycol market due to its robust demand driven by significant industrial growth, particularly in countries like China and India. Rapid urbanization, increasing production capacities, and a burgeoning automotive sector contribute to the rising consumption of ethylene glycol, particularly in the manufacture of antifreeze and plastics. The region's substantial population and evolving demand for consumer goods further bolster the market, positioning Asia Pacific as a leader. Additionally, the region benefits from lower production costs and abundant feedstock availability, enhancing its competitive edge on a global scale.

North America

North America is witnessing steady growth in the ethylene glycol market fueled by the rebound of the automotive sector and significant investments in petrochemical production. The region, particularly the United States, boasts advanced infrastructure and technological capabilities, which facilitate efficient production. Additionally, regulations promoting the use of environmentally friendly products drive demand for ethylene glycol in applications such as antifreeze and plastics, supporting market expansion. However, challenges such as fluctuating oil prices and increased competition from imports could restrain significant growth in the region.

Latin America

Latin America has shown potential in the ethylene glycol market, particularly due to the emerging economies and increased industrial activities in countries like Brazil and Mexico. The region benefits from ample natural resources and lower production costs, which can enhance competitiveness. However, market growth is tempered by economic instability and fluctuating demand from end-user industries such as textiles and automotive. Efforts to boost infrastructure and foreign investments may further drive the market performance in the coming years, but challenges related to political and economic conditions persist.

Europe

Europe is characterized by a mature ethylene glycol market, driven by stringent environmental regulations and an emphasis on sustainability. The demand for biodegradable and eco-friendly products enhances the market potential in this region. However, Europe faces stiff competition from the Asia Pacific region and a shift toward renewable feedstocks, potentially limiting growth. While established industries, particularly in automotive and textile sectors, contribute to demand, the region's overall growth is moderate compared to more rapidly developing areas. Regulatory pressures and fluctuating costs may influence the future dynamics of the ethylene glycol market in Europe.

Middle East & Africa

The Middle East & Africa region exhibits a growing ethylene glycol market, primarily fueled by the availability of natural gas and favorable production conditions in oil-rich countries like Saudi Arabia and the UAE. Investments in petrochemical projects and infrastructure development are poised to enhance production capacities. Despite this potential, the market faces challenges such as geopolitical tensions and economic disparities across the region. While growth can be significant due to resource availability, the uneven development among African nations could hinder uniform progress in the ethylene glycol sector across the continent.

Ethylene Glycol Market Competitive Landscape:

Influential participants in the worldwide ethylene glycol sector, comprising leading chemical producers, propel advancements and enhance production efficiency, thereby influencing supply chains and pricing structures. Their tactical partnerships and financial commitments to eco-friendly technologies are crucial for adapting to increasing environmental regulations and market expectations.

The principal stakeholders in the global Ethylene Glycol industry consist of:

1. The Dow Chemical Company

2. Shell Chemicals

3. Sinopec Limited

4. LyondellBasell Industries N.V.

5. BASF SE

6. Saudi Basic Industries Corporation (SABIC)

7. Sinopec Beijing Yanshan Petrochemical Company

8. Al Jomaih and Shell Lubricating Oil Company

9. Reliance Industries Limited

10. Huntsman Corporation

11. Formosa Plastics Corporation

12. Indian Oil Corporation Limited

13. Qilu Petrochemical Company

14. Petróleo Brasileiro S.A. (Petrobras)

15. Eastman Chemical Company

These firms play a crucial role in the ethylene glycol sector, significantly influencing production and distribution across diverse markets worldwide.

Global Ethylene Glycol Market COVID-19 Impact and Market Status:

The Covid-19 pandemic significantly affected the global ethylene glycol market, leading to a short-lived drop in demand as a consequence of reduced industrial operations and transportation limitations, alongside disruptions to supply chains.

The COVID-19 pandemic had a profound effect on the ethylene glycol market, primarily influenced by global supply chain interruptions and a reduction in demand from critical industries. Initially, many manufacturing facilities were forced to close temporarily, causing a significant drop in both production and consumption of ethylene glycol, which is mainly utilized in antifreeze, plastics, and textiles. sectors such as automotive and construction, which heavily rely on ethylene glycol, faced notable contractions, worsening the situation in the market. However, as economies began to reopen and manufacturing activities resumed, demand started to gradually recover, especially in the production of polyethylene terephthalate (PET) for packaging and textiles. Furthermore, the pandemic ened the emphasis on hygiene and healthcare, leading to increased demand in specific applications. In summary, although the onset of COVID-19 brought significant challenges to the ethylene glycol sector, the subsequent economic recovery has contributed to its stabilization, though future demand trajectories remain uncertain.

