Market Analysis and Insights:

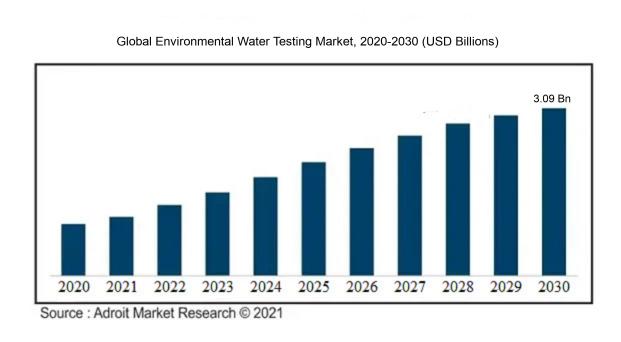

The market for Global Environmental Water Testing was estimated to be worth USD 2.18 billion in 2023, and from 2024 to 2030, it is anticipated to grow at a CAGR of 5.03%, with an expected value of USD 3.09 billion in 2030.

The Environmental Water Testing Market is experiencing significant growth due to several key factors. One primary driver is the rising awareness of the importance of clean water for public health, leading to an increased demand for water testing services. The concerns over water pollution resulting from industrialization and urbanization are also prompting the need to monitor and preserve water quality. Additionally, strict government regulations on water quality and safety are compelling industries to regularly conduct water testing. The escalating incidence of waterborne diseases is further emphasizing the necessity for precise and dependable water testing methods. Technological advancements in water testing equipment and techniques, such as the integration of advanced sensors and automated systems, are propelling market expansion. Moreover, substantial investments in research and development aimed at enhancing water testing methodologies are driving market growth. These factors collectively are anticipated to sustain the market's upward trajectory in the foreseeable future.

Environmental Water Testing Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 3.09 billion |

| Growth Rate | CAGR of 5.03% during 2024-2030 |

| Segment Covered | By Type, By Application, By Region . |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Thermo Fisher Scientific Inc., Agilent Technologies Inc., Danaher Corporation, Shimadzu Corporation, PerkinElmer Inc., Horiba Ltd., Bruker Corporation, MilliporeSigma (Merck KGaA), Bio-Rad Laboratories Inc., and IDEXX Laboratories Inc. |

Market Definition

Environmental water analysis is the meticulous scientific examination of water samples to determine the existence and concentrations of different pollutants, impurities, and detrimental chemicals that may have negative effects on the environment and human well-being. This process is undertaken with the objective of assessing the standard of water sources, recognizing possible risks, and providing insights to guide decisions in safeguarding and preserving aquatic ecosystems.

Environmental water testing is of utmost importance for a variety of significant reasons. Firstly, it serves as a vital tool in the surveillance of the general well-being and purity of water bodies such as rivers, lakes, and oceans, which are indispensable for the maintenance of life and biodiversity. By conducting tests, it guarantees the safety of water for consumption, recreational activities like swimming, and the sustenance of aquatic life forms. Secondly, it plays a crucial role in the identification and prevention of the dissemination of detrimental pollutants and contaminants, such as heavy metals, pesticides, and bacteria, which can have adverse impacts on ecosystems and human health. Moreover, routine testing facilitates early detection of potential waterborne diseases, enabling proactive measures to be implemented to minimize the risk of outbreaks. In essence, environmental water testing is an indispensable component in safeguarding our natural resources and ensuring the welfare of both ecosystems and human communities.

Key Market Segmentation:

Insights On Key Type

Portable

The Portable water testing equipment is expected to dominate the Global Environmental Water Testing Market. Portable devices offer the advantage of being compact and lightweight, allowing ease of transportation and convenience for on-site water analysis. With increasing concerns about water quality and pollution levels, the demand for portable water testing equipment is expected to rise. This part is likely to dominate the market due to its versatility, portability, and effectiveness in providing accurate and immediate results, making it an ideal choice for fieldwork, environmental monitoring, and emergency situations. The portability factor gives it an edge over the other parts, contributing to its dominance in the Global Environmental Water Testing Market.

