Market Analysis and Insights:

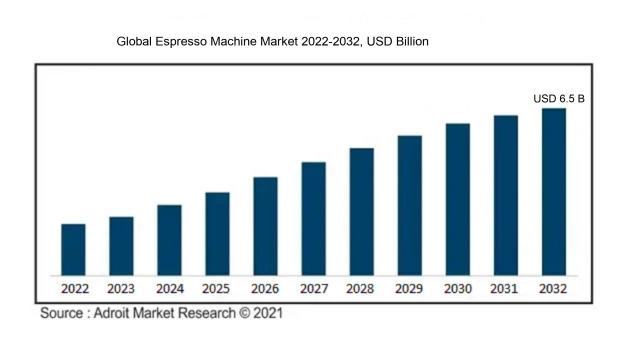

The market for Espresso Machines was estimated to be worth USD 3.5 billion in 2022, and from 2022 to 2032, it is anticipated to grow at a CAGR of 6%, with an expected value of USD 6.5 billion in 2032.

The Espresso Machine Market experiences significant momentum due to several key drivers, including the burgeoning coffee culture, a growing consumer inclination towards premium beverages, and an increasing trend among coffee aficionados to brew at home. The rise of specialty coffee shops and cafes further fuels this demand as patrons seek genuine coffee experiences. Innovations in espresso machine technology, such as programmable features and automated functionalities, attract both casual brewers and professional baristas alike. Moreover, the growth of e-commerce platforms has enhanced the availability of diverse espresso machine brands, thereby supporting market expansion. Environmental considerations also play a crucial role, with consumers leaning towards machines that advocate sustainability or utilize recyclable materials. In addition, the influence of social media personalities who showcase coffee-making techniques and recipes has fostered a vibrant community surrounding espresso enjoyment, which in turn elevates interest in high-quality espresso machines.

Espresso Machine Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2019-2021 |

| Forecast Period | 2022-2032 |

| Study Period | 2021-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 6.5 billion |

| Growth Rate | CAGR of 6% during 2022-2032 |

| Segment Covered | By Product Type, By Application, By Distribution Channel, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Breville Group Limited, De'Longhi S.p.A., Nestlé S.A. (Nespresso), Rancilio Group S.r.l., Gaggia Milano S.r.l., La Marzocco, Philips N.V., Jura Elektroapparate AG, Saeco International B.V., Rocket Espresso Milano, Faema (a Cimbali brand), ECM Manufacture, Lavazza S.p.A., Bezzera, and Krups, which operates as a subsidiary of SEB Group. |

Market Definition

An espresso machine is a distinct apparatus engineered to prepare coffee by applying high pressure to hot water as it passes through finely milled coffee grounds. Its primary function is to create a rich, concentrated coffee extract termed espresso, which forms the foundation for a variety of coffee beverages.

The espresso machine plays an essential role in the coffee sector, acting as the foundation for various coffee drinks such as lattes, cappuccinos, and Americanos. By harnessing high pressure, this machine extracts deep flavors and fragrances from finely-ground coffee, producing a concentrated espresso shot that serves as the base for numerous beverages. Its accurate brewing capabilities enable baristas to consistently deliver high-quality drinks, which boosts customer satisfaction and fosters loyalty. Moreover, espresso machines are indispensable in cafés and restaurants, fueling their coffee culture and contributing to distinctive experiences that set them apart in a competitive environment.

Key Market Segmentation:

Insights On Key Product Type

Super Automatic

Super Automatic espresso machines are expected to dominate the Global Espresso Machine Market due to their convenience, ease of use, and efficiency. As consumer preferences shift towards automation and hassle-free brewing experiences, these machines cater perfectly to busy lifestyles, enabling users to enjoy high-quality espresso with minimal effort. Additionally, advancements in technology have led to the production of super automatic machines that not only streamline the brewing process but also offer customization options for taste preferences. With the rising trend of home baristas who seek quality without the complexities of traditional brewing methods, super automatic machines are gaining popularity and are likely to capture a significant market share.