Latest Trends and Innovation in The Global Ethylene Glycol Market:

- In October 2022, Indorama Ventures Public Company Limited announced the acquisition of the ethylene glycol production plant from the U.S.-based company, Nan Ya Plastics Corporation. This acquisition enhances Indorama's production capabilities and strengthens its position in the global ethylene glycol market.

- In February 2023, Mitsubishi Chemical Corporation launched a new technology for producing bio-based ethylene glycol using renewable resources. This innovation is part of their ongoing commitment to sustainability and reducing the carbon footprint of chemical manufacturing.

- In June 2023, LyondellBasell Industries N.V. revealed its plans for a major expansion of its ethylene glycol production facility in Channelview, Texas. The expansion is expected to increase the plant's capacity by 400,000 tons per year, thereby meeting the rising global demand for ethylene glycol.

- In August 2023, Sabic and ExxonMobil announced a joint venture to develop a new ethylene glycol production facility in the Gulf Coast region, which is anticipated to become operational in 2025. This collaboration aims to leverage both companies' strengths to enhance supply stability in the North American market.

- In September 2023, Dow Inc. launched a new line of ethylene glycol solutions designed for use in the automotive industry, focused on improving thermal stability and performance. This product innovation is expected to cater to the increasing demand for high-performance materials in vehicle manufacturing.

Ethylene Glycol Market Growth Factors:

The expansion of the Ethylene Glycol market is propelled by a rising need from the polyester and automotive sectors, as well as by its growing use in formulations for antifreeze and coolants.

The market for Ethylene Glycol is experiencing robust expansion, driven by various critical factors. A primary catalyst for this growth is the escalating requirement for antifreeze and coolant solutions within the automotive sector. Furthermore, the surge in production of polyethylene terephthalate (PET) resin, widely utilized in the manufacture of beverage containers and packing materials, intensifies the demand for ethylene glycol. The rapidly evolving textile industry also plays a pivotal role, as ethylene glycol is essential in the synthesis of polyester fibers.

Additionally, the rising inclination towards sustainable and bio-based production methods is stimulating advancements in the manufacturing processes of ethylene glycol, which resonates with both environmentally aware consumers and producers. Regionally, the Asia-Pacific area stands out as a major player due to swift industrial growth, increasing urbanization, and a vigorous manufacturing ecosystem. Supported by government initiatives that encourage the responsible utilization of ethylene glycol and improvements in recycling technologies, the market’s attractiveness is significantly enhanced.

With escalating investments in infrastructure and energy-efficient solutions, the ethylene glycol market is set for sustained growth, mirroring the growing demand from diverse end-user sectors, including automotive, packaging, and textiles. This establishes ethylene glycol as a fundamental component across various industrial applications.

Ethylene Glycol Market Restaining Factors:

The ethylene glycol market faces significant challenges due to strict environmental regulations and the fluctuating costs of raw materials.

The ethylene glycol industry encounters various obstacles that may impede its growth trajectory. Primarily, the volatility in raw material costs, largely sourced from petroleum, introduces production unpredictability and can adversely affect manufacturers' profit margins. Additionally, the implementation of more rigorous environmental regulations poses challenges since the manufacturing of ethylene glycol can generate harmful emissions and waste, necessitating significant financial investments for compliance. Compounding these issues is the emergence of alternative substances, such as bio-based glycols, which attract consumers and sectors focused on sustainability.

Moreover, fluctuations in the automotive and construction industries, notable consumers of ethylene glycol, can lead to unpredictable demand patterns, jeopardizing market stability. Economic recessions further exacerbate this situation by prompting industries to lower their production rates, resulting in diminished demand. Furthermore, concerns related to the safety and health risks associated with ethylene glycol may impede investment and innovation in production methods.

Nevertheless, in spite of these hurdles, advancements in production efficiency and the expanding range of applications for ethylene glycol across diverse end-user sectors, including antifreeze and cooling solutions, indicate a promising market outlook. As industries continue to evolve and integrate new technologies, the ethylene glycol sector is poised to uncover avenues for growth and sustainable development moving forward.

Segments of the Ethylene Glycol Market

By Product

• Monoethylene glycol (MEG)

• Diethylene glycol (DEG)

• Triethylene glycol (TEG)

By Application

• Polyester fibers

• PET resins

• Antifreeze & coolants

• Others

By End Use

• Textile industry

• Automotive industry

• Healthcare and pharmaceuticals

• Industrial applications

• Chemical industry

• Packaging industry

• Construction industry

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America