The market for enhanced oil recovery is expected to grow at a compound annual growth rate (CAGR) of 7.20% from 2023 to 2032, from its estimated valuation of US$ 49.40 billion in 2022 to US$ 98.64 billion by 2032.

.jpg

)

The global enhanced oil recovery market was valued around USD 98.08 billion and is projected to witness significant growth with CAGR of 8.3% over the forecast period. Growth in number of mature wells is the key factor which has led to shift from traditional extraction methods to advanced oil extraction methods such as enhanced oil recovery methods. The market is anticipated to show significant growth in forthcoming years with North America leading the overall market with >40% of the demand.

Enhanced oil recovery is an advanced process of oil extraction from reservoir. Oil recovery is divided into three major processes: primary recovery, secondary including tertiary recovery. When oil cannot be recovered from these two methods, tertiary recovery, also known as oil recovery, is applied. Enhanced oil recovery method is regarded as a very productive method which can increase the oil production by 75% for a given site. While primary and secondary methods apply artificial lift devices, gas and water injection, enhanced oil recovery alters the chemical composition of hydrocarbons so as to extract the oil from the surface.

Enhanced oil recovery market is estimated to witness remarkable growth in coming years owing to several factors such as depletion of the oil reserves, increase in global demand for numerous sectors, mainly transportation are projected to supplement the demand. Rising demand for oil along with increase in number of mature wells has led to increase in adoption of advanced technologies such as enhanced oil recovery to improve the extraction process. Therefore, owing to these factors, enhanced oil recovery market is projected to show significant growth with CAGR of 8.3 % over the forecast period.

Enhanced Oil Recovery Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | US$ 98.64 billion |

| Growth Rate | CAGR of 7.20% during 2023-2032 |

| Segment Covered | Technology, Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | BP plc, Cenovus Energy, Inc., Chevron Corporation, Equinor ASA, ExxonMobil Corporation, LUKOIL, Petróleo Brasileiro S.A. |

Key segments of the global enhanced oil recovery market

Technology Overview, (USD million) (Million bbl)

- Thermal

- Gas injection

- Chemical

- Other EOR

Application Overview, (USD million) (Million bbl)

- Onshore

- Offshore

Regional Overview, (USD million) (Million bbl)

- North America

- US

- Canada

- Mexico

- Europe

- United Kingdom

- Germany

- Russia

- Asia Pacific

- India

- China

- Australia

- Latin America

- Middle East & Africa

Frequently Asked Questions (FAQ) :

Key market trends-

- The increasing demand for crude oil is expected to drive the enhanced oil recovery market in the foreseeable future. EOR method increases the production capacity of an oil reservoir by 35%. Some of the EOR technologies, such as waterflooding and CO2 injection, are cost effective than other EOR methods.

- Companies present in the market are investing a huge amount of money in the research and development of new technology. Companies are trying to develop non-thermal technologies like hydraulic fracturing to enhance oil recovery. Gas injection is believed to be the fastest growing technology owing to its various benefits. In gas injection method, mostly CO2 is injected to react with the oil to modify its rheology and permit the oil to flow unhindered within the reservoir. Many companies are also developing carbon capturing and storage (CCS) technique to enhance oil recovery.

- Companies are using various new methods for storage and injecting CO2 and other gasses in the equipment to enhance the oil production. Various viscosity-enhancing and high molecular weight polymers are also added in waterflooding method to improve the sweep efficiency of the waterflood.

- Companies are investing in R&D activities for developing better resources to extract oil from the well at all stages. Companies are focusing on generating the right option for field development. To produce oil, as fast as possible, appropriate strategies are frequently adopted to develop an oil reservoir.

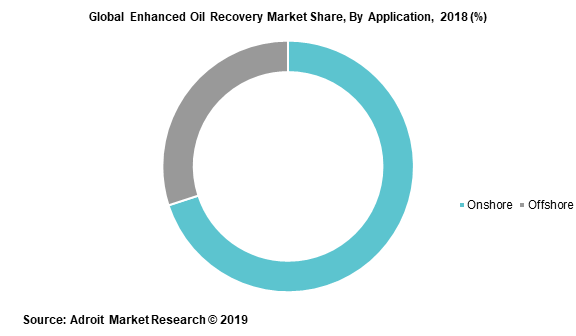

The global enhanced oil recovery market is segmented on the basis of technology type and application. On the basis of technology, the market is categorized into gas injection, thermal process, and chemical extraction among other enhanced oil recovery extraction process. By application, enhanced oil recovery market is segmented into offshore and onshore oil extraction.

By technology, thermal recovery method dominates the enhanced oil recovery process accounting for more than one third of the market share. Thermal recovery technology is projected to be valued at USD 70.7 Billion by 2025. In this method, heat or steam is introduced to the well which helps in reducing oil viscosity and increases the oil permeability. Stream flooding, combustion, and cyclic steam injection are also applied in this method depending upon the site. This method is suitable for shallow wells with higher viscosity such as tar sand and heavy oil. This method is largely applied in regions and countries such as North America, Venezuela and Indonesia. Thermal extraction is also projected to witness significant growth in Asia Pacific owing to ongoing growth in exploration and production activities.

Gas injection is projected to emerge as the fastest growing segment with CAGR of 9.3%. This growth in demand can be attributed to several advantages offered by gas injection method over its counterparts, which includes high pressure which results in better yield.

By application, onshore dominated the demand which was valued USD 67.9 billion in 2017. The onshore area dominated the demand owing to presence of high number of aged wells which propels the demand for enhanced oil recovery technology.

The regional analysis of the global enhanced oil recovery market is divided into key regions such as North America, Europe, Asia Pacific, Central & South America and Middle East & Africa.

.png)

North America dominated the global enhanced oil recovery market with market share of 41.3% in 2018. Furthermore, the region is projected to continue is dominance with a CAGR of 8.7% over the forecast period. Presence of mature wells coupled with well-developed infrastructure for enhanced oil recovery is the key factor to support the growth of this technology in the region. In the recent years, per capita consumption of oil in the US has steadily increased from 2012 to 2017. According to CEIC, US’s oil consumption was reported at 19,879.852 Barrel/Day in 2017, an increase of nearly 0.9% from consumption in December 2016. Along with growing consumption, governmental support such as National Enhanced Oil Recovery Initiative (NEORI) will also boost the overall demand.

Presently, Asia Pacific is regarded as the fastest growing region with rapid growth of per capita income which has provided significant growth to many industries. Crude oil plays an important role in propelling the industrial growth. Automotive industry is playing a key role in demand of crude oil in the region. With the increasing transportation activities and growing number of individual vehicle owners, the industry is set to play a pivotal role in escalating the demand of crude oil in the region. The oil consumption in the region is increasing nearly twice as fast as compared to the world as a whole the oil production in the region is sharply limited in comparison with the demand. The total oil consumption in this region is three times the quantity of oil produced here. This is resulting in heavy import from North America and the Middle Eastern countries. Owing to this, domestic exploration activities in the region have significantly increased. Overall, Oil recovery market in Asia Pacific is projected to grow at 8.5% of CAGR over the forecast period.