Handheld

The Handheld type, although not expected to dominate the Global Environmental Water Testing Market, still holds significant importance in the industry. Handheld water testing devices offer the advantage of being compact, convenient, and easy to use. They are suitable for quick testing applications and are often used for spot checks or preliminary water analysis. While they may not have the same level of versatility and accuracy as portable or benchtop devices, handheld water testing equipment finds applications in various industries, including residential, municipal, and commercial sectors. Their affordability and ease of use make them a popular choice for routine water quality testing.

Benchtop

The Benchtop type, while not anticipated to dominate the Global Environmental Water Testing Market, plays a crucial role in laboratory settings and research applications. Benchtop water testing equipment offers higher accuracy and precision, making them ideal for detailed analysis and complex testing procedures. These devices are typically larger in size and require a stable workbench or laboratory space for operation. They are commonly used in research institutes, environmental testing laboratories, and industrial laboratories where comprehensive analysis and data generation are paramount. Despite not dominating the overall market, the benchtop part holds prominence due to its ability to cater to precise scientific requirements and specialized testing needs.

Insights On Key Application

Environmental

The Environmental application is expected to dominate the Global Environmental Water Testing Market. As environmental concerns continue to rise, there is an increasing focus on monitoring water quality and ensuring the safety of natural water sources. Environmental water testing is crucial for industries such as agriculture, mining, and manufacturing, which can have significant impacts on water resources. Additionally, governments and regulatory bodies are implementing stricter regulations regarding water quality, leading to a higher demand for environmental water testing services. The need to identify potential contaminants, assess pollution levels, and evaluate the effectiveness of remediation efforts further drives the growth of this part. Therefore, it is expected that the Environmental part will dominate the Global Environmental Water Testing Market.

Home & Drinking Water Suppliers

The Home & Drinking Water Suppliers is an essential component of the Global Environmental Water Testing Market but is not expected to dominate. This part caters to the needs of households, offices, and other establishments that rely on portable water sources. Testing the quality of drinking water is crucial for ensuring public health and preventing the spread of waterborne diseases. However, the demand for home and drinking water testing is usually limited to specific areas or regions rather than on a global scale. While there is a growing awareness of the importance of clean drinking water, the size of this market may not surpass the dominance of the Environmental part.

Bottled Water Suppliers

The Bottled Water Suppliers is also an important player of the Global Environmental Water Testing Market but is not expected to dominate. Bottled water suppliers are responsible for ensuring that the water they sell meets regulatory standards and is safe for consumption. As the demand for bottled water continues to rise, there is a need for rigorous testing to maintain quality and consumer trust. However, the market size of this part is limited to the bottled water industry, which is just one aspect of the overall environmental water testing market.

Waste Water Treatment Organizations

The Waste Water Treatment Organizations plays a crucial role in the Global Environmental Water Testing Market. These organizations are responsible for treating and managing wastewater from various sources such as municipalities, industries, and commercial establishments. Water testing is a vital part of wastewater treatment to ensure that effluents meet regulatory standards and do not harm the environment when discharged. The demand for environmental water testing services from waste water treatment organizations is driven by the need to monitor and control pollution levels, optimize treatment processes, and comply with environmental regulations. While this part may not dominate the overall market, it significantly contributes to the growth and sustainability of the Global Environmental Water Testing Market.

Clinical and Hospitals

The Clinical and Hospitals application is another important component of the Global Environmental Water Testing Market. Water quality testing is crucial in healthcare settings to prevent the spread of infections and ensure the safety of patients, staff, and medical equipment. Clinical and hospital facilities require regular monitoring of water sources, including drinking water, medical equipment sterilization, and wastewater. While this part serves a specific industry, the demand for environmental water testing services in clinical and hospital settings is expected to grow due to the increasing focus on infection control and patient safety.

Others

The Others refers to any other applications of environmental water testing that are not specifically categorized in the given parts. This catch-all category may include niche industries, research institutions, educational facilities, or other specialized applications. While these applications contribute to the overall Global Environmental Water Testing Market, they are unlikely to dominate the market due to their specific nature and smaller market sizes compared to the dominant parts discussed above.

Insights on Regional Analysis:

Europe

Europe is expected to dominate the Global Environmental Water Testing market. With stringent regulations in place regarding water quality and safety, the European region has witnessed significant growth in the environmental water testing market. The presence of well-established infrastructure, advanced technologies, and a high level of consumer awareness has propelled the demand for environmental water testing services in Europe. Additionally, the region's commitment to sustainable practices and environmental conservation has further boosted the market growth. Europe's dominant position in the Global Environmental Water Testing market can be attributed to its robust laboratory facilities, strict compliance with regulatory standards, and the increasing need for water testing across various industries.