Semiautomatic

Semiautomatic espresso machines appeal to coffee enthusiasts who value the art of brewing while still seeking some level of convenience. These machines provide a balance between manual control and automated features, allowing users to engage in the brewing process without the need for intensive training. Their popularity has been supported by a growing community of coffee lovers who appreciate the hands-on experience and craftsmanship involved in creating the perfect shot of espresso. Additionally, brands continue to innovate by incorporating modern design and durability into semiautomatic machines, attracting both novices and experienced users.

Automatic

Automatic espresso machines fill the gap between semiautomatic and super automatic options, offering users an efficient brewing process with consistent results. Users can benefit from programmability that allows them to brew a perfect cup at the touch of a button. This convenience resonates well with those looking for a more hands-off brewing experience while still retaining some control over the process. As manufacturers focus on enhancing technology, the automatic category will continue to grow as consumers seek reliability and simplicity without sacrificing quality.

Insights On Key Application

Commercial

The Commercial application of espresso machines is expected to dominate the Global Espresso Machine Market due to the growing demand for high-quality coffee experiences in cafes, restaurants, and hotels. With the increasing proliferation of coffee shops and the rising consumer trend towards specialty coffee, establishments are investing heavily in premium brewing equipment that delivers consistent quality. Additionally, the escalating number of coffee-centric events and competitions fosters innovation among manufacturers, leading to advanced espresso machine designs that cater specifically to commercial needs. This market not only accounts for a significant share in terms of revenue but also shows considerable growth prospects as more businesses seek to upgrade their coffee offerings.

Household

The Household application of the espresso machine market is growing steadily, driven by the rising trend of home brewing and gourmet coffee consumption among consumers. More people are opting to brew their own coffee at home, especially post-pandemic, leading to increased sales of compact, user-friendly machines. The convenience of preparing cafe-quality espresso in the comfort of one's home appeals to coffee enthusiasts. Moreover, the availability of various home espresso machine models tailored for different budgets further facilitates this growth, as individuals seek to replicate their favorite coffee shop experiences within their domestic spaces.

Insights On Key Distribution Channel

Online

Because more and more customers are turning to e-commerce platforms, the online channel is predicted to dominate the global espresso machine market. Online shopping has become much more popular due to the ease of perusing a large selection of goods, evaluating costs, reading reviews, and making purchases from the comfort of one's own home. Consumer engagement and brand awareness have grown as a result of the expansion of digital marketing and social media influences. Furthermore, this trend was accelerated by the COVID-19 pandemic, as more people grew accustomed to making purchases online. Retailers also benefit from lower overhead costs and can reach a global audience, further solidifying the online channel’s strong position in the market.

Offline

Despite the growing popularity of online shopping, the offline channel continues to hold its place in the Global Espresso Machine Market, primarily due to the hands-on experience it offers consumers. Many potential buyers prefer visiting brick-and-mortar stores where they can physically examine machines, interact with knowledgeable staff, and receive personalized recommendations. The tactile experience of testing various espresso machines allows customers to make more informed decisions. Furthermore, offline outlets can leverage in-store promotions and events to attract consumers, fostering a sense of community and brand loyalty that online shopping cannot replicate.

Insights on Regional Analysis:

North America

Due to a number of factors, including a robust coffee culture, high levels of disposable income, and a growing trend towards speciality coffee consumption, North America is anticipated to dominate the global market for espresso machines. Major players and cutting-edge product offerings in the US and Canada contribute to the market's continued expansion. Additionally, the increasing popularity of home brewing equipment in the wake of the COVID-19 pandemic has led to a surge in demand for high-quality espresso machines. Moreover, regional consumers exhibit a preference for premium and sophisticated machines, prompting manufacturers to cater to this niche, solidifying North America's leading market position.