North America

North America is anticipated to exhibit substantial growth in the environmental water testing market. The region has stringent regulations and high environmental standards, driving the demand for water testing services. Furthermore, the growing concerns about water contamination and pollution, along with the need for water quality monitoring, are expected to contribute to market growth in North America. The presence of key market players and advanced technological advancements also play a significant role in driving the region's market growth.

Latin America

Latin America is poised to experience significant growth in the environmental water testing market. The region's expanding industrial sector, coupled with increasing environmental awareness, has led to an augmented demand for water quality testing services. Government initiatives to develop sustainable water management practices and enforce regulatory standards further contribute to market growth in Latin America. Additionally, the rising population and urbanization have led to increased water pollution concerns, stimulating the need for environmental water testing services in the region.

Asia Pacific

Asia Pacific is projected to witness substantial growth in the environmental water testing market. Rapid industrialization and urbanization in countries like China and India have resulted in increased water pollution and a ened demand for water testing services. The region's growing population and rising awareness about the health hazards associated with contaminated water further drive the market growth in Asia Pacific. Moreover, government initiatives to improve water quality standards and increasing investments in water infrastructure development contribute to the flourishing environmental water testing market in this region.

Middle East & Africa

The Middle East & Africa region is expected to experience steady growth in the environmental water testing market. Factors such as the scarcity of water resources and the need to ensure water safety and security drive the demand for water testing services in the region. Increasing industrialization, particularly in oil and gas sectors, further contributes to the market growth. Additionally, government efforts to regulate water quality standards and the adoption of advanced technologies for water testing propel the environmental water testing market in the Middle East & Africa.

Company Profiles:

Significant contributors within the international Environmental Water Testing sector play a vital function by offering cutting-edge water testing solutions and technologies aimed at promoting environmental welfare and safeguarding water reserves. These entities are dedicated to fulfilling the need for precise and dependable water testing, empowering government bodies, businesses, and individuals to make well-informed choices to safeguard the well-being and integrity of water environments.

Prominent companies in the environmental water testing sector comprise Thermo Fisher Scientific Inc., Agilent Technologies Inc., Danaher Corporation, Shimadzu Corporation, PerkinElmer Inc., Horiba Ltd., Bruker Corporation, MilliporeSigma (Merck KGaA), Bio-Rad Laboratories Inc., and IDEXX Laboratories Inc. These organizations are actively engaged in offering cutting-edge solutions and technologies for environmental water testing, encompassing instruments for water quality analysis, testing kits, and reagents. They maintain a strong emphasis on continuous product innovation and advancement in order to address the growing requirement for precise and dependable water testing solutions. Additionally, these leading entities leverage various strategic approaches such as partnerships, collaborations, and mergers and acquisitions to broaden their market presence and meet the changing demands of customers.

COVID-19 Impact and Market Status:

The Global Environmental Water Testing market has experienced a decrease in demand as a consequence of the impact of Covid-19, which has led to supply chain disruptions and economic uncertainties.

The global outbreak of COVID-19 has brought about significant repercussions for the sector of environmental water analysis. In light of the ened focus on public health and the imperative to curb the transmission of the virus, the maintenance of water quality has assumed paramount importance.

Consequently, there has been a surge in the demand for water monitoring services to guarantee the safety of drinking water reservoirs, wastewater systems, and recreational water facilities. The shutdown of numerous industrial and commercial enterprises has resulted in a decrease in industrial waste discharge, thereby yielding a positive impact on water quality.

Nevertheless, the pandemic has presented obstacles to the field, including restricted entry to sampling locations as a consequence of lockdowns and travel constraints. Additionally, the economic downturn triggered by the pandemic has led to financial constraints, culminating in diminished resources allocated to projects focused on water evaluation. Despite these hindrances, experts anticipate a resurgence in the market as the globe recuperates from the effects of the pandemic, with governments and industries demonstrating an increased emphasis on water quality within their post-pandemic agendas.

Latest Trends and Innovation:

- In November 2019, Eurofins Scientific announced the acquisition of TestAmerica Environmental Services, expanding their environmental testing capabilities in the United States.

- In September 2020, Thermo Fisher Scientific launched the Thermo Scientific NexSAR HPLC-ICP-MS System, a solution for simultaneous analysis of organic and inorganic contaminants in environmental water samples.

- In January 2021, ALS Limited acquired Investiga, a leading provider of environmental testing services in Australia, enhancing their presence in the environmental testing market.

- In March 2021, SUEZ announced the successful completion of their acquisition of Laborelec, strengthening their position in environmental water testing and analysis.

- In June 2021, Agilent Technologies introduced the Agilent 6546 LC/Q-TOF, a high-resolution accurate-mass tandem mass spectrometer for environmental analysis, allowing for more precise water testing.

- In July 2021, Bureau Veritas expanded its environmental testing services with the acquisition of Lukrom, a Polish laboratory specialized in water and environmental analysis.

- In September 2021, Shimadzu Corporation announced the release of the NexION 5000 Multi-Quadrupole ICP-MS System for ultra-trace elemental profiling in environmental water samples, providing advanced analysis capabilities.

- In November 2021, PerkinElmer acquired Horizon Discovery Group, a provider of gene editing and gene modulation technologies, allowing for advancements in environmental water testing and genetic analysis.

Significant Growth Factors:

The Environmental Water Testing Market's expansion is propelled by factors such as growing consciousness regarding water contamination, stringent regulatory standards imposed by governments, and the escalating demand for access to secure and uncontaminated drinking water.

The market for environmental water testing is poised for substantial expansion due to a multitude of driving forces. Primarily, the escalating awareness and apprehension regarding water contamination and its repercussions on human well-being and the ecosystem are fueling the need for water testing services. Global governments and regulatory bodies are enacting strict standards and regulations concerning water quality, further catalyzing market expansion.

Furthermore, the surge in industrial and urban activities has resulted in the discharge of diverse pollutants into water sources, necessitating regular monitoring and testing to ensure adherence to environmental mandates.

Similarly, the increasing frequency of natural disasters such as floods and hurricanes has magnified the necessity for water testing services to assess the safety and quality of drinking water supplies in affected regions. Additionally, advancements in water testing technology and methodologies have enhanced testing precision and efficiency, broadening the customer base. The adoption of digital platforms and cloud-based solutions for data analysis and management is also fostering market growth. Moreover, the mounting focus on sustainable water management strategies and the execution of water conservation programs are anticipated to further propel the environmental water testing market. In essence, these driving factors collectively stimulate the demand for water testing services, driving significant market expansion.

Restraining Factors:

Challenges encountered by the Environmental Water Testing Market include navigating stringent regulatory requirements, coping with the expensive nature of testing apparatus, and dealing with restricted availability of cutting-edge laboratory amenities.

The Environmental Water Testing Market has experienced notable growth in recent times due to ened awareness regarding water quality importance and the enforcement of strict water testing regulations. Despite these advancements, various factors may impede market expansion. Chief among them is the high expense associated with cutting-edge water testing technologies and equipment, potentially limiting smaller enterprises from investing in comprehensive solutions. Moreover, a scarcity of skilled professionals in the environmental water testing sector presents a challenge given the requisite expertise in data analysis and interpretation. Additionally, intricate regulatory frameworks and variations in water testing standards across different regions may cause market confusion and inefficiencies. A significant hindrance is the restricted accessibility to water testing infrastructure in remote regions and developing nations, where water quality analysis is imperative. Despite these obstacles, positive market prospects persist. Governments and regulatory bodies are increasingly prioritizing water conservation and quality, fueling the need for environmental water testing. Technological advancements such as user-friendly testing kits and portable devices are enhancing the accessibility and cost-effectiveness of water testing.

Furthermore, the rising public awareness concerning water contamination and its detrimental health impacts will create opportunities for companies within the environmental water testing sector.

Key Segments of the Environmental Water Testing Market

Type Overview

• Handheld

• Portable

• Benchtop

Application Overview

• Environmental

• Home & Drinking Water Suppliers

• Bottled Water Suppliers

• Waste Water Treatment Organizations

• Clinical

• Hospitals

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America