Latin America

In Latin America, the espresso machine market is experiencing steady growth, driven by the region's rich coffee heritage. Countries like Brazil and Colombia, known for their coffee production, are witnessing an increase in espresso consumption as quality coffee culture expands. However, the market is still developing and faces hurdles such as lower consumer spending power compared to more affluent regions. Nevertheless, local manufacturers are beginning to tap into the growing demand for affordable espresso machines, targeting emerging middle-class consumers who are becoming more quality-conscious.

Asia Pacific

Asia Pacific is a rapidly growing region for the espresso machine market, particularly driven by rising urbanization and changing lifestyle preferences in countries like China, Japan, and Australia. The burgeoning middle class and increasing western influence on coffee consumption are contributing to the demand for high-end espresso machines. However, competition from instant coffee and cost-effective brewing solutions can pose challenges. Growth is further supported by innovations in espresso technology and sustainable practices, appealing to environmentally conscious consumers, thus propelling the local market forward.

Europe

Europe holds a significant share of the espresso machine market, primarily due to its long-standing coffee culture and a diverse array of espresso products. Countries like Italy and Germany are at the forefront, showcasing a blend of traditional and modern brewing techniques. The market benefits from a strong emphasis on quality and craftsmanship, with many consumers willing to invest in premium equipment. However, European consumers also demonstrate a strong inclination towards sustainability, driving demand for eco-friendly products. The market is competitive, focusing on innovative designs and advanced technology to capture discerning coffee enthusiasts' interest.

Middle East & Africa

The Middle East & Africa region is characterized by an emerging espresso machine market that is gradually gaining momentum, mainly influenced by changing consumer behaviors and a growing coffee culture. In countries such as the UAE and South Africa, there's an increasing trend toward premium coffee experiences, prompting investments in high-quality espresso machines. However, the market faces challenges such as lower penetration rates and economic variances, which may limit growth. Nonetheless, the rise of cafes and specialty coffee shops is driving demand, creating opportunities for international brands to enter this budding market.

Company Profiles:

Major contributors within the global espresso machine market, comprising producers and suppliers, foster innovation, improve product standards, and broaden their market presence via strategic alliances and focused marketing efforts. Their influence is vital in addressing consumer needs and responding to evolving industry trends.

Prominent companies in the espresso machine industry feature Breville Group Limited, De'Longhi S.p.A., Nestlé S.A. (Nespresso), Rancilio Group S.r.l., Gaggia Milano S.r.l., La Marzocco, Philips N.V., Jura Elektroapparate AG, Saeco International B.V., Rocket Espresso Milano, Faema (a Cimbali brand), ECM Manufacture, Lavazza S.p.A., Bezzera, and Krups, which operates as a subsidiary of SEB Group.

COVID-19 Impact and Market Status:

The Covid-19 pandemic created considerable turmoil in the worldwide espresso machine market, resulting in decreased sales attributed to factory shutdowns, supply chain interruptions, and a decline in consumer expenditure on non-essential items.

The COVID-19 pandemic had a profound effect on the espresso machine market, presenting both hurdles and new prospects. The onset of lockdowns and various restrictions caused a dip in sales, particularly as restaurants and cafes shuttered their doors, leading to diminished demand for commercial espresso machines. Conversely, as more individuals found themselves at home and sought out high-quality coffee experiences, there was a remarkable increase in interest for domestic espresso machines. This home brewing trend was further accelerated by the rise of remote working arrangements and a shift in consumer preferences towards high-end kitchen appliances. Additionally, disruptions in supply chains affected product availability, prompting manufacturers to recalibrate their production strategies to align with the ened demand for home brewing equipment. Consequently, the market underwent a significant transformation, placing greater importance on innovative designs and features tailored for the home barista. In summary, while the pandemic presented its share of challenges, it also sparked a notable shift towards the home espresso machine sector, thereby altering the landscape of the industry.

Latest Trends and Innovation:

- In January 2023, Nestlé announced the acquisition of the Italian espresso machine brand, E.S.E. (Easy Serving Espresso), to enhance its coffee offerings and solidify its position in the premium coffee market.

- In April 2023, Bialetti Industries launched a new line of high-tech espresso machines equipped with smart technology that allows users to control brewing parameters via a smartphone app, aiming to attract tech-savvy consumers.

- In September 2023, Siemens Home Appliances introduced its latest automatic espresso machine featuring advanced microfoam technology, enabling barista-quality milk frothing at home, thus catering to growing consumer demand for premium coffee experiences.

- In June 2023, De'Longhi acquired a controlling stake in the innovative coffee startup, BluShift, known for its eco-friendly espresso pods, aligning with the company's sustainability goals and expanding its product portfolio.

- In March 2023, Jura AG secured a partnership with AWS to integrate cloud-based features in its espresso machines, allowing for personalized user experiences and remote troubleshooting capabilities.

- In February 2023, Breville launched a new espresso machine line called the "BES880," which incorporates an upgraded PID temperature control system, enhancing temperature stability during extraction and appealing to coffee aficionados.

- In October 2023, Philips introduced its latest series of espresso machines that utilize AI technology to learn user preferences and customize drink recipes, marking a significant innovation in user interaction within the coffee appliance sector.

Significant Growth Factors:

The market for espresso machines is witnessing expansion as a result of a surge in coffee drinking habits, technological innovations, and a growing inclination towards specialty coffee drinks.

The market for espresso machines is undergoing considerable expansion, influenced by several pivotal elements. Firstly, there is a notable rise in global coffee consumption, particularly among younger consumers who prefer café-style drinks in the comfort of their homes. This shift has fostered an uptick in the demand for premium espresso machines. The growing trend of premiumization in coffee drives many consumers to seek out sophisticated equipment that can produce café-quality beverages. Moreover, advancements in technology have facilitated the creation of intuitive and high-performance machines that appeal to both casual coffee lovers and seasoned baristas.

The emergence of specialty coffee establishments and the third-wave coffee movement have further cultivated an appreciation for espresso-based drinks, thereby amplifying consumer interest in such products. The proliferation of e-commerce platforms has also simplified the purchasing process, allowing consumers to explore a diverse range of espresso machines and accessories, which enhances market accessibility.

Additionally, increasing awareness of environmental issues has spurred the demand for sustainable and energy-efficient models. Innovations in design and functionality have expanded the options available to consumers. As more individuals are educating themselves about home brewing methods, there is an increasing readiness to invest in espresso machines. Collectively, these dynamics are propelling a vibrant growth in the espresso machine market, mirroring evolving consumer tastes and lifestyles related to coffee.

Restraining Factors:

Significant upfront expenditures and ongoing maintenance demands serve as major limiting factors in the espresso machine industry.

The Espresso Machine Market encounters various obstacles that could impede its growth trajectory. Firstly, the substantial upfront investment required for high-end espresso machines may discourage price-sensitive consumers, restricting market development primarily to wealthier demographics. Furthermore, the operational intricacy associated with certain models might overwhelm inexperienced users, prompting them to opt for more straightforward coffee-making techniques. Issues related to maintenance and repairs can also deter potential buyers, who might be apprehensive about the costs associated with upkeep and potential technical difficulties. Additionally, the rising competition from more affordable coffee options, like instant coffee or single-serve devices, presents a significant challenge, especially among those who favor convenience in their coffee preparation. The ecological repercussions tied to manufacturing practices and the use of plastic materials may also elicit concern from eco-conscious consumers. Nevertheless, as the global coffee culture expands—particularly among younger generations such as millennials and Gen Z—there is an increasing demand for artisanal coffee experiences, presenting an opportunity for market innovation. By prioritizing sustainable practices, creating user-friendly products, and offering budget-friendly entry-level options, espresso machine producers can navigate these challenges and engage a passionate customer seeking high-quality coffee solutions.

Key Segments of the Espresso Machine Market

By Product Type

• Semiautomatic

• Automatic

• Super Automatic

By Application

• Household

• Commercial

By Distribution Channel

• Online

• Offline

